“Essentially every single person I met along that trip is now unemployed”

My perspective on the current coronavirus crisis, and how it differs from the stock market crashes in 1987, 2000, and 2008.

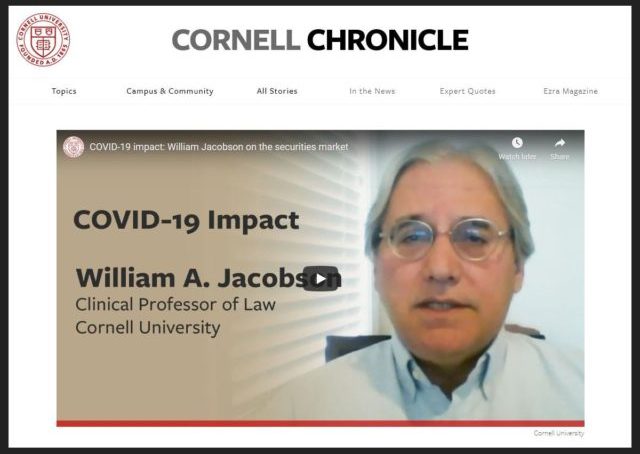

I was asked by Cornell media production people to appear in a video discussing the current coronavirus crisis.

Now that was a shock. I’m not used to being promoted by Cornell. So I behaved myself, I didn’t want them to regret it.

Here’s the story from the Cornell Chronicle, the university news newsletter:

William A. Jacobson, an expert in securities arbitration, says it’s tough to compare the current economic downturn to earlier ones, due to its health-related roots and wide-ranging scope. Unlike other stock market downturns, such as those related to 9/11 or the financial crisis of 2008, this one will require a longer-term perspective. “We need to remember that this is a marathon, not a sprint,” he says.

Jacobson is clinical professor of law and director of the Securities Law Clinic at Cornell Law School. His areas of expertise include civil litigation and arbitration, concentrating on investment, employment and business disputes in the securities industry.

For more COVID-19 impact videos, see the playlist on YouTube.

The trip to Los Angeles I refer to was my California Dreaming trip that included the Legal Insurrection reader reception.

Some excerpts:

It’s hard to compare this to any specific earlier event. Certainly a lot of comparisons are being made to 9/11. 9/11 was a shock to the system and in terms of the terrorist event of 9/11 it was over in a day. Of course the repercussions lasted for awhile, but this I think is much more systemic.

It really goes to things such as our food supply, our supply of other things, our ability to travel. I went to a conference where I spoke a few months ago in Los Angeles and one of the things that I thought about a lot is almost every single person I met on that trip from the Uber driver to get to the airport, all the people who worked in the airport, the people who ran the airline, the people at the car rental on the other end, the hotel on the other end, essentially every single person I met along that trip is now unemployed and that’s really shocking. The travel and the entertainment and the hotel industry has been completely collapsed and devastated.

I’ve been through a lot of market ups and downs. I started after graduating law school. My first big foray into the legal world in the stock market was the 1987 crash, and that is something which it wasn’t as precipitous say is 9/11 but it did take everybody by surprise.

That was in October, 1987, by the end of the year, the market was back to where it started. Things were over. Then there was the tech wreck crash in the late nineties into the early two thousands, and then there was the financial credit crisis in 2008, so the market goes through cycles.

I do believe that two, three, six years from now we’re going to look back upon this and we will have gone through it and gotten through it quite well. That doesn’t make it easier now because this is not going to be a one day or one week hit. It’s going to be an ongoing process. My perspective on it is having gone through many of these crashes in the stock market, these economic crises, is that we just need to keep that longer term perspective. Need to remember that this is a marathon, not a sprint.

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

Unemployed citizens have all the time to dig into all their politicians from local to Federal!

The chief insurrectionist behaves himself. Stealthy, Professor. Very stealthy. 😉

Ain’t misbehaving you say?

WYNONNA PERFORMS ELLA FITZGERALD’S “AIN’T MISBEHAVIN”

https://youtu.be/p8vjLJESVM4

He’s still The Insurrectionist, but he kept it *Legal*. 😉

I agree this is going to be more difficult to get restarted as it has emptied a lot of savings and credit people might have had available, credit card companies are cancelling cards, increasing rates, and the stock market took a huge hit. People who were looking toward retiring soon will have to rethink their plans as they were hit hard with a lot of less to recover.

Disposable income is going to be low, so stores will suffer, millions out of work, and businesses have become cutthroat in reducing payments to employees they still have, even though many I work with have monthly contracts which are still being paid. Vacations will be few. Activities, concerts, sports events, even movies will be viewed as luxury items for a while, which might cause numerous businesses to go under.

Hiring will be slow.

And this didn’t need to happen. It was based on faulty computer programs projecting deaths to be in the million or two range. And governors who became instant dictators, like Cuomo, who are drunk with their usurped powers.

What is to stop this from happening again in the fall, if we see reopening start now, when the virus is likely to resume?

We are in pretty dark times. I’m not comfortable with an idiot like Cuomo running our state either.

