Chase Bank Cancels Pro-Trump Covfefe Coffee

No further payments can be processed by the bank’s WePay service

The purge of anything and everyone even vaguely related to President Trump is taking yet another ominous turn.

Two banks, Deutsche and Signature, severed ties with Trump ostensibly due to the Capitol events of January 6th, but apparently just having a pro-Trump internet business is enough to get one cancelled.

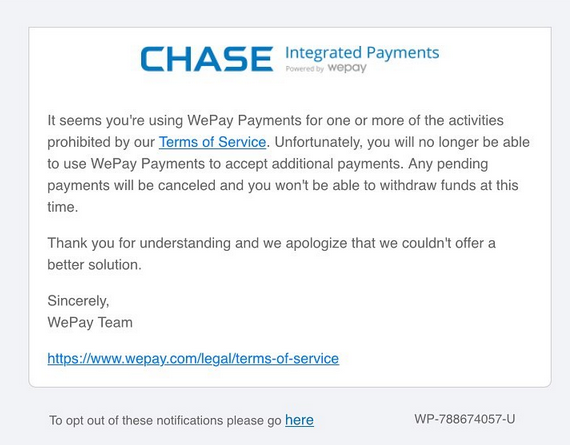

Pro-Trump Covfefe Coffee reported that it received a notice from Chase Bank that they had allegedly violated the terms of service and would no longer be able to use its WePay payment processing service.

In an email sent to Covfefe Coffee, Chase Bank claimed that the pro-Trump coffee company, founded in 2018, was using their WePay payment processor “for one or more of the activities prohibited by our Terms of Service,” and that as a result, they would be withdrawing use of the service, with all pending payments cancelled.

Speaking exclusively to National File, a spokesman for Covfefe Coffee noted that the company had been using the payment processor for two years without issue, and the declaration from Chase came completely out of the blue. The spokesman suggested that they were removed for solely political reasons; National File examined the Terms of Service of WePay, and could not find any legitimate reason for to have been removed.

Here is the email sent to Covfefe Coffee and posted on their Facebook page:

PJMedia notes that “This is not the company’s first experience with being canceled by big tech. In 2019, following a successful launch on Amazon, they were suspended from advertising on the platform. They were eventually told that having the phrase ‘Make America Great Again’ couldn’t be included on a listing that is in [sic] being advertised because Amazon believes the slogan ‘incites hate’.”

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

Sickening. We are going to have to take up arms if we are to survive. If they can cancel a business we can be cancelled. I’m not going quietly.

It would be a crying shame if Chase branches started to burn down.

No need for that. Just write a check on Monday and transfer your accounts to another bank. How many of the 75 million Trump voters use Chase services? Just stop, and transfer your money and use of services like their credits cards to other providers. Your best bet will be a smaller community bank or credit union. They will be more vulnerable to sudden capital outflows, and friendlier.

Which what I did years ago. They are not a reputable company. Cheated me out of several hundred dollars and refused to check out what happened because it wasn’t enough money lost. Never understood that logic.

Very similar experience happened to me. Chase is seriously not honorable and I suspect there are lots more like you and I.

Cancel culture needs to get sued like it was a Christian baker being made to make ghey wedding cakes.

Or as scooterjay says we might need to fight our way out

And, in which court do you believe you will get justice?

Fair trials are history.

Sued under what law? The baker could only be sued because he was in a state that had a law banning discrimination on the grounds of sexual preference. What law bans this, in whichever state/city whose laws apply to this case?

Contract law prohibits one party to a contract from breaching it without cause.

The payment processor is alleging Cofeve Coffee violated its TOS. It will have to prove that violation if taken to court.

If the courts are corrupt at all levels, its pointless, but the bahavior is in fact, against the law as pertains to the agreement between the parties.

I thought of that, but it seems there is no contract as such; it’s just a service that they provide and the only terms are the TOS, which says they can do whatever they like.

I think a law that would require them to explain themselves would be constitutional, and would be of at least some use.

