Citibank Explains Their Plan to Curtail Second Amendment Rights

Since when does a bank have the power to legislate?

Thursday, Citibank released a statement explaining their plan to curtail the second amendment protections of their customers and partners.

“Today, our CEO announced Citi is instituting a new U.S. Commercial Firearms Policy. It is not centered on an ideological mission to rid the world of firearms. That is not what we seek. There are millions of Americans who use firearms for recreational and other legitimate purposes, and we respect their Constitutional right to do so,” explains the company’s blog. “But we want to do our part as a company to prevent firearms from getting into the wrong hands. So our new policy centers around current firearms sales best practices that will guide those we do business with as a firm.”

Let’s pause for a moment to reflect on the fact that one of the country’s largest banks is mandating unconstitutional “best practices” for their customers.

Citibank announced the following new rules:

Under this new policy, we will require new retail sector clients or partners to adhere to these best practices: (1) they don’t sell firearms to someone who hasn’t passed a background check, (2) they restrict the sale of firearms for individuals under 21 years of age, and (3) they don’t sell bump stocks or high-capacity magazines. This policy will apply across the firm, including to small business, commercial and institutional clients, as well as credit card partners, whether co-brand or private label. It doesn’t impact the ability of consumers to use their Citi cards at merchants of their choice.

These kinds of corporate policies do little more than confirm the intellectual vapidness of mob-bending corporate culture. None of these policies do jack to curb what’s a deep-rooted cultural problem affecting our young men, but to the new rules…

First of all, gun shops do not sell firearms to customers (who are not licensed dealers) who haven’t passed a background check. This does not happen, contrary to widespread propaganda which has misled the public. So, minus 8,736 points for the ignorance of this feel-good statement because that’s all it is.

Secondly, and most concerning, Citibank is acting to fill a void elected officials chosen by the American people ought to fill — making policy decisions germane to our Constitution. Democrats know raising the gun purchase age to 21 won’t fly at the national level, so is it any surprise policy changes are occurring in the “private” sector (I say “private” because of the gobwads of taxpayer money Citibank has received)?

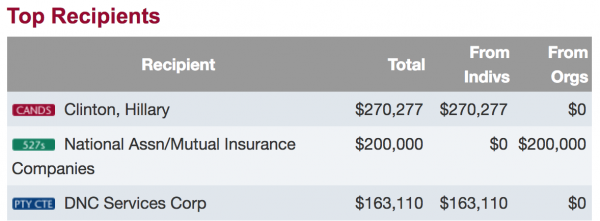

Citigroup, its affiliates, and employees gave over $3 million in the 2016 election to various candidates, PACs, and organizations. Not surprisingly, the most money given to a single candidate was Hillary, followed by donations to a Jeb Bush supporting PAC.

Thirdly and annoyingly, what constitutes a “high-capacity magazine”? Well? And again, why is a bank telling businesses what merchandise they can sell?

This goes far beyond virtue signaling into veritable legislating. We should all be concerned. Very concerned.

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

A generation of Corporate Snowflakes. I wonder if Citibank can deny services to an existing customer acting lawfully based on that stated policy.

One of these geniuses will declare that you can’t buy a gun with our credit card – and the media will love them.

After losing tons of customers and money, they will blame the NRA, the President et al.

Exactly.

Seems like a tortious interference lawsuit (class action) by FFLs who are existing Citi customers would be appropriate here.

All the speculation surrounding Citi’s latest position and its subsequent impact is just that, speculation.

Citi is just one more organization where senior management believes one of it’s responsibilities is to influence legislative affairs rather than tend to their business. I don’t know for whom Citi speaks with this most recent statement, but I would prefer they tend to their core business which they seem to have forgotten as seen in their most recent $70 million fine for a shortcoming in their anti-money laundering compliance. See January 4, 2018 Business News as reported by Reuters.

I wish that I had a Citi card so that I could cancel it.

Well, I’ll cancel mine for you. I’m going to tell them to NOT BE A DICK or they will “get woke and go broke”. They may not miss my little $10k credit card, but I SURE WON’T MISS THEM!

I cancelled mine in your name.

