Judge launches special inquiry into missing IRS emails and Lerner hard drive

Insufficient IRS explanations cause Judge to order sworn answers from IRS about Lois Lerner’s hard drive and emails.

Judicial Watch has sued over missing IRS emails in the federal district court in D.C., pursuant to its FOIA request for such documents.

The IRS was ordered to provide explanations as to missing emails, particularly Lois Lerner.

The IRS provided explanations, but those were not good enough for the Judge, who launched his own inquiry into the matter, as Judicial Watch explained in a statement posted on its website:

Judicial Watch President Tom Fitton made the following statement in response to today’s order from Judge Emmet G. Sullivan regarding the recently “lost” emails of Lois Lerner and other IRS officials, which were the subject of longstanding Judicial Watch Freedom of Information Act (FOIA) requests and lawsuit (Judicial Watch v. IRS (No. 1:13-cv-1559)):

In an extraordinary step, U. S. District Court Judge Emmett Sullivan has launched an independent inquiry into the issue of the missing emails associated with former IRS official Lois Lerner.

Previously, Judge Sullivan ordered the IRS to produce sworn declarations about the IRS email issue by August 11. Today’s order confirms Judicial Watch’s read of this week’s IRS’ filings that treated as a joke Judge Sullivan’s order.

Judge Sullivan, in his earlier ruling, appointed Magistrate Judge John M. Facciola to manage and assist in discussions between Judicial Watch and the IRS about how to obtain any missing records from other sources. Magistrate Facciola is an expert in e-discovery, and authorized Judicial Watch to submit a request for limited discovery into the missing IRS records after September 10.

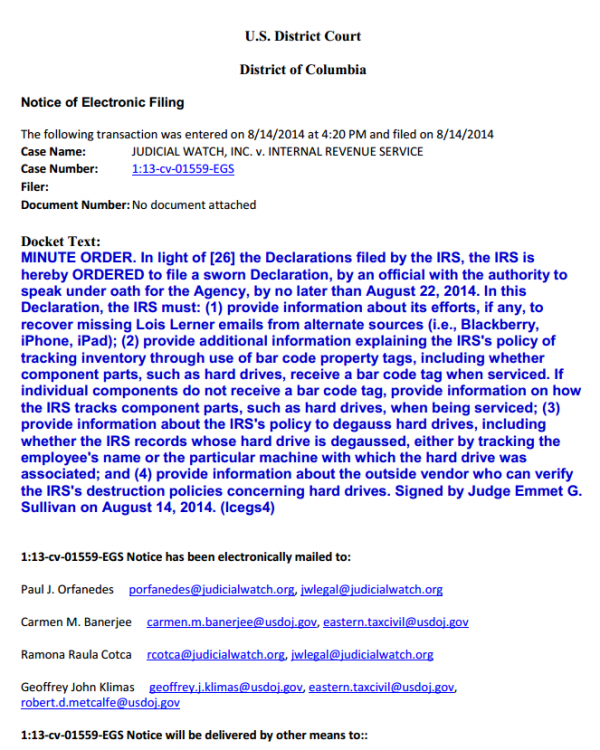

Here is the Judge’s Order (emphasis added, hard paragraph breaks inserted for ease of reading):

MINUTE ORDER. In light of [26] the Declarations filed by the IRS, the IRS is hereby ORDERED to file a sworn Declaration, by an official with the authority to speak under oath for the Agency, by no later than August 22, 2014.

In this Declaration, the IRS must:

(1) provide information about its efforts, if any, to recover missing Lois Lerner emails from alternate sources (i.e., Blackberry, iPhone, iPad);

(2) provide additional information explaining the IRS’s policy of tracking inventory through use of bar code property tags, including whether component parts, such as hard drives, receive a bar code tag when serviced. If individual components do not receive a bar code tag, provide information on how the IRS tracks component parts, such as hard drives, when being serviced;

(3) provide information about the IRS’s policy to degauss hard drives, including whether the IRS records whose hard drive is degaussed, either by tracking the employee’s name or the particular machine with which the hard drive was associated; and

(4) provide information about the outside vendor who can verify the IRS’s destruction policies concerning hard drives.