I think this will take years to recover from, and that is if we are fortunate in not seeing a repeat of the shutting down of the country over a flu or virus again.

many have learned how to be very frugal the last few months, will this behavior stay or go back to what was considered normal? People are realizing they can cook at home more, they don’t need all those new clothes or need those weekend getaway trips or seven day cruises.

Time will tell.

Hear Hear!

Someone pointed out this Dem-PANIC started in the season of Purim in which God works in hidden ways.

As OG36 has almost intimated, governments can no longer afford to fund education K to PhD. Hollywood will have to fold

because the masses will not afford their anti-family, anti-American crap.

Plus Buck is correct. If you cook from raw foods you can do it frugally for about $1 per day per person. That is even before factoring in all gardening folks are planning on doing now. Families are valuing each other more and above the evil marketing of endless crap ( the MSM scared them into that ). And home sown or seamtress sown clothes offers individuality and uniqueness. Unlike the China imports that really are all the same regardless of the store or their price points.

Half the products could disappear and never be missed. Example: could not find a facial scrub not made China. Then I thought of baking soda. Checked it out on the web and it is confirmed its a great facial scrub.

“….Purim, a festival marking the Jewish people’s rescue from genocide at the hands of the Persians. Megillat Esther, the tale of their deliverance, is read twice over the holiday, and contains a thrilling plot of espionage, betrayal and unexpected twists to rival any modern-day spy story. However, one of the most notable aspects of the Megilla, from a religious perspective, is the complete absence of God’s name anywhere in the narrative….”

The ‘hidden hand’ and Purim

Seth Freedman

https://www.google.com/url?sa=t&source=web&rct=j&url=https://amp.theguardian.com/commentisfree/belief/2010/feb/27/purim-judaism-religion&ved=2ahUKEwjwxriTm6PpAhVIWq0KHZezDjcQFjABegQIBRAB&usg=AOvVaw2iI4WCcHU5lf8qhv42RyXA&cf=1

Megillat Esther is the only one of all the books of the Torah, the Prophets and the Holy Writings which does not explicitly mention the Almighty. As such the Purim story is used as a prime example of how God operates in a concealed manner to perform miracles on behalf of the Jewish people. The “hidden hand” aspect of the Megilla is an incredibly powerful concept, especially in modern times

Better sew those clothes. Sowing them will just get them dirty, and eventually will make them rot. As Pinocchio learned the hard way, and as Bloomberg has yet to learn, farming involves more than simply sticking something in the ground and waiting for it to grow.

Where is your baking soda made?

Revelation 18 is a real eye opener … I’ve often focused on verse 4 where the Father tells his people “come out of her my people” – so who is the her? She’s described as a whore who buys and sells and who has derived her life from the blood of saints and prophets … the chapter speaks of a time that people will lament because all the buying and selling she feasted on came to a halt over night …

Of course what’s happening now is real/literal – and the scriptures are spiritual in nature … but it’s still startling to me just how quickly everything came to a screeching halt and we were relegated to actually spending time with our families. I admit I’m blessed to see some of the wonderful videos of people being creative getting uploaded … mindful of another scripture – OT? about the Father turning the hearts of parents to their children and so on … I hope this time will have the effect of healing some of our societal ills and antisocial behaviors we’ve seen in recent years.

The “Lord loves a working man.”

Steve Martin, the Jerk.

The Harlot of Revelation (“Mystery Babylon”) is almost certainly the Roman Catholic Church. There is no other entity or institution that comes close to fulfilling the descriptions of the “Woman Who Rides the Beast” of Revelation.

“[M]indful of another scripture – OT? about the Father turning the hearts of parents to their children and so on …”

Malachi 4:5-6, speaking of Elijah the Prophet being sent by God in the “latter days” to prophesy to God’s people.

Thanks Doug.

“What is to stop this from happening again in the fall, if we see reopening start now, when the virus is likely to resume? ”

Oh my God! Whatever are we going to do?!

Let me help you Chicken Little. We’re going to do what we always do: live our lives while you cower in fear.

You see…We’ve had far worse diseases run through our society, and we have Pneumonia and Influenza kill tens of thousands (83K this season combined. IIRC over 100K last year) and we live our lives and go about our business.

You bought into the hysteria and now you (And your ilk) want more doom and gloom to justify more tyranny come the fall. You can have the former and hide under your bed while the rest of us live our lives.

Try the latter again and we’ll see if the Wisconsin state house protest was a one off or just the beginning.

Glenn Reynolds said it best: first things go slowly; then the move very suddenly.

GIVE ME LIBERTY OR GIVE DEATH.

Screw death, give me liberty.

You have one hell of a nerve.

Do you have a brain? Can’t you hear the reports of what is being projected? You think for one minute that’s these governors will just go back to being what they did before?

F you. I’m not a “chicken little” but you are an a**hole. I’m out working every day. Yet I’ve seen my investments loose significant amounts, near half a million is gone. That’s just from this time. Nearing retirement isn’t when you want to see that much disappear.

Things will come back, but not all that quickly. I know of at least 10 businesses that closed for good in my neighborhood. This is reality. And with NY in the shape it’s in and with Cuomo in charge the restrictions on opening doesn’t sound likely to be quick.