Whelp let me tell ya a little story about Christian who wouldn’t bake a cake. He lived in liberal shithole and tried to keep his family fed. Then one day came a dyke pair through the door.

I think you know how our little story ends.

Fascism by other means.

I hope they lose tremendous business, but sadly, too many will ignore this or even applaud this without thinking it through.

I’m glad I’m older, my time to deal with the destruction of this country will be far more limited. I fear for my family having to live through the horrors that are to come.

If I hear that F¥€Kong word “best practices “ once more !!!

I have nothing to do with Citibank and I never will now.

They must think the SJW will flock to them

Because common sense tells me this is a losing business decision.

And we thought Bloomberg’s soda size was crazy..

I hate these people

SJWs don’t have any money…unless they borrow it, hmmmmm.

I’m not big into conspiracy but it seems more and more apparent have managed to effectively push fascism through large corporatations. They dominated academia and have moved farther into the public square.

Corporations may have “social conscientiousness” but I smell money.. billionaire money and corporate cronyism.

Rollerball anyone?

I have said the same thing many times over the years. Interesting that Rollerball was set in 2018 according to the book.

“In the near future, there will only be corporations, comfort, conformity and Rollerball…”

But without Rollerball, we would not have the great Johnathan E.

That’s the definition of Fascism: use a veneer of “private business” to support government tyranny.

“But we want to do our part as a company to prevent firearms from getting into the wrong hands.”

…and you are going to do that how? By walking the streets of the south side of Chicago, personally? How about East LA? How about NYC? Do you do business in Brazil, gun deaths there are more than the combined total of the entire world. How how do you define “wrong hands”?

Dang…..to be able to cut a card and send it back, but I don’t have Citi.

What’s next? Can’t buy those magazines ’cause they’re sexist? Can’t buy that political gear ’cause it’s “extreme’? Can’t buy that literature ’cause it insults Muslims? Can’t buy …

–> Can’t buy that literature ’cause it insults Muslims? <–

don't worry the headchoppers already take care of that!

CHARLIE HEBDO, anybody ???

They’re intent on turning us into the likes of Europe.

As Professor Reynolds was fond of saying, “Incentives matter.”

Ultimately, even if a business WANTS to stay unpolitical, it has to take into account that one side will send thugs around to destroy property and assault employees…. and the other won’t even deploy to stop them.

If Citi weren’t a bunch of hypocrites, they’d deny transactions from any retailer that sells firearms or accessories. If they want to control behavior, they need to do it at the level of the customer. Of course, they won’t because customers would leave them and I suspect many would transfer balances and shut down their cards. This stunt isn’t going to do any good and it will do very little harm since Operation Choke Point already chased most dealers away from citibank (they were a more than willing participant).

Corporate lawyer double talk. Citibank would like nothing less than a global firearms ban.

First craft a method to make cashless transactions on certain ‘things’ difficult. Especially in the only nation on earth that allows private ownership of a specific ‘thing.’

Step 2. Encourage industry wide best practices adoption.

Step 3. Winning

One third (a lot or more … ass talking) of the Russian market is unseen by the the Russian government. Most transactions are done through barter … enter Bitcoin.

Nanny’s nanny, people work around.

I remembers when banks used to tell their customers that they would not count a wife’s income when a married couple tried to get a mortgage, because she was just going to get pregnant and quit working.

That’s how the ERA passed in Texas.

The residual anger of being treated unjustly may well have made it easier for people to let Congress over-control banks, to the point that we had a mortgage crash in 2007.

It would be a shame to repeat that kind of history.

“Remember” is not supposed to be plural.

I guess at this point every fact has or will be politicized.

Perhaps the only fact we might agree on is that the banks didn’t mind the regulation. They happily gave mortgages to unqualified people, securitized the loans, sold them off and bought CDS’s when it started falling apart. Nobody went to jail.

Lehman, AIG and Bear Stearn were the only losers. The rest would love to be regulated like that again. Guess who is obliging them. Hint: It is not Pocahontas.

George W. Bush warned about the problem in January of his first year in office, and repeatedly thereafter, to great derision by the Democrats, until the roof caved in. The whole country suffered as a result.