Signed by Judge Emmet G. Sullivan on August 14, 2014. (lcegs4)

[Note: Judicial Watch represents Legal Insurrection in our attempt to obtain documents from the District of Columbia regarding the non-prosecution of David Gregory for a clear gun law violation.]

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

THE best news all day!

Interesting. This private organization seems to be making more headway on this than Congress.

It seems odd but a private organization, going through the courts can often get more information than the Congress. This administration has zero respect for Congressional oversight but they can’t as easily ignore a federal judge… who can throw people in prison.

I believe Congress also has the right to throw people in prison. The just won’t exercise it.

The issue with all of these tactics being used by congress and the administration seems to be mostly theater, as real information is only coming from outside those branches of government.

I still firmly believe that if the republicans hold both houses of congress after this midterm, there will be a lot of finger pointing to the problems created by the democrats and very little fixing of those problems.

After all, these IRS issues affected Tea Party groups, despised by both republicans and democrats who want to grow the government bureaucracy therefore their power and not shrink it.

Wonderful news!

Thanks to Judicial Watch for continuing to pursue this!

Ok lawyers…

Assume the administration–as is it wont–continues to lie, hide, defy and then goes on offense against this judge.

Assume the administration is caught red-handed and doesn’t give a damn.

what then?

I ask, because I expect that is what will happen.

Not my wheelhouse, but…

a judge’s power to hold someone in contempt is “plenary”…which means expansive. It isn’t without limits, and can be reviewed by other courts.

When a judge finds you in contempt (after a fair amount of due process were you can show you have not been in contempt), if you are sent to jail for 60 days, you DO 60 days in most jurisdictions I know anything about. No good behavior.

When you get out, the judge can bring you right back into court to see if your attitude has been adjusted.

This judge has a reputation for being a good, smart, no-BS from the government kinda judge, as I recall.

Someone needs to ask why didn’t the IRS IT restore the contents of her hard drive from backups onto her new drive?

THIS! Forget her hard drive and her ipad etc. These emails exist somewhere on a server and no one is talking about this. I don’t care if her computer was run over by a truck. There is a network email service that is backed up constantly. Why is no one asking for the network records? Anyone in IT know this. Where are the IT experts?

Check the dates of the files on her new hard drive to see if anything was restored off backups.

I’m not sure what dates would be updated in a restore. Not ‘date modified’ or ‘date created’. What else ?

Date last accessed?

Pretty sure that doesn’t change on a restore, unless you open the file.

Emails aren’t stored on local hard drives. The totality of this excuse by the administration is ridiculous. You can pull up every email and text message ever written by her on her blackberry or your own personal laptop. You need only connect to the server with a login name and password.

Maybe, maybe not. Sorry, but you make invalid assumptions.

Now, IRS official policy regarding email and document retention, that’s a different story.

Maybe time to give LL ‘limited transactional immunity’ to make her give up the 5th and testify, under oath, in court.

I STRONGLY suspect this thing goes WAY over her (willing co-conspirator) head.

“Emails aren’t stored on local hard drives.”

Email certainly can be stored on local hard drives. All major email applications (Thunderbird, Outlook, etc) have the ability to take email off a server and store it locally. And contrary to what you might think a lot people still use that functionality.

Odd that you make such a claim.

Exactly true. My email is removed from the server as soon as it’s downloaded to this computer.

But that’s not how the IRS works and this judge knows it.

actually even pop/imap store a bit after when you say to remove. the full removal isn’t instant.

and the logs of the emails are still there no matter what you do.

but like you said, irs doesn’t use this method.

they use exchange server.

emails may be copied to the client (if using cached exchange mode) or only on server (if using online mode) but the emails STAY on the server until retention criteria manipulate it.

why are people not talking to the exchange admins?

the hard drive is a moot point.

the bigger issue is how someone had ability to edit backups/retentions in violation of rules.

That’s right… setting the option to ‘delete from server after retrieval’ does not work instantaneously and it certainly doesn’t remove the messages from the backups that are taken of everything that happens on the servers. And it doesn’t remove it from upstream mail servers or the servers of the other parties you’re communicating with. Information that go into the the Internet stays there forever if you’re willing to look hard enough to retrieve it.

