Revenge of the Nerds: Reddit “WallStreetBets” Short Squeezes Hedge Fund on GameStop Stock

In response , Team Biden is ‘monitoring situation’ and points to female Treasury Secretary.

The last time I headed into GameStop, a chain store selling a wide variety of games (software, board, role-playing), was about four years ago when my son participated in a “Magic the Gathering” tournament.

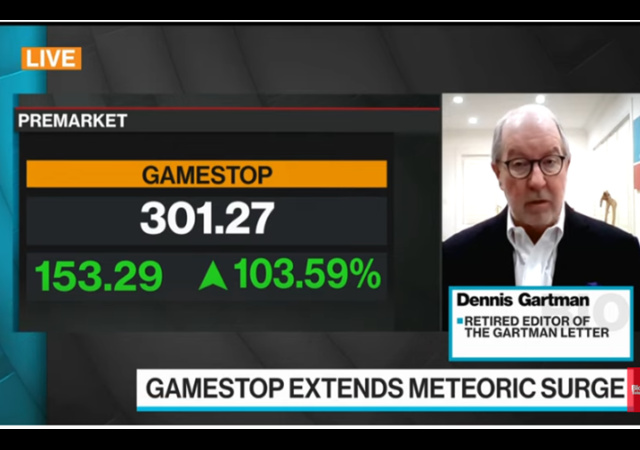

Imagine my surprise upon discovering that the chain, which has been hard-hit by the rise of online gaming and COVID-19, had stock worth more than Apple or Facebook.

GameStop stock is currently priced higher than Apple, Facebook, Microsoft or Disney stock. Didn't think I'd be typing those words in 2021

— Shannon Liao (@Shannon_Liao) January 27, 2021

And while I personally value Facebook very little, the GameStop share price is genuinely astonishing.

Market Fweedom! pic.twitter.com/vV5QWDG6lS

— Patrick Howley (@HowleyReporter) January 27, 2021

The stratospheric value results from millions of renegade stock traders “short squeezing” some of Wall Street’s most sophisticated investors.

[T]…hey apart of a frenzy that appears to have originated on a Reddit message board, WallStreetBets, a community known for irreverent market discussions, and on messaging platforms like Discord. (One comment from WallStreetBets read, “PUT YOUR LIFTOFF DIAPERS ON ITS ABOUT TO START.”) Both Tesla’s Elon Musk and the billionaire tech investor Chamath Palihapitiya have encouraged the crowd via Twitter.

Egged on by the message boards, these traders are rushing to buy options contracts that will profit from a rise in the share price. And that trading can create a feedback loop that drives the underlying share prices higher, as brokerage firms that sell the options have to buy shares as a hedge.

Ace of Spades HQ has a summary of the fiscal complexities. In a nutshell, here is what happened:

1) Big firm investor borrows GSE [GameStop] stocks for a set price per stock with an agreement to repurchase it at some price at a specified period (e.g., $60/share in 3 weeks).

2) Big firm investor imagines selling the stock at $60/share but repurchases it in 3 weeks for substantially less money per share (e.g., $40/share). Big firm investor then makes $20/share, minus what he gives to the firm from which he borrowed stocks (which also made money on borrowing fees).

However, in this situation, the independent traders kept buying the stock, raising the price. Citron Research and Melvin Capital borrowed billions of dollars worth of GameStop stock, only to see Reddit Traders kept on buying (up to 471% over its valuation). That meant Citron Research and Melvin Capital had to buy at it at higher prices before it went any higher, and the cycle of escalating costs continued because the prominent investor had to keep on buying it. Hence, they had enough to return it at the specified period.

As noted in this beautiful video summary, “It was like 2008 in reverse”.

Having been “short squeezed,” Melvin Capital and Citron Research have closed their bearish bets after the stock’s climb fueled massive losses.

Melvin Capital and Citron Research closed their short positions on GameStop stock after the company’s massive rally formed an extraordinary short squeeze. The former ate a huge loss when it ended its bearish bet on Tuesday afternoon, CNBC reported.

The Citron managing partner Andrew Left said in a video on Wednesday that most of the firm’s position was covered when GameStop traded at about $90 at “a loss of 100%.” He added that he maintained a smaller position in the stock.

“We’ll become more judicious when it comes to shorting stocks,” Left said. “Doesn’t mean the industry is dead, but it just means you have to be more specific.”

And that is how a group of small investors made billions off of an elite investment firm. The independents are also eyeing Blackberry, AMC, and Nokia Oyjis for similar actions.