I have not read the WePay terms of service, but I would think it is indeed a contract. Users of the service likely pay some sort of consideration for the use of WePay, therefore, it’s a contract. It is highly likely there are, however, “sole discretion” clauses, but they still need to show cause to exercise that discretion. However, once done, such a contract would be very difficult to assail in court. In some locals, sole discretion must still be “reasonable” or lacking in malice. But in most places, “sole discretion” is sole discretion.

Be careful what you agree to. Never assume good faith by the other party. Never give the viability of your business to the sole discretion of another party, no matter how convenient it may seem. If you have any capability to negotiate terms of a contract, try and make sure the word “sole” is stricken and replaced by the word “reasonable,” and insert the ability to arbitrate or litigate disagreement.

If you are unable to get such terms, make any such relationship as temporary as possible.

Acceptance of a TOS may not be a formal contract, but it’s certainly an implied contract, being an understanding between the parties in which one business lays out rules of conduct and the other business agrees to abide by them to assure continued service. That’s enforceable as is any formal contract.

If Chase wants to give someone the boot under the TOS for no cause, it should state in the TOS that it has the authority to do so. Only then would the booted have no cause of action against the bootee.

As I understand it, it does.

But perhaps there should be legislation to require them to give a reason.

The bakers (in Colorado and Oregon) were not discriminating on the basis of sexual preference. They both stated clearly that they served all customers without question.

If you confuse “discrimination” with unwillingness to provide a specific product, you are very much misled. Try ordering a ham and cheese sandwich in a kosher deli and see how far you get.

Of course they weren’t. That’s why they won. But that was the charge against them. That they were discriminating on the grounds of sexual preference, in a jurisdiction where that is illegal. Had they been in a jurisdiction where there isn’t such a law the whole case could not have begun.

Here it is, private companies can NOT abrogate your rights with impunity.

18 U.S. Code § 241 – Conspiracy against rights

If two or more persons conspire to injure, oppress, threaten, or intimidate any person in any State, Territory, Commonwealth, Possession, or District in the free exercise or enjoyment of any right or privilege secured to him by the Constitution or laws of the United States, or because of his having so exercised the same; or

If two or more persons go in disguise on the highway, or on the premises of another, with intent to prevent or hinder his free exercise or enjoyment of any right or privilege so secured—

They shall be fined under this title or imprisoned not more than ten years, or both; and if death results from the acts committed in violation of this section or if such acts include kidnapping or an attempt to kidnap, aggravated sexual abuse or an attempt to commit aggravated sexual abuse, or an attempt to kill, they shall be fined under this title or imprisoned for any term of years or for life, or both, or may be sentenced to death.

(June 25, 1948, ch. 645, 62 Stat. 696; Pub. L. 90–284, title I, § 103(a), Apr. 11, 1968, 82 Stat. 75; Pub. L. 100–690, title VII, § 7018(a), (b)(1), Nov. 18, 1988, 102 Stat. 4396; Pub. L. 103–322, title VI, § 60006(a), title XXXII, §§ 320103(a), 320201(a), title XXXIII, § 330016(1)(L), Sept. 13, 1994, 108 Stat. 1970, 2109, 2113, 2147; Pub. L. 104–294, title VI, §§ 604(b)(14)(A), 607(a), Oct. 11, 1996, 110 Stat. 3507, 3511.)

I don’t think this applies at all in this instance, which would likely be a contract tort.

Nope. There’s no constitutional “right or privilege” to use a bank’s services. The bank is entitled to deny its services on any grounds except those specifically prohibited by law.

They are, nevertheless, bound by any contract they have made with a second party, and all associated governing contract law. So, they cannot do anything they desire. But, likely, they wrote a contract to that effect.

Click “Accept” at your own peril.

I believe the left is quickly leaving us no choice but to use your second option. It really is a “the ball is in their court” type of a situation. This result will not be on us…….it will be on them……

Yes. Let the media wail…and let them know they are next.

Just sent them a message demanding they reverse this decision, and telling them if they do not I will cancel my credit card with them.

One credit card account isn’t going to concern them. What it will take is someone with a medium to large company that uses Chase for their corporate credit cards. They call him, and threaten to cancel, say, a 5000 credit card account. Or even a little mom and pop operation that might have six or eight cards, that can have some affect if enough mom and pops do it.