The IRS ‘ claim” is that to save money ( with a Billion/year IT budget ) they kept server backup tapes for about 6 months before recycling them- and sort of forgot to notify National archives that some data may have been lost- as required federal law.

http://www.c-span.org/video/?320133-1/missing-irs-emails

The House Oversight and Government Reform Committee held its second hearing about the Internal Revenue Service’s (IRS) recordkeeping practices and the loss of an unknown number of emails related to former IRS official Lois Lerner. Archivist of the United States David Ferriero appeared before the committee, as did attorney Jennifer O’Connor, who served as special counsel to former acting IRS commissioner Danny Werfel from May to November of 2013. Mr. Ferriero said the IRS did “not follow the law” when it failed to report the missing emails.

Oh and during that same time period, somewhat fewer than 20 hard drives of related to lerner managers-aides- azlsom had hard drive issues- but perhaps their emails were not lost ?

I would be interested in seeing the IRS IT policies. I would say this having supported Gov’t networks for about 15 years. Allowing users to say to their local drive is highly unusual, even my docs is automatically mapped to the file server. So even if Lois had .pst files set up and pulled her mail off the server most likely that date would reside on a network share. Furthermore, if she was pulling her mail off to her local drive that would impact her ability to access those messages via her black berry which certainly wouldn’t be accessing her local drive remotely.

— current policy

http://www.irs.gov/irm/part10/irm_10-008-060.html

IRS manual

http://oversight.house.gov/release/new-testimony-irs-may-still-missing-lois-lerner-e-mails-backed/

They may have the “ability” to remove the email from the servers after downloading. But no corporation or government entity has their email servers set up that way. There are standard record retention rules that must be followed.

OK, good movement.

We all know the guv at all levels will now try every trick in the book to mess with the judge.

Let’s see where that goes from here …..

Did Leon Jaworski have any kids in law school ?

Yup. Blackmail, bribery, coercion…they’ll try it all. Hope Sullivan is as pure as the driven snow.

Or better. My dog peed on the last bunch.

There will be a very limited number of people in IT that had direct access to her computer, related email servers, etc.

Subpoena them all, under oath. I’m not talking ‘all IT people in the guv, 100,000’s of them’, just ‘the maybe dozen or so with direct access, job asssignments, etc, related to this.

pjm said …. August 16, 2014 at 4:27 am

Again, they conflate ‘backups’ with document retention archives required by law.

‘Backups’ you recycle periodically to control media costs. ARCHIVES you recycle – never.

By law.

This is the IRS- laws are only for the little people- it is the ‘ we dont care WE dont have to ” —

Listen to the testimony of the National Archivist who said under oath ‘ they did not follow the law ‘ re emails and notification of possible loss of data.

http://www.c-span.org/video/?320133-1/missing-irs-emails

The House Oversight and Government Reform Committee held its second hearing about the Internal Revenue Service’s (IRS) recordkeeping practices and the loss of an unknown number of emails related to former IRS official Lois Lerner. Archivist of the United States David Ferriero appeared before the committee, as did attorney Jennifer O’Connor, who served as special counsel to former acting IRS commissioner Danny Werfel from May to November of 2013. Mr. Ferriero said the IRS did “not follow the law” when it failed to report the missing emails.

http://www.youtube.com/watch?v=s1UT2Ms5E2k

Ex IRS agent tells it like it is

The IRS appears to have violated internal IRS policy by not printing out all of Lerner’s emails, and may have also violated the law by failing to set up protections against the loss of these emails.

http://oversight.house.gov/release/testimony-irs-needed-two-days-confirm-lerner-hard-drive-crash/

Testimony: IRS Needed Only Two Days to Confirm Lerner Hard Drive Crash

AND never a mention of using the then current backup tapes to recover what was on lerner hard drive when they removed and replaced it !!

http://waysandmeans.house.gov/news/documentsingle.aspx?DocumentID=388731

Lerner Hard Drive Was “Scratched”

IRS ignored advice to use outside experts to recover data

Washington, Jul 22

t is also unknown whether the scratch was accidental or deliberate, but former federal law enforcement and Department of Defense forensic experts consulted by the Committee say that most of the data on a scratched drive, such as Lerner’s, should have been recoverable. However, in a declaration filed last Friday by the IRS, the agency said it tried but failed to recover the data, but is not sure what happened to the hard drive afterwards other than saying they believe it was recycled, which, according to the court filing means “shredded.”