However, our corporate overlords’ plan stopped regular Americans from getting rich off of the elite and well-connected.

TD Ameritrade said it was restricting trading for GameStop GME, +134.84% and AMC Entertainment Holdings AMC, +301.21%, as well as other names, amid a triple-digit percentage surge in the price of those companies in recent days.

“In the interest of mitigating risk for our company and clients, we have put in place several restrictions on some transactions in $GME, $AMC and other securities,” a spokeswoman for TD Ameritrade told MarketWatch, referring to the ticker symbols of the companies.

“We made these decisions out of an abundance of caution amid unprecedented market conditions and other factors,” she said.

Charles Schwab, which bought TD Ameritrade but is still operating as an independent retail brokerage platform, said that it has tightened margin requirements in some of those trading names, including GameStop.

Meanwhile, the response by the current administration is everything you would expect. They are “monitoring the situation“…likely to see how it can profit.

The White House and Treasury Department are monitoring the situation involving GameStop and other companies that have seen sharp gains on the stock market, White House Press Secretary Jen Psaki said on Wednesday.

Shares of both GameStop and AMC Entertainment Holdings more than doubled on Wednesday, forcing hedge funds to take heavy losses and sparking calls for scrutiny of anonymous stock market trading posts on social media.

Biden White House Press Secretary asked about GameStop, AMC and Blockbuster stock market drama.

She responds by reminding everyone that they have the FIRST FEMALE treasury secretary & says they’re “monitoring the situation.”pic.twitter.com/Lu2PR6NAdd

— The Columbia Bugle ?? (@ColumbiaBugle) January 27, 2021

Biden team doesn't know what to make of Gamestop situation, totally clueless. Source tells me they just called up a contact at Jeff Sprecher's office to explain and they still don’t get it.

— Jack Posobiec (@JackPosobiec) January 27, 2021

Many Americans are cheering for the Reddit “nerds” who got their revenge on Wall Street.

Translation: How dare the PEASANTS find a way to game the stock market to their benefit, only BILLIONAIRES who run hedge funds & large banks can do that

— nelson mandela (@shakazulu2016) January 27, 2021

REMINDER: Wall Street hedge funds running to the exchanges to halt trading to prevent losses is another example of why the game has always been rigged in favor of the elites.

When you lose it is okay, but when they lose the game is turned off.

— Pomp ? (@APompliano) January 27, 2021

The Wolf of Wall Street 2 is gonna be bonkers. #GameStop #wallstreetbets pic.twitter.com/9eXBmXHZJU

— SuburbaniteSlob (@AlexWeberComedy) January 27, 2021

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

The reaction to GameStop is like watching Trading Places and, at the end, when the Duke brothers are shouting, “Get those traders back in here! Turn those machines back on!” the options board…does exactly that. That’s what this looks like to me.

…and now Reddit shut down “WallStreetBets”. Nothing like having friends in high places.

Insiders at Robinhood are revealing they were pressured by a call from the White House to halt GMS trading.

RH is settling traders account in GMS without their knowledge! Selling for a fraction of the Market Value!

OFFICIAL PHONE LOG – POTUS WHITE HOUSE

SUBJ: PHONE INTERCEPT G SORROS AND J BIDEN 20210126 1438Z

BEGIN TRANSCRIPT:

SORROS: Joe, is this Joe?

POTUS: Yes, sir. This is Joe.

SORROS: WTF!

POTUS: Uh, um, my pen…. have you seen my pen? Where’s, where’s my pen?

SORROS: I’m the one that’s supposed to manipulate markets! Who authorized this? Do you know what kind of short exposure I have on this. Me and Buffet….

POTUS: Um, let’s see, it’s not, it’s not… um

SORROS: We can’t let a bunch of deplorable peasants make money in the stock market, Joe. I’m supposed to fleece them, you here me! It’s not supposed to be the other way around.

POTUS: Um, my pocket… maybe… um… no… um, what was I looking for?

SORROS: I’m losing BILLIONS, do you hear me BILLIIONS! Do you know how much I give to Democrats! Maybe you want to think about how I’m gonna pay the bills for you jerks if I’m losing BILLIONS to a bunch of, of, of LITTLE PEOPLE!

POTUS: Hmmm, yeah, Little people. I like Dopey. He’s my favorite. But those guys in the Wizard of Oz. . . Hello? I’m sorry, who am I, um, who am I speaking… dang, where’s my pen?

