Gas Prices Hit All Time High, National Average Passes $5/gallon

No end in sight

Whomever is in Biden’s earpiece sure has made a mess of what was a good thing. Cost of everything has skyrocketed. I know I’m not the only one feeling the pinch of sudden and astronomically high gas prices.

There seems to be no end in sight.

According to GasBuddy, who monitors gas prices nationally, the national average per gallon has surpassed $5.

From WPTV:

GasBuddy announced Thursday morning that the national average price for one gallon of gas has reached $5, setting a new record in the U.S.

Meanwhile, AAA reports that the national average price sits at $4.97.

In all 50 states, the average price of gasoline is above $4.63, according to AAA.

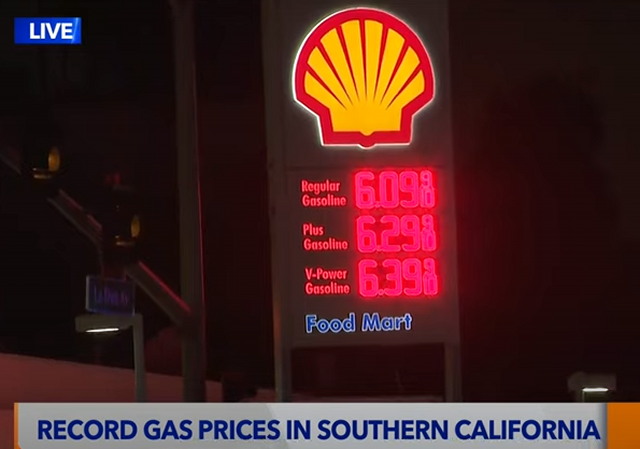

California has the highest price of gas – the state average is $6.40, although some places have recorded prices as high as $9 per gallon.

2022 has already been a record-breaking year in terms of gas prices.

According to GasBuddy data, the national average price of gas broke the $4 per gallon threshold on March 5.

Two days later, the national average broke another record and reached $4.10 per gallon.

Another record was set in late April when diesel prices reached $5.16 per gallon.

Petroleum analysis expert at GasBuddy, Patrick De Haan warns that prices could worsen throughout the summer if refiners face unexpected issues, including major hurricanes.

If I didn’t know any better, I’d think this was all on purpose.

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

“Gas price hits all time high” reminds me of the Simpsons:

Bart Simpson: This is the worst day of my life.

Homer Simpson: You mean, the worst day so far.

The unthinking left has emoted the country into a point where we are approaching an economic death spiral.

Biden loves this, as do other Dems, who are either outrageously rich (on a gov’t salary) or the gov’t is paying for it directly. They think it will drive us to electric vehicles.

Somewhere, Cloward and Piven are smiling, not to mention Putin and Winnie the Pooh Xi Jinping.

The Left sees this as a “short term” problem on the path to a green new future. A reminder…. all disease is self-limiting and all bleeding eventually stops.

Unfortunately, death is still one of the means by which such limits are imposed.

It was the plan all along

Trump told us but millions didn’t give a sh!t…

Bad tweets and pussy hats

Can’t make this crap up

Let’s divide the country, I don’t belt we can come back from this without millions of deaths, like 100 million…

“I don’t belt we can come back from this without millions of deaths, like 100 million…” THAT is their plan. Doing their part for global population realignment. The Great Die-Off is underway.

Intentional? That gives the proponents of this state of affairs too much credit. We shouldn’t underestimate our political opposition but we shouldn’t overestimate them either. Ascribing them with unmatched abilities or insurmountable power is a distortion. Oil, wherever the source must be extracted, shipped and refined. We have plenty of oil. We don’t have the refinery capacity to match demand for gas or diesel. Why? Over the years as existing refineries aged they weren’t updated or expanded nor were new refineries built. Largely due to insane environmental policies but also NIMBY sentiment.

We find ourselves in a similar situation as the protagonists in Atlas Shrugged. The solutions are known but the political system refuses to allow them to be implemented. So we coast along on the declining infrastructure of yesterday instead of building anew. The d/prog locusts will continue to demand that ‘industry’ provide the goods they want while simultaneously refusing to allow industry to repair or replace capacity much less build new plant and equipment.

Eventually the system deteriorates and ownership or potential investors walk away. We see a similar dynamic in our labor market. Many retired early due to vax mandates across every field. LEO in Seattle retiring or leaving as conditions became unbearable is another example. Nothing is set in stone but there’s only so much deterioration and defered maintenance before things become beyond repair.

Prices today are a reflection of many decades of poor decisions and a great deal of mal investment. The Biden admin policy choices broke the camel’s back for sure but that was less than two years of ‘straw’ added to the back of an already stooped and exhausted camel.