Further complicating the situation, the Committee’s investigation has revealed evidence that this declaration may not be accurate. A review of internal IRS IT tracking system documents revealed that Lerner’s computer was actually once described as “restored.” In a transcribed interview on July 18, IRS IT employees were unable to confirm the accuracy of the documents or the meaning of the entry “recovered.”

AND besides- IF or when they ever decide to have lerner spend some time in club fed- you can bet on Xmas ever 2016, she gets the ‘ get out of jail free’ card from Obama- then reward for being a good supporter . . .

This business about the hard drive is nothing but a red herring.

What about the mail SERVERS? What about the redundant mail SERVERS? What about the off-site backups of the mail SERVERS? What about the existence of the same emails on the mail SERVERS of the other people she was communicating with? For example, if we are interested in emails between Lerner and the White House then subpoena the White House email records… they’ll reside there, too.

Do these people not have a basic understanding of IT functions?

Thank you, Paul. You are correct – red herring. It seems like no one DOES have knowledge of how IT networks function. A business network is nothing like your gmail or aol email. Servers are backed up constantly and stored according to formal record retention rules. These emails are stored somewhere. Judicial Watch and/or Issa’s committee need to get some IT experts on board and put a stop to this “lost emails” B.S.

But according to Public testimony in House hearings by the Commish- and other docs, tape backups in that section of IRS were only kept for 6 months before recycling. This apparently was to to the so called cost of tapes AND a limit on how many emails by IRS personel could be stored on the server. I agree its all BS – and the commish can only testify re hearsay, not admissible in court.

http://www.c-span.org/video/?320133-1/missing-irs-emails

The House Oversight and Government Reform Committee held its second hearing about the Internal Revenue Service’s (IRS) recordkeeping practices and the loss of an unknown number of emails related to former IRS official Lois Lerner. Archivist of the United States David Ferriero appeared before the committee, as did attorney Jennifer O’Connor, who served as special counsel to former acting IRS commissioner Danny Werfel from May to November of 2013. Mr. Ferriero said the IRS did “not follow the law” when it failed to report the missing emails.

http://oversight.house.gov/release/new-testimony-irs-may-still-missing-lois-lerner-e-mails-backed/

New Testimony: IRS May Still Have Missing Lois Lerner E-mails Backed Up

July 21, 2014

Official in charge of document production also raises possibility of new e-mail losses from ‘less than 20’ officials

During a transcribed interview with congressional investigators on Thursday, July 17, IRS Deputy Associate Chief Counsel Thomas Kane, who supervises the IRS’s targeting scandal document production to Congress, testified that new developments now make him uncertain whether e-mail back-up tapes containing lost e-mails from key IRS targeting official Lois Lerner exist or not. The new testimony is at odds with the June 13, 2014, memo [ http://oversight.house.gov/wp-content/uploads/2014/07/6.13-Wyden-Hatch-Response.pdf ] sent to Sens. Ron Wyden (D-OR) and Orrin Hatch (R-UT) by the IRS which reported that the IRS, “Confirmed that back-up tapes from 2011 no longer exist because they have been recycled.” Kane had reviewed the June 13 memo but noted his current uncertainty with investigators.

Here is the claim re IRS tapes

here is claim re IRS tapes

from http://oversight.house.gov/wp-content/uploads/2014/07/6.13-Wyden-Hatch-Response.pdf

II. Physical Retention, Collection, and Production of Email

The IRS email system runs on Microsoft Outlook. Each of the Outlook email servers are

located at one of three IRS data centers. Approximately 170 terabytes of email

(178,000,000 megabytes, representing literally hundreds of millions of emails) are

currently stored on those servers. For disaster recovery purposes, the IRS does a daily

back-up of its email servers. The daily back-up provides a snapshot of the contents of

all email boxes as of the date and time of the backup. Prior to May 2013, these backups

were retained on tape for six months, and then for cost-efficiency, the backup tapes

were released for re-use. In May of last year, the IRS changed its policy and began

storing rather than recycling its backup tapes

*

Again, they conflate ‘backups’ with document retention archives required by law.

