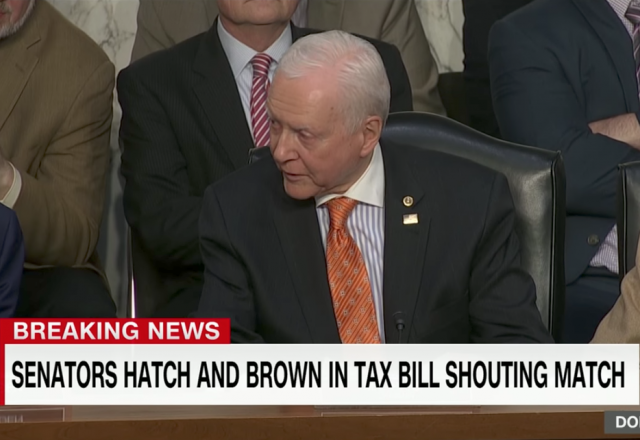

Sen. Orrin Hatch Lets Loose on Sen. Sherrod Brown: ‘I get a little tired of that crap’

Angry Orrin Hatch is the best Orrin Hatch

During a Senate Finance Committee hearing Thursday evening, Utah Republican Sen. Orrin Hatch was unusually animated.

When Sen. Sherrod Brown (D-OH) suggested the current tax reform legislation would hurt the middle class, all hell broke loose.

“I come from the poor people and I’ve been here working my whole stinking career for people who don’t have a chance, and I really resent anybody saying that I’m just doing this for the rich. Give me a break. I think you guys overplay that all the time and it gets old, and frankly, you ought to quit it,” said Hatch, clearly agitated.

Sen. Brown’s attempts to interject were shut down by Hatch who said, “wait a minute, I’m not through!” Brown persisted and Hatch beat his gavel until Brown stopped and then proceeded.

“Listen, I’ve honored you by allowing you to spout off here and what you said was not right. That’s all I’m saying. I come from the lower-middle class originally. We didn’t have anything, so don’t spew that stuff on me. I get a little tired of that crap. And let me just say something — if we worked together, we could pull this country out of every mess it’s in, and we could do a lot of the things that you’re talking about, too, and I think I’ve got a reputation of having worked together with Democrats,” ranted Hatch.

Brown suggested the Senate start with CHIP (Children’s Health Insurance Program). But Hatch would have none of it.

“I’m not starting with CHIP. I’ve done it for years. I’ve got more bills passed than everybody on this committee put together, and they’ve been passed for the benefit of people in this country and now all I can say, I like you personally very much, but this bull crap you guys throw out here really gets old after a while and to do it right at the end of this…it’s just not right.”

“It takes a lot to get me worked up like this,” said Hatch.

Digging this spirited Sen. Hatch.

[h/t Free Beacon]

Follow Kemberlee on Twitter @kemberleekaye

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

Once every 6 years, Orrin Hatch becomes a tiger!

Good for Orin!

Romney was a big clue to the GOP morons. No matter WHAT YOU DO, you will never be accepted or liked by Democrats. So just tell them to go to hell and do what you need to do.

It certainly isn’t the best tax plan in the world, I personally am NOT enthusiastic about the total lack of real spending cuts. But it doubles the standard deduction, which approximately 75% of Americans use every year.

So this plan will cut taxes for over 75% of Americans every year (and more since with a higher standard more people will take the standard).

That’s a pretty good deal for Americans that actually pay taxes.

Okay, that was good. But don’t delude yourself. Hatch is as much a part of the swamp as the American alligator.

“Republican Sen. Orrin Hatch of Utah, a close friend of the late [Democrat] Sen. Edward Kennedy, says they collaborated on a lot of significant legislation through the years.” That of course is the very heart of the problem,

https://www.npr.org/templates/story/story.php?storyId=112264375

Well, if the good Senator is interested in cutting out the “crap,” how about he stop acting like the Senate seat is his to pass along to whomever he would like. And, after 40 years, retire gracefully and stay out of the way of the people of Utah deciding who their Senator will be.