SORROS: JOE! JOE! This is George… George Sorros! Snap to it. What are you going to about this?

POTUS: What? Yeah. I saw it, I remember, I think, seeing it… Um. It seems I’ve lost my pen. Do you known where my pen is?

SORROS: I can’t believe I actually paid money for this. Why do I have to do everything my GD self?

END TRANSCRIPT

A point of order.

Share price is not the total picture in stock valuation. The number of outstanding shares also matters. So 1 outstanding share valued at $1,000,000 is not a greater stock value than 4 outstanding shares valued at $500,000 apiece. Stock value times outstanding shares is market capitalization.

As of this comment posting:

Gamestop’s Market Cap: $22 billion

Facebook’s Market Cap: $795 billion

Apple’s Market Cap: $2.344 trillion

Yes, this is why stocks can split and trade at a lower share price with the company’s valuation actually unchanged. It makes the shares a little more accessible to the smaller investor who wants the blue chip stock. AAPL did this a few years back and it was a good move. It isn’t why they hit the boom, but it definitely drove up their share price because more people could access it for investment.

Then, some others just want to keep their share price up without splitting to look like the biggest dog on the block. This is key to a company like TSLA that is trading way beyond what it should based on actual earnings.

It’s a different story, though, when the pledged shares are 140% of the issued shares. And market cap doesn’t mean anything in a price bubble.

Even with the phantom shares the Gamestop market cap is still miniscule compared to Facebook or Apple. But my post was not about market cap anyways. It was in reply to this sentence in the above article.

“Imagine my surprise upon discovering that the chain, which has been hard-hit by the rise of online gaming and COVID-19, had stock worth more than Apple or Facebook.”

I was pointing out that it isn’t actually true that Gamestop is worth more in the market than Facebook or Apple.

I like Pensaki’s reply. Our Sec. of Treasury has a vagina so we have total control of the situation.

That was priceless. The logical conclusion to basing everything on identity.

Just like the Wuflu situation, no matter how badly this ends the Joseph Goebbels media will claim the Biden* administration’s response was a smashing success.

You sure about that?

She is insanely stupid.

Yup.

Lookout, Reddit — you’re going to get sent to bed without your supper!

And wait until your father gets home!

I’m sure legislation is being drafted to protect the hedge funds from getting beat at their own game in the future. Nancy can buy Tesla shares right before Slow Joe announces the entire federal fleet of cars is being changed to 100% electric and nary an eyebrow is raised at the SEC. The SEC saves that scrutiny for reddit users capitalizing on publicly available information.

As I understand it, Congress is exempt from any insider trading laws. There’s nothing the SEC could do anyway, unless Trump was in Congress and then there would be some sort of action.

No, it is not exempt. Any congressmen caught insider trading is arrested and charged. See Chris Collins. I don’t know why anyone would think otherwise.

The catch is that tiny word “caught”. It’s not all that easy to catch insider traders in the first place; catching congressmen doing it is somewhat harder, and there’s indirect but strong evidence that many of them get away with it.

Nancy Pelosi placed a million dollar bet on Tesla, with suspicious timing. So, it really looks like some Members of Congress really are more equal than others.

“Any congressmen caught insider trading is arrested and charged.”

Well, at least not when congress is in session, but, in theory, otherwise, yes… in theory.

You realize that a Federal bailout of Wall Street fatcats is coming – paid for by YOUR tax money!

Anybody want to bet that the “conservatives” at the National Benedict Arnold Review Online will be full steam ahead in favor of government regulation?

After all, “free market” means ruining the little people, not the donor class that pay the bribes to fix the markets…

I seriously doubt anyone at NR will or would support a bailout of the wall street fatcats.

Probably (and hopefully) not. But I was talking about their screams for regulation that must ensure that only the correct people win.

So the first 46’s press secretary comes up with (besides, no doubt, announcing she’d be circling back) is the excuse that this “tragedy” happened because the person in charge is a woman?

LOL, can’t make it up.

(Of course, Ms Psaki, whose government twitter disappointingly does not inform us of zer/her/his/… pronouns, didn’t mean that.)

When will people learn that Dems and their friends in Big Tech, the media and finance are playing Calvin ball?

We know it, and so does this gaggle of small investors.

The thrill here comes from discovering how to game the Calvinball.

Funniest damned story of 2021 so far.

…and now from The Verge “Robinhood blocks purchase of GameStop, AMC, and BlackBerry stock “

Saw that this morning when I logged on to my account.

