GameStop Politics: Democrats’ Hubris And Abusiveness Will Lead To Their Own Short Squeeze

There’s some political equivalent here. I don’t know what it looks like yet, but there’s only so long the rapid destruction of jobs and the economy and political persecution can continue without the political equivalent of a short squeeze on Democrats.

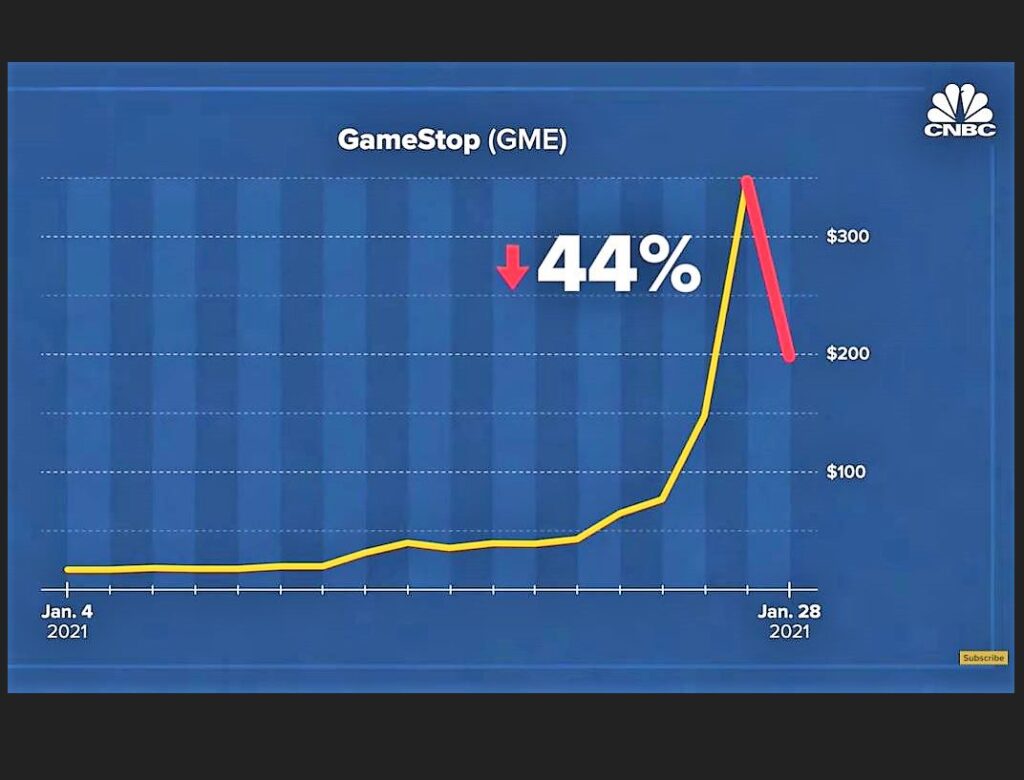

The big story yesterday and today is the short squeeze in GameStop, and some other wobbly securities. The narrative is that the good little guys at Reddit stuck it to the big bad billionaire Hedge Fund guys.

That’s the obvious answer, time will tell whether it’s true.

Clearly, the big bad Hedge Fund guys suffered big league, but who profited? Was it really the little guys? I heard someone call this a pump-and-dump. Some people likely got rich as the stock soared and they sold into the pump. Was that part of the plan? Call me cynical.

What happened to the small investors who bought, not sold, into the pump and then had to sell on the dump?

When the dust settles, probably a lot of small investors got hurt. And there will be legal issues for companies like Robinhood that prevented purchases at some point during the day, thereby putting downward pressure on the stock.

It’s hard, if not impossible, to have sympathy for the billionaire short sellers. The Wall Street Journal has a pretty good report on the ugly short-selling industry, and how the intimidation of online mobs we see in politics have targeted them and their families.

Which got me thinking about the significance of GameStop in this political environment.

