Bryan Jacoutot ably explored the core reason for the Motor City’s recently fiscal crash: unfunded liablities.

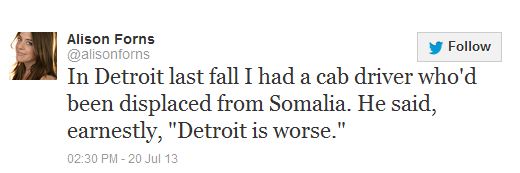

As a former citizen of the Detroit area, I simply shake my head, as the city’s race-based politics and poor business environment caused me to flee to the Golden State over 20 years ago. Subsequently, the continued devastation caused by the entrenched Democratic oligarchy is such that it makes a Somali exile long for his home country:

However, as a Californian, I really have nothing to crow about. Several of our cities have filed for bankruptcy, for the same set of reasons plaguing Detroit. In fact, the population of the two larger cities combined (Stockton and San Bernardino) is 500,000 plus — so the scale is on-par with that of Motown’s money wreck.

I am following the developments closely. Interestingly, Stockton is putting a sales-tax measure on the ballot to a potential solution. Good luck with that!

Michigan Circuit Court Judge Rosemary Aquilina ordered Detroit’s bankruptcy filings be withdrawn because they violate state law guaranteeing that pensions must be paid to public employees. Additionally, the judge specifically cited President Obama’s corporate bailout during her remarks on the decision, further ordering that a copy of her declaratory judgment be sent to the White House.

John Sieler of CalWatchdog notes how the ruling and attitude may impact California:

If Obama intervened in Detroit, he would have to intervene across the country, setting a new precedent of the federal government bailing out cities. And if that happened, you would see dozens, maybe hundreds, of cities declaring bankruptcy as a way to get federal funds. Thousands of cities everywhere, even financially sound ones, would become even more fiscally reckless, especially on pensions, assuming that, no matter what happened, the feds would bail them out.

Such bailouts soon would amount to hundreds of billions of dollars, goosing the already immense federal debt of $16.7 trillion.

And even if the president wanted to blow billions on municipal bailouts, the U.S. House of Representatives now is controlled by Republicans who wouldn’t cooperate. As a start, they wouldn’t bail out a city that voted 98 percent Democratic in the last election. And Republicans also wouldn’t want to bail out workers whose unions continually attack Republicans, while manipulating the system to push public employee pay and benefits to unsustainable levels.

As to the GM bailout, the latest estimate was that its final cost to taxpayers will be $25 billion. Just letting the normal bankruptcy proceedings go forward would have saved that money, while still reorganizing the company, albeit on terms not as favorable to the UAW and Democratic political ambitions.

Gov. Snyder’s office is appealing Aquilina’s decision and no doubt will prevail in the state’s own circuit court, which understands federal precedence in bankruptcy cases. Even if it loses there, the bankruptcy court will decide the case.

For California, this new Detroit drama will confirm that federal bankruptcy courts can set aside state constitutional protections on pensions.

In contrast, lawyers for the city of San Bernardino just asked a bankruptcy judge to set aside the objections of two public employees’ pension funds and rule that the California city is eligible for Chapter 9 protection.

Let’s hope our federal government forces the states to address these cases with sensible bankruptcy plans, and not by printing “Obama Money” to solve a massive crisis decades in the making.

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

I think that this put my ointment in a previous thread a lot better – that the GOP House is not going to bail out Dem strongholds, esp knowing that some of that money will be used politically against them. And what is not mentioned is that TARP money is part of how the federal govt was able to manipulate the GM and Chrysler bankruptcies in favor of their union pensioners. It worked because they were able to control classes of creditors through access to TARP funds, etc. This isn’t going to be available for these municipalities.

Not surprised that union attys are trying to prevent municipal bankruptcies, but that isn’t going to help them that long. The money just isn’t there. Problem with trying to get the bankruptcies stopped is that they are just telling lenders and contractors that they aren’t going to get paid, because all the money is going to go to pensions and benefits. Why would anyone lend money or provide services to such cities?

The bigger question (and bigger problem) is that no contractors are willing to do business with these bankrupt cities except on “evergreen retainer” (aka payment in third-party escrow) or Cash on Delivery.

