Post-SCOTUS Gay Marriage: Religious institution tax exemptions at risk

Definitely in progressive crosshairs, as the government warned during oral argument.

Forty-eight hours after the Supreme Court’s monumental gay marriage decision, and progressives are already calling for an end to tax exemptions for churches.

Anticipating the Supreme Court’s eventual ruling on Obergefell v. Hodges, Senator Mike Lee and Rep. Raul Labrador introduced the First Amendment Defense Act. The bill would protect religious institutions who, for religious beliefs, do not actively participate in gay wedding ceremonies.

In an op-ed published two weeks ago in the Deseret News, Sen. Lee explained:

This is a bill that would prohibit the federal government from penalizing individuals or institutions on the basis that they act in accordance with a religious belief that marriage is a union between one man and one woman.

The First Amendment Defense Act, which Rep. Raúl Labrador, R-Idaho, will introduce in the House of Representatives, would prevent any agency from denying a federal tax exemption, grant, contract, accreditation, license or certification to an individual or institution for acting on their religious beliefs about marriage.

After hearing the oral arguments in Obergefell v. Hodges, Sen. Lee was most disturbed by a question asked by Justice Alito.

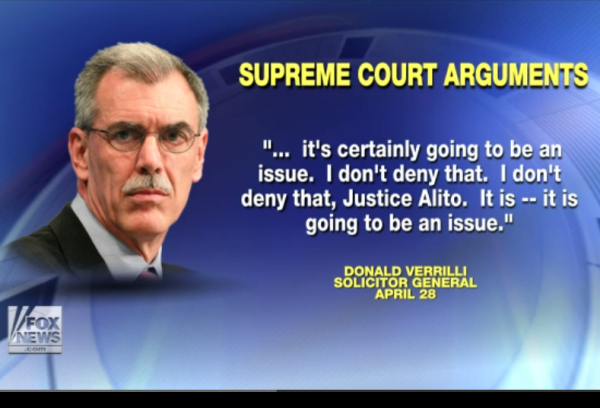

But back in April, when the Supreme Court heard oral arguments in the case, Solicitor General Donald Verrilli revealed that the implications of the court’s ruling in Obergefell v. Hodges extend far beyond the narrow issue of marriage licenses.

In a brief back and forth about IRS regulations, Justice Samuel Alito asked Solicitor General Verrilli whether religious institutions — including schools — that maintain the traditional definition of marriage would lose their tax-exempt status should the court strike down state laws defining marriage as the union of a man and a woman.

The solicitor general responded: “It’s certainly going to be an issue. I don’t deny that. I don’t deny that, Justice Alito. It is, it is going to be an issue.”

This was a chilling moment, but not totally unexpected. For years we’ve seen warnings that, for some activists, the objective is not just legal recognition of same-sex unions, but government coercion of individuals and institutions to affirm — and even participate in — such unions, regardless of good-faith religious objections.

Video report via Fox News:

Sunday, TIME published an article by New York Times columnist Mark Oppenheimer called, Now’s the Time To End Tax Exemptions for Religious Institutions.

Liberals tend to think Sen. Lee’s fears are unwarranted, and they can even point to Justice Anthony Kennedy’s opinion in Friday’s case, which promises “that religious organizations and persons [will be] given proper protection.”

But I don’t think Sen. Lee is crazy. In the 1983 Bob Jones University case, the court ruled that a school could lose tax-exempt status if its policies violated “fundamental national public policy.” So far, the Bob Jones reasoning hasn’t been extended to other kinds of discrimination, but someday it could be. I’m a gay-rights supporter who was elated by Friday’s Supreme Court decision — but I honor Sen. Lee’s fears.

I don’t, however, like his solution. And he’s not going to like mine. Rather than try to rescue tax-exempt status for organizations that dissent from settled public policy on matters of race or sexuality, we need to take a more radical step. It’s time to abolish, or greatly diminish, their tax-exempt statuses.

Interestingly, Oppenheimer doesn’t argue for abolishment of tax exemptions as punishment for holding sacred the belief in traditional marriage. So why strip churches of their tax-exempt status? To redistribute the wealth, of course; use one social issue as a guise to push another, completely unrelated issue.