But go ahead and be a Pollyanna and think some magic wand will turn the switch right back to normal. Meanwhile I will make sure to ignore your ignorance and you.

I’m in Texas, and although it’s very heartening to see the corona nonsense ending, that is just stopping the bleeding. I agree with you, it’ll be a long time before the jobs come back, and I am worried about going into the election this fall with unemployment still above 15%, which I think likely.

No one has been paying much attention to the oil crash, but here in Texas, there have literally been hundreds of thousands of layoffs from that source alone, and there’s no way any of those are coming back this year. Just FYI, Texas has had over 2 million layoffs in just the last 8 weeks. It’s bad, and there’s no sugarcoating it.

A huge percentage of my tiny area work in the oil/NG field. Almost all of them are unemployed at the moment. The area is already dirt poor and most people don’t have much of a cushion.

It’s gonna be bad for a while, I think.

If they would reopen state parks to overnight camping, I would be visiting!

Meaning, you know, driving, USING GASOLINE.

Experts who were completely wrong, 1, 3, and 6 months ago now want us to believe their projections for 1, 3, and 6 months from now.

Show me the expert who presented an ACCURATE curve…can’t seem to find him/her. Bueller? Bueller?

Ironically, Occam’s Razor would have worked. The simplest explanation would have been to start with the level of flu deaths and multiply by 2 to 4 for the fact that flu deaths reflect reductions due to flu shots and prior exposure to flu. That is about where we may end up, not the roughly 50 times flu deaths from the 2.2 million Imperial College London model that scared Trump into a lockdown.

The “faulty computer programs” were probably on purpose. I work in this area, and it seems to me that the models were not meant to be accurate; they were meant to have an effect.

The man was a repeat-mistaken-statistician.

I can’t believe Birx and Faucci went to Trump relying on that idiot’s figures.

Birx and Faucci- the gift that gave the dems the catastrophe the dems prayed for.

I fear we have set the precedent that Governor’s merely have to declare an emergency to acquire dictatorial powers. It is only a matter of time until a climate emergency is declared by some Governor. Ironically it will be justified with bogus climate models. Have to follow the science.

ASK HUEY P LONG HOW THAT TURNED OUT FOR HIM.

Oh that’s left of him…..nothing……

As bad as the financial effects are (haven’t worked in two months now, have to look for a new job…hahaha, good luck with that, being 55+), the thing that concerns me most is the utter destruction of the Constitution and the BoR. These tinpot dictator governors are bent on making 1984 look like a Sunday School picnic. “Contact tracing,” vaccine mandates, “social distancing,” and all the other garbage…sorry, that’s not the America I grew up in.

Ronald Reagan was right – we’ll spend our sunset years telling our grandchildren what it was like to live free.

What’s left to say that’s not already been said?

I live in NorCal. 16 people tested positive and got well. No one died. No one has tested positive in three weeks. We’re locked down. We’re waiting on the State to let us get back to work. The State is determined to bleed us white.

From beginning to end not one grocery worker in town got sick. Not one – yet those are the people most likely to get sick since they come in contact with far more people than police and fire workers. Yet we’re at defcon five. The media insist we remain at defcon five.

“not one grocery store employee sick…..”

That is the report from people all over the country.

Unfortunately it isn’t. Just this morning I heard that at this supermarket alone nine employees have tested positive and three have passed away in the recent weeks.

Unbelievable. How could any human being object to that? Seriously. Whoever downvoted it should please drop dead and go directly to Hell; you pollute the earth with your existence.

I down voted your question.

1- to troll you

2- being right is not a popularity contest that requires affirmation and up votes.

3-5- to troll you.

My daughter is the manager of a local store of a nationwide grocery chain. Lots of employees have gotten Covid, including probably her, since her young son got it, with symptoms (and tested positive) – 100% recovered.

New York is different. Twitchy this morning ran a piece on how outside NY hardly anyone personally knew someone who died of this. Here I don’t think I know anyone who hasn’t lost someone.

New York should have been quarantined and the subways closed from the start of this. But none of the rest of us needed that. I live in a county, population 220,000. 4 deaths TOTAL, all of them elderly with pre-existing conditions. Our hospitals and clinics are empty.

The subways can’t be closed. The city depends on them. Essential workers have no other way of getting to work, people who need to get places have no way of getting there. They have to run. Even what they’re doing now, closing the system for four hours each night, is a hardship for about 12,000 people, but that’s a small enough number that the MTA can arrange alternatives for them. Doing it for the daytime ridership would be impossible.

Well, since this is so desperate a situation, with all kinds of dictatorial edicts, just ORDER New Yorkers to move elsewhere, without subways.

The previous economic and market downturns are entirely different from the current one. In those situations, the economy, mostly the financial markets, collapsed due to failures in one or more segments of the investment market. The economic problems caused by the “reaction” to the COVID virus are entirely different. In the first place, only the production markets are affected. In the short term, the investment markets, such as the USSE, have only lost about 10% value. The production markets have totally collapsed, losing from 50%-90% of their value. And, as these business markets require consumer investment [purchases], idled workers will keep consumer expenditures far below what is needed to grow the economy back to pre-COVID levels. We are looking at years, not months for a significant recovery.