It could serve as something of an inspiraction and outline for how to push back against the political equivalent of the short-selling hedge fund billionaires — the smug, aggressive, and abusive Democrats, liberal media, and leftist activists who feel invulnerable to challenge, who brag about how they are going to purge the deplorables from public life, deprive them of the ability to earn a living, cancel them from life and the internet. They are ascendant, taunting people, trying to criminalize political opposition to the party that controls both Houses of Congress, the presidency, higher education, increasingly elemenary and secondary education, the entertainment industry, and Big Tech.

Whatever other elements there end up being in this story, it is sure that the short-selling hedge fund billionaires didn’t see it coming. A bunch of people organizing under the radar stuck it to them.

I think there’s some political equivalent here. I don’t know what it looks like yet, but there’s only so long the rapid destruction of jobs and the economy and political persecution can continue without the political equivalent of a short squeeze on Democrats.

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

It’s similar to swarming attacks. A group picks out a vulnerable target, coordinates an action and time, and executes. It of course needs to be sudden and unexpected. Feign disgust at local Republicans of opposition candidates. Donate nothing. Then strike on election day as a swarm.

Telegraphed moves are less effective as they give the target a chance to prepare.

I would suggest looking at school board members, county delegates, district attorneys, judges, that sort of thing, especially off year small potato local elections.

Perhaps that’s the lesson.

I don’t know what it looks like yet, either, but I’m not sure the analogy is a good one.

The Gamestop hack was possible only because both sides got to play under the same rules — make exactly the same buys, sells, puts, calls, and straddles as the big boys — until the rules were changed by the big boys to protect themselves and screw the little guys.

The politicians covered their butts this way long ago. We can’t write our own bills, make our own executive pronouncements, set our own budgets, decide our own taxes, or dispatch our own enforcement (though constitutionally we should have the means to do this). Most importantly, the big news services will never kiss our ***es, only government’s. And if anything, the disparity is being widened, not remedied — we no longer have free speech, free elections, free access to the courts, or now even a right to the own self-defense of our own lives without being persecuted for it.

The financial paradigm was: do unto them as they do unto you, because that was still in the realm of possibility. The political one is becoming: when you bit by bit close off all citizen recourse, only one recourse remains that you can never close off, and you attempt this at your own risk.

In Oregon we can get legislation passed via voter initiatives so stuff can happen that bypasses the legislature, and woe be the legislature that attempts to derail it. Has happened for things like property tax hikes, which it turns out is really unfair as long term property owners see small rate increases each year while a new owner of a house gets the ‘current assessment” whammy. It is possible to have houses on the same street paying completely different property taxes depending on how long it has been owned. Of course, people are idiots, and a lot of bad initiatives do get passed, once the voters have reached the 50% entitlement level. We now have really rich people paying for early preschool indoctrination. The guillotine can’t be far behind for these folks.

Even initiatives have been corrupted, with entrenched politicians running initiatives behind your back in order to achieve something they can’t do in the legislature.

Similar to cops secretly making a “red flag” call against a gunowner so they can confiscate his guns without affording him the due process they would be required to afford him as cops if they were operating under “normal” law.

Your property tax example is not limited to Oregon, there is also one in Florida and is extrememely popular. Once you meet the requirements property tax increases are limited to 3% a year on your home. This is a good deal for long term residents as Florida is prone to extreme fluctations in home prices and valuations for taxes. The valuations tend to go up quickly and come down very slowly even when the values steeply decline for a short period.

Florida also allows you to transfer a certain amountto a new home if you decide to move within the state.

This does not apply to rental units.

AZ is also big on ballot propositions. They have become the favored tool to enact big legislation, and the state constitution was changed a while back to make it nearly impossible for the legislature/government to overturn or change them. Now, we have permanent early mail-in voting, higher minimum wage, extra 3% taxes on the wealthy to “help” school funding, etc. Basically the progressive agenda is rolled out this way more easily since the propositions always sound so beneficial.

So Nancy Pelosi buys $1M in stock options (!) in Tesla a few days before Joe Biden announces government vehicles will all be electric (not sure how that’s legal).