Reading. It’s what adults do.

And then the Dems blamed Bush for the crash.

So GWB warned. Considering that Bush (2003-2007), like Trump does now, controlled all the levers of government, it would seem he could have fixed the problem he was warning about.

It will be the same story with Trump. The man who took no blame for the failure of 3 casinos will undoubtedly blame democrats, Martians or anybody but his administration when the sheet hits the fan.

I am sure you read. Too bad you can’t comprehend. That takes education and thinking; not just claiming that getting old makes you an adult.

You did prompt me to take a look and I found an article that puts the blame on both sides. Who Caused the Economic Crisis? That was my point.

I’ll bet that all that reading that you do is just stuff to re-enforce what you already believe.

Great job finding a link you don’t even ascribe to based on your post…

Do you feel special now, snowflake?

Oh LOOK. It’s yellow-troll again.

Yellow-troll, perhaps you should go back and actually, you know, LOOK AT HISTORY to determine WHY the banks were giving mortgages to unqualified individuals.

Hint: Go look at the Bill Clinton / Janet Reno “Anti-Redlining” rules from the Department of Justice. Those “Anti-Redlining” suits and governmental actions confused “insufficient income” with “Blackness.” They didn’t care that correlation does NOT mean causation.

GUESS why the whole thing collapsed.

Because yellow-troll will NEVER actually be honest with his assessments, HERE’S THE LINKS:

https://www.nytimes.com/1994/08/26/opinion/justice-cracks-down-on-redlining.html

https://www.justice.gov/archive/ag/speeches/1998/0320_agcom.htm

http://articles.chicagotribune.com/1994-09-12/news/9409120029_1_chevy-chase-justice-department-branches

https://www.americanthinker.com/articles/2008/10/what_really_happened_in_the_mo.html

The short version of it is that post anti-redlining, the mortgage brokers created “sub-prime” mortgages and then “monetized” the mortgages into investor packages, backed with a form of insurance (default credit swaps), and then SOLD those packages and insurance to investors. It started out with one to three “sub-prime” mortgages per unit of 100 mortgages, then became 3-5 per 100, then topped out 7-9 per 100.

When the interest rates were LOW, those 7 to 9 individuals who were making the “interest only” payments could pull it off. But when the Fed increased the rate, those “interest only” payments doubled, and the mortgagees couldn’t handle the debt service and defaulted. The purchasers of the credit units called their insurance (the credit default swap) to be made whole, and the resulting chaos from so many defaults at once tanked Bear Stearns, Lehman Brothers, and came within a hair’s breadth of tanking AIG.

Bush did not control Congress any more than Trump does. And FNMA/FHLMC were controlled by Clinton holdovers, including Barney Frank’s boyfriend.

Well, except, of course, he didn’t. You can point me to a filibuster proof majority….

Of course. What else could they do? Once Fannie & Freddie started buying these bad mortgages the banks had no excuse not to write them. They could no longer claim to be worried about the bottom line, because the government would just say “what’s the problem, if you’re worried they won’t pay just sell them”.

And once Fannie & Freddie started buying them all their competitors felt pressured to buy them as well, in order not to be driven out of business. They should have resisted, but how could they explain to their investors why everyone else was making all this money and they weren’t?

The core of it all was government pressure to make bad loans to “minorities”.

Regulations to ensure equal access are not the problem, du#b@$s. Regulations as a form of social engineering are.

In response to YellowGrifterInChief

Massachusetts proves Einstein’s Law of Infinite Stupidity: https://www.investopedia.com/news/massachusetts-launches-no-money-down-mortgage-program/

Inflate, crash, repeat.

Serious question. How can Citibank enforce a contract to require client businesses to age discriminate against people with every right to purchase a particular product?

Wait for the lawyer who doesn’t have a lot of billable hours.

May the scent of a class action lawsuit soon be wafting on the winds.

Can’t use class action because Trump changed the regulations implemented by the CFPB so that all you can do is individual arbitration. Oh, the irony of you guys wanting to use class action or the govmint to fix something you don’t like.

