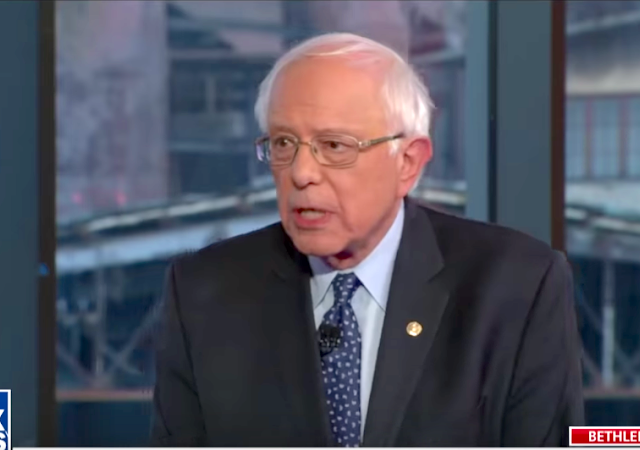

Bernie Sanders Now Pushing ‘Make Billionaires Pay’ Act to Fund Healthcare for One Year

“would impose a one-time 60% tax on wealth gains made by billionaires between March 18, 2020, and Jan. 1, 2021”

Bernie Sanders is using the Coronavirus crisis to push a massive one-time tax on billionaires, dubbed the ‘Make Billionaires Pay’ act.

His socialist instincts never fail him.

Lauren Feiner reports at CNBC:

Sen. Sanders proposes one-time tax that would cost Bezos $42.8 billion, Musk $27.5 billion

Top tech leaders and other billionaires would be forced to hand over billions of dollars in wealth they’ve gained during the coronavirus pandemic under a new bill introduced by Sens. Bernie Sanders, I-Vt., Ed Markey, D-Mass., and Kirsten Gillibrand, D-N.Y.

The “Make Billionaires Pay Act” would impose a one-time 60% tax on wealth gains made by billionaires between March 18, 2020, and Jan. 1, 2021. The funds would be used to pay for out-of-pocket health-care expenses for all Americans for a year. As of Aug. 5, the bill would tax $731 billion in wealth accumulated by 467 billionaires since March 18, according to a press release. If passed, the bill would tax billionaires on wealth accumulated through the end of the year, however.

Under the bill, tech and other business titans who have seen their wealth shoot up during the pandemic would take huge charges. Amazon and Walmart, for example, have both seen their stocks grow as Americans increasingly relied on their services during stay-at-home orders during the pandemic.

Here’s an alternative way of describing this:

LULZ…this is literally theft: Sen. Sanders proposes one-time tax that would cost Bezos $42.8 billion, Musk $27.5 billion https://t.co/iIsTCCKjAU

— Pradheep J. Shanker (@Neoavatara) August 7, 2020

Bernie wants to use the money to pay for healthcare for all Americans for one year. What happens next year?

Today, with @SenMarkey and @SenGillibrand, I am introducing a 60% tax on the obscene wealth gains of 467 billionaires during this pandemic in order to guarantee healthcare as a right to all for an entire year. #MakeBillionairesPay https://t.co/6BxIHVTYvF

— Bernie Sanders (@SenSanders) August 6, 2020

Adriana Belmonte writes at Yahoo Finance:

Bernie Sanders wants to tax billionaires’ pandemic gains to fund health care

A new bill introduced by Sens. Bernie Sanders (I-VT), Kirsten Gillibrand (D-NY), and Ed Markey (D-MA) would implement a one-time 60% tax on billionaires to cover the health care costs of every American for a year.

The Make Billionaires Pay Act would tax the $731 billion in wealth accumulated by the richest 0.001% of America between March 18 through August 5. This would apply towards 467 individuals.

“The legislation I am introducing today will tax the obscene wealth gains billionaires have made during this extraordinary crisis to guarantee healthcare as a right to all for an entire year,” Sen. Sanders said in a statement. “At a time of enormous economic pain and suffering, we have a fundamental choice to make. We can continue to allow the very rich to get much richer while everyone else gets poorer and poorer. Or we can tax the winnings a handful of billionaires made during the pandemic to improve the health and well-being of tens of millions of Americans.