‘Backups’ you recycle periodically to control media costs. ARCHIVES you recycle – never.

By law.

I recently saw an interview with the guy who is credited with inventing “the cloud”, can’t remember his name, but they asked him about the whole government “lost e-mails” thing. His laugh was all you needed to hear to understand that he realizes it crap. He also said he could probably find all those e-mails in very little time what so ever.

OK, Mr. Witness, how did you determine it was scratched ?

Oh, you held it up under the light and saw the scratches ?

OK, right through all those little tiny TORX screws, and the metal covers, then you unscrewed the platters from the hub, removed them (being careful not to damage the heads) and examined them ? Is this your normal procedure to diagnose a bad hard drive ?

What’s that ? You think you hear your mother calling ???? STF down and answer me.

… http://www.judicialwatch.org_wp-content_uploads_2014_08_Judicial-Watch-v.-IRS-01559.pdf

…I am a Senior Investigative Analyst at the Technology & Support Center

(TSC) within the Electronic Crimes unit of the Criminal Investigation Division (CID) of

the Internal Revenue Service (IRS) and have been employed in that role for more than

10 years.

2. I have approximately 24 years of continuous experience working in the

field of digital forensics and data recovery.

I agreed to attempt to recover

data from a hard disk drive that had ceased operating properly and had been removed

from the laptop assigned to Lois Lerner (the subject hard drive).

n July 22, 2011, I received the subject hard drive and connected it to the

Ace Laboratories PC3000 UDMA (Ultra Direct Memory Access) diagnostic system ..

NOTE NO VERIFICATION THAT THE HARD DRIVE RECEIVED WAS LERNER . .

( NO TICKET OR EVIDENCE SUBMITTED ?? )

8. O n July 22, 2011, I opened the subject hard drive in the Class 100

Laminar Flow Workstation and noticed a well-defined concentric scoring around the

center of the top platter…

15. O n August 4, 2011, I attempted unsuccessfully to perform a “hot swap” on

the subject hard drive, as I was unable to read any data from the subject device platters.

16. O n August 4, 2011, I re-assembled the subject hard drive, packaged it for

return and advised MITS of my unsuccessful attempts at data recovery.

17. O n August 5, 2011, I returned the subject hard drive to MITS via UPS.

I declare under penalty of perjury that the foregoing is true and correct.

..

Excellent information. Thank you.

For those a bit late to the party- a thumb nail

1) IRS uses an outdated Microsquish email system called outlook and a server system which would wind any legitimate company IT Chief in club fed should any questions arise.

2) http://www.irs.gov/irm/part10/irm_10-008-060.html

3) http://www.c-span.org/video/?320133-1/missing-irs-emails

The House Oversight and Government Reform Committee held its second hearing about the Internal Revenue Service’s (IRS) recordkeeping practices and the loss of an unknown number of emails related to former IRS official Lois Lerner. Archivist of the United States David Ferriero appeared before the committee, as did attorney Jennifer O’Connor, who served as special counsel to former acting IRS commissioner Danny Werfel from May to November of 2013. Mr. Ferriero said the IRS did “not follow the law” when it failed to report the missing emails.

4)

http://waysandmeans.house.gov/news/documentsingle.aspx?DocumentID=388731

IRS ignored advice to use outside experts to recover data

Washington, Jul 22 | 0 comments

Washington, DC – Despite early refusals to make available IT professionals who worked on Lois Lerner’s computer, Ways and Means Committee investigators have now learned from interviews that the hard drive of former IRS Exempt Organizations Director Lois Lerner was “scratched,” but data was recoverable. In fact, in-house professionals at the IRS recommended the Agency seek outside assistance in recovering the data. That information conflicts with a July 18, 2014 court filing by the Agency, which stated the data on the hard drive was unrecoverable – including multiple years’ worth of missing emails.