What should be most alarming to people is the fact that, given the timing and nature of the actions taken in response to the COVID pandemic, the likelihood that this was all an unfortunate coincidence is startlingly small. Orchestrated actions were taken to destroy the global and US economies. Whether the release of the virus was accidental or not is moot. In order for the response to reach this point, it required that the news media exaggerate the threat posed by the virus to insane levels, the medical experts had to engage in wholly unsupported flights of fancy where the dangers of this virus were concerned and politicians had to willingly do what has never been done for an infectious disease before, in modern history, shut down their own economies, thereby costing their countries billions or trillions of dollars. Who benefited from all of this? Who lost the least? There is someone behind the curtain.

British Pandemic Model Creator

Resigns After Breaking Lockdown Rules

to Meet Lover

https://legalinsurrection.com/2020/05/wuhan-virus-watch-british-pandemic-model-creator-resigns-after-breaking-lockdown-rules-to-meet-lover/

Surprisingly it was a woman.

Excellent observation by both you and oldgoat36. Roughly half of Americans work at small businesses. A material percentage of those businesses will not reopen, some helped to their demise by poor funding and handling of the PPP and Disaster loan programs. A small business with fixed expenses can not keep paying the rent for long with no income (and no certainty of future customers). Then all those laid off who eventually get their jobs back have seriously damaged finances. Spending habits will change and be more conservative. I personally do not expect to see 3.5% unemployment ever again.

As you seem to also think, this whole thing is very suspicious. Original estimates of up to 2.2M American deaths clearly induced Trump to shut things down. I saw stats today that 2/3 of American counties have had one death or less. That makes it obvious that keeping those counties open, with self-quarantining of the elderly and infirm elsewhere (but also open) would have had drastically lower economic cost and probably less deaths as well – with lower deaths from heart attacks, suicide, drugs, alcohol, neglected care, etc. As to who benefits, I have wondered if this was Phase III of the efforts to unseat Trump – the MSM, the Dems mouthpiece, certainly seems to prefer bad news.

My personal opinion is that this “pandemic” is not merely to unseat Trump. That is only part of it. This is a move of desperation by the elite Establishment worldwide to destroy the rising populist movement around the world. The populists [read as “the common people”] are being starved into submission.

While we tend to be parochial, and concentrate on domestic news, populism has been growing around the world for the last five years. France has the Yellow-vest populist movement. Germany is experiencing a nationalist populist uprising. The same in Italy and most of Europe. Certain nations in South America have seen an upsurge in populist political candidates. Even nations such as Iran and Russia were struggling with domestic populist movements. The capstone to the populist movement was the election of Donald Trump, as President of the United States. Now, the populists had control of the largest, most powerful economic engine in the world. So, while the US was a big target, it was not the only target. Then, of course, we have had other ideological groups seek to piggyback on the destruction caused by the corona virus response, which tends to muddy the waters.

This is all class warfare on a global scale. And, we are closer to armed insurrection, in the US, than we have been since the 1800s. Regardless of whether Trump is elected in November or not, a powerful group is going to feel threatened on an existential level. Worldwide, there are state actors who are more than willing to engage in open warfare using force of arms to protect their domestic positions. I don’t know exactly what the solution to all of this is. But, the common people had better wake up before it is too late.

Test-run for the Antichrist-controlled global system.

Cheer up Professor!

It’s only going to worse.

For the Democrats!

I’ve been too busy to comment recently. Some random thoughts.

Well, I finally have a day off, and I’m a bit tipsy after a dinner that all but mandated a healthy bit of imbibing, and I know I’ll kick myself tomorrow for saying this and for rambling on in run-on sentences but, I have to admit that Bill exhibits the temperament and intellectual calm and fairness we should expect in all our professors and teachers.

And to think he began teaching by way of a problem with his eyes.

And there I was one night at work a few months ago … I kept wondering if it was my imagination, or if I was really seeing flashes of light in my peripheral vision. I looked away from the dark background of my computer screen towards the off-white wall and … I saw thousands of “floaters.” Little dots everywhere.

I went outside for a walk thinking my eyes were strained. It was then I remembered Bill talking about having a similar experience. When I got back to the police station where I work I told the lieutenant in charge what was happening and told him I was calling my wife to take me to the emergency room.

This lieutenant, who just retired a few weeks ago, would spend the first 15 minutes of his day when he came in joking with me about just about everything. He started making jokes about “floaters” likening them to turds floating in the toilet, among other things, and I finally had to break with protocol and say, while grudgingly laughing in frustration, “Lieuten … Dude, I’m being serious. I’m not joking. I’m seeing floaters everywhere. Thousands of them.

After a visit to the ER, I ended up at the Stein Eye Clinic at UCLA the next day. Been there a few times since and was supposed to go back a couple weeks ago when they sent me a message that all appointments had been rescheduled to June because of the coronavirus.