Meanwhile, you’re not allowed to buy stock in GME or AMC on Robinhood.

— Alana Mastrangelo (@ARmastrangelo) January 28, 2021

not the first time, look at bernie madoff, and jon corizne they were both alleged doing the same thing

Meanwhile, insiders at Robinhood relate hearing the phone call from the WHITE HOUSE telling them to halt trading in GameStop.

Easy rumor to start and spread. Hard to verify. I read it on the internet, so it must be true.

Easy rumor for a reason.

https://patriots.win/p/11SKC2IadV/its-jen-psakis-brother/c/

Rules for thee, but not for me!

Explain how a President, has never had a real job, been in Public office for over 40 years, married to a high school teacher, and accumulates 9 million dollars. Nothing to see here?!?

The amazing power of compound interest. Or bribes.

why does a life long government employee need two S Corps?

Professor,

As you well know, no one is forced to sell a stock during a price decrease. Will some small investors, particularly novice investors, who jumped into this idea/event/movement at say $200 a share on Wednesday lose money? Maybe, but losses are realized upon selling, if they don’t sell….they haven’t lost. At least until this whole thing comes apart, which it will.

Was there an outside presence using the small investors, manipulating them to pump and dump? Maybe.

To me the bigger question is the failure of our regulatory structure to proactively and vigorously enforce the limits on short positions; naked shorts. Excess shorts exceeding the available stock supposedly up to 140%, that isn’t supposed to occur.

The failure to make sure that the trading is done in a transparent manner. IMO, the exchange should be the backstop ‘market maker’. The firms holding the membership should collectively, be responsible for orderly trade flow. That simple step will stop most of the scheming. When the membership of the exchange has a financial incentive to ensure smooth and transparent trading it will occur, not before.

The short selling or variants with some Wall Street ‘name’ going on some financial news program and telling the world that ‘x industry’ or ‘y stock’ is absolutely positively going to move in one direction or another while that same Wall Street ‘name’ takes the opposite position through options because he knows his stance is garbage or uses the CNBC interview to move the market after his firm has ‘front run’ their own trades to push a stock price in a particular direction must stop.

Anyone attempting to defend any brokerage house that locked individual accounts or impeded trading when neither the exchange or the regulators had done so is full of it. Those firms were not protecting their order flow. They were clearly protecting their relationship with certain funds and individuals.

The

In my opinion, the SEC is “captured” and absolutely NOT the little guy’s friend here, or ever. (Once in a while they might make an example of a minor player, or company.)

I have not forgotten the crash of 2007-2009. The compliant SEC pulled the “Uptick Rule” in 2007, in place since the Great Depression to prevent mass naked shorting of stocks – some timing indeed. Naked shorting of everything under the sun, but especially financial stocks, commenced with many not surviving, partly because they could not raise needed capital with stock prices plummeting so fast. The SEC used to publish Naked Short lists showing the stocks most naked short, the “victims” – often with short positions larger than the number of outstanding shares – but did not restore the Uptick Rule or stop the abuse (and only did something minor in 2010). I owned stock in one of the victims back then – VERY dangerous to stay around against entities which can sell shares they do not own in unlimited supply.

Actually, yes some people were forced to sell. Robinhood sold stock for a significant number of people with no sell orders. That action is being tacked in a class action lawsuit filed earlier today.

It will be interesting to see if this really happened. Did these alleged “forced sales” involve ordinary stock positions, with no margin, options, short positions, and other special situations? Did some of the investors have stop-loss orders in the system, which they conveniently forget to mention now that their cunning plan went bad?

When things go wrong, people have a tendency to blame anyone but themselves. Robin Hood is surely a convenient blame target.

I took a look at some of Robin Hood’s terms and conditions. There are quite a few reasons why they could legitimately sell shares in some accounts. The press describes the typical Robin Hood investor as not too sophisticated. (Like everything the press spews out, there’s no reason to assume it’s true.) I wonder how many of them accepted the terms and conditions without reading them. How many gave permission to sell shares when they signed up, and either forgot or never understood what they agreed to?