Defenders of tax exemptions and deductions argues that if we got rid of them charitable giving would drop. It surely would, although how much, we can’t say. But of course government revenue would go up, and that money could be used to, say, house the homeless and feed the hungry. We’d have fewer church soup kitchens — but countries that truly care about poverty don’t rely on churches to run soup kitchens.

…I can see keeping some exemptions; hospitals, in particular, are an indispensable, and noncontroversial, public good. And localities could always carve out sensible property-tax exceptions for nonprofits their communities need. But it’s time for most nonprofits, like those of us who faithfully cut checks to them, to pay their fair share.

If you were among the many who saw the writing on the wall before Obergefell v. Hodges was handed down, you weren’t paranoid. You were right.

Follow Kemberlee Kaye on Twitter

Donations tax deductible

to the full extent allowed by law.

Comments

“Civil disobedience” pertaining to the rule of law in order of Hillary Clinton, Obama and Scotus should then be expected.

I think eliminating all charitable deductions is a great idea, lets start with the Clinton foundation, the Rockefeller foundation, the Ford foundation, the Bill Gates foundation, green peace, the nature conservancy, and about a thousand others whose boards are completely dominated by liberal democrats and do nothing other than promote liberal causes and goals.

Exactly what I was thinking.

This is not a ‘potential’ threat. It is a real, open and direct threat against any and all conservative organizations.

In the meantime, the ones that openly promote progressive political agendas receive protection and support. They are indeed fundamentally transforming America.

You missed a biggie: unions.

http://www.foxbusiness.com/government/2012/07/05/union-bling-union-junkets-1969452526/

Howz ’bout we end the practice of affirmative action which has only served to dumb down the nation with a net loss for those who were supposed to have been helped.

And, while we’re at it, end of all of the “feel good” programs that deflect from advancing the needs of America!

Ain’t gonna happen.

Tax exemptions for conservative and Christian organizations will be revoked while exemption for leftists organizations will remain.

They are all going to be revoked because the left always turns on its own and because tit is the last big pool of money left that can pay for all the underfunded government give aways.

I can’t see how our natural right to freedom of religion can be morally circumvented by legislation or court fiat, but we are no longer a nation of laws, nor do we try to pretend we are.

Civil disobedience? I don’t see that happening in mass, as sheep don’t have the principles or courage. The religion of the majority of Americans, Christianity, has been effectively replaced by the religion of the ruling elites, secular progressivism. And, just as under Islamism, you can convert, choose second-class citizenship status and pay an extra tax, or be deprived of your liberty or life. Think about it: Islamists and illegal alien felons are valued more under Obamunism.

Present day marriage is a combination of a civil institution and a religious one. Congress should pass a law logically separating these two things. And protecting religious practices and beliefs from interference with free exercise under the First Amendment. The government should have no say in what a religious institution considers allowed or not allowed (or required or not required) in the religious portion of marriage. Nor be allowed to discriminate against one group or another because of their beliefs.

The civil portion is nothing but civil unions under a different name. These should always

have been available to everyone. The government should never have been able to discriminate against one group or another.

I am sure these is some clever senator who can write the law to achieve these ends, make it apply to all the states (Full Faith and Credit?) and fly under the radar of Kennedy’s opinion.

Well said and amen.

This speaks to the current situation where the licensing/registration of the marriage and the solemnization/ceremony are both government controlled activities. There is clearly a state interest in the registration function, i.e., inheritance, support of children, etc. The licensing interest is to generate money. There really is no state interest in the solemnization process save that the officiant is required to sign and submit the license.

States would be wise to separate the two. The state could continue to provide officiants. e.g., judges, etc. as well as religious leaders, priests, imans, wiccans etc. to function as officiants but not require their officiants signatures on the license not require that they have a license to solemnize marraiges. So when an iman refuses to officiate at a SSM he couldn’t be guilty of discrimination because he is not licensed by the state.