I don’t know. It mike take a genius and diligent work to create, but any idiot can destroy. Even dumb people are still pretty dang smart when they focus on something.

How can it not be intentional? Insane environmental and labor polices do not appear by accident.

See below

No chief, that’s not correct. I work too much in P,O&G as a PE and the big ones (XOM, BP, Marathon, Conoco) are clients I do frequent TAR’s with.

We have the capacity ( and then some) to provide our gas/oil and export ( we did it until Biden shut it down) and refineries are on cycles for TAR’s already. Our are no better or worse than any other country’s.

The administration doesn’t influence whether O&G replaces or repairs existing capacity- never have and never will. What does influence it is the FORECAST which is where they put the indirect chokehold on the market by hitting the supply chain.

(They do inhibit expansions through the weaponized EPA just like they do mining and foundries and chemical plants)

The labor lie is another bogus liberal lie promulgated by RINO’s. The problem is getting SKILLED people. I need seasoned millwrights- BA;s in “Social Justice” need not apply.( unless they can take a pair of Starrett “Last Words” and get shaft centers <.003" cold)

Prices is another lie. Prices today reflect GOVERNMENT INDUCED COST at every level of the chain. Manufacturing hasnt changed much but OSHA,EPA,DOT regulations (indirect costs) have SKYROCKETED.

I do the Six Sigma and cost tracking- the actual "manufacturing costs" are reasonably flat and stay that way- not much deviation when there is an existing process and manufacturing line.

Power costs more, Lubrication costs more, Insurance costs more, HSE costs more, Transportation costs more, Materials cost more- those ARE greatly influenced and induced deliberately by the GOVERNMENT both internally and by treaty.

No, bad decisions made by "greedy business people", didn't get us where we are- the GOVERNMENT PUT US HERE.

This is in fact, not only intentional but by design integrated into the overall 2030 and 2050 plan.

I am not blaming business. I blame the actions and in actions of decades worth of political decisions. Business responds to incentives and disincentive because they are rational actors for the most part.

We have less refinery capacity today than a year or five years ago. That is a fact. That’s not due to maintenance halts or a seasonal issue. The missing capacity was closed down. A new project would be something like 8-10 years of permitting before breaking ground. Then the refinery would have a life of 25+ years. If the project was able to get past all the hoops. Lots of uncertainty in that process.

Investing huge sums in that process in the face of ESG, EV madness and general hostility from govt towards completion of the project would be irrational. That’s why new refineries aren’t built. Too much regulation which drives up cost and uncertainty. Skilled labor matter. Many skilled people with vast experience retired early. That knowledge is gone. Some recent grad can’t replace the lost experience and skills built over decades. We can’t ignore that.

Not exactly, its a “fact” in a sense but with typical Govt “word games”. I’ll explain. (generally)

When they report the capacity drop, they are talking about calendar days ( not stream days) because many ( not all) of those lines “shut down” are in fact idle ( not closed and locked out or permanent).

Those lines are idle ( on solvent conversion, i.e. fuel production) because their operation/maintenance is business driven and the scamdemic cut into US usage thus business decisions to keep them down.

Actual stream day capacity ( capacity of the process) is adequate for US usage (but needs some TLC to provide OCONUS sales of product as well as oil)

The actual plant construction is cheap ( process plants are not all that expensive to build)- its the permit process (Govt driven) that’s the expensive bottleneck.

Anyone who says or believes that the govt doesn’t directly influence large parts of this is simply not qualified to speak on the subject or is deliberately lying.

The part about aging refineries is bogus political doublespeak also. When an asset is properly maintained (bottom of the bathtub curve in the P-F curve) its life is indefinite ( see ISO 55001). That’s an excuse people use to not answer further questions.

All declines in US petroleum production are in fact USG driven and can go away just that fast. Mining and Steel also.

We can recover them all and lead the world. The left knows this. The RINO’s know this. Our enemies know this.

Trump knew this and was doing it- that’s the root cause of the unified effort to remove him and MAGA.

Yes. That’s my mostly my point about aging infrastructure and investment. In an environment with significant regulatory headwinds and stupid policies the investment dollars go elsewhere. That’s a rational response to the situation, it’s not some evil plot by business to raise prices.

I am under the impression that actual total refinery capacity has declined. The NE has had several refineries close operations completely which is causing localized shortages in available diesel and aviation fuel. Is that not correct?

A report this am states that a refinery in Houston operated by Lyondell that may close ahead of schedule this year. They blame equipment failure and poor prospects for a return on investment to update facilities. How many others will do the same facing similar headwinds from your perspective?

Interested in the input of someone like yourself with a better inside view than those of us relying upon open source information.

@ Chief

Yes, we have lost some capacity so it has declined BUT that’s a loaded question depending on how you pull from the column.