To even contemplate doing business otherwise is to invite not being paid. With the filing of the Bankruptcy Petition, that gives Mr. Orr a couple of better options (as post-bankruptcy provided services are given “priority” payment status in full).

But Orr’s biggest and best bullet is the ability to reject contracts previously signed. This will bring Detroit’s Union’s to their knees.

Largely this is why I advise my clients NEVER to plan on a “pension” system to be there when they retire, and the MOMENT that they do, to take a “payout” and roll it over into a Self-directed IRA. A pension benefit is just another contractual term, and in bankruptcy it can be amended downward or disposed of in whole by a stroke of the judge’s pen.

TARP money was available for GM and Chrysler because they both had financing arms (GMAC) that allowed them to call themselves banks.

One lesson here is that it can take a long time to count ballots when people vote with their feet.

Almost 20 years ago I saw an item in a business magazine about a big problem moving companies were having with an imbalance of far more customers moving out of California versus those moving in. The reporter called U-haul, which reported a small problem the other way.

Today most of the migration into California is from cold weather blue cities such as Boston, New York and Chicago to San Francisco and LA. I suspect much of that is for life style as opposed to economic reasons.

My experience in Chicago was that urban politicians like it in the short term when potential voices of dissent move out. In the long run it deprives them of much needed tax base because the real innovation often departs with them.

It’s time to get out of California. My husband is looking for work elsewhere and we are planning our escape… we will miss it, but there are so few opportunities we have no other choice. If we stay, we face a higher tax burden and ever increasing “fees” from the government, while wages stagnate, not to mention the opportunities and education available to our sons will be much greater outside California.

For a lot of cities, whose histories go back 150 years and more, their prosperity, born of optimal conditions of location and circumstances, took just a couple generations to utterly squander.

The ultimate lesson is not just what Thatcher said, about running out of other peoples money, but the inherent danger of being able to spend other peoples money on still more other people.

“Welfare” is a euphemism for bribes funded by the taxpayers, and “Campaign contributions” is mostly a euphemism for “legal” bribery, thinly veiled.

I have far less confidence in the Institutional Republicans blocking Federal bailouts for cities and states. Any bailouts will easily pass the Democrat Senate; both because of their majority and because of the votes of the usual “Republican” suspects there. Figure every Republican who voted to throw open the borders and literally give the Democrats the votes of 11-30 million illegals at government expense will have no qualms about directly Federally funding the Democrats’ campaigns with bailouts.

In the House, we have Boehner, who has yielded to Obama on every major issue brought up for a vote, himself and his cabal voting with the Democrats against the majority of the Republican caucus. As noted above, the immigration amnesty is a good marker of the position on bailouts. Boehner is widely expected to throw out a House bill with the word “Immigration” in it, let the Democrats substitute the Senate bill verbatim in Conference, and then support the Conference bill against the will of the Republican caucus. Faith in the ability or willingness of the Institutional Republicans to resist the Left is almost always misplaced.

SoCA Conservative Mom | July 22, 2013 at 12:12 pm

Amen. Even my California-loving oldest daughter and her family have picked up and moved themselves and their business out of California last month. Which please me no end, to see them move back to America.

Subotai Bahadur

Not to contradict the Somali cab driver, but an interesting blog post I saw a year or two ago featured photos of Detroit and a godforsaken African city (Mogadishu?) side by side.

Commenters could identify which was which–how? In Detroit you could still see metal. In photos of the African city, all the metal had been stripped and sold for scrap.

Africa: poorer but more entrepreneurial.

“As to the GM bailout, the latest estimate was that its final cost to taxpayers will be $25 billion. Just letting the normal bankruptcy proceedings go forward would have saved that money, while still reorganizing the company, albeit on terms not as favorable to the UAW and Democratic political ambitions.”