If Robin Hood really did sell shares without authorization, I expect the courts and/or arbitrators will force them to make good on the investors’ losses. That will take years. Unless Robin Hood collapses.

kyrrat,

If their broker, Robinhood acted without the authority, permission or knowledge of the person who owned the shares, that person wasn’t ‘forced’.

In what I described the broker acted unlawfully. He can no more sell your common stock position without permission than a realtor could sell your house without permission.

IMO, some of these claims regarding sales, were likely margin positions. The broker can act in the event of a margin call. However, there are constraints.

Way back in the early 90s when I took the series 7 and was a stockbroker for several years prior to 9/11, the rule was you contact the client and that client either pays in cash to support the margin requirements or you sell to support the margin requirements.

That margin requirement action is a horse of an entirely different colour than a simple long position in common stock.

If Robinhood actually sold common stock position without permission the leadership of the firm and the brokers responsible should individually be bared from the industry for life.

Action by the various State Securities regulators is very possible as well.

More than likely, those sales were margin orders. It’s clearly outlined in RH’s T&C that they can.

If that is not the case, then RH has added more woes to its already burgeoning ones.

The other aspect is that,by compelling the individual investors to only sell on the slump, the broker firms appear to have bailed out the hedge funds at the expense of the individual investors.

Basically the hedge funds had to buy their post bail out shorts by the end of today, and by both blocking retail purchases, and according to some reports, pushing sales through that the retail stock buyers hadn’t authorized, the brokers gave the hedge funds the ability to get out of shorts they could not have otherwise covered.

Really corrupt deal all around.

“As you well know, no one is forced to sell a stock during a price decrease.”

The app, Robinhood, allegedly did exactly that to some of its customers.

Valerie,

My statement is correct. No one is ever forced to sell a stock. The owner can be as stubborn as they desire regarding ownership of common stock.

If, as alleged, their broker Robinhood, sold their position without authority, that brokerage is going to be sued into oblivion.

This is a very basic principle so I suspect that some of the ‘forced sale’ reports are actually to do with margin requirements not simple long positions in common stock.

That is a big difference. Your brokerage house can act to sell your position to cover margin requirements. That brokerage firm is allowed to protect itself under certain circumstances.

They can’t liquidate your simple common stock position without permission.

Suit’s been filed.

Filing a lawsuit is almost as easy as starting a rumor on the internet.

Does the suit have merit? Only time will tell.

True enough on the margin requirement sales. But, would a stock that is increasing in value be subject to a margin call? If I buy stock at 50% margin (50% my money and 50% brokerage money) and the stock is going up in value, significantly in this case, wouldn’t the brokerage’s investment be more than safe. Now, maybe there is a clause that the brokerage house can recover its investment while the stock is moving upwards thereby reducing its investment and increasing the investor’s percentage accordingly.

But, to wait, if that is what they did, to make these margin call sales after the price had fallen due to the freeze on purchases, would seem to be unethical, no?

One of the things that bothers me about this is GME can’t take advantage of it, a public offering takes too long to accomplish under the SEC’s onerous rules. If I was GME, when the stock was at $350 I’d be offering stock to the short sellers at some high price. “Let us help you close your short position”.

Speaking of which, how has Melvin and Citron been able to maintain their short position? Regular people would have been crushed by capital calls. Have they been shown favoritism and not been hit with capital calls? Meanwhile the brokerages are tightening margin requirements for retail investors.

I’m given to understand they managed some sort of either bail out or loan to get them out of their original short position, and then promptly turned around and did an even bigger short of the stock based on the high prices.

Then, by locking out buy orders prior to the due date for their second short, they were the only ones in town able to buy the stock, and were able to pretty much set the price it traded at, so we’re able to recover their losses from the first failed short, and then some.