I wonder what the toll has been of all untreated or undiagnosed, non-coronavirus health problems during this span of time?

My sister works for a high-end cruise ship company. Probably the worst business to be working in right now. She went from being voted the company’s employee of the year last year by her coworkers to now wondering if the company will survive. She said about half the employees have been laid off. The vast majority of her income has been through commissions … those have completely evaporated. There are no cruises.

I know I had some unified theory for my conclusion when I started this, but I can’t remember what it was now.

It’s time for bed.

Things are still pretty grim … but it’s been a pretty good day news-wise for conservatives and people who believe in justice and the American way and all that sappy … but nonetheless … in the end, good stuff. Beware of floaters.

Hopefully just vitreous separations without retinal injury. Can develop slight warping of vision and a “cellophane” membrane over retina. Hang in there. A lot of doctors have seen needed care get delayed. I have full telemedicine capability but “the laying on of hands” is so important.

Christ I hope someone has checked the blood pressure…. THOSE spots are deadly.

Floaters are not fun.

I had an eye bleed that caused numerous floaters due to the clotted blood in the eye. My ophthalmologist said they were basically untreatable. I read a research paper published by some doctors in Taiwan. They did an experiment with daily doses of Bromelain supplements, a proteolytic enzyme derived from pineapple. I have been taking them for a couple of months now, and the numbers of floaters have decreased. YMMV.

China and globalist allies in and out of the country are hoping the USA is beyond the tipping point toward hegemony. They are still active in Blue states and cities trying to further destabilize the country. My heart aches for all of our citizens who have been damaged by these external and internal attacks. The war is far from over and we have much that needs avenging. The question now is what is the final transition for the country? We have to win.

Here is a review of the major shortcomings and bugs of the Imperial College Modeling software that predicted the millions of deaths in USA…. it’s bad…really bad.

https://lockdownsceptics.org/code-review-of-fergusons-model/

Imperial College should be toast.

I was on a walk this evening and tossed a food wrapper into a recycling bin on the street which prompted the homeowner to start yelling at me that there was a pandemic and that I needed to spray his bin with Lysol. He was serious. There is Covid derangement syndrome out there that makes TDS pale in comparison. Staying sane appears to be more of a challenge than staying safe.

So my Branco cartoon suggestion is a variation of “Bring out your dead.” For Portland, have a guy pulling an empty cart with “ted” on his back while a wiry woman next to him holds a frying pan and a mallet above her head, with “kate” on her back. The key, of course, is that the cart is empty, reflecting Oregon having just over 100 deaths attributed to covid, but we need to stay locked down till July 6th to be certain. Other than the whack-job I encountered earlier, I see fewer and fewer people buying the story that is being sold. This might backfire to the point where Oregon goes red the next time around.

LukeHandCool,

“After a visit to the ER, I ended up at the Stein Eye Clinic at UCLA the next day. Been there a few times since and was supposed to go back a couple weeks ago when they sent me a message that all appointments had been rescheduled to June because of the coronavirus.”

I’m not a physician, but having experienced the visual event exactly as you did twice in recent years, I’m wondering, on behalf of your continued eyesight in the affected eye and in reference to the above you encountered at UCLA-Stein, whether you’ve been seen by an ophthalmologist yet for the ocular emergency that may be present: a PVD (posterior vitreous detachment), with possible retinal tear, which may, in the worst possible (and, with emergency care, preventable!) case, lead to a partial or complete retinal detachment. You don’t want to get to this last, worst possible stage; it wouldn’t be good.

So, has a physician-ophthalmologist (MD/DO) or certified optometric physician (OD) examined your eye yet? If so, what’s the diagnosis?

Have you been treated with any laser

Mike “All jobs are essential jobs” Rowe

https://youtu.be/5SWFXkjuDsQ

I put my money where my mouth is.

Professor- these are very different but for recovery I would argue we are more like 9/11 than 2008. The economy was not broken in January. The math for America was damn good before this event it will be good again very soon- like July 31 when the pandemic UI runs out.

I bet on this stuff with real money and I am right. Always.

On March 23, I sold about 5% of my stock portfolio and bought options on those same index funds (DIA and SPY). Most of the expirations date are out to 2022, so I’ll be holding these for a while to maximize the returns.

My returns on that have been between 40% to 300% to date. It is the greatest investment return I’ve seen in my lifetime and I’ve done some good ones… compare this to 2008…I was younger with less cash to do this with.

—-

In 2008, Labor Day, I reflected on the situation that was looming. I was a 1099 contractor on a month to month contract. Banks were looking sketchy. I owned a porta potty business on the side and I could do the math on those spec properties and everyone buying/building beyond their means. I had a 6 figure income and everyone had far nicer stuff than me. Nothing added up. There was something intrinsically WRONG with the debt to equity ratios for most American house holds. McCain was an idiot, Obama was an idiot and even if they weren’t there was no fixing that magnitude of bad math at the household level…this was 1929 math. Knowing my day job was insecure, I sold 80% of portfolio on Tuesday and paid off my mortgage. The banks started falling like dominos on Thursday.