A former employer of mine bank with the B of a. They did enough things to annoy him, that he switched over to I forget which bank actually because he was making the switch right as I was changing to a new job. But the point remains that a couple of days before I left for my new job, the Bank of America representative was in doing a song and dance show for him to get him to keep his accounts there. Several credit cards several checking accounts and a couple of other banking instruments were moved to this new bank. I want to say it was Union Bank. It may have been.

And then upon cancellation the credit card company simply demands immediate payment for all outstanding debts on those “5000 company credit cards” (plus all interest, fees, and penalties to which they are owed) and the company is forced to cut a check for a considerable amount of money to pay off all their obligations and then business practically stops while they search for a credit card company that will issue them 5000 new credit cards so that that business can continue. (Because employees aren’t going to use their personal credit cards for company business. At least, I wouldn’t)

Just saying.

And where will you go? How many credit card issuers are there, really? Chase seems to have about a million different ones.

Virtually every bank or credit union in the country offers some sort of a Visa or MasterCard. They may not have all the whizbang so Chase has, but one has to ask oneself does one really need these perks?

Capital one and American Express are 2 easy choices.

Chase and the rest of them are multi-billion dollars a year corporations. I seriously doubt they’d be concerned at all if you or perhaps a couple hundred small time credit card users cancelled your cards. You aren’t the ones making them the money. So by all means, cancel away, but its highly doubtful it will change their minds.

I don’t say “Sue ’em” very often, but in this case, I’ll make an exception. Sue ’em. Sue ’em until their eyes bleed.

I agree, if the victim can find a law to sue under. I’m afraid they won’t find one, that in whichever state/city it is whose laws apply to this case, there is no such law.

The TOS very likely has a clause that its terms are to be interpreted under the laws of such-and-such principality, and that dispute resolution will be conducted under some venue for mandatory arbitration with no ability to sue thereafter.

I would think that some version of public accommodation would work. They market their financial services to the public, so to deny someone for political flavor is not much different than doing so for the color of one’s skin or the objects of their affection. File suit and let them explain the difference. At $400 per hour and up.

The Right has to stop playing nice. They don’t like us anyway, so why spin your wheels trying.

Sue the bastards!

PS.. Who is this coffee company and will they accept checks and or credit cards direct?

Best to my knowledge federal law makes it a crime to discriminate on the basis of color, sex or gender (male/female). But no federal law makes it a crime to discriminate on the basis of political affiliation.

So any lawsuit would ultimately be pointless.

While technically true it lacks imagination.

Haven’t we heard for the last four years, that Trump supporters are White Supremacists? That means that targeting Trump supporters is nothing but a disguise for the racial discrimination the bank willingly implements.

The disparate impact, activist judges have established, is enough to prove racial discrimination.

Is it ridiculous? Of course. It is however precedent. It needs to be used against the perps.

And before someone says a company has no race: the newest fad of “race-owned company” provides the reasoning around that problem.

Unless they are forced to play by their own rules they will never feel the need to return to sanity.

And in the end any “lawsuit” filed against a multi-billion dollar corporation is going to be squashed flat in very little time. Or will be dragged out endlessly until the plaintiffs simply run out of money to pursue the lawsuit. Either way it’ll end poorly for the plaintiff. Guaranteed.

Ironically enough, California has such a law. Presumably it was enacted to protect left-wing employees from avaricious conservative employers. However, as with all public policy measures, there are unintended consequences.

For example, James Damore of Google fame is suing them in state court under the California statutes.

Sigh. This again. How many times do I have to explain that there is no general law against discrimination? Where do people get this idea that “public accommodations” must deal with all comers? It’s just not true. There is no such law. There is a law banning public accommodations from turning down customers on specific grounds. Skin color is one of those groudns under federal law. Sexual preference is not, and nor is political opinion, but there are states and municipalities that have their own laws banning such discrimination. So it depends where you are.