Citadel bailed out Melvin. The Reddit people, I hear, are not going to sell their positions in GME until close of business. There’s also talk they may not sell until next week. Apparently, a lot of short contracts are coming due as of today. If a block does not sell, it’s going to be more of what happened yesterday – funds shorting each other, trying not to be the one holding the hot potato.

I don’t think that is how it happened Voyager. A reader may read your bailout as a government bailout. What I believe happened is that another company – associated with Melvin – came in with a loan or with capital. I had heard they covered their shorts but at a HUGE loss. Covered, in this case, means they settled their position taking the loss not that they didn’t lose anything. This is the down side of a short.

Now, if they bought more shorts, we would have to look at their position. How the freeze by Robinhood was conducted I am not sure. If one can’t buy then another can’t sell. Every buyers needs a seller. Or am I missing something?

Only retail buyers were locked out. The hedge funds weren’t locked out, so they could keep buying to cover their shorts, in an artificially falling market created by the lockout in retail buyers.

Randian, if that is true, those transactions need to be reversed. Do you have a creditable link to this?

One of the givens in a short sale is the risk of a stock going up and up. A normal stock would always have sellers as it is going up so a short seller could close their position and take a moderate loss. But, to short every share and then some of a stock, puts, as we have seen, the short seller in either an enviable or unenviable position. In this case, the latter.

The SEC must not let this stand.

I heard an “insider” today claim that at some point before Robinhood starting playing its games, the clearinghouses seeing a huge problem with liquidity due to a huge volume of small transactions, they changed their deposit requirements from 1-10% to 100% for transactions of $GME and a handful of other stocks. He believes that this action put smaller retail brokers like RobinHood in a liquidity crunch, and that’s the real reason why RobinHood put the trading restrictions in. They didn’t want to broadcast the real reason because if the market (investors) hears a broker say “liquidity crisis” they panic, which causes other huge problems.

I put it as a plausible theory, but evidence is needed.

Robinhood is already being sued for stopping trading.

They are also a sister company to Melvin which was one of the hedge funds. Melvin, as I understand it, has already lost 30% because of the short squeeze will still be around. Robinhood will not and those suing will not get much of their money.

It’s like this scene from “Margin Call”.

https://www.youtube.com/watch?v=1e1iiUIZxQk

To understand better, the traders are basically ending their careers. The people they are trading will never trust them again. You can’t trade if no one will trade with you.

Also, one of the last scenes.

https://www.youtube.com/watch?v=LtFyP0qy9XU

I used their app for the good part of a year. After what they did this week, I’m selling my positions by March and I’m already starting up on another one.

They can eat a massive bag of Richards.

look up the history of Cabelas, they had an investor kill the company

I don’t know HOW the hedge fund got Schwab/Ameritrade to freeze buying, but they did. They did with the expressed intent of protecting SOME investors at the expense of others.

I’m not versed in SEC regulations, but how is this NOT market manipulation with the intent to control or materially impact a stock’s price? While there is nothing illegal about a thousand nobodies colluding to buy a stock at the same time, when you are a brokerage house- market manipulation (which is what they did) is contrary to their position as a brokerage.

The equivalence you are looking for professor is that the “connected” win at the expense of the rest of us. This is how dems work, whether it’s pay to play or killing serial rapists who know too much. The hedge funds either threatened or called in a favor OR it was they were gambling with the brokerages money, either way the brokerages committed a big sin to choose a winner and to choose losers from within their own customer base.

Andy, are you saying they stopped all purchases, watched as the price then dropped, and then, while keeping the purchase freeze on for most buyers, allowed the short sellers to buy from investors who were then ready to sell fearing the price would go lower?

If that is the case, this must be illegal!

Yet that is exactly what happened.

Now you know why Wall Street supposts democrats with so much money: for the legal protection for scams. Just like the rich pervs like weinstein and epstein.

Just look at pelosi’s recent scandalous trades.

As if the GOP sh-t in office didnt know about this?

PDJT’s idea of changing the GOP will fail: it’s too deeply corrupt.

Market manipulators should be prosecuted whether they are individual investors, or, large funds.