I managed to keep my day job and invested all that way down and up again, though a bit too conservatively using covered called deep in the money. I made a good 10%, but had I believed in America more, I would have been 50-60% returns that year. Lesson learned.

My money says this isn’t a marathon, it’s a 10k. We aren’t that far away from recovery. Trump and congress have rigged this to get us back under 5% unemployment by the election. Think about it… that pandemic UI pays you more to stay at home… when that ends, everyone who is an asset to the work force will magically will find work again.

My money says bet on America. It’s not broken.

Zero percent chance of under 5% unemployment by election day. It won’t even be close. Half of American employment is in “small businesses”. A good deal of those are not coming back – can’t survive the lockdown period, or the extra period with few customers, or the change in demand due to Covid. Imagine a travel agency, a bridal shop, someone selling furniture, many restaurants (a low margin business to start with), car repair shops, energy industry workers, etc. I will be happy if it is 8% by year end which, if I am right, makes Trump’s reelection uncertain.

Nope- 5%.

It will be 8% by mid/late August.

I insure small businesses. I run a small insurance agency. That’s my semi-retirement gig. I am plugged in.

The majority (VAST Majority) are artificially unemployed. They are getting paid more to stay at home. When the order is lifted and the subsidy to stay at home ends, most will be up like a ricochet.

BTW- those self employed 1099s will ‘disapper’ from the counts because you can’t get UI as a self employed individual except through the federal emergency. A few will be out, but they won’t be counted anywhere.

I watch new business filings in my area like a hawk- because that’s my market- a lot of guys have been hanging their shingle out during this mess. It is of course half what it would be normally, but I was surprised. They are going to get after it as soon as the order is lifted.

I also would see who is going under… my customers are laying low and going to weather it.

Being in small business insurance, you are, of course, familiar with liability. This is what a business owes. many of these liabilities are recurring, usually on a monthly basis. These include loan interest, utilities, rental or mortgage payments, suppliers, insurance, etc. Most businesses have to have at least as much monthly income as they have liabilities. Now, so far, we have a significant portion of the business community which has had no income for two months and most of the rest have had reduced income. This means that they are already behind in meeting their existing liability. The PPP loans simply add another layer of future liability to that.

In order to make money, a business has to have a sufficient customer base which spends enough money to allow it to meet its liability and still show a profit. Most of our businesses deal with non-essential products and services. They rely upon their customer base to have sufficient discretionary funds to allow them to spend money on non-essential products and services. With a large unemployed population, this reduces the discretionary funds available to the consumer base. Also, in uncertain economic times, consumers are more tight fisted, tending to save, rather than spend. And, of course we have the reduction in expendable products such as food. With half the market for food products eliminated, for the last 2 months, a significant portion of the food supply has been destroyed or is being destroyed. This drives up prices for a basic necessity, food stuffs. Finally, add in the reduction is customers, who can be accommodated, under these oppressive, insane social distancing standards and business incomes are reduced even farther. And, we haven’t even dealt with the destroyed export economy. The global market has tanked, as well.

Nope, we will not see an economy anywhere near what we enjoyed, in January 2020 by the end of 2020. And, probably not for several years after that.

I am on record as saying that we may never see a 3.5% unemployment rate again. It is a risky prediction as declining birth rates and possibly rising death rates will tend to make labor more scarce. However, even in a best case scenario, there will be many shifts between newly favored and unfavored industries and jobs. Jobs are not interchangeable, which will lead to higher unemployment rates for many years, if not decades. For perspective, note that last year’s 3.5% was the lowest hit in 50 years.

I didn’t say ALL would be made well again.

I also didn’t say we’d hit 3.5% again soon. The economy and job market was red hot. A 5% UE rate is not right where we left off.

Yes- those liabilities exist. Do you honestly believe any majority of landlords are going to start booting businesses that fall behind in the next 6 mos… to what end? A vacant commercial space for 2 years??? No- that’s suicide. Go upstream- is ANY bank going to foreclose on a commercial space that is functionally working BUT behind on rent due to this? No- again, that’s suicide. That’s also presuming you’ve found the ones who go NO help. They are out there, but it’s not the majority.

I’ve got a couple of gyms in my book, they are both shutdown and will be the last to open up. Both will make it. They have all utilities and overhead and will eat some of that.

A lot of restaurants will fail. No doubt. Airlines and Boeing are screwed. Farming is as screwed up as it has ever been as well. But that represents the delta between 3.5% and 5%. It’s not 8%.

The food services sectors right now are clamoring for workers. Also this is a entertainment/service economy thing- so far the white collar crowd is working from home and much of the blue collar crowd has been deemed essential. The local feed and farm supply is as booming as ever.

Good luck getting into a salon when this opens back up- they could run 24/7 and still be booked 10 months out.

I disagree with the consumer sentiment tanking too badly- thanks in part to the disaster money- the people who spend… are spending. The debt to income ratios are not at 2009 levels. Amazon is pushing delivery dates out- that aint because people aren’t spending on crap purchases.

This isn’t ideal, but this is a down turn that will be short. Also remember, we’ve got Trump at the helm, not the prior president who told us to buy tire gauges to fight high gas prices.

