Elizabeth Warren Wants the IRS to Do Your Taxes

What could go wrong?

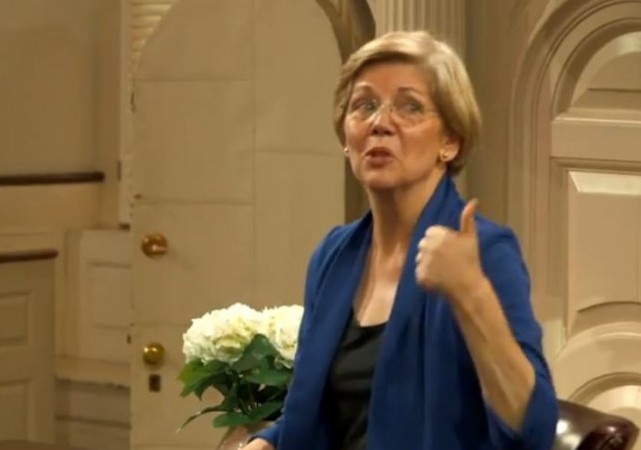

Do you trust the federal government to prepare your taxes for you? Elizabeth Warren thinks so.

Should the Tea Party activists and others who have been harassed by the IRS for political reasons in recent years be expected to trust the agency with preparing their returns? Isn’t it bad enough that the IRS can use its power of audit?

Boston.com reported:

Elizabeth Warren thinks the IRS should fill out your tax returns

With Monday’s tax filing deadline looming over many Americans’ weekends, Sen. Elizabeth Warren’s new bill may seem like a godsend.

The Massachusetts Democrat introduced legislation Wednesday that would allow U.S. taxpayers to have the government do their taxes for them—for free.

The conveniently timed “Tax Simplification Act of 2016” would direct the IRS to develop a free, online tax preparation and filing service, using tax information the IRS already has, which Americans could choose to use to have their taxes filed directly with the government, instead of using a third-party service, such as TurboTax.

“This year, taxpayers will spend an average of 13 hours preparing and filing their returns, and will pay $200 for tax preparation services – a cost equal to almost 10 percent of the average federal tax refund,” Warren said in a statement.

Since the IRS already gets individual wage statements (W2) from employers and 70 percent of taxpayers do not itemize deductions, according to Tax Policy Center, return-free filing could completely eliminate the requirement to file a tax return for 8 million to 60 million households, and make the process a lot simpler for others.

It isn’t a particularly new idea. President Ronald Reagan endorsed the return-free filing in 1985. So did President Barack Obama during his 2008 campaign. Denmark, Spain, and Sweden, among other countries, already send their citizens pre-filled-out tax returns to be approved and sent back.

Something tells me that if Reagan was alive today, he might not agree with Warren’s proposal, in light of recent developments.

You also have to love the offering of socialist European countries as evidence that the idea works well in practice. I’m sure Bernie Sanders will be singing this same tune in no time.

If liberals are really concerned about how confusing our tax system has become, how about offering real tax reform or coming over to the idea of a simple flat tax instead?

Warren and other big government progressives are obviously banking on the hope that people have forgotten all about the IRS scandal and their allies in big media are doing everything they can to help.

One News Now reports:

Media on IRS scandal: ‘We know nothing!’

There have been new developments in the IRS targeting scandal but if you watch the news on ABC, CBS or NBC, good luck hearing about it.

That’s because it’s been more than 500 days since the broadcast news networks covered the scandal.

According to a new study by Geoff Dickens, deputy research director at the Media Research Center, CBS and NBC last reported on the targeting of conservative groups by the IRS in October of 2014.

ABC lagged way behind last covering it in May of that year, nearly 700 days ago.

Perhaps Senator Warren can get back to us when someone has been held accountable.

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

She has never heard of TurboTax?

Here it is: free for simple returns.

https://turbotax.intuit.com/personal-taxes/online/free-edition.jsp

last time I filled out an actual paper 1040, there was a block to check if I wanted the IRS to figure my taxes and bill me. Unlike a request for an extension, no money was required to be sent with it. Took them 4 months to bill me and I had 90 days to pay with no penalty. (I hadn’t expected to owe THAT much)

Nope. Nuh huh. Ain’t gonna happen. Time for Atlas to shrug … big time.

I see no objection to allowing this as an option. Let them prepare your return and send you a copy for review, and if you find anything wrong with it you can object within some fixed time, otherwise you can do nothing. If you choose not to review it then you’re accepting their assessment. Even if they make a mistake in their favor, it may be cheaper to accept it than to devote the time you’re required to do now to file a return.