The money generated from this 60% tax would go towards covering out-of-pocket expenses for the uninsured and underinsured for one year.

This is a one-time tax, so again I ask, what happens next year?

Are we supposed to believe people will just give this up after one year?

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

And that’s when they all leave

ever notice his definition of rich is always much higher than his worth and is a sliding scale based off his worth?

He seemed to usually base it on percentages, to me.

OrJustStupid

Bernie: I will impose a one-time 60% tax on wealth gains made by billionaires between March 18, 2020, and Jan. 1, 2021.

Me: What will you do on Jan. 2, 2021?

Bernie: I will consider imposing another one-time 60% tax on wealth gains made by billionaires between March 18, 2021, and Jan. 1, 2022.

Me: But many of them won’t be billionaires any longer.

Bernie: RACIST!

You would think a POS that has been in the Senate since before there was a building would know just by going to the IRS that the top 1% pay way more than their share of taxes NOW.

You should do a quick goog on the panama papers. pretty interesting read.

OrJustStupid

He does, it’s just that he thinks it’s legal for the government to steal everyone’s money but his.

Keith ellison, now ag of minnesota, once said – “It’s not that there isn’t enough money, it’s just that the government doesn’t have it”.

Buy more ammo.

This sounds like something that should be a no-brainer, but I can’t wait to see how we pick it apart to justify the super rich making tons of money during a global pandemic.

OrJustStupid

A lot of it was and still is blue state governors shutting down the small businesses under the lie that the chinese flu is more potent than if you go to Amazon or a big box store.

With no real other choices America shopped Amazon, Walmart and big grocery stores.

Democrats were probably paid off by those billionaires to do so.

OK, how about this? It’s not your money, and using the government to seize it by force is still stealing. Does that get through to you?

Since “billionaires” are all avid Democrats; I’m all for sticking it to the likes of Bezos, Buffet and Zuckerberg.

So Soros doesn’t rate?

While we are at it, how about the “rich”. People like Comrade Millionaire Bernie?

If someone is in a puckish mood and can get in to one of the admittedly semi-controlled Biden appearances [the “semi” is because no one can tell what Biden will say] they should lay out Sanders’ proposal with his name unattached, and see what Biden says. If he approves we can use it against all Democrats.

Subotai Bahadur

“For one year.” My a$$. We all know how that one works.

Democrats – one stupid idea after another.

As to your point.

Once the 16th Amendment was added to the Constitution (February, 1913*) Congress swiftly enacted the Revenue Act of 1913 (October, 1913; Pub. Law 63-16. 38 Stat. 114), progressive rates a heralded feature. That statute was soothingly sold the same way. “Just the top. top earners will be paying, and at a really low rate.” But the 1913 statute was amended almost immediately [e.g., Revenue Act of 1916, War Revenue Act of 1917 (remember, war is Big Gov’s / Democrats’ best friend; lying is second nature to Democrats; Democrat Wilson ran on the platform of no US involvement in the European war, meaning that there would be no new taxes to pay war costs nor dead Americans )]. Suddenly, a huge percentage of the naive, i.e., income earners who were “promised” to remain unaffected, was included among the so-called “top, top earners.”

And the rates: boy, did they go up! The “normal” (the so-called “small”) rate doubled, from 1% (1913) to 2% (1916) (at the high end); the “surtax” rate more than doubled, from 6% (1913) to 13% (1916) (again at the high end).

But it was the Revenue Act of 1918 that really brought the fangs out, setting the tone for what we are saddled with today, roping in everyone productive. No longer was the left singing a “just tax the wealthy” refrain. Now it was “Tax Everyone.” Take note of how fast that happened. The combined progressive high end tax rate was now >75%. The significance of the 1918 statute was the corralling of everyone productive into paying the income tax. And it remains with us >100 years later, except now an expanding Welfare Class (which didn’t exist in 1918; that magical event of “creation by statute” had to wait until Democrat LBJ’s Great Society programs) has been saddled onto a shrinking productive Tax-paying Class.

They can’t count past one. Every succeeding law is always a “first step”. One time… all of the time.