5)If one reads/downloads the answers given to True the Vote case

https://s3.amazonaws.com/s3.documentcloud.org/documents/1227881/92-2-2.pdf

Case l:13-cv-00734-RBW Document 92-2 Filed 07/18/14

STEPHEN L. MANNING

….to the best of my knowledge no

one at the Internal Revenue Service has first-hand knowledge

of the serial number on the hard drive that was in the laptop

computer assigned to Lois Lerner at the time of the Help Desk

complaint on June 13, 2011.

7. In response to recent inquiries made by the Internal

Revenue Service to the 3rd party IT hardware support vendor who

supplied the laptop computer at issue, the 3rd party vendor

advised the Internal Revenue Service that the hard’ drive that was in the computer assigned to Lois Lerner when the

Specialist responded to the June 13, 2011 Help Desk call

contained the serial number 2AGAH01E1XN0ON.

… . . According to the Specialist, prior to joining the Internal Revenue Service, from 2004 to 2005, formal Microsoft training was completed through ****Lions World Services for the Blind,***** a certified Microsoft training and testing center, which included the following curriculum: CompTia A+ Hardware 2000, CompTia A+ Software 2000, Microsoft MCP 2000, Microsoft MCSE 2000, Microsoft MCSA 2000, . . .

******T APPEARS that the IT specialist may have been blind or had very poor vision. That would not stop him from running standard software tests on lerner computer.. ***

….. The hard drive had been removed from a laptop assigned to

Lois Lerner by an employee of the User and Network Services

branch of the Internal Revenue Service Information Technology

business unit before it was received by the Analyst.

****How did he determine that – What proof it was the lerner hard drive ?****

http://www.judicialwatch.org_wp-content_uploads_2014_08_Judicial-Watch-v.-IRS-01559.pdf

…I n the on-site IT office, I examined the computer for signs of physical

damage and I do not recall seeing any. . . .

11. Following the above attempts, on June 13, 20111 ordered a new hard

drive to replace the subject drive in Ms. Lerner’s computer hard drive. On June 14,

2011, I installed a new hard drive into Ms. Lerner’s computer, and I began the process

of installing software on that new hard drive so that the computer could be returned to

Ms. Lerner in an operable condition ..

*** NOTE NO MENTION OF RELOADING FROM A SERVER OR OTHER BACKUP**

2nd tech to examine drive said ” 2. I have approximately 24 years of continuous experience working in the

field of digital forensics and data recovery.

I agreed to attempt to recover

data from a hard disk drive that had ceased operating properly and had been removed

from the laptop assigned to Lois Lerner (the subject hard drive).

n July 22, 2011, I received the subject hard drive and connected it to the

Ace Laboratories PC3000 UDMA (Ultra Direct Memory Access) diagnostic system

.NOTE NO VERIFICATION THAT THE HARD DRIVE RECEIVED WAS LERNER . .

( NO TICKET OR EVIDENCE SUBMITTED ?? )

……8. O n July 22, 2011, I opened the subject hard drive in the Class 100

Laminar Flow Workstation and noticed a well-defined concentric scoring around the

center of the top platter…

15. O n August 4, 2011, I attempted unsuccessfully to perform a “hot swap” on

the subject hard drive, as I was unable to read any data from the subject device platters.

16. O n August 4, 2011, I re-assembled the subject hard drive, packaged it for

return and advised MITS of my unsuccessful attempts at data recovery.

17. O n August 5, 2011, I returned the subject hard drive to MITS via UPS.

I declare under penalty of perjury that the foregoing is true and correct.

AND BTW the bit about a software firm and servers

The outfit was sonasoft

http://www.sonasoft.com/

http://www.sonasoft.com/sonasofts-irs-email-archiving/

Sonasoft presentation. Slide 28

The record at USASpending.gov verifies that the IRS had an annually renewed contract with Sonasoft at the time of the supposed loss of Lois Lerner’s emails, in June 2011. Patrick Howley beat me to the finish line to report (at TheDC) that the Sonasoft contract was terminated shortly afterward. The annual contract, which had been renewed in September 2010, expired without renewal on 31 August 2011. The IRS-Sonasoft relationship was severed altogether on 8 September 2011, with a de-obligation purchase order.