Tweeted by @JordanUhl

2008 Financial collapse? You should have considered the risks!

Student loan debt? You should have considered the risks!

Credit card debt? You should have considered the risks!

Hedge fund makes a risky bet & might go under? It’s not their fault, shut everything down!

It is foolish to regard this “mob investing” strategy as some sort of a blow against capitalism, or hedge funds for that matter. It bears the same relationship to investing as Antifa riots do to legitimate first amendment protest; to wit, none.

This phenomenon is merely a vehicle to enrich some millionaire/billionaire types at the expense of other millionaire/billionaires.

The hedge funds who are shorting these stocks are getting hammered, to be sure. However, the wealthy investors who own these stocks are now being made wealthy, at least on paper, beyond their wildest dreams. What a blow for equality!

In reality, the first one of the legitimate investors in, let’s say Gamestop, who decides to cash in will pop this bubble and cause all these amateur investors to lose billions of dollars.

Any short selling hedge fund that can withstand the current wave of “mob rule” investing long enough to await the arrival of the collapse of the stock price will profit handsomely.

What is happening now is just mob hysteria masquerading as investment.

It will all end in tears.

“(T)he wealthy investors who own these stocks are now being made wealthy, at least on paper”

Ay, there’s the rub. In market speculation, what goes up must come down, and most of them are going to lose their shirts when the prices collapse – and hurt a lot of other people when the momentum crashes the rest of the market.

I read that part of the problem is that a brokerage can lend out the same shares to more than one person, effectively creating a fractional stock reserve similar to how our money supply is managed by the fed. One of the redditors noticed that the “float” (number of shares shorted) exceeded the number of outstanding shares and the stock was ripe for a squeeze play.

If there’s a problem here, I think the place to start fixing it is not allowing more shares to be loaned out than exist.

Absolutely! It’s one thing to loan shares for a short, another thing to loan non existing assets as existing ones. I don’t have much sympathy for the hedge funds that got burned here. If they didn’t properly stop loss their positions, they deserved to be taken to the cleaners. This situation should hopefully prove to people that the stock market isn’t driven by fundamentals, but by the emotions of the buyers and sellers, and is now easily manipulated by others outside of the big funds and banks.

“should hopefully prove to people that the stock market isn’t driven by fundamentals, but by the emotions of the buyers and sellers”

Yes, but that’s true of most if not all markets. The only reason anything ever gets bought or sold is because two people differ on the relative value of a good and its price.

Not at all. In most markets, things get bought and sold because a seller and a buyer agree on a price.

Shorts are anti-main street anyways. You basically have to bet for workers to lose out and companies to suck somewhere in the country. That should have never been allowed IMO. That’s not really investment in a company, it’s gambling against what could contribute in at least some small way to GDP. That money can be used much more productively investing in positive forces for the American economy.

And there are definitely manipulations, governmental and extra-governmental (but involving government players) that go on within those industries to make those businesses a little easier to tank. So, a free market argument against short regulation is not really protecting anything other than crony capitalism.

Naked shorting is probably the most dangerous investment tool around like selling naked calls. You are BEGGING to get burned. I don’t care about the politics of who did it, they got burned because lava happens to be hot.

Drink a fifth of whiskey before driving a Ferrari the wrong way down the interstate to beat rush hour traffic while you are at it…it’s that stupidly dangerous.

Anybody else notice something interesting about the class of person involved in this caper?

These are the people who used to go to GameStop as kids, just like those who were involved in Gamergate and who subsequently detected the fraud in the election.

The Democrats slandered the Trump supporters as being old, uneducated, angry white men, but the Gamergate scandal disillusioned tech-savvy young men, who went looking for another solution to the old political system. They gave a distinct shot of energy to the 2016 Trump campaign.

I watched thousands of red flags fly the night of the election and in the ensuing weeks, and while the testimony came from people of all ages and groups, the presence of the cheating algorithms and their intentional nature was established, again, by computer-savvy young people, who might or might not be Republican voters, and who talked in a language that most of their elders could not grasp. (No, your honor, statistical anomalies really are evidence, you just don’t have the math skills or the willingness to listen.)

The current GameStop episode is driven equally by good math skills and by affection for a company that made toys. They noticed something the hedge fund managers thought nobody important would see.

What we are witnessing is the emergence of a large class of savvy, educated, self-educated young people.

This class is not monolithic, politically speaking, but it is something new under the sun.

