Bernie Sanders: Corporate Taxes Will ‘Absolutely’ go up if Dems Take Over

“the top 1 percent and large multi-national corporations”

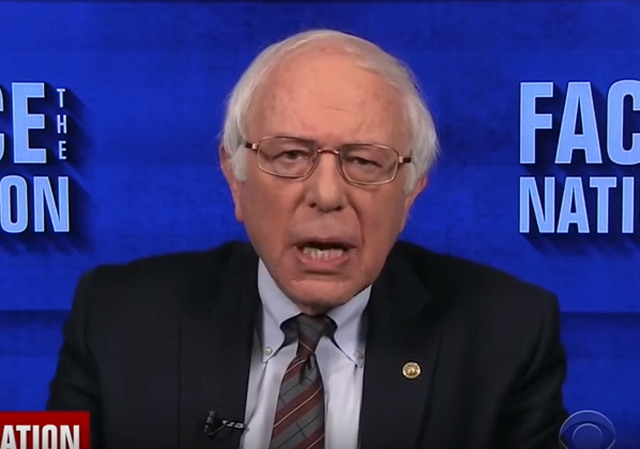

Bernie has been helping Democrats advance the narrative that the GOP tax reform bill is a big break for the wealthy and no good for the middle class. Yet Sunday on Face the Nation, Sanders admitted an inconvenient truth.

Sanders said that if Democrats regain control in 2018, corporate taxes are going up. The left thinks nothing of burdening job creators.

Valerie Richardson reports at the Washington Times:

Sen. Bernie Sanders: Corporate taxes would ‘absolutely’ go back up if Democrats win Senate in 2018

Sen. Bernard Sanders said Sunday that corporate taxes would “absolutely” go back up if Democrats retake the Senate in 2018.

“I think we’re going to take a very hard look at this entire tax bill and make it a tax bill that works for the middle class and working families, not for the top 1 percent and large multi-national corporations,” the Vermont independent said on CBS’ “Face the Nation.”

Asked if that would mean raising the federal corporate tax rate, which would drop from 35 to 21 percent under the Republican tax-reform plan expected to pass Congress this week, Mr. Sanders said, “In my view, absolutely.”

Republicans have touted the reduction as a way to stimulate the economy and repatriate companies that have moved overseas in order to avoid the U.S. corporate tax, the highest among the world’s major economies.

Watch the video below:

Bernie also conceded defeat on the tax reform bill.

Kyle Feldscher of the Washington Examiner:

Bernie Sanders concedes defeat on tax reform: ‘We did everything that we could’

Vermont Sen. Bernie Sanders said opponents of the Republican tax reform plan did all they could to stop it and essentially conceded defeat before a vote scheduled for Tuesday.

Sanders said on CBS’ “Face The Nation” there were too many forces opposing Democrats that they could not overcome.

“We did everything that we could. But at the end of the day what you had is people like [Treasury Secretary Steven] Mnuchin, who is worth $300 to 400 million; the president of the United States, who is worth several billion dollars, as you mentioned; from four or five thousand lobbyists doing everything they could to write a bill which significantly benefits the wealthiest people in this country and the largest corporations,” he said.

Bernie just can’t fathom a scenario where the government takes less money in taxes.

He has better plans for everyone else’s wealth.

Featured image via YouTube.

Donations tax deductible

to the full extent allowed by law.

Comments

The GOP tax bill is a fine exercise in tinkering.

It isn’t “reform”, and it isn’t “historic” in any important sense.

Bernie is right. It not only CAN be reversed, but by its own provisions, it is only temporary in many of its featured provisions.

We had the chance to really reform the tax system. That chance has been squandered.

To comply with ignorant Senate rules the sunset of the income tax rate reductions, the doubling of the standard deduction, the increase of the the child tax credit, and tax break for partnerships, limited liability companies. The sunset year will be … wait for it … 2026 well after Trump is out of office and prolly when the GOPe manages another limp dick candidate that will lose to the Democrats. Big fucking hairy deal.

The two most important features have no sunset … repeal of the individual mandate and the lowering of the corporate tax rate from 35% to 20% have no sunset.