FOAD!!!!!

Doesn’t matter if I do.

The truth is still the truth, Baby.

WOW yellow-troll. You’re a moron.

The CFPB regulations do not ban 3rd party class action suits without a contractual provision. Since no transaction will have been consumated in this instance, it doesn’t apply.

The CFPB reguations DO allow companies to require individual arbitration of claims rather than class-action arbitration WHEN CONTRACTUALLY PROVIDED FOR, in an appropriate clause, and where such clauses are not prohibited by state law.

False.

Banks may be sued by existing customers who are engaging in lawful commerce.

That is what should happen here.

No, they may not. No customer has the right to remain a customer if the bank decides to drop them. Banks are not slaves.

Wrong.

Existing customers such as FFLs in this case may file class-action tortious interference against Citi for their change, which damaged their businesses, and which they were not informed of prior to contracting with Citi.

BS. The FFLs will just have to find a different bank. They have no right to remain Citi’s customers forever. They were never promised such a thing. And the FFLs certainly have no obligations to their customers, with which Citi can interfere; yesterday’s customers have already been served, and tomorrow’s customers exist only in potentia, so they have no rights.

Yes they can, but they were damaged in the process by the new Citi “policy.”

That’s tortious interference.

We’ll see what happens – right now, a revolt against Citi is taking place on twitter, with large numbers of people boycotting by canceling their Citi credit cards, and boycotting businesses who do business with Citi.

Stock was down a bunch last I checked.

This new policy will be very costly.

No, it is not. Explain whose contracts are being interfered with, and how.

i think that shitybank needs to do best practices and state that they want yoots to be 21 in order to vote – if they can’t be trusted with a gun, how can they be trusted with a ballot

— no bullet, no ballot -best practices require ID to vote (maybe with background check if the ID has not been forged or stolen!

it’s best practices, don’cha think ?

This is a legal blog, right? Like, there are lawyers around? Who understand that the Fourth Amendment is a A Thing, and that private companies can’t legislate because they don’t have a monopoly on the legal use of force?

they have the next best thing – they can and do control your finances – try getting an unsecured loan, except of course if you are a (D).

You could always get a Payday Loan.

But you have to bake cakes whether you want to or not, but you can prohibit someone from legally buying a product if you want to limit the product sales.

I have had a Citi Mastercard for 20+ years. I called them tonight and stated that I will use it again when they rescind this stupid requirement. I curtailed the use of my TD Bank account when they did the same thing, transferring my direct deposits and auto pays to a credit union. While my individual actions don’t amount to a hole in the snow, I hope that others will have an effect. Today Dick’s Sporting Goods admitted that their politically correct decision of rifle sales has had a negative effect on sales volume.

30+ year Citicard holder. Just now transferred all of my auto payments and cancelled the card.

Restraint of trade?

“…a “restraint of trade” is any activity that hinders someone else from doing business in the way that he would normally do it if there were no restraints. While federal, state, and local governments can pass laws and regulations that create obstacles for certain kinds of businesses, it is generally considered improper for individuals to restrain one another’s trade in certain ways. Someone who loses business or suffers another injury may have a tort case against another individual whose trade-restraining behavior injured him.

The federal Sherman Antitrust Act makes unreasonable restraints of trade illegal, as well as actionable under the civil law.”

(Source: http://www.rotlaw.com/legal-library/what-is-restraint-of-trade/)

The problem with application herein of the Sherman Anti-Trust Act is: Define “Unreasonable.”

The litigation ALONE on if this is or is not “unreasonable” would fill volumes, and probably have to be resolved by the SCOTUS.

Well, similar to others, I’m done. My cancellation of their 2% cash back card would have been a bit of a pain for me, but Penfed has a 2% unlimited cash back for veterans.

Get woke, go broke.

Trump should require that Citi drop its ownership in the Federal Reserve. If they don’t, then threaten to nationalize the Fed. There is a buy back clause the we can easily afford, and that alleviates most of the national debt.

After Citi is no longer a Fed owner, any bank can pickup their business for pennies on the dollar.