No, statistical anomalies are not evidence. They merely point you to where there might be evidence to be found. You still have to go there and look for it, and be prepared for the possibility that it’s not there.

Then no chemistry experiment was ever valid. And yet, somehow, we get information out of them all the time.

And that is why “forensic science” is a crock, and juries should be very skeptical of what such “experts” tell them.

By the way, I came to that conclusion about 40 years ago, in reaction to the travesty that was Lindy Chamberlain’s prosecution.

“No, statistical anomalies are not evidence. They merely point you to where there might be evidence to be found. You still have to go there and look for it, and be prepared for the possibility that it’s not there.”

Not exactly correct. Statistical analysis results can be circumstantial evidence. This is especially true when the results are anomalous where a claim is being made. While circumstantial evidence should be verified by direct evidence, if enough circumstantial evidence can be accumulated which supports itself, then it can be considered to be likely accurate/ Especially if there is no direct evidence to the contrary or a lack of reasonable circumstantial evidence presented.

Today’s stock market is a casino with the major financial firms, funds, etc. as the house. They drive prices up and down, making their money from the arbitrage. Now, that so many outsiders are becoming involved and doing similar things, it’s disrupting their game, and they don’t know how to deal with it. Since they own most of government, it can be expected that their competitors will be regulated out of business and the taxpayers will robbed again to bail them out.

This really couldn’t have happened to a more deserving bunch of assholes.

AMEN!

Oh! Are you saying the entire Biden, Obama and Clinton families have been shorting Gamestop? I did not realize that.

Tim Pool et al. have had good discussions of this:

“Robinhood BANS Stock Buying For Gamestop And Others, Media Cronies SMEARING WSB As Alt Right”

https://www.youtube.com/watch?v=vtYRmSPKNqY

“WallStreetBets Reddit Has Been Forced Into PRIVATE, What Is Going On Over There??” ( https://www.youtube.com/watch?v=Dmw2mWNVS2A )

The whole idea of the stock market is to buy low and sell high, not vice-versa. When everybody wants something, that’s the time to sell at the high price. When prices are low, that’s the time to do your research and buy underpriced quality investments.

I still suspect that a bunch of small independent investors will lose their shirts in this GameStop bubble, and some well-connected rich financiers will get much richer. That’s the way it usually works.

Yes, someone always loses their shirt in the Ponzi scheme that the markets and financial system have become. Right now it seems like the hedge funds have taken a bath, because of the reasons mentioned by Phil below.

Eventually when they cover their positions is when the fun will really begin.Who will be the first to sell and who will buy at the inflated price?

Unless they took out a loan to buy their shares they won’t.

They might lose everything they paid for the shares they got, but unlike the gamblers at that hedge fund (that apparently didn’t hedge their bets) their loss is limited to the sum invested.

Well I guess the question is, how much of their “paper” profit will they realize?

The price of GameStop keeps going up not only because the “rogue” investors keep buying it but because the hedge funds (who collude among each other) kept buying to cover too. In fact, the # of shares shorted exceeds the float so they can’t close their positions. Not only did the hedge funds sell shares short, they also levered their short positions by buying puts on margin.

This is a much-needed event. It’s time to expose the Wall Street collusion that will police the new SGE (social, government, environmental) policies being crammed down investors’ and companies’ throats.

The Wall Street establishment is being taught a valuable lesson here but you can bet their political buddies at the SEC, FINRA, DOJ and Congress will swoop in to “fix” the broken fix.

There sure seems to be a lot of “politically connected” money betting against recovery.

Hmmmm.

Interesting: from the Daily Caller;

“Treasury Sec. Janet Yellen received more than $800,000 in speaking fees from a hedge fund that has become embroiled in the saga over stock trades for video game retailer GameStop, according to her financial disclosures.

Citadel, a hedge fund founded by Ken Griffin, a major GOP donor, paid Yellen $810,000 to speak at several events from October 2019 to October 2020, according to Yellen’s filings with the Office of Government Ethics.

The Chicago-based hedge fund paid Yellen $292,500 for a speech on Oct. 17, 2019, $180,000 for one on Dec. 3, 2019, and $337,500 to speak at a series of webinars held from Oct. 9-27, 2020.

Citadel is invested heavily in Melvin Capital, a hedge fund that was reportedly on the brink of bankruptcy this week due to a surge in GameStop share prices.”

When someone is paid hundreds of thousands of dollars for a couple hours of work, it raises my suspicions. What is the difference between an exorbitant speaker’s fee and a bribe?