Sanders, Ladies and Gentlemen, is the ranking member of the Senate Budget Committee. If the Democrats take over the Senate next year he’ll be the chairman of the committee. Imagine what he’ll think up then.

The most utterly useless and miserable totalitarian apparatchiks in American society attempt to steal wealth from the most productive people in American society — entrepreneurs who’ve created more jobs, more wealth and more economic activity in five minutes, for employees, retirees, pension funds and society-at-large, than the vile and plumb useless Dhimmi-crat demagogues will accomplish their entire miserable lives.

They should only allow someone to own ONE HOME! All the other should be given to those in need….

I’d rather see an ongoing 90% tax on Congresscritters.

Even Sanders knows there’s no such thing as a “one time tax.” And, yes, taxing wealth is confiscatory and thus essentially legal theft.

BUT, the real problem isn’t Sanders, it’s how many Americans don’t (1) realize that essentially all of billionaires’ wealth is productively invested (and not used to support current consumption), and (2) have no moral issue with using the power of government to take what others have acquired by lawful means.

Although one wonders what government would really do with all that loot. Presumably much of it would be in the form of common stocks; would government attempt to quickly liquidate all that, regardless of the effects of doing so? If government tried to take billionaire’s real estate, would courts rule that a violation of the Fifth Amendment’s Takings clause? Or does that perhaps not apply if the amount of wealth is judged to be “obscene”?

Do those who favor such a thing see the massive economic disruption that would ensue as a bug or a feature, and who do they think is going to feed them if they finally crash the American economy (including the role of $USD in international trade)?

^ this

I would think that the government would insist on cash, as they do now. It would be up to the individual billionaire to figure out how to liquidate enough of his/her assets to pay the tab. Since there wouldn’t be any (or anywhere near enough) buyers for as much as a trillion dollars in assets, that means a stock and real estate market crash to make the recent crash (and the 1929 crash) look like mere blips in comparison. Of course, the kicker is that if the markets sank that far, few of them would be billionaires anymore, and therefore not subject to the tax (!).

And of course there are alternatives: If the Chinese stepped in and bought those assets, they’d pretty much control this country.

Now, on the other hand, there’s the possibility that the Fed would simply print up another trillion or so dollars and buy up all the assets itself, thereby gaining effective control of the economy, in which case we would suddenly find ourselves in a socialist country without all the fuss and drama of fighting a revolution.

One time? Yeah, right. Since when did the Democrats settle for “just this once” when it comes to taking money.

I think Bernie! is losing his nerve. A mere 60%? ONE time? Come on, man! Is that the spirit that made North Korea and Kampuchea great?

If the issue is progressive costs, then maybe “shared responsibility”. If it’s progressive prices, then Obamacare and other single/central-driven market distortions are the problem.

It looks like The Commie is finally making his move for the nomination.

Losing control of their “ANTIFA/BLM enforcement wing” probably scares the DNC more than losing Silicon Valley $$$ does. The Commie is in full control of The DNC’s “enforcement wing” and this proposal is red meat for them.

Bernie Sanders is a putz.

@Bernie Sanders … STFU …

Anus.

I like this idea but his priorities are mixed up. Use the money to pay for the wall. Completed in one year. Then pay 11 million illegals to self deport. Give them 10 thousand a year for five years if the money is spent in country. Pay their plane fare back. AGREE NEVER RETURN. That’s around 600 billion.

Just confiscate the holdings of all “Foundations”

Sans pictues, it’s meme time (picture of bernie at the top).

Official Bernie Sanders drinking game.

Rules:

Every time the Bernster mentions a free government program, chug someone else’s beer!

Jealousy is for losers.

.

It’s not a tax.

It’s confiscation.

And it will not be “one time.”

I have a better idea. A multi-time tax on millionaire politicians. Money mysteriously made by anyone after gaininig public office should be taxed at near-confiscatory rates.

Don’t like it? Stay out of government and get a real job. Your choice.

Hello.. We’re focusing on Bernie here because he is a vocal visible target. WHAT ABOUT THE COSPONSORS?

Is the Republican party New York ever going to get off their ass and run somebody that can pose a credible challenge to Gillibrand? She’s not AOC stupid, but her take on things like this is almost as bad. It’s like they’ve given up, so this is what we get.