Well, if you want to go back analyze that failure correctly you have to look at decisions made during the lame duck presidency of George W. Bush. The Big 3 had already been to Congress in September of 2008, hat in hand, before the elections. After Obama won, but before the end of 2008 Bush authorized about $18B, which came from TARP, I believe, to prop up GM and Chrysler, which were threatening to file before the end of the year. Bush issued a statement indicating that he didn’t want a new president entering office with 2 failed automakers on the doorstep. I think that Dick Cheney, in his memoirs, mentioned that he regretted this decision – to give short term support to GM and Chrysler. All it did was give them time in the early months of the Obama Administration to create a pre-packaged deal that screwed bondholders and enhanced the outcome for the UAW. If they had filed year end 2008, Chrysler might have been a Chapter 7, and even GM could have gone that route, but the useful and productive assets would have been acquired and reorganized, and you might have close to the situation you have today (minus Chrysler/Fiat). Perhaps the transactions cost would have been higher that way than in the prepackaged approach taken in May and June of 2009, but you wouldn’t have had the explicit taxpayer contribution.

GM and Chrysler are water under the dam.

What is critical for the House GOP to do is to stand up and state that there will be no bailouts for Detroit.

Someone has to focus on the back-door bailouts that the Obama Administration might try, and this needs to be an issue. I think the mere idea of bailing out Detroit could be a very good issue for the GOP in 2014.

Do you know the legal differences between loans and bonds?

During bankruptcy?

Loans comes with separate contract agreements and maybe be backed by collateral. Cities use bonds because of the special tax treatment given to their interest.

“As a start, they wouldn’t bail out a city that voted 98 percent Democratic in the last election. And Republicans also wouldn’t want to bail out workers whose unions continually attack Republicans, while manipulating the system to push public employee pay and benefits to unsustainable levels.”

Umm, are we talking about the same Republicans that folded like a cheap suit with Fast & Furious or Benghazi?

They won’t bail out Detroit because they’d have to bail out every bankrupt city, plus I could envision distressed cities filing bankruptcy early just to grab federal money.

The problem many of these urban centers have experienced relates to an incident in my rural area some years ago. When I complained about corruption in the process run by a black-majority Council, one member stood up in her seat and railed about how white politicians ran the country for decades and “now it’s our turn.” And there is the rub.

Because she was right, the old white machine was corrupt, too, their cronies and relatives all got paid. BUT they also knew the limits, that the essential services had to be delivered and well enough to satisfy citizens, and the bosses had to be happy with the gravy left over. When black politicians inherited these posts, they didn’t worry so much about the services as the money and power and ensconcing their own cronies in puff positions.

As services declined, the tax base deserted, leaving the cities in a downward spiral their new majorities had no way to stop.

The old Democrats were corrupt but able and skimmed off the top and bottom. Modern Democrats are corrupt and incompetent and leave nothing after they are done skimming.

A white councilman told me about his debate with a black councilman in New Orleans (about 25 years ago). The white guy had an antique business, and felt city workers should be efficient and as few as possible.

The black guy felt city jobs were a way to provide for those that could not get jobs otherwise. He viewed it as a sort of working welfare entitlement, largely for blacks (NOLA was like 62% black).

There was a lot of fraud and abuse, but New Orleans has an advantage as a big tourist town, and a big port. A few billion in Katrina aid got spread around pretty freely also.

But indeed many blacks have a couple decades of “it’s out turn” built in to them, and feel a right to be angry and riotous if others try to deny them.

This is from Shelby Steele in the WSJ

http://online.wsj.com/article/SB10001424052702303302504577323691134926300.html

There will be a perhaps massive readjustment to the municipal bond markets if the courts pull off the stunt they did at GM, that is, screw the bond holders to avoid reducing union employee benefits to PBGC maximum benefit levels. At the least, interest rate required for new bond offerings will rise, costing cities across the country more to service their massive debts.

Another consideration is that the holders of municipal bonds tend to be the very rich trying to lower their taxes. This group has so far been sheltered from the fallout of bubbles bursting. Municipal bankruptcies would put these two Democratic constituencies at one another throats.

FYI: the PBGC does not insure public employee pensions.

The remaining ~3 years of this far left administration’s economic and environmental policies should provide the opportunity to actually see how this plays out when multiple cities file bankruptcy and states run out of other peoples money.

– Popcorn –

No, not popcorn. This is just an opportunity for the Federal Government to expand its tentacles. Obama et. al. just need to figure out how to do it.

[…] Detroit is a shiny example of one of the many cities, and even a few states, which are sinking under the burden of debt brought about by public service union contracts. […]

[…] In the Michigan city of Ann Arbor, University of Michigan student Derek Draplin shares a few thoughts about Detroit’s recent bankruptcy. […]