Will landlords begin evictions for a 2-3 month lapse of rent? Maybe, maybe not. However, this assumes that the tenant will be up and running at a level which will offset the 2-3 months of no income, immediately. If the tenant comes back at an income level which will not allow that business to pay its rent, and other liabilities, the business will likely file for bankruptcy anyway. Now bank foreclosures. Back in 2019, the rules for qualifying assets for banks and other lending institutions changed. Prior to that, a foreclosure was counted as a total loss of the outstanding balance of the loan. Now, the appraised value of the property taken in foreclosure is counted as an asset and used to offset the outstanding loan amount at the time of foreclosure. So, which looks better on the books; a $1 million dollar outstanding loan, which is in arrears, or the acquisition of a $5 million dollar piece of property minus the $1 million dollar unpaid loan?

Also, you seem to discount the likelihood that people, who have been out of work for 2-3 months, will not have the disposable income necessary to support non-essential businesses to a sufficient level to stimulate the economy back to pre-COVID levels. Dining out is a luxury. Gym memberships are a luxury. Frequent trips tp the barber or salon are a luxury. Travel, large ticket purchases [such as cars, furniture, houses], frequent clothing purchases, small appliances, entertainment venues, etc are all luxuries. A cash strapped public will be making choices as to which non-essential product or service they spend their existing disposable income on. And, the lessened spending on luxuries means lessened spending on the downstream suppliers who produce luxury goods or necessary park for luxury goods. Lower retail auto sales effect not only the retail dealership, but the auto manufacturer, its parts suppliers, their raw material manufacturers, and even the finance industry. The same is true across the board for all consumer based industries. Then we have the problem of consumable necessities, such as food stuffs. Vegetables, meat products, eggs, etc. have no appreciable shelf life. With 50% of the food market gone, these consumables are either rotting or being destroyed. This means that for several months, food prices will increase, markedly. Causing a further drain on consumer resources.

Then we have taxes. The money being spent on the response to this virus is enormous. The federal government has spent nearly 2 trillion dollars since the first of the year, on this situation alone. The state and local governments have done the same, or more. And, for most of the last two months, there has been little tax revenue coming in to offset it. Where are these funds going to come from? Increased taxes and cost of government services is the only place. How does this effect the spending power of the consumer? It reduces it. This affects the income stream of the business community. And, then we have the credit industry. How much spending is being done through credit cards and how does this affect the consumer’s future income? If people are charging more than they are making, this will have to be paid back out of savings and/or future income. This limits the a mount of actual disposable income which the consumer has available.

I would not take the fact that Amazon is pushing out delivery dates to mean that the population is still spending large amounts of money on luxury goods. There is also the matter of reduced staffing in the distribution centers, reduced numbers of delivery personnel as well as the divergence of brick and mortar shoppers, who are now locked out of those businesses, to online ordering.

It is all well and good to have a rosy outlook. But, it took a decade for the unemployment rate to decline from 10%, in 2008, to about 5%, in 2017. Now we are at nearly 15% and half of the workforce is sitting on the sidelines. Also, there are no more viable global markets for American goods. That was destroyed in response to the virus, as well.

The bottom line is that the US economy is going to be in the tank for a long time, as the world rebuilds. The US does have an advantage in that we comprise 27% of the consumer market of the entire world. It is possible for this nation to establish a largely self-sufficient consumer manufacturing economy which is almost wholly domestic. But, it will be very expensive and it will take time. The media, the political class and the leadership of the medical community has sunk the world economy and those who participate in it.

State governments are in for a reckoning that is for sure. Bring popcorn to watch that play out. That has no impact on the near term economy.

If a business was run well before the closing- it will make it. They have cash reserves, they own their stuff, they have good supplier relationships and they don’t have debt.

If a business was mortgaged to the hilt and barely scraping by in the best economy ever, it will not. Some parts of the business community are in fact pie crust– easily made, easily broken. Most are not.

You are discounting that virtually every spender in the economy is getting a fat check, many fatter than when they were working. On top of that, the lower echelons of workers are making MORE staying home than they did working. On top of that sole proprietors are getting UI too. The government will have a debt hangover, on top of a bigger reckoning of debt, but that has no impact on the economy in the 3-12 month timeframe.

This is NOT 2008-9. People are not underwater by 200k on their homes nor will they be. Real estate, construction will be moving again by July. Boeing Layoffs will not have a iota of impact to the Washington housing prices…at best they will flatten. In 2009, no one was faced with a choice of being paid more to stay at home than to work their old job. In 2009, no business was clamoring to open back up- now businesses are filing lawsuits to open back up- that is a HUGE difference.

There are lines to get into stores selling discretionary durable goods (due to the distancing) like Lowes and HD. Yet when I go in, they are more crowded than before the pandemic AND there is a line to get in. That is not the sign of an economy collapsing.

Due to the interest rates- I’m seeing my customers refi their homes- and put money back in their pockets.

No sir- this downturn is rigged to put anyone up for election in November back in office in January… and that applies to both parties.