I’ve been asking that for years regarding Hillary Clinton’s speaking fees.

I’ve been asking the same question about the enormous royalty advances book “authors” like Barack Obama get. Have their books honestly earned out these advances?

Sounds legit to me. I mean when you get to that sort of vital and influential position in government that your whim can destroy entire economies, I think 800k is a pretty reasonable insurance payment to ensure your interests are being considered, don’t you? I mean, there is no quid-pro here – nothing actually in writing that anyone can point too that I am aware of.

And remember, everyone who works for the government has the absolute highest integrity. Much, much higher than those who do not work for the government who are rather dirty, smelly, and quite deplorable. In fact, she is so incorruptible, she deserves that money, if anything, just as a test of her rectitude, because now we can see, even though she rakes in tons of influence money, it does not affect her judgment or moral rectitude one iota. Now, if that does not give you confidence in the system, I do not know what will.

I agree that ‘part’ of the investment is by the ‘stick it to the man ‘ folks on WSB, part of it is based on investing in Game Stop after the addition of new Board members with conversion to online sales skills as noted here: “In a press release, GameStop refers to the appointments as a “refreshment” of the board, asserting that the new appointees “bring deep expertise in e-commerce, online marketing, finance and strategic planning” to its operations. Board chair Kathy Vrabeck added that these skills should “help us accelerate our transformation plans and fully capture the significant growth opportunities ahead for GameStop.” The new directors will be eligible for reelection to a reshuffled nine-member board during GameStop’s annual meeting in June.

Analysts at Baird echoed Vrabeck’s statements, noting that the directors now include three individuals with previous experience at online pet supply seller Chewy (NYSE:CHWY), which has seen outstanding performance during recent quarters, based on the strong success of its e-commerce model.”

It IS entirely possible the stock was under-valued. It is’t worth it’s current price (IMO) but it WAS under-valued.

What this illustrates is that, with sufficient money, the stock market is easily manipulated.

Stocks are not tied to the actual value of the companies that issue them. Their value is based solely upon their popularity. And, that popularity is based upon the number of shares trades for a profit. If a stock is rising in price and investors continue to buy it, then the price [value] of the stock will continue to increase. If the stock os sold, it will decrease in price [value]. This is not related to the financial health of the company involved. Now, the Gamestop case was a bit more complicated than that.

So, here we had a group of investors obtaining stock to sell short. News of this would drive the price of the stock down. When finally sold, those selling short would realize the difference in the price, of the stock, at the time it was “borrowed” and its sale price. So, another group of investors saw the stock prices drop and decided to generate a rally, which would generate an increase in the price of the stock. Now, nothing has changed, recently, with regard to Gamedstop or its operations, which would make their stock more desirable. The stock price is being manipulated by third party outside the larger economy.

As I have pointed out for the last year, given the fact that the global economy, in hard goods and most service industries, has been tanked, the stock market should be in the toilet as well. But it is not. Stock prices are being maintained and increased through both active and passive manipulation. A large investor, or a large group of investors acting in concert, can drive up the price of a stock from $X to $X+10% percent. If the stock is then sold, the investor makes a 10% profit. A large sell off will usually result in a lowering of the stock price. The investor then purchases the stock at the lower price and repeats. So, big investors actually make money when the economy is down. The question is, where do those profit come from? Well, one source is large trading funds. These funds are composed mostly of small investors and things like pension funds. So, who gets hurt?

Someone on Twitter:

“Trump was keeping the gamers under control. Get rid of Trump and boom within a week the gamers have destroyed billions and bankrupted a hedge fund.

“I’m begging you for God’s sake put Trump back in office before the gamers kill us all.

Halting trading is preventing retail investors from profiting from the current situation and putting further pressure on Melvin and Citron. A drop from the current price to, say, $20/share would make for enormously profitable puts, because that’s what’s eventually going to happen. I doubt they have the capital to maintain their current position indefinitely, eventually a capital call is coming their way, if the exchanges aren’t totally in the tank for them. I don’t believe for a second they’ve actually realized losses yet, they can’t unwind their position voluntarily without either the exchange forcing it because of a failure to meet a capital call or because they declared bankruptcy. Their announcement that they’re out is, in my mind, a clearly fraudulent statement intended to convince retail investors to cash out, tank the stock, and save them.

Quite frankly, what do you want the feds to do about this? I’d prefer that they do nothing…in which case Psaki’s answer was the correct one.