The Fed is already a government agency in all but name. The “shareholders” are not shareholders in any meaningful sense; they are compelled by law to hold exactly so many “shares”, not a fraction more or less, and are told when they must “buy” or “sell” some in order to keep their balance at exactly what the regulator requires. There is no market on which these “shares” can be bought or sold, and the “dividends” they pay are a fixed percentage, unrelated to the Fed’s performance or to the market; in other words they’re not dividends, they’re interest payments. 100% of the Fed’s “profits”, after paying these so-called dividends, goes to the Treasury. Nor do the “shareholders” get to elect a board in proportion to their shareholdings, or to elect the main board at all. The pretense that it’s a private entity rather than a government agency is pure flimflam.

If all of this is the case, then why is the interest on the national debt so high? The only interest should be on US Savings Bonds and other legitimate debt.

After the M2 money supply is expanded, there is some payment on that debt. There is no line item in the national budget where we see a $1 Trillion or so flow in from the payback of this expansion. Where does that money go?

The Fed has expanded the M2 money supply by about 13,000 times over a hundred years. M2 has put on about $500 billion in the last year. If the money flows back to the Fed, then the Fed has profit which needs to be dumped in the Treasury by your argument. Yet the taxpayers never seem to see it. By now, we are missing around $30 Trillion in profits (expansion plus interest). The dividends to the private banks must be pretty high.

In addition, dumping the profits into the Treasury would strongly inflate the money, since more M2 would have to generated to pick up the slack.

In any event, the picture that you paint doesn’t seem to add-up. I have never seen this inflow of money in national budget.

Um, sorry, but your comment is full of ****. The interest on the national debt is high because there’s so much of it, and the lenders obviously demand a market rate of interest (though a lower one than they demand of anyone else, because they’re not worried about default). The Fed has nothing to do with that.

The only interest is on US Savings Bonds and other legitimate debt. T-Bills, T-Notes, T-Bonds, etc. What other interest do you imagine the USA is paying?

Expanding the money supply has no effect on the US debt. Why would it? Nor does it create profit for the Fed. Again, why would it?

The Fed has never made anything like a trillion-dollar profit. I don’t know where you got such an idea. The highest profit it’s made in a year was in 2015, when it came just shy of $100 billion. Last year profits were down to $80 billion. And if you haven’t noticed that in the Treasury’s income it can only be because you haven’t looked.

The “dividends” (i.e. interest rate on a forced loan) to the private banks are pretty high right now, when market interest rates are low. I believe the Fed pays a flat 6% regardless of what the market rate is. Right now that’s a great deal for the banks, except of course they don’t get a choice in how much they “invest” in what amounts to a relatively high-yield bond, so they can’t increase their “investment” to take advantage. But when market rates were in the double digits it was a terrible deal, and they weren’t able to reduce their “investment” in it.

I think you are reinforcing my point. You said that the Fed profits are dumped into the Treasury. So an expansion of M2 and the payback of principal and interest is in the trillions of dollars which the Treasury never sees. If you think that profit on the US economy is $100 billion on a good year, you need a new calculator.

The US debt is not serviced much by Treasury products. The Treasury sells some of this stuff, but the big part of the debt is borrowed from the banks. If that part is circular, as you propose, the interest would be minimal. Yet as you state, the money never comes back. Hmmm….

Fed profits are not “dumped”, they are remitted to the Treasury. Because the Fed is effectively a government agency, so where else would the profits go? But the rest of your comment is gobbledegook.

This doesn’t mean anything. You seem to have no idea what M2 is, or what it means to expand it. You’re just using words you’ve picked up somewhere without understanding them.

What do you mean by “profit on the US economy”? GDP? Do you imagine the entire GDP goes to the Fed?! How could that even work? Why would the Fed get that? The Fed makes a profit on its operations of buying and selling US bonds. Every dollar of that profit goes to the Treasury, and yes, it’s in the range of $80-100 billion a year.

Yes, the US debt is serviced exclusively by Treasury products.

Um, how do you think that works? How could the Treasury borrow anything, except by selling bonds?