It’s a horrible shame that the man doesn’t read your every word and accept it as gospel even though you don’t discuss any of the actual issues that a legally interested reader might care about. I’m a lawyer and I thought you might actually be wrong per the Supreme Court’s ridiculous decision in Bostock. You’re right but this pattern of going out of the way to deride people on your side instead of trying to help is unbelievably annoying.

For those who are interested in the issues here, the Civil Rights Act of 1964 has different definitions of what type of discrimination is illegal in different contexts. Title VII, for employment, prohibits discrimination based on “sex.” The Supreme Court’s ridiculous 2020 decision in Bostock — with Justice “I hire lots of women to show what a good boy I am” Kavanaugh in the majority — extended “sex” to include both being a homosexual and being a “transsexual.”

In contrast, the provision for discrimination against a business’s customers, Title II, doesn’t prohibit discrimination based on “sex.” So federal law, as I read it, should allow discrimination based on sex, against homosexuals, and against “transexuals.” Of course, lots of jurisdictions have local anti-discrimination laws that go beyond federal law.

Obviously, none of this is legal advice but rather commentary about the state of the law and anyone considering whether to so “discriminate” should contact a lawyer instead of relying on what I’m saying here.

Thank you for the info and for asking for Mr. Milhouse to be a little nicer. That bugs me, too.

Even under Bostock “sex” doesn’t include the state of being homosexual or transsexual. But discrimination on the grounds of sex does include treating someone in a way you wouldn’t if they had been the opposite sex. Which ends up covering a lot of the same ground, but not quite all of it. And yes, Bostock is ridiculous on its face, but Gorsuch’s reasoning is fairly solid; it’s the precedents he refuses to question that are wrong, or at least should be questioned. Which is why I wonder what Thomas thinks about Loving, because Bostock is its progeny.

Hey tender snowflake, since when do conservatives worry about how the truth appears? The truth is the truth, and Milhouse told it. If you need a good cry, go to MSNBC. More your speed.

Both of my credit cards are chase

Anyone know the best card to get cause I will very much want to cancel mine

I’m with capital one. I’m sure they will pull some sort of stunts in the future, but I’ve been with them for well over a decade, and the service has been excellent. I also have credit cards with two credit unions. Maybe a credit union is the best thing. They’re usually local.

I’ve had a BoA card since ’94, and a Chase Freedom card since ’92. I just paid off the BoA & cashed out my rewards after their announcement of turning over activity information; I haven’t decided whether to out and out cancel it just yet. I guess we’ll see how Chase acts, but news this doesn’t give me a good feeling. I bank only with locals & credit unions. The big banks couldn’t care less about you as a customer.

Gonzo, if you’re a veteran, I’d recommend Penfed Power Cash Rewards. 2% cash back on all purchases, and not one of the larger “woke” banks.

And even if you’re not a veteran. Penfed agreed to run the NRA affinity program after First Bankcard cancelled them. They have lots of non-veteran business now, even directly. They no longer even mention national service on their website.

If you have a military connection, USAA.

I have Citi as a Costco user. And I have 5-Star, formerly AFBA (Armed Forces Benefit Association). I pay the balance monthly so I don’t even know the interest rates for time payments.

Get one from a local bank. Avoid the large international institutions.

Don’t cancel your accounts. Leave them open. Use them once a year or so. It costs Chase a bit to maintain an account, so why do them the favor of closing?

And DON’T tell them why. They don’t care about your opinion. They hate what you stand for, and have no intention of changing.

Information is money. Cost them money by withholding information. 10,000 angry (small) customers rage-cancelling will just make them laugh. 10,000 accounts that stop producing revenue, without explanation, might mess us their quarterly forecasts a little bit. 100,000 accounts that stop producing revenue might cost a woke mid-level VP a raise or promotion.

If patriotic customers are collectively big enough to hurt Chase, the BEST way to hurt them is silently, without explanation. Hurt Chase, hurt their investors, hurt their employees. Then they might feel the pain. They’ll shrink, their competitors will grow, and some of their competitors might not hate America. We can’t fix Chase. We might be able to replace it, over time, with something a little less rotten.

That’s a good idea, but unfortunately, while it does cost Chase something to keep your account open, in most cases you are paying that cost.