I’m sticking with H and R Blockheads. Between buying a house from my mother and my wife’s rather odd expenses from her teaching job, the probability of me filling out my own return without screwing up is zero, and the probability of the US Government getting it right is seven figures in the negative direction.

About H&R Blockheads. I don’t know if you’re serious, but if you are, I recommend that you find another outfit. Those people are part time and amateurs (literally) and have screwed up my return twice. I gave them up years ago.

I would never trust the Ruling Class to do any such thing.

If – and ONLY if – the IRS is limited to using information already provided to the government and THAT I AM NOT LIABLE in any way, shape or form for taxes that arise from information that they did not have, or arising from errors and oversights in their calculations.

I further demand the opportunity to challenge them on their calculations and results, and that no penalties accrue (a) while disputes are settled, (b) against any tax-related information not received on time, and (c) against errors or tardiness in the IRS calculations. I also demand that penalties accrue against the IRS for errors that occur in my favor.

And more, if I really start to think about this.

Reminds me of the old joke about the new, simplified tax form –

Step 1 – How much did you earn last year?

Step 2 – Send it to the IRS.

I’d agree only if I can do her tax return without her ability to protest how I do it and what she owes.

And she would owe after I gone done calculating her “fair” share.

Warren probably lists her home address as somewhere on tribal land to get a property tax break.

I don’t recall the exact stats, but I do recall reading a piece once, that if you call the IRS “x” number of times for advice on how to fill out portion “y” of your tax return, you were bound to get a different answer each time. So the IRS doesn’t even know how to do your income tax!!! No thanks!

The gov just wants to have all our money.

Of course to do this, the IRS would have to hire another million employees or so. Maybe that’s what she wants – a jobs program? Because, nothing says “stable society” like one where everyone is a tool of government.

am offended Legalisurrection refuses to use Warren’s correct name Senator Elizabeth ‘Redskin’ Warren

Lizzie must #FeelTheBern on her left to come out with such nonsense, which I suggest should henceforth be known as, “Going full Warren.”

I sent my payment for $6063 dollars to the IRS last Monday and they still haven’t cashed my check. I guess their too busy sending out checks to illegals and other con artists that they don’t have time to actually cash a check from a tax payer. But I bet had I not sent that check, it wouldn’t take them as long to notify me that Im late in filing my payment. Time to abolish the IRS and while were at it, its also time to put Lois Lerner in prison where she belongs.

And the flip side: the damn fools took money out of my account when they weren’t supposed to, and would supposedly send me a refund check. That was mid February, and here I am two months later, still waiting for my money that they stole to be returned to me ~

A preview of a President Warren. Scary.

When Warren considers having Harvard admissions retroactively review her claim of status as an American Indian, maybe then we’ll consider her idiotic plan and quickly reject it.

It takes the IRS computer 7 to 10 days to process an electronic return. At a guess, the IRS will stay about 10 months behind. If they’re lucky.

last time i filed taxes (you don’t file when you make $0/year) the IRS sent me a letter, saying they had made some corrections, and did i object. being of sound mind, i did not, and they eventually sent me my return.

then i signed an on-line petition at the White House…

about 8 weeks later, i got a letter saying that there was an error in my filing, and that i owed them my return, plus penalties & interest.

purest coincidence, i’m sure.

I’ve long maintained that doing one’s taxes is actually pretty easy. It’s determining your taxable income that is difficult. But once you have your taxable income, hey – it’s just a matter of looking up the tax amount on a chart.

I wonder if Sen. Warren is aware of the amount of tax information that is NOT automatically passed to the IRS – cash payments for personal services, cash tip income, foreign income and foreign taxes paid, charitable gifts (especially non-cash), losses and damages in excess of insurance, etc. etc. etc.

Either this stuff has to become non-taxable, or the tax reporting requirements are going to go sky-high. And they already tried that with that whole Form 990 fiasco a couple years ago.

What the Senator has not considered is the extent to which the entire Tax Code would have to be re-written in order to accommodate her goal. (And I’m not necessarily against that, either.)

The correct response to “filing taxes is too expensive/complicated” is ABOLISH THE IRS, not “let Uncle Sam do your taxes for you,” you dimwitted broad.

Typical leftist – every solution involves the damn government ~

Surely you jest! Heap big problem!