I am ok with that.

Plus, these tax-reduction ‘Sunset’ provisions have a long history of being punted down the road as they approach, mostly because the CBO scaling is a joke, but in order to appease the Dark Ones who lurk there, we have to repeat the joke every few years instead of making them ‘permanent.’

(*) Yes, I know. ‘Permanent’ in DCSpeak is ‘Until the Dems seize office again and set fire to them.’

Someone please call this Millionaire Sanders Fraud out for what he is – a Fake.

“Suddenly, Democrats Don’t Like Taxing the Rich”

“There’s a reason Republicans have been able to move forward on taxes, but not Obamacare or border security. The Donor Class *wants* a tax cut, and have given permission for their pet senators to vote ‘Yes.’ Even “man of mighty principle” Sen. Bob Corker has gone from No to Yes… now that the new tax plan has a carve-out that will make him millions….

“The Democrats are very angry that the tax plan caps the deduction for state and local taxes at a level that only benefits the middle class. In fact, the states with the highest state and local tax burdens are California, Connecticut, Illinois, Maryland, Massachusetts, Minnesota, New Jersey, New York, Oregon, Rhode Island, Vermont, and Wisconsin. Between them, these twelve states send exactly one Republican senator to Washington, all but one have gone Democrat in every presidential election since 1992. According to the Google machine, all of these states but Maryland and Wisconsin have recently raised taxes, and/or are planning on tax increases in the coming year….

http://www.gaypatriot.net/2017/12/18/suddenly-democrats-dont-like-taxing-the-rich/

“We had the chance to really reform the tax system.”

Sure we did /sarc

Tell us how?

No, scratch that, you can’t and wont.

Rags, I was disappointed by this as well, we had a chance to really fix things and like always its a bunch of BS.

Anything for a WIN.

Something from the not learning from history file,

“Many have described my [Mondale] 1984 presidential campaign promise to raise taxes as exemplifying the folly of proposing tax hikes during an election.”

https://www.washingtonpost.com/opinions/walter-mondale-as-in-1984-we-again-need-the-courage-to-raise-taxes/2011/04/14/AFxVSSkD_story.html

https://www.youtube.com/watch?v=07m39CQRJXw

Of course taxes will go up under Democrats. Thats all they are good for, increasing costs on the people!

How would the Democrats pass a law if they captured one house? How could they possibly raise taxes?

Bernie is a socialist. To a socialist, everything belongs to the state and is doled out as it deems fit. This is why heart surgeons and toilet cleaners make the same wage in a socialist utopia. But, people being people, the people who run the government enjoy a much higher lifestyle than does the rest of society. The Democrats are no different, even the socialists among them. Congress Critters always leave Congress much richer than when they entered it. And, much richer than they salaries would allow for. Not to mentions all of the perks and benefits that their constituents pay for.

What would really help the middle class is to cut welfare programs. Get the government out of healthcare insurance, starting with Medicare and Medicaid. Eliminate subsidies to various industries which allow them to maintain higher prices at the expense of their customers. Restrict grants to projects which are actually likely to provide useful data, not measuring cow flatulence. Cut out the pork from public spending and see how much the middle class can save.

“All within the state, nothing outside the state, nothing against the state.”

The new motto of the DNC, stolen from Benito Mussolini

Bernie’s interview ought to be played as an ad for the GOP nominee in every Senate race next year.

Take what you can get.

Work to elect people in office that will reform the system further.

The majority of current office holders believe your work effort belongs to them. Get rid of them.

As expected this is a cluster F … the R’s are incapable of rational thinking … the D’s are whining little candy asses. As long as legislation passes on a partisan vote … we can expect to be jerked around every time the party in control changes.

But Bernie, why not a 100% tax on profits? Plus maybe a tax on assets on top of that? Bring the Jubilee!

@Bernie … first you need to pass a bill raising the corporate tax … then you’re gonna need someone in the White House that agrees to sign it. Looks to me like you’re gonna have to wait for the 2020 election. But hey … thanks for the heads up … now I know your intentions and I have plenty of time to offshore my small company. Are ya satisfied now?