My Chase United Airlines Mileage Plus Visa costs $60 a year. I’m going to have to use over 330,000 frequent flier miles first before I close the account.

I know as a private company it will be claimed they can do whatever they want but I wonder on what legal basis Chase Bank has for

stealingrefusing to release any money in their account.Wow, never mind. It is in WePay’s terms of service that they can seize any monies in the account if they believe it is the result of illegal activity.

Wonder where the “seized” money goes in the end.

Source:

https://go.wepay.com/terms-of-service-us/

Many banks take the attitude that it isn’t your money, it is their’s. Case in point: if you have a large deposit in say a savings account, walk in the door and try to pull it all out at once. They will do everything they possibly can to keep from coming across with your money.

They have some legal time to come up with it. It’s the checking account that they have to pay right away.

Sorry, was heading for the “reply” thing and hit the down vote by accident.

In any case, been there done that and I won’t take any guff or nonsense from the bank. If I request to close an account I expect my request to be honored with the minimum of fuss. (And no, they don’t get to ask what I’m going to do with the money. That’s none of their business.)

But yes, they do try and hold onto it no matter what.

“Many banks take the attitude that it isn’t your money, it is theirs’s.”

Actually, it’s not – you gave it to them. All you have in return is a promise from them to give it back to you upon demand. You are, in effect and in deed, an unsecured creditor of the bank.

Banks may do such things as convert you deposits in bank stock or enact a depositor “bail-in” where they just take a portion of your deposits to maintain bank liquidity.

If you have substantial bank holdings, or a dependency upon your deposits in a bank or credit union, best to diversity.

But they’re not alleging fraud or illegal activity. Just some unspecified violation of their terms of service. That’s not enough for them to seize the money. That is something that can be sued for, in any jurisdiction. They’ll at least have to come out and say exactly what it is they’re alleging. And then they may be open to a suit for defamation.

PayPal has a history of similar crap, they freeze an account and demand more information. I promptly removed them from my websites. Eventually, they lifted the freeze, I removed all the money, and did not restore them. My freeze was until hell freezes over..

Wepay is owned by Chase isn’t it?

This is unbelievable

As bad as I thought it would be it is worse already and it’s only 2 weeks

Boy do we need a plan…

So, how about both naughty and nice lists, online with details of why.

just when I was considering them as a new bank after I close my BOA accounts

With the exception of USAA I have pretty much given up on all banks. All of them will nickel and dime you to death on the service charges, or they’re starting to get so political but it’s unbelievable. I’ve pretty much switched over to credit unions. They may not have the fancy-schmancy travel cards and all this other sort of thing, but at least their banking is done in a businesslike fashion. If you happen to live in North East Tennessee, I can’t speak highly enough of Eastman credit union. If you’re a veteran, navy federal is pretty good.

I have a little bit of cash in a cedit market account, may need to explore that union to do more and more of the regular banking

I repeat, use smaller regional banks and credit unions. All the big banks are shady.

If your husband is a naval veteran can his spouse open an account?

Absolutely. I think all you need to do is ring them up on the phone and talk to an account opener. Or whatever they call them. I think provision of the DD 214 copy will do the job. Just ask the nice lady at the other end of the phone. In the last few years I haven’t been successful in getting good insurance rates from them, but that’s the way the cookie crumble ‘s. Am I run a small checking account out of there and I also have their version of an American Express card. 5% back on gasoline purchases is pretty good. When I talk to people on the phone, they all seem competent, and they are always polite.

I just realized I didn’t know which institution you were talking about. What I just said above applies both the USAA and to Navy Federal credit Union. Also there’s a credit union based out of the Pentagon, called pen fed. That might also work for veterans and veterans family

I’ve been on my husband’s account with NavyFed since we were married, but a few years back, well after he retired, I opened one where I was the principal shareholder (it’s easier if we work out of separate accounts, less “oops, forgot to mention I took some cash out!” causing overdrafts). Our daughters have accounts and I believe they would even let my parents open one, and I’m their only tie to the military.

See above. PenFed accepts general business now.