Again gobbledegook. What do you mean by “circular”? If the Treasury borrows from the banks, how would that money end up with the Fed and thus go back to the Treasury? You really seem to have no clue about any of this. Go read something about it and come back when you’ve educated yourself.

Circular means that it goes in a circle. The government borrows the money from the Feds. When the government pays interest on the money, you say it goes back to the treasury. Yet the treasury gets very little of the interest payment back.

The Treasury products are very little. I haven’t seen the exact number, but it is not significant.

The money comes from expanding the M2. Go look at the Fed site. They will show you a chart of it. The M2 expands whenever money is borrowed, and the Feds can’t cover it. This has been the practice in money markets since 1672. It might be new to you. Only the central bank gets this privilege.

To go back to my original point, if the White House or Justice Department threatens Citi with their seat at the central bank, I’m sure they will back down. Their very survival depends upon that seat. You claim they take all this money (literally trillions of dollars) as a public service. They must be saints.

No, the government does not borrow money from the Fed, except in the same way it does from anyone else — by issuing bonds, notes, etc. These products are not “very little”, they amount to 100% of government borrowing. Where on earth did you get any other idea?

This is still gobbledegook. It’s not even wrong, it’s meaningless. The money supply expands whenever anyone borrows money from one person and lends it to someone else. The vast majority of new money is not created by the Fed, because the vast majority of lending is not done by the Fed. Go educate yourself because you’re just not making any sense.

Citi doesn’t have a “seat” at the Fed. It’s a “shareholder” (i.e. lender) to the Fed, just like every bank, because it’s required by law to be one, and it’s a very occasional customer of the Fed when it needs an overnight bridging loan. Neither the White House nor the DOJ can threaten to take either of those things away.

The money supply only expands when the Fed loans money it doesn’t have. A private loan does not impact money supply. And the Feds might have the money it loans. In that case, the M2 is not expanded. Only the central bank expands the M2.

The amount of money made by the Feds is public and private debt, except for non-bank debt which isn’t very much, times discount rate (2% in 2017). So the Feds cleared $2 trillion in 2017 if you count interest and expansion. I can assure that money wasn’t put into the Treasury.

I’m trying to tell you how it works, but I’m getting the impression that you don’t want to know.

Oops.

That is very obviously wrong. The money supply is defined as all cash plus all bank deposits. Every time I lend $100 to my bank and they lend $80 of it to you, the money supply has expanded by $80. If you lend that to your bank which then lends $64 of it to someone else, the money supply has expanded again. The Fed has nothing to do with this process. It happened exactly the same way before there was a Fed, and it will happen the same way if the Fed disappears.

That is garbage. The Fed makes money only on its own trading and lending.

I see you’ve backed off the claim that the Fed lends money to the Treasury, so you’ve learned something at least.

You’re trying to tell me how it works, but you have no idea yourself.

Isn’t this a conspiracy to deprive people of their civil rights?

No. Nobody is being deprived of any right, except in those places where age discrimination against 18-20-year-olds is illegal, and in those places Citi will have to make an exception.

So a business can deny service to deprive someone of their “rights” Christian bakers know better.

How many times must you be told before you understand that everyone has the right to refuse business with anyone they don’t like, for any reason at all, except those specifically forbidden by law?

In some places it’s illegal to discriminate on the basis of sexual orientation. In those places and those places only you can’t refuse to bake cakes for gay people (though once the Supreme Court rules on the current case, you probably won’t have to customize cakes for gay weddings). In other places, no problem.

In some places it’s illegal to discriminate against 18-20-year olds, and in those places you can’t refuse to sell them guns, and Citi can’t make you. But in most places there is no such law, so it’s perfectly legal not to sell them guns, so Citi can insist that you don’t if you want to do business with it.

Nowhere in the USA is there any law against discriminating against gun dealers, so Citi has every right to do what it’s doing.

Not quite.

Existing Citi customers who are FFLs are effectively having their businesses interfered with by this change, undisclosed to them when they contracted with Citi, are damaged as a result of this change.

I’ll overlook your dumb comment here in light of your spot-on comment above about the mortgage meltdown.