“choose second-class citizenship status and pay an extra tax”

Is the extra tax merely the same tax that other businesses pay, or are cooking up some special “church tax”?

“Businesses”…?!?!

See how you constantly lie? It’s just constitutional with you, being a Collectivist troll.

Oh come on now, have you seen Osteen’s house?

Have you seen Trumka’s…???

The President of the Red Cross’s…???

What’s your argument here, that you want all non-profit tax breaks taken away? Sounds good to me!

My position on the tax code is very clear and oft repeated.

Burn it down.

No social engineering at all. That includes a progressive tax rate and redistributionist policy.

Any time a liberal says “fair share”, run away. Fast. Now.

I think this is quite an important concern regarding the future of freedom of religion and freedom of speech in this country. That said, the other day I saw a comment by someone on the left, who had been vocal with support for gay marriage, raise similar concerns about religious organizations being forced to violate their beliefs. So, if it comes to a fight over this issue (which it might), I think we have a point of view that will win over most of the public.

I agree with you unnamed commenter that churches should not be forced to perform gay marriages if they do not wish to.

However, tax policy is not a matter of religion, and I am all for the stripping of all church-related tax deductions regardless of whether or not the church is pro-gay marriage.

The adage actually is, “The love of money is the root of all evil.”

There’s a difference.

Sorry, I don’t know how that ended up here. Meant to be a reply to Gasper, below)

But it’s time for most nonprofits, like those of us who faithfully cut checks to them, to pay their fair share.

Umm… waitaminute. If they’re “non-profits”, what is there to tax? Their very existence?

Their business activities, their property, sales tax on their purchases, etc.

Lawlessness should never be honored. When law becomes godless totalitarianism persecution as in Rome under Nero or Stalin then the disenfranchised become diaspora and the diaspora becomes individualized communities of ICTHUS symbolized home worshipping believers. Persecution will further grow the Kingdom of God on earth-as in China and North Korea and as in all totalitarian states.

But if gay marriage and tax policies are a matter of law, how could they also be considered “lawlessness”?

Your Collective at its 20th Century apogees in Communist and Fascist states had very developed “laws”.

Sharia is a body of laws.

Sometimes saying something is “lawful” is merely to support tyranny.

But you were really just saying that to tell another lie, as we all see.

How come you never talk about my ass anymore, Rags?

I think we’ve illuminated your nature as a hate-twisted, lying Collectivist troll sufficiently that we can ask Prof. Jabobson to rid his comment thread of you.

Censorship eh? How delightful…

You constantly use profanity and insults in your responses (not just to me). I am of the opinion that this website would be better off without you.

But you don’t see me whining to the professor about it….

(hit submit instead of preview)

We’d have fewer church soup kitchens — but countries that truly care about poverty don’t rely on churches to run soup kitchens.

Of course. On the subject of bumper-sticker platitudes as public policy, if we zeroed-out the Defense budget, think of all the government soup kitchens we could have!

Yes, Comrade, there must be no “charity” unless it is taxpayer-funded, government-mandated charity. Such things are a threat to the Collective.

Why in the name of the Wide World of Sports do we even NEED a ‘Defense of the First Amendment’ Bill? Are we now getting an idea why the Tyrant al-Chicagi and his corrupt Regime scooped up so much ammunition and wants to take out guns away?

Lenin did it. Hitler did it. Mao did it. al-Chicagi wants to be just like them.

Looks like Oppenheimer wants to smother genuine charity — the kind that people perform willingly and joyfully — and replace it with coerced “charity,” extracted from you by the federal government.

Years ago, a lefty was railing about the supposed heartlessness of the Reagan era with its “tax cuts for the rich,” and when I casually mentioned that charitable giving had soared in those years, he was shocked into silence for a bit. Obviously it was something he had never heard before, and he had no data to refute me, so his reply was: “Well, they had to give more because social spending was slashed so much!”

I said, “The spending wasn’t really slashed; it just didn’t increase so fast as before.” He had no answer to that, so he turned away.

What I should have said is: “Who was forcing those greedy rich people to give more? Why did they think they had to?” But the point is: he thought voluntary charity was inferior to coerced redistribution.