The Dhimmi-crat-promoted narrative here appears fallacious, because the market manipulators were allegedly the “little guy” — lots of them. Coordinated individual action to pump up stocks is still market manipulation, and, it should be prosecuted as such.

My point is that the securities laws apply to protect everyone. Every investor, large and small, should play by the same rules. The Dhimmi-crats are suggesting — deceitfully and stupidly — that market manipulation undertaken by swarms of individual investors is somehow allegedly laudable and praiseworthy conduct. It’s not.

And their point is that the securities market is rigged, and they plan to break the algorithm, anyway.

https://wsbets.win/p/11SKC196O4/ok-listen-up-frens/

The Dhimmi-crats’ anti-Wall Street rhetoric is offensive to rational minds.

The public markets are the most democratic aspect of capitalism, and, the greatest wealth creation vehicle every conceived. Any person can own shares of the most successful companies, and, prosper as a result.

Publicly-traded companies are paying tens of billions of dollars into retirees’ and pension funds’ accounts, annually, in the form of dividends. The public markets do more to enrich retirees than the government ever could or will. Not that that’s government’s role, at any rate.

Ive had my wins and losses on the stock market.

win – Receiving 10% profit share for a number of years and then dividends twice a year (on top of those profits).

loss – Those same shares going from £16 each to 11p in 2007.

Win – Being invited to bid (and pay) for shares in the Post Office float here in the UK. So I bid for as many as I could afford at the time (around 10k shares).

Loss – The man allocating 230 shares to every private individual who bid for shares regardless of how many those private individuals wanted.

Loss – Institutional investors being prioritised over private investors for the Post Office float.

Fuck you – selling those shares for a 50% profit but sadly 50% of fuck all is still fuck all at the end of the day.

One more win – Buying Air NZ shares at 50c and then selling them for $1 each after a month which paid for our wedding 🙂

I have listed to several experts on the business networks, when asked they can’t explains why there were 140% of the shares in the options market. How can more shares be shorted than even exist.

How can you short a share tha doesn’t exist?

Somebody please explain.

You can sell goods now that you are going to acquire/produce in the future. Selling shares you currently do not own is no different.

As I understand, brokerages can loan the same shares out to more than one party. I didn’t know this before. So, they’ve created a fractional reserve system in stocks essentially. That’s how the fed grows the money supply. Buying up all of the outstanding shares was then similar to a bank run.

I also understand that the hedge funds may have been naked shorting so heavily (140% of the outstanding stock I saw somewhere) in order to force the price down so they could get a better gain. This story has been unfolding for over a year, and the hedge funds could have made something like 80-90% at the GME low, but they seemed to be wanting a GME bankruptcy to then gain 100%. If that’s true, I guess it didn’t quite work out for them.

buck61, hedge fund A buys put options in unlimited quantity in the options market. Options market maker B has to hedge his exposure to a decline in the price he just acquired through that transaction with hedge fund A, by selling short shares in a ratio to his exposure – which depends on various things, like the difference in the option strike price and the market price. Given there is no uptick rule any more, market maker B can just continually sell short shares in the open market (driving the price down) until he has hedged his trade with the hedge fund. The SEC is complicit with this, with the standard position being that short sellers are good – they help contain excessive advances and “provide liquidity” (a very common phrase) on declines (at the bottom, after declines the short selling contributed mightily to).

It’s not a question of ‘who profited’? It’s a question of ‘who failed to profit?’ and the answer to that one is easy.

Well, I’m sure this isn’t going to be a popular post but if those “small investors” got greedy and bought into the pump and then didn’t dump in time and lost it all don’t have my sympathy. They either were too stupid and/or greedy to realize the risks of what they were doing or they knew exactly what was going on and just failed to time the dump of their stock at the right moment. So nope, no sympathy for them at all.

IMO this is not so much of small investors seeking a profit so much as a ‘movement’ or ‘event’ to send a message.