Citi has the right to change its terms of service whenever it likes. Nobody has a permanent contract binding Citi to serve them forever, no matter what they do. If Citi decides tomorrow that it’s going radical vegan and drops all butchers from its customer rolls, or that literacy is a bad thing so it’s no longer going to do business with bookstores, that’s its right and nobody’s rights will have been infringed.

Not if such a change damages current customers. They have a claim against Citi in this case, and class action is a very real possibility.

Not if such a change damages current customers. They have a claim against Citi in this case, and class action is a very real possibility.

No, they don’t. Nobody, ever, has a right to permanent service from anyone else. Every company’s terms of service are subject to change whenever they like.

Whatever you say, Milhouse.

We can all ignore the gay bakery case now – nothing to see here. Milhouse has decreed it so.

Fercryinoutloud, this again? You clearly know nothing about the “gay bakery” case. You seem to think all discrimination is illegal; if so, you are wrong.

In most places even discrimination against gay people is perfectly legal. In some places it isn’t, and in those places the question the Supreme Court is now deciding is whether designing a custom cake is a form of speech. Since there is no law anywhere banning discrimination against gun owners, there’s no issue to even discuss.

Hmmm. Remember Operation Chokepoint? This sounds like more of the same, only without the government pressure. Interesting. Makes it seem like that may not have been an entirely one-sided effort.

Exactly right.

The difference in this case is there is no financial industry-wide impact, only a single company voluntarily curtailing operations.

However, existing Citi clients (who are FFLs) may have a claim against Citi for damages, having entered into agreements with Citi prior to their announcement of these new restrictions.

I don’t think you realize THE BIGGER PICTURE. A multi-national financial institution is attempting to circumvent the US Constitution and impose their own ideas of what the law should be, calling it “best practices”.

The consumer has been told how great CREDIT CARDS are, how we should move to a PAPERLESS ECONOMY. Well, this consumer just woke up once I realized CITIBANK is working with OTHER financial institutions so that ALL OF THEM will follow these “best practices” and add MORE.

Once they take away the paper money, then they can control EVERYTHING we buy.

NOPE, NOPE, NOPE. Sorry , I am not comfortable with this.

What CITIBANK has done is BIGGER than just restricting gun sales, it is WAY BIGGER, and I want nothing to do with it. I cancelled my #Costco visa and will cancel every Citibank card I have. I will also cancel ANY credit card of ANY financial institution that follows these “best practices”.

GO back and read the letter AGAIN. This is BIGGER than anyone realizes.

I agree Kathie, this is a test case and if it goes ok, then they can force us to follow all of their moral dictates. Or so they think – that view of their assumes that everyone just falls into line because what other choice is there?

Human ingenuity will kick in, as it always does, to get around this problem and will likely include not doing business using banks. Some other system will arise, and the big banks will likely fail, unless they change course before they crumble.

Rumor has it, Edward Skyler, the Senior Public and Governmental Relations exec at Citigroup worked as Deputy Mayor under Michael Bloomberg (of Everytown fame).

Could be coincidence, but this is all timed a couple days before the March for Our Lives protests and a bit over a month after this was written:

https://www.nytimes.com/2018/02/19/business/banks-gun-sales.html

(for those who don’t want to give the NYTimes a click, it’s a columnist pushing financial institutions, including credit cards and payment systems, to blacklist gun sales)

Come on, you know better than that. They’re not legislating. You remain just as free as you were to do as you like. But they have the same right you do to refuse to do business with those they don’t like, or who do things they don’t like, except when specifically forbidden by law.

If you have the right to boycott them then they must have the same right to boycott you. There are laws restricting this right on specific grounds; everywhere in the US you can’t boycott someone for their race, sex, national origin, disability, and one or two other things, and in some places there are state and/or local laws that restrict this further, e.g. for sexual orientation, etc. But the basic rule remains that you have the right to discriminate and boycott on any grounds except those specifically forbidden. And so do they.

So boycott them; they deserve it. But don’t claim they have no right to do what they’re doing. Unless you’re in a state or city where discriminating against 18-20-year-olds is illegal, and they’re insisting you break that law as a condition of doing business with them. That’s surely illegal.