I just remembered the hackneyed term he used: “decade of greed.”

“Rather than try to rescue tax-exempt status for organizations that [frown on sodomy], we need to take a more radical step. It’s time to abolish, or greatly diminish, their tax-exempt statuses.”

I’ve got an even better idea, asshole: Let’s simply abolish the federal income tax.

How much you want to bet that this is only targeted toward Cristian churches and that mosques, which almost universally teach that homosexuality is wrong and denounce gay marriage, will be exempted.

This was never about equality and was only ever about an attack on christian values.

Eliminating ALL tax deductions – including the supposedly sacrosanct mortgage interest deduction, there will never be a better time: with rates this low, few will lose much, and they will mostly be 1%-ers already – should be part of general tax reform, which offers far more potential for economic stimulus than any rate reductions at this point.

That solves the problem. And studies of varying laws have shown that religious institutions and actual charitable institutions benefit the least from deductibility; their donations are motivated by true belief and altruism, not tax benefits.

Actually, as someone who’s been on the board of and worked extensively with several 501(3)c registered nonprofits (non-religious, non-political), tax exempt status does make a difference, and it would hurt us if it were taken away.

If a high-wealth individual bequeaths us $1m in their will, we currently get the whole $1m. If we weren’t a tax-exempt organization, Federal estate tax of 40% and State estate taxes of up to 20% would apply (don’t die in Washington or New Jersey, people!). Why does the government deserve that money more than the local battered women’s shelter or animal refuge?

And for living donors, there are gift tax limits to make sure that high-wealth individuals don’t give away too much of their money before they die without the government getting its cut. At the moment, I think it’s $14,000 a year – anything over that and you’ll get hit with a penaltax (penalty-tax) for giving away too much of your own money. Unless, of course, you’re gifting it to a non-profit.

Then of course there are the toss-up situations, where people could go to the time and trouble of selling items they no longer want or need (and then paying tax on the proceeds), or they could gift them to a 501(3)c and take a tax deduction. I really do think that sometimes that influences people’s decisions.

Is there a lot of abuse of tax-exempt status? Yes, heaps! I’m all for tightening things up. “Non-profits” where less than 10 cents on the dollar go to any kind of good works tick me off. But don’t throw the baby out with the bathwater. There are a lot of smaller 501(3)c orgs out here who perform valuable services for the community, for far less money than the government could ever do it, and I think that treating them the same as you would a for-profit corporation would hurt them severely.

(accidentally down-thumbed you trying to hit “reply” – sorry!)

It will be interesting to see what happens now when Hobby Lobby refuses to extend benefits to same-sex partners using the same religious exemption argument as it did in the Obamacare case.

Do you think they will? Asking them to provide the same benefits to same-sex married couples as they do to traditional married couples is not the same as asking them to pay for abortifacients.

It’s interesting that churches that purport to spread the word of Jesus are so concerned with money.

The churches belong to the left, anoNY. They overwhelmingly support your side, not conservatives. This recent action by the SCOTUS could change that in time, but at the moment, they belong to you. Whatever punishment is inflicted on them will hurt your side, not ours. The addage: “Money is the root of all evil” is still true, even for the religious.

The adage actually is, “The love of money is the root of all evil.”

The whole verse goes, “For the love of money is the root of all evil: which while some coveted after, they have erred from the faith, and pierced themselves through with many sorrows.”

There’s a difference.

Thank you for the lesson, Amy.

Sorry, that’s just one of my bug-bears. Lefties frequently like to misquote that Bible verse to demonize “the evil rich”.

Amy: Your comments are welcome and always will be when given in that spirit.

Again with your very clear hatred of Christianity.

Interesting.

What I find comical is…well, besides almost all your stupid comments…is that your Collective is at least as money-focused as any institutions on the planet.

And it’s always someone ELSE’s money you are MOST focused on.

I am just following Jesus’s advice. When asked whether the faithful should pay taxes to the romans, he famously said to “render unto ceasar” that which is his. I believe this was in Mark, somewhere.

ANOTHER set of lies, told to deflect from the point.