While I am certain these people won’t mind if they make a buck that appears to be secondary to the goal of recognizing a circumstance in which small investors could squeeze the short play of hedge funds.

You are correct though. Everyone is a grown up. As long as an investor qualifies for the type of account then that investor is cleared to trade. If they want ‘hand holding’ that investor can hire a CFP. If they choose to rely upon their own decisions then so be it.

However, there should never be what appears like an attempt to ‘collude’ in order to assist one party to a trade. The totality of the decisions by brokerages and social media to interfere with the ability of these small investors to trade and communicate with one another looks an awful lot like the big guys closing ranks.

That isn’t surprising. It is a bit surprising that it was done so obviously and openly.

My understanding is that a brokerage house does not have an unlimited ability to buy shares for their clients. There’s a period of time when it’s the broker’s own money paying for the purchased shares, and they only have a limited amount of money to work with.

Eventually the client pays the broker, and the broker does have some sort of claim on the client’s deposited money. In the meantime, the broker has to rely on whatever they have on deposit at the clearing house. They can’t keep placing buy orders forever. They have to find more money and deposit it, and that takes time.

There was something in Robin Hood’s statement saying they had to raise money and call on lines of credit to meet their obligations at the clearing house. If they hadn’t done that, the clearing house would probably shut them off completely, and none of their clients could buy or sell any stocks.

I don’t think it’s fair to assume collusion caused their actions. It may have been an obvious and predictable reaction to trading volume that was many times what they were prepared to handle. It may have been so predictable that some parties expected it and took advantage when it happened.

On the other hand, there could have been collusion. I’ll wait for the evidence, if the MSM ever lets it see the light of day.

If Robin Hood sold a customer account’s stock not on margin, with no sell order and no stop-loss order on file, as was reported in my local paper today with quotes from a customer (but not 100% complete info) they IMO should by shut down. If this is established and the SEC does not do that, you will know whose side the SEC is on. (I already do, from past experience.)

Request denied! You have no standing or laches or whatever!

One can weigh in with points and comments, humbly I suggest, where one is uncertain about every jot or tittle. The role then falls on experts, I am guessing you might be one, to educate on the fullness of the law or the procedures.

I have heard from two different writers, both it would seem with experience in the industry, with two versions of what the Wall Street Reddit guys purchased. One said they bought options, the other said, no, they bought the stock. So, if you are concerned about misinformation going around, it isn’t just the neophytes.

Sorry readers. I put this in the wrong spot. It was supposed to go as a reply to RRRR below. It has no context here.

Scaramouche regrets the error.

“When the dust settles, probably a lot of small investors got hurt.”

So? That’s how the market works; there are winners and there are losers. Are you suggesting that somehow small investors ought to be a protected class of some sort, insulated from the consequences of their own choices? Perhaps the little people ought not to be allowed to trade at all?

No. The issue here is-ONCE AGAIN- the glaring hypocrisy of our binary systems. There are rules, yes, but they only apply to the little people. The whales are “too big to fail,” and there right to make billions off of manipulating the collapse of brick-and-mortar businesses must be protected at all costs. But woe unto the little people who try to play the same game. They must be crushed.

While everyone here has been preoccupied with kabuki theater, here is what Sen. McConnell has been up to:

https://theconservativetreehouse.com/2021/01/28/decepticon-maneuvers-dont-forget-who-owns-the-new-york-stock-exchange/#more-207503

Time to take the red pill.

Has the Conservative Treehouse gone wacko?

The article claims Jeffrey Sprecher owns the New York Stock Exchange.

It took me 5 minutes to find out:

– The NYSE is a subsidiary of a public-traded company called Intercontinental Exchange (ICE).

– Jeffrey Sprecher is the CEO of ICE.

– As of March 2020, he owned 1.1% of the the ICE common stock

– The biggest holders of common stock were The Vanguard Group, T. Rowe Price, and BlackRock.

So either there have been big changes since 2020, someone at the Conservative Treehouse is an idiot, or they’re making stuff up.