FWIW

http://waysandmeans.house.gov/news/documentsingle.aspx?DocumentID=388731

Lerner Hard Drive Was “Scratched”

IRS ignored advice to use outside experts to recover data

Washington, Jul 22

t is also unknown whether the scratch was accidental or deliberate, but former federal law enforcement and Department of Defense forensic experts consulted by the Committee say that most of the data on a scratched drive, such as Lerner’s, should have been recoverable. However, in a declaration filed last Friday by the IRS, the agency said it tried but failed to recover the data, but is not sure what happened to the hard drive afterwards other than saying they believe it was recycled, which, according to the court filing means “shredded.”

Further complicating the situation, the Committee’s investigation has revealed evidence that this declaration may not be accurate. A review of internal IRS IT tracking system documents revealed that Lerner’s computer was actually once described as “restored.” In a transcribed interview on July 18, IRS IT employees were unable to confirm the accuracy of the documents or the meaning of the entry “recovered.”

The big media is sure all over this story. Not. They’re zzzzzzzzzzzzzzzzzzzzzzzz.

Maybe someone that knows more about this stuff can help me out with this. I work for a Government Agency, admittedly State not Federal.

As far as I know, none of my e-mails, nor anyone’s e-mails are actually stored on our computer hard drives, they are stored on the e-mail exchange server, which is backed up multiple times both on and off site. So basically I could take a plasma torch to the hard drive in my computer at work and it would mean that not a single e-mail was lost.

I have worked with computers for the past 20 years and can never remember a time when e-mails were stored on my hard drive.

So to me this whole missing hard drive thing is just a bunch of crap.

Uhh gremlin- the IRS uses Outlook- and IF one downloads from server emails to keep their section of server from being overloaded or above limits- then the emails do apparently dissapear from server. But normally server backups would have previous days emails and could be restored. except that IRS claims they only keep backup tapes for 6 months before recycling them.

http://www.c-span.org/video/?320133-1/missing-irs-emails

The House Oversight and Government Reform Committee held its second hearing about the Internal Revenue Service’s (IRS) recordkeeping practices and the loss of an unknown number of emails related to former IRS official Lois Lerner. Archivist of the United States David Ferriero appeared before the committee, as did attorney Jennifer O’Connor, who served as special counsel to former acting IRS commissioner Danny Werfel from May to November of 2013. Mr. Ferriero said the IRS did “not follow the law” when it failed to report the missing emails.

http://oversight.house.gov/release/new-testimony-irs-may-still-missing-lois-lerner-e-mails-backed/

New Testimony: IRS May Still Have Missing Lois Lerner E-mails Backed Up

July 21, 2014

Official in charge of document production also raises possibility of new e-mail losses from ‘less than 20’ officials

During a transcribed interview with congressional investigators on Thursday, July 17, IRS Deputy Associate Chief Counsel Thomas Kane, who supervises the IRS’s targeting scandal document production to Congress, testified that new developments now make him uncertain whether e-mail back-up tapes containing lost e-mails from key IRS targeting official Lois Lerner exist or not. The new testimony is at odds with the June 13, 2014, memo sent to Sens. Ron Wyden (D-OR) and Orrin Hatch (R-UT) by the IRS which reported that the IRS, “Confirmed that back-up tapes from 2011 no longer exist because they have been recycled.” Kane had reviewed the June 13 memo but noted his current uncertainty with investigators.

Kane and a Committee investigator had the following exchange during Thursday’s transcribed interview:

Investigator: You stated at the time that document was produced to Congress, the document, the white paper in Exhibit 3[the June 13 memo], that it was accurate to the best of your knowledge. Is it still accurate?

Kane: There is an issue as to whether or not there is a ‑‑ that all of the backup recovery tapes were destroyed on the 6‑month retention schedule.

Investigator: So some of those backup tapes may still exist?

Kane: I don’t know whether they are or they aren’t, but it’s an issue that’s being looked at.

Kane also testified that in addition to the IRS officials who had experienced hard drive crashes, as reported to the House Ways & Means Committee, a number of officials above and beyond these officials “have had computer problems over the course of the period covered by the investigations and the chairman’s subpoena” that could prevent the IRS from fully complying with the subpoenas. Kane characterized the number of such individuals as “less than 20” and named IRS officials Andy Megosh, Kimberly Kitchens, Justin Lowe, and David Fish as members of the new group.