Navy Federal is great! Look at the rules…easy to join.

https://www.navyfederal.org/membership/become-a-member.html

Impossible to join if you’re single and neither you nor your parents are veterans.

That maybe so. But the nifty thing is there are all manner of credit Union someone can join now. Penn Fed is a big one. There are other credit unions in your town we’re just living worshiping or working with in the geographic area qualifies you for membership. I’d give them a look.

As a side note, Liberty Mutual Insurance stinks as bad as BoA…

My experience with them was good, but this was a long time ago. The companies that I dismiss out of hand and will not even talk to our, Allstate, State Farm, and that’s it. I forgot third one. Farmers was pretty good. But I haven’t dealt with them and probably three decades.

I had homeowner’s with Farmer for a long time with no problems until they got into a beef with the state. They sent me a letter telling me they were terminating my insurance, so I switched to another agency. A few months later, after they’d settled their dispute with the state, my ex-agent called me wanting me to come back to Farmer’s. Guess what I told them?

Farmers has a bad reputation for paying claims. I’d stay away from Farmers, State Farm and Liberty Mutual

Sad to hear that. Our local State Farm were the only people we could get to insure our house when we bought it because it was over 50 years old. The local agent is fantastic, and they’ve been very helpful with the few car accidents we’ve had. (Rear-ended by a semi at a stop light!) GEICO was excellent service for car insurance for years, but we switched after we got the homeowner’s with State Farm because the rates were so much better with the multiple policy discount. Otherwise we would never have switched.

On the other hand, after All State cancelled our homeowner’s in Virginia because the house was broken into before we even moved into it, and we ended up in the state pool for the uninsurable with essentially *no* contents coverage, I’ve refused to even talk to them about anything. And after dumping our homeowner’s insurance, they couldn’t understand why we were switching our car insurance too… Idiots.

It may be worth filing an el cheapo suit just to make them say what violation they’re alleging.

Maybe one idea for legislation that might attract enough support to pass, and that doesn’t violate anyone’s rights, would be to make service providers, even free ones, give a reason for cancelling someone’s account. Yes, it’s your server and you reserve the right to withdraw your services at any time, but it doesn’t violate any of your rights to be made to say why.

Given that Chase is national… any commerce law to apply?

So discrimination is fine and dandy as long as no law prohibits it?

All the anti discrimination laws made on sex, religion, race, and no one slipped in politics?

So the next discrimination case the one being sued just says yes he is a different race, sex, religion but I just hate his politics so screw off?

Yes, that is exactly right.

The federal law doesn’t include sexual preference either, and not all state or local laws do; in those places it’s perfectly legal to discriminate on that ground. (This is still technically true even after last year’s supreme court decisions, but you have to be careful. You can still discriminate on the grounds of sexual preference, in those places that haven’t banned it, but not on the grounds that the person has done something that you wouldn’t object to if they were the opposite sex. Not that you should want to discriminate in this way, but obviously there are people who do, so I’m talking about those people.)

Unfortunately for this entire thread concerning “discrimination,” Chase did not claim that they terminated Covfeve over politics. The claim was “terms of service” violation.

We know why they were terminated, but that’s not what is on the record. “Violation of terms” is on the record. Sue them, force them explain and prove the violation.

“Yes, that is exactly right”

Well, I would not say it is just “fine and dandy.” I think it is both unethical and morally reprehensible, without more knowledge or information on the rationale for the move by Chase. But, agreed, it is certainly legal, at least on the basis of federal law.

I hold the law may be an ass. Something may be both legal and reprehensible. An example being the day when one man could own another as property. Of course, reprehensibility is in the eye of the beholder, but so is, too, very often, the legality of a matter. Hence, opposing parties presenting before a jury.

The Courts can and have added protected classes such as sexual orientation or illegal immigrants who were not included by Congress in the Civil Rights laws.

Assuming Congress will never add protection for political speech, we are at the mercy of SCOTUS to say this constitutes discrimination by private parties.

I think that it is past time to identify and protect the new vulnerable groups.

Get you state officials to take away the banks charter to operate within your state unless they change their evil ways.