See how you lie?

How dare you call Mark a liar! heh

The Left loves to reinterpret biblical scripture to suit their purposes (bashing believers over the head with it, primarily — Alinsky’s Rule 4), even though they think it’s all a bunch of lies anyway.

So set me straight, what was Jesus talking about when he was asked whether people should pay taxes to Caesar?

He said to give Caesar whatever belongs to Caesar, which is nothing. He said it in a way that wouldn’t get him arrested, that’s all. If you borrowed Caesar’s screwdriver or umbrella, of course you should return it, but he doesn’t own anything you earned. That all belongs to God, from Whom all wealth comes.

THE POINT:

“…your Collective is at least as money-focused as any institutions on the planet.

And it’s always someone ELSE’s money you are MOST focused on.”

YOUR RED HERRING:

Jesus (who I don’t believe in, and who’s religion I HATE) said…blah, blah…

THIS is how you lie. Constantly.

Please, it is beyond the bounds of sanity to equate the “religion” of Jesus with today’s Christianity.

That is pretty much the point of every comment I have ever written that includes a quote from the Jesus…

You’re very trying, child.

That is correct, but not in any way that would make you happy. Jesus’s religion was orthodox Judaism.

ANother RED HERRING…!!!

Where, BTW, did you study theology…???

The question of where I studied theology is a RED HERRING!

Here’s a non-red herring. What do you think Christianity is about?

Christianity as practiced today, or Jesus’s teachings?

Jesus’ teachings.

I think that Jesus’s teachings are about acting in a way that is the exact opposite of the way fundamentalist Christians tend to apply their political power.

Jesus taught love and compassion, and would abhor the use of political power to oppress a minority (laws against gay marriage) for no good reason, regardless of his own personal feelings on whether or not gay sex is a sin.

Jesus said to turn the other cheek when an enemy strikes you, while our fundie conservatives would instead send out F-16s (though it is true that this position isn’t limited to conservatives, plenty of hawks in the Democratic party as well).

Jesus forsook all political power, rendering unto Caesar, so to speak.

There are true Christians out there, probably, but hearing their voice is impossible considering the example of meekness they follow. I do not consider the majority of “Christians” today to be truly following their own savior.

This is not to say that I follow the words of Jesus either, I respect most of what he said, but I still don’t consider myself a Christian.

Jesus believed homosexual acts should be capital crimes. Forget about marriage laws! He also believed that one people on earth are God’s children, and the rest are dogs, to be fed only what the children don’t eat. He beleived that there are fundamental differences between men and women, and each have their own role in life. And nothing he taught supported reaching into other people’s pockets to give to the poor; it was always about reaching into your own pocket, and encouraging others to do the same.

The major religious institutions in this country have supported the liberal cause for decades. I wonder how that support will be repaid in the future. Will they experience an epiphany moment of, “Oops!”

Then it would include every last Muslim organization that Democrats are in bed with.

But the upside is that we could use it send millions of devoutly Catholic illegal Mexicans back home, couldn’t we? We could apply anti-religious tests to virtually any Federally funded benefit including the imaginary right to sneak in and stay here. What happens when all the self professed ‘sanctuary cities’ are forced to close?

So churches need more ammo. Research grade I mean. Like, take cross sections of productive members of society and compare statistics of how many went through confirmation or Sunday school. What percentage of those raised by sex, drugs, rock ‘n roll hippies, or gay partners, advance into the successful class?

Then we make a hockey stick style graph, showing we are at a tipping point, and the values instilled largely by churches are foundational to success. The cold front moving in from the left has a chilling effect on our foundational virtues, and the whole island may tip over. heh

Justice Thomas points out these “equalities” being demanded are really entitlements our government decided to confer on marriages. That really related to raising children in families, not by villages. Hillary wants public union teachers to raise the village child, but she’d erase the village church influence.

Rand Paul puts it this way:

http://time.com/3939374/rand-paul-gay-marriage-supreme-court/

One inequality from the kid’s point of view, is that gay marriages begin with a broken home, one parent excluded in order to fulfill the sexual desires of the other. While the LGBTs demand special class status, they are neither a separate class nor species. Whatever transitional event happened was either deliberate choice or perhaps some abnormality in development (of which we all have many). That event makes them not equal, when it comes to children.