So, how many businesses have sufficient cash reserves to last 6-8 months with no or reduced income? How many businesses own sufficient inventory to last that long? And, the basis for having good supplier relationships is paying your suppliers on time. Remember, in many instances the suppliers have had no or significantly reduced income for the last 2 months as well.

Now, I am not sure what you are talking about concerning people getting a fat check. If you are speaking of unemployment, that goes away when a person is reemployed [and in most states that means at any job. Also, there is a lack of security when on unemployment. Of course, the same insecurity will exist among the employed, which will likely cause them to curtail spending and increase savings. Also, people who are unemployed usually have trouble qualifying for loans for major purchases, such as automobiles, furniture and houses. Now, you can not have it both ways. If businesses need workers and those workers can make more on unemployment insurance, while sitting at home safe from the virus, where are all of the necessary workers going to come from?

The reason why businesses were not clamoring to reopen in 2009 was because they were not forced to close, kin the middle of a thriving economy, by the government. The businesses which were closed in 2009 did so because of a widespread economic downturn. When society reopens this year, we will just be starting the true economic downturn. However, we will be starting it with an unemployment rate of 14.7+% and over half the work force idle. We will also be starting it with a massive government debt. And, due to the COVID danger hyperbole, with a workforce reluctant to return to work.

LOWES and HD are your examples of non-essential purchasing? Two lousy stores in the entire nation? Please. These are specialty stores which sell essential items; such as cleaning supplies. But, they also depend upon the building trade to stay afloat. If the housing market does not come back, these stores will struggle, significantly. People with reduced funds do not remodel their house or do extensive landscaping.

How much money can one actually put in their pockets when refinancing for 1-2% lower, on a middle class home mortgage? And, that money has to be amortized over 10-15-30 years. After the refinancing feeds, how much disposable income are these people going to have? Then of course we have the rental population, who can’t refinance their housing costs?

Good try, but I’m afraid that we are not going to see Happy Days for a long, long time; economically.

Mac45, I basically share your point of view, but will add one datapoint. Garden centers are not closed in my state. I have never seen my local nursery so packed, with everyone wearing masks and social distancing. I attribute it to generating some constructive, safe activity outside the house by “stir-crazzy” people.

His reference to people getting a bit fat check is to the $600 per week extra Federal check through July 31 on top of state unemployment. For a large number of people this nets them more than they were making. Also, the PPP program for small businesses covers payroll for two months plus occupancy and utilities.

However, I think that November is going to be interesting. Trump’s talk about a fabulous recovery may cost him the election, if people are still really hurting on election day. How many small business failures does it take to swing the votes in a few close states. Since I think it will be a “for” or “against” Trump election, Biden being mentally impaired will not matter unless it is very obvious. If Trump can not hold his dramatic rallies throughout the country, in contrast to Biden, that will be another handicap.

Watch South Dakota, where hydroxychloroquine is being run through an outpatient use trial, for which the doctors who like it say it is good, not for people already in desperate shape. If results are good, that could change the dynamic of treating the illness, cut deaths dramatically and improve the mental attitude of the country. Trump could get some credit.

How many petunias have to be bought before the economy gets back to pre-COVID levels? And, how does planting a few flowers around your home translate into unfettered economic support for all of the businesses, such as restaurants, entertainment venues, clothing, furniture, bars, entertainment venues and a score of other businesses? How does this help small appliance businesses, auto dealerships, furniture stores, the building industry and other large ticket product and service providers? It doesn’t.

Now, politicians are already talking about dis-incentivising unemployment insurance, which pays better than the jobs people are now out of. In fact one state is talking about setting up a snitch line to report people who do not go back to work. WTF????? Also, the only PPP funds, which do not have to be paid back, are those paid directly to employees. Everything else is a loan. But, these stop gap measures are just that, very short-term incentives. The extent of the damage already done to consumers and the business chains that they support will determine how long the recovery will take. Now, except for the stock market, all business chains in the country have been heavily damaged. Prices will have to go up to cover the losses all along the chain. Taxes will almost certainly have to go up to cover this fiasco. It is not going to be bubble gum and rainbows, for a while.

Give it a rest on the “petunias” – obviously psychologically-driven expenditures. I share your view, if not more bearish. For example, no restaurant, a low margin business, can make a profit at 25% capacity unless they have a booming curbside order business. Look at major bank, Citigroup, now selling (after a huge general market rally) at 55% of the pre-collapse high. That is a good indicator that this is not just a short term problem.

A massive number of small businesses have been put in the position of being startups again. How many of them will decide that the opportunity is too uncertain to risk a lot more equity capital to gamble on how many customers return? The answer is a lot and some of them might have survived, but will not stick around to find out.

Only problem I see – isn’t the fed unemployment given for 6 months with the supercharged $600?

The extra $600 per week runs through July 31. I have read articles saying that will make it difficult to get lower paid people to return to work, since they are making more sitting at home with no work and no Covid risk. I know someone dreading the call that his business has reopened.

I remember many years ago talking to my grandfather about what it was like to live through the Great Depression. I don’t want to find out what that was like firsthand.