The column is decided by the business needs so you get “X” fort fuel, Y for plastic and so on which gives an aggregate number total.

They then reduce those number individually and report a decline. ( download a report and look at the format by entity- you will see what they are doing)

It is a loss but recoverable by line reconfiguration so its not a big net loss.

Also that decline is further obfuscated by playing games with what its declined against.

For example- we have lost capacity yes so we have declined somewhat.

We can produce 100% of our usage needs with reduced exports ( if at 100% of available usage ) so we factually don’t have production issue ( its reported that way for ratings and influence)- its a paper govt dictated thing.

I am not at Lyondell but everybody in Energy Corridor knows about it. That place has been let go ( allowing a managed decline) for decades knowing it was going out- they are just using it for click bait now.

The industry as a whole doesn’t need a “rescue” in terms of a miracle- they need a Houdini to get out of the straight jacket and box the govt has put them in.

This entire thing is a complete manufactured crisis by the left and the RINO. They saw Trump was breaking the enemies back and the enemies threw enough money to the GOPe to stop him from crushing them. ( the left was already there)

If I’m following you then what we have is:

1. We do in fact have less total current refinery capacity overall than previously.

2. More refineries will likely close over the short term for various reasons further reducing available capacity.

3. This is reversible given a less overtly hostile regulatory and business investment climate.

That would seem to imply that:

1. The short-term outlook is bleak, Biden admin isn’t likely to reverse course on hostility to our domestic oil and gas industry.

2. Change will require an Admin which embraces oil and gas from exploration to the pump and all points in between.

3. Additionally it will require a Congress willing to pare back burdensome regulatory authority from the out of control bureaucracy.

Does that accurately summarize the current situation, short term prospects and very broadly define the solution?

@Chief

1: in a single word, yes we have lost net capacity but its a nebulous statement without a qualifier (s). We had ( stream) excess capacity to meet needs so losing “some” isn’t a significant impact. (yet) Also, we can adjust the column in terms of what we want ( scaled production) if necessary. Then also, plants ( refineries) are idling lines, closing lines, configuring new lines all the time so without specifics, the statement “losing capacity” is “user defined” and often misleading.

2:”Close” has 2 definitions ( possibly 3) “Out of business closed obviously but that doesn’t always happen. It can also mean “idle” ( pumping “stuff” to keep machines working but ready to go online in short order) and it can also mean “down” ( changeover/maintenance/ business lull)- this happens all the time also. Now, often companies who shut down “lease” their permit allowance so another refinery makes up the loss. In essence, not a liner one sentence one definition scenario.

3: Yes, very much reversible and could almost be real time immediate.

Your implications are pretty much spot on

Taurus,

Thanks for engaging. I appreciate it.

The price we see today is the lowest it will ever be or ever was. After Biden pulled the rug out from the energy sector and left them with a costly infrastructure, they are not going to reinvest in production if a Trump should ever get elected. If they’re content with profit margins now, ain’t no reason to go back to $2.00 gas.

In my part of CNY today the listed price for regular at most of the stations I passed was $4.99.9. Most places have a 10¢ gallon discount if you link your checking account with their card, and the local spot I get gas at currently offers a summer special 20¢ discount if you pay for it at the pump with their phone app. So I paid $4.79.9 I fill up weekly, the nice thing about high mileage hybrids. Next week the discount price will be >$5 a gallon. Actually a few months later than I had predicted when Joe was installed as POTUS.

We are going to have a great depression if things don’t change

It could be argued we’re in one right now- beginning stages thereof. Like collisions at sea, they happen very slowly, until suddenly they happen all at once.

But, but, Brandon said the economy was great, as did Geraldo on The Five today, raving about the 3.6% unemployment rate. I tell everyone who will listen that inflation is understated and is really about 10 points above wage growth …. that MUST eventually lead to people buying fewer numbers of goods and services = recession.

“”raving about the 3.6%””

But they don’t seem to mention all of the people who have left the workforce and aren’t counted as unemployed.

Yes indeed the labor force participation rate is down about 1.5% from 2019. That is a whole lot of people out of the labor force. Those missing people aren’t on unemployment nor seeking a job. Both those categories +the employed comprise the labor force.

Thanks to Dementia Joe the communist pedophile.

Under Trump we had $2.19 gas.

Under Biden the only place you can get gas for $2.19 is Taco Bell.

Taco Bell is higher too now just like all of the low margin fast food junk is. They already ran on volume at low margin and their food costs have risen.

If I’m not mistaken, gasbuddy data is user submitted. I would expect their numbers to be slightly underestimated as prices just keep going up and user data tends to lag behind the latest price changes.

I don’t know how AAA gets their data, but if it is from any government source they have plenty of reasons to have their data lag even further behind whether it be local, state, national and regardless of political persuasion.