On what grounds? They can’t just do it on a whim.

How do you know his state officials aren’t Democrats?

The state may do anything on a whim. Have you not been paying attention the last 11 months?

The state may do what it wants, the people may do what they want. And as the two coincide, so, too, does civic harmony. As the two diverge, so, too, does civic disunion.

They were eventually told that having the phrase ‘Make America Great Again’ couldn’t be included on a listing that is in [sic] being advertised because Amazon believes the slogan ‘incites hate’.”

Amazon might have a point there. “Things go better with Coke,” “We try harder,” and “Diamonds are forever” all used to rile me up pretty good.

It does, but the hate flows from the left not Trump supporters. What Amazon is really saying is that slogans that the right can’t have slogans that the left doesn’t like.

Oh yeah, they’re all using Jan 6th to label all Trump supporters as insurrectionists.

Time to go full virtual currency. No payment processors. No gatekeepers. No governments making your fiat worthless.

I canceled Chase years ago.

It’s important we hold the people running Chase accountable:’

Jamie Dimon, CEO

Board of Directors:

Linda B. Bammann

Todd A. Combs

James S. Crown

James Dimon

Timothy P. Flynn

Mellody Hobson

Michael A. Neal

Michael A. Neal

Lee R. Raymond

https://www.jpmorganchase.com/about/our-leadership

Covfefe Coffee has a slam-dunk lawsuit against Chase for conspiracy to suppress civil rights.

Lawsuits against speech censorship by social media companies are harder because they have Section 230 protection for censorship of protected speech so long as the censorship is in “good faith.” That can probably be overcome in the present situation where the direct intent of censorship to suppress protected speech.

Current censorship isn’t a byproduct of enforcing something legitimate like civility and if “good faith” means anything it must mean not intentionally suppressing the most protected form of speech, which is political speech. But that argument doesn’t even have to be made when banks engage in political suppression because they don’t have Section 230 protection.

Chase Bank’s actions are clearly suppressive of the political rights of Covfefe Coffee. The only question then is whether its actions can be considered conspiratorial. If so then they are subject to both criminal prosecution and civil suit under the 1964-65 Civil Rights acts.

Note that anti-trust law is founded on the understanding that monopoly power in itself constitutes conspiracy (a trust), and this understanding is well founded. As the only provider of a service the monopolist is indistinguishable from a large number of independent providers who are conspiring to restrict output and raise prices.

Since only a small number of banking groups provide transaction services these groups all have substantial market power or monopoly power and hence are properly considered to be trusts or conspiracies.

People are allowed to conspire to do many things, such as speak and associate and work together for the advancement of shared political ideals. The Civil Rights Acts specify things that people are NOT allowed to conspire to do. In particular they are not allowed to conspire to suppress OTHER people’s rights to speech and association, which is exactly what Chase is doing.

There will obviously be no criminal charges coming from the illegitimate election-stealing totalitarian communist Biden administration but the Civil Rights Acts anticipated that. They were written at a time when government itself was the primary culprit in the suppression of civil rights.

Thus the door to civil suit is wide open at a time when the judiciary is the one branch of government that is majority conservative. Use it!

This is nonsense because Chase is not a state actor. It has every legal right to choose whom it does business with, so long as there’s no law specifically saying otherwise.

Similarly Twitter/Facebook don’t need to rely on section 230 to suppress messages they don’t like. What they need section 230 for is to prevent some perverse court from ruling, as did the court in the infamous Prodigy case, that censoring some messages makes them responsible for everything they don’t censor, even if they’ve never read it let alone approved it. Which the supreme court explicitly rejected in the case of bookstores, and would therefore presumably have also rejected had the Prodigy case got to it, but it never got that far because Congress stepped in to fix it.

From a person prone to turgid prose, I think you should have stopped with one word, “Nonsense.”

It is all that needed to be said in this instance.

My wife say we have too many Credit Cards.

Chase just make it easy for me to decide which one to cancel.

I love Capitalism, because I can choose who I do business with or not!

My wife says…

Why can’t we edit our own comments, if we notice a typo after clicking “Submit”?