Golly gosh Milhouse. Bake the cake. In other words, give them reason to regret their foolish precedent. Perhaps in a couple of decades it will get rolled back?

Huh?

Rhetorical questions and questions which I know the answer to are sometimes used for the sake of fostering discussion, not as a literal ask.

I can see no way for Citi to enforce their new rule. It’s one thing to make a rule and another to enforce it.

What difficulty do you foresee in enforcing it?

PS Eugene Volokh agrees that Citi will have to make an exception for those places where state or local law bans discrimination against 18-20-year-olds.

“This

offerthreat is good except where prohibited by law.”I’m sure many of the readers on the site, unfortunately, already have a Citi card. All military members and DOD employees are required to have a Government Travel Card (GTC) that they have to use for airfare, lodging, etc when going TDY (business trip). The GTC may even extend past the DOD to other government agencies, I don’t know. Maybe others on here can enlighten me on that. Citi has over a million of their cards in the hands of government employees that Uncle Sam is paying the bill on. Shame they are getting all that business.

http://www.defensetravel.dod.mil/site/govtravelcard.cfm

Ya’ll are also missing the part where Citibank owns First Data, the largest card processor…. it doesn’t matter who your bank is, businesses have to be able to process those cards and the majority either use First Data or contract through them.

Consider what enforcement of this edict looks like…. inspection of your business and inventory by a local bank officer? Secret shoppers sent in to “catch you” not living up to their interpretation of best practices?

In our state (Washington), Citi is now the credit card company affiliated with Costco. The Home Depot credit card is also sponsored by Citi. We will be cancelling both promptly. We don’t spend a huge amount, but if enough of us do this it will hurt them.

I need a list of major corporations that are affiliated with Citibank. No more purchase of their products.

Stop with the “tortious interference” nonsense. With whose contracts is Citi interfering? Dealers don’t have contracts with their customers, so Citi can’t force them to break those contracts. (And this barely affects FFLs anyway, because they already do background checks. It affects people who aren’t dealers but sell the occasional gun once in a while. They certainly don’t have contracts with anyone with which Citi can intefere.)

Once again Milhouse you are mistaken. The NICS system has been known to fail to produce a result, neither authorizing, nor prohibiting, a sale. This is accounted for in Federal statute by FFL dealers being authorized to continue the sale (i.e. deliver the firearm to the purchaser) after three business days with no final response from the NICS. ATFE is supposed to monitor these sales and, if the final result is blocking the sale, to recover the firearm from the buyer. I doubt this Citi “best practice” crap will claim those with concealed licenses, who are exempt from the NICS check, are sales without a background check, but one never can tell when the Lefties are virtue signalling. And outside states which ban normal capacity magazines, all FFL dealers would be impacted by the City ban on selling legal, normal capacity magazines. In fact if Citi were to adopt the NY State SAFE standard as their magazine standard, some states which limit magazines to “only” 15 rounds would have their FFL dealers impacted. And finally, those retailers who are not Dicks would be blocked from long gun sales to potential customers aged 18 through 20.

So yes, there is a significant potential for interference with FFLs doing legal business which doesn’t meet the Social Justice posturing of Citi.

“…by the City ban…” Should be Citi.

I said it barely affects FFLs. It’s uncommon for the background check not to come back within the three days. Yes, the 18-20 thing does affect them, and the limit on “high capacity magazines”, whatever they end up deciding that means, but the requirement for doing background checks will hardly ever affect FFLs because they do them anyway.

The point is that regulus arcturus’s theory about tortious interference is silly. I wonder whether RA actually knows what tortious interference means, or did he just see the term somewhere and pick it up without understanding it. Citi is not forcing anyone to break a contract.

I had a Citibank Credit Card with American Airlines. When American merged with USAir I decided to keep the card with the bank associated with the other part of the merger.

Now I see I made the right choice in cancelling the Citibank Card.

Others may have mentioned this, but I haven’t been able to read all the comments.

Citi has announced a plan to encourage all banking institutions to join Citi in establishing and enforcing these “best practices”. IIRC I also read where some Citi management person intimated (outright stated?) that they will be adding to the list.