Now, it’s possible I missed the really important bits that tie the whole conspiracy together. I’ll try a few off the top of my head, and see if they take off on the internet:

– Intercontinental Exchange has the same initials as Immigration and Customs Enforcement, because NEW WORLD ORDER!!!

– Mitch McConnell’s retirement money is invested in Vanguard mutual funds, so obviously he’s an insider.

– BlackRock is a dog whistle racist company (because the name) leading the global fight for WHITE SUPREMACY.

You read it on the internet so it must be true!

“Jeffrey Sprecher is the founder and CEO of ICE, which now owns the New York Stock Exchange.” Seems like, you buried the lede here. tldr? Does the Founder/CEO exercise control? Why yes, they typically do. What a wacko hit-job, you attempted.

Irrelevant. You are a ****ing liar, just like Conservative Nuthouse. You know perfectly well that nobody said anything about effective control. The Nuthouse claimed that Sprecher owns the NYSE, and that is an outright cold-blooded lie. You are defending that lie, which makes you a liar too.

Not so sure you are right, Milhouse. Here is some background on Mr. Sprecher:

https://www.atlantamagazine.com/great-reads/market-movers/

Yes, because “to own” has only one meaning. It never means to have power or mastery over something, as you can easily verify looking it up here.

You can sell goods now that you are going to acquire/produce in the future. Selling shares you currently do not own is no different.

Should have been a reply. Sorry for the double post…

The White House spokes-critter responded to a question about the GameStop gambit by using identity politics to point out how we now have a woman Treasury Secretary (who happens to have been paid by these same hedge funds only months ago).

An answer like this would have been totally unacceptable during the Trump Administration.

Bank of America can’t sell your house without your consent and without a mortgage on it. Yet they did–and to more than one person. There is no way that you can compensate someone for having their family heirlooms and other personal property either sold or dumped as garbage. So they didn’t.

Exactly this happened following the subprime crash. They weren’t the only financial institution which did this. A friend found out that BoA, which did NOT have a mortgage, would be selling his house when someone asked him why he wasn’t present at the sale. He was one of the lucky ones.

This sounds insane, but we are in an insane world. Do you have any links to stories about this?

ABC News. https://abcnews.go.com/Business/bank-america-sued-foreclosing-wrong-homes/story?id=9637897

Holy cow! I had no idea! I knew there were problems with proving ownership (with mortgage-backed securities and derivatives, AIG and all that), but I heard nothing about foreclosing on properties they don’t even have a relationship with.

I hope BofA paid dearly for this incompetence.

Thank you for bringing this up and supplying the link. It is enlightening.

I understand that the traders can “borrow” stock from the brokers and then use it in the short selling process–that’s how they ended up with exchanges of 140% of the entire amount of stock. Maybe preventing that would address some of the issues.

Re your first sentence: It wasn’t 140% of the stock the trader owned, it was 140% of the entire stock of that company that was ever issued. Don’t matter how flexible your broker is, he can’t provide you with shares that don’t exist.

I have found this article and some of the commentary interesting, but I have one request. Only if you REALLY know how shorting stock works — including who borrows what from whom, what the roles of brokers and clearing firms are, the tax consequences and and under what circumstances a short seller can be forced to “cover” by buying or borrowing shares in the market to close the short position — should you be addressing the details. Ditto as to comments on when a brokerage firm can or cannot liquidate a position. Ditto as to whether buying (or selling short) to profit from what you hope will intra-day or one-day movements or encouraging a buying or selling frenzy or trying to “stick it to the hedge funds” is or is not a violation of the securities laws.

Request denied! You have no standing or laches or whatever!

One can weigh in with points and comments, humbly I suggest, where one is uncertain about every jot or tittle. The role then falls on experts, I am guessing you might be one, to educate on the fullness of the law or the procedures.

I have heard from two different writers, both it would seem with experience in the industry, with two versions of what the Wall Street Reddit guys purchased. One said they bought options, the other said, no, they bought the stock. So, if you are concerned about misinformation going around, it isn’t just the neophytes.