When lesbians decide to have a child, they start him off in life removed from one of his genetic parents, by choice. So it is essential for them to claim they are made that way by God, but religion and science say no.

There is already a lot of evidence that one of the best things to help children is to have an involved father at home. It is like 95% of the time that one parent homes are run by moms. Churches will need more studies to sell their family values on grounds broader than the authority of the Bible. I think the evidence is out there.

Also odd is that one partner in the gay relationship generally “role plays” the part of the opposite sex. Why they approach/avoid the real thing is a matter for psychologists maybe, but can they provide that role when it comes to parenting? I don’t think that is determined.

Oh I cannot wait for the results of your scientific study. Just remember not to bypass the trailer parks!

Excellent! Another of your bigotries exposed!

A real model Collectivist “man of the people”.

right, because there’s no sex, drugs, rock n roll in trailer parks. And all gays are designers or run art galleries.

Studies should be done. I think they’d find within every demographic, Christian church involvement is highly correlated with success, even if as adults they stray.

“Christian church involvement is highly correlated with success, even if as adults they stray.”

Tough to prove causality when that straying happens. However, I am going to go ahead and doubt your whole premise. Now, your response should be to start doing some social research to prove your point to me.

Fortunately, some research has been done.

“Who Really Cares” by Arthur Brooks.

The secular left cares, but only with someone else’s money.

“But of course government revenue would go up, and that money could be used to, say, house the homeless and feed the hungry. We’d have fewer church soup kitchens — but countries that truly care about poverty don’t rely on churches to run soup kitchens.”

Oppenheimer is mistaken, perhaps even delusional, to think that a government funded bureaucrasy, in which a large percentage of the money allocated is used to pay people to perform a service, which they do to get paid, can perform anywhere close to the success of an organization of volunteers, working out of love and respect for the Lord (Col. 3:23-24), in which nearly all of the money allocated is used for the people being serviced. The ones “that truly care about poverty” are the those that do it because they want to do it, not because they are paid to do it.

Why not simply allow all charitable contributions as tax-deductible, except political donations? Then the government doesn’t get to decide, and everyone benefits.

http://www.sgberman.com/2015/06/29/lets-make-all-non-political-giving-tax-deductible/

That’s already the case, but the IRS has to decide what is a charity, and if you’re going to exclude political giving then the IRS needs to decide what that is.

I’m disappointed with Kemberlee’s article. She selects a quote from Oppenheimer’s article which makes it look as though he is advocating eliminating tax exemptions and deductions for only religious institutions. Read his article. He is advocating eliminating tax exemptions and deductions for everyone and everything. Including universities and bloated non-profits.

Two problems with this:

1. If only we could believe him.

2. He feels compelled to make this ignorant statement: “countries that truly care about poverty don’t rely on churches to run soup kitchens”. This is the leftist utopian fantasy. “Poverty” is not in need of care, and “countries” are incapable of “caring” about the poor – who ARE in need of care. Only people can care about people. The further you get away from people caring about people, the more likely you are to end up with a communist paradise (i.e. hell-hole).

Once again, read “Who Really Cares” by Arthur Brooks.

Why don’t churches simply state that their marriages are spiritual and not legal? When a gay couple comes to be spiritually married, then they have to take the classes where they are taught the evils of recreational sex. Even animals know that sex is for procreation (not recreation).

“Even animals know that sex is for procreation (not recreation).”

I don’t understand the “argument from animals”. Conservatives seem to think that it is somehow a plus that animals “agree” with them.

In my opinion, if your argument relies on animals as intellectual fellow-travelers, you might want to re-evaluate your position…

Even animals know that sex is for procreation (not recreation).

No, they don’t. (Not that it matters what animals “know”, but this is just nonsense.)

Oh, and no form of Xianity that I’ve ever heard of has any problem with recreational sex, so long as it’s between husband and wife. You must be thinking of some other religion.