*** AGREE THE IRS responses to date are suspect- and they are forcing everyone to chase a bizzare trail and methods and ‘ if you do NOT ask exactly the right question- we get to play word games and such. Not quite stonewalling, but the next best thing — neener neeener I cant hear you — or OH you didn;t ask for the widget number xyxss4567 so we didn’t provide it . .

Looks like the IRS is still playing ‘ guess the secret word ‘

Case l:13-cv-01559-EGS Document 28-1

DECLARATION OF xxx

1. I am currently employed by the Internal Revenue Service in the

Information Technology business unit. I have been employed by the Internal Revenue

Service in a variety of positions of increasing responsibility since 2009.

2. My current position is Deputy Chief Information Officer for Strategy &

Modernization, in which capacity i oversee, amongst other organizations, the User and

Network Services organization in Information Technology (IT).

3. I have been in my current position since May of 2013. During the time

period of June – September of 2011, my position at the Internal Revenue Service was

Associate Chief Information Officer, Enterprise Networks.

4. According to IRS IT inventory reports, the equipment assigned to Ms.

Lerner with data storage capability, both at the time her electronic data was collected for

response to the Congressional investigations and at the time of the hard drive failure in

Case l:13-cv-01559-EGS Document 28-1 Filed 08/22/14 Page 2 of 4

2011, was a laptop and a Blackberry device. According to the same IT inventory

reports, the IRS did not issue an iPhone or iPad to Lois Lerner.

5. There is no record of any attempt by any IRS IT employee to recover data

from any Blackberry device assigned to Lois Lerner in response to the Congressional

investigations or this litigation.

6. The Blackberry device assigned to Lois Lerner at the time of her departure from the IRS (which, according to IRS IT inventory reports, had been issued to her on February 14, 2012) is in the possession of the office of the Treasury Inspector General for Tax Administration. According to IRS records, that office took possession of the device on June 10, 2013.

7. In the standard IRS configuration of Blackberry devices, the Blackberry

device displays and stores only email (both sent and received) that is also stored in the

Microsoft Outlook mailbox of the assigned user, with the possible exception of draft

messages created on the Blackberry but not sent, which would appear on the

Blackberry only. Therefore, standard IRS practice and policy in the collection of

electronic data does not include collecting data from Blackberry devices because the

email of a Blackberry user is collected through the process of collecting the contents of

the user’s Outlook mailbox files.

8. I have seen no IRS record indicating that the Blackberry assigned to Lois

Lerner was configured other than in accordance with the standard IRS Blackberry

configuration described above.

9. As stated in my prior declaration, IRS IT inventory bar code tags are

assigned to “whole” equipment and are not assigned to internal component parts such

Case l:13-cv-01559-EGS Document 28-1 Filed 08/22/14 Page 3 of 4

as hard drives. This is true of component parts even after they are removed from the

equipment in which they were originally installed.

10. When responding to requests for service from IRS employees, if an IRS IT

Technical Specialist determines that a hard drive is not operating properly and needs to

be removed from the user’s computer and replaced, the IT Technical Specialist normally

takes appropriate actions to attempt to recover data from the hard drive at the location

of the employee/user, and sometimes at another IRS location, but typically does not

ship the hard drive to a third party to perform service on the hard drive.

11. I have seen no IRS records indicating that the IRS IT division has ever

sent any personal computer hard drives to any external vendors for service.

12. Once an IRS IT Technical Specialist removes a broken hard drive from the

user’s computer, replaces the hard drive with a new hard drive in the computer, and

either recovers data or fails in their attempts to recover data, the broken hard drive is

considered excess equipment and is batched with other miscellaneous equipment

(equipment that does not contain inventory bar code tags) for degaussing and

destruction. Because such equipment does not contain an IRS IT inventory bar code

tag it cannot be individually tracked through the degaussing and destruction process.

13. In accordance with IRS policy in effect at the time, magnetic media that

potentially contained any confidential taxpayer information was required to be

degaussed (a process described in my prior declaration). This includes, amongst other

miscellaneous equipment, all hard drives removed from IRS users’ computers.