Actually, Brown was correct, in one respect.

All the current tax plans provide little or no tax relief to most middle class tax payers [Less than $1500 a year is not very much]. In some cases, middle class tax payers will see a tax increase, if the live in a high local and state tax state and they itemize. Also the lower third of the rich, those making $1,000,000 or more, will get hosed as well. The ones who benefit the most from the tax bills, are corporations.

Orrin hatch knows this. Everybody in the Congress knows this. And, this is not a bad thing, as most dynamic models show that the increased revenue available from reduced taxes will translate into business expansion which will benefit the middle class. However, the Republicans have been trying to sell these tax bills as directly benefiting the middle class by allowing them to keep more of the money that they own. And, most of them are terrified that common people will find out the truth.

“[Less than $1500 a year is not very much].”

To a family earning 40-50K, and spending every dime, $1500 is a big deal.

Corporations do not pay taxes, their customers pay them. Every penny cut will show up in lower prices for the consumers including middle class consumers.

Three thing here.

First $1500 is about a single month’s healthcare insurance premium. So, if you have to pay for healthcare insurance, there goes your entire tax decrease. It is not really very much in today’s economy. And, $1500 is the estimated high end tax decrease.

Second, though corporate taxes are passed along to consumers and any decrease in those taxes is welcome, you are making the same assumption that others are making. This is that these tax breaks will be passed on to consumers in the form of lower prices. Now, it may happen that way. But, as history has proven, it may not. If the consumer base is comfortable with the price of an existing commodity, then they will pay it regardless of a reduction in the cost of production or procurement. Just look at coffee prices, as an example. The most likely use for increased revenue due to a reduction in corporate taxes, is that the money will be used to either increase production, resulting in the hiring of additional workers, or it will go to dividends for investors. Which is chosen depends upon the individual corporation. Also, the amount of the tax deduction will depend upon exactly what deductions and deferrals are eliminated. So, while all tax decreases are welcome, there is no way to accurately predict how they will affect the middle class.

Finally, the GOP has a big problem with the tax reform bills, as currently written. They allowed the Dems to control the debate and ended up selling these plans as directly benefiting the middle class. And, they do not do this for all middle class taxpayers. Most people will see a small to modest tax decrease. But, some will actually see an immediate increase in their taxes. On top of that, fees for Medicare coverage is going to go up, eliminating most, if not all, of the tax decrease that retirees may get. The GOP promised everyone in the middle class more money in their pocket, following a tax decrease. And, they are not going to be able to deliver that and never were. They OWN this failure. But, they are committed. If they do not pass some kind of tax reform plan, they are going to pay heavily in 2018. And, that scares the party.

Kabuki. This means nothing until the rinos actually discard their bromance with the anti-American left. The swamp dwellers literally and viscerally despise the tea party base.

The assault on the soul of our nation continues unabated. I am not in any way encouraged by the pretense of support for Conservative principles. Hatch, McCain, Collins and the rest of the rinos are only surrogates for the evil witches in Hansel and Gretel and the Wizard of Oz.

This nation is not now and may never be at the point where the death of the evil ones is a conscionable alternative. What a horrific time that would be.

Senator Hatch needs to resign from the Senate immediately, like Gene Simmons.

The Republican tax reform has all the tax cuts ‘paid for’ which means that there are no tax cuts. All that happens is somebody else is paying more in taxes for every person paying less in taxes.

Bout time Orrin. You actually got some mainstream time with your tantrum. I always wonder why the hell things have to be so complicated. Intentional obfuscation? I’m realizing you (D’s & R’s) are all a bunch of dumba**es in leading others but are brilliant in getting wealthy with your influence. ‘Nuff of that, let up rain so I can get me Bambi’s mom 😉 F’ off PETA while I’m at it 🙂