College Students Already Applying for Loan Forgiveness Under Biden’s Program

“You can potentially get $10,000-20,000 forgiven just by spending that minute and a half, so there’s no reason not to spend that time”

This story focuses on students in Colorado, but this is obviously happening all over the country.

CBS News in Colorado reports:

Colorado college students begin applying for student loan forgiveness as program opens

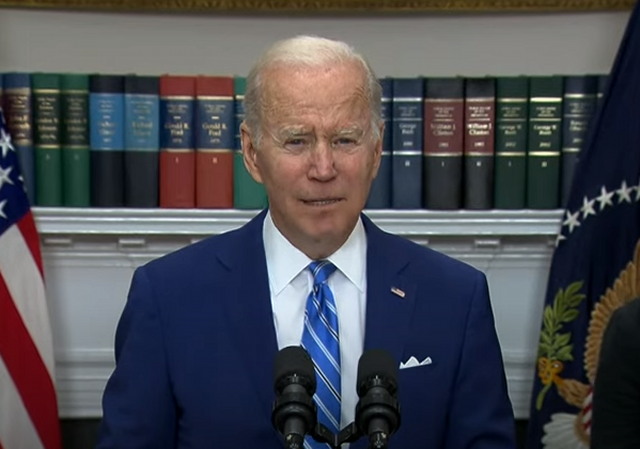

The U.S. Department of Education officially launched its online application for student loan forgiveness on Monday. President Biden calls it “a game changer for millions of Americans” looking for some help making ends meet.

“It takes a minute and a half maximum to fill out,” said Ryan Smith, a senior at Metropolitan State University in Denver.

Smith is among the millions who’ve already applied for student loan debt forgiveness. He said he applied when a beta version of the website launched late last week.

“You can potentially get $10,000-20,000 forgiven just by spending that minute and a half, so there’s no reason not to spend that time,” Smith said of encouraging others with student loans to apply.

All that’s needed to apply – a quick click on StudentAid.gov. There, applicants simply enter their contact information, date of birth, and social security number. Only individuals who earned less than $125,000 in 2020 or 2021 and married couples with total annual income below $250,000 are eligible for loan relief under the program. About 95% of Americans with college loans are expected to qualify, helping some 40 million people like Smith.

“I have a pretty significant amount of student loans just to help get me through. It’s definitely a relief that my payments are going to be 2/3 of what they were originally, which is significantly lower,” said Smith.

Unless challenges from conservative lawmakers block efforts, the Department of Education could begin forgiving student loans as early as next month. It’s a difference-maker for Smith, but he also sees it as a step in the right direction for future students seeking higher education.

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

The only surprise is that they bothered to do something.

And just in time for the midterms!

There are many reasons not to spend that minute and a half, starting with declining to be a thief, even when the stealing’s being done for you, and you’re getting a cover story along with the loot.

That these reasons don’t count for the proclaimer is itself interesting.

If you can get it, take it? If you can get away with it, it must be Ok? You really don’t want me playing that way. A

Seriously, play that way, that’s the system we have. Playing by different rules is just cheating yourself, and then what incentive would the most egregious takers have to make the rules better, if they can have giveaways to their friends and you won’t even take your share?

If a tax cut/deduction/write-off you didn’t agree with in principle applied to you, are you telling me you wouldn’t take it?

This particular carve-out for votes is going to end up costing all of America a large amount in inflation and taxes. If it applied to you, you’d be a fool not to mitigate that damage by taking it.

It’s even worse. I have a buddy in IT. During the last two years he’s paid off $18k of student loans and now has $8k left. He read fine print of the rules and anything he paid off during COVID he can get back, so he called his lender and they’re sending him a check for $12k and now he’s getting his full $20k forgiven. It’s crazy.

Many in our family have small student loans we scrimped, saved and did without to repay in our early years. WHERE DO WE GET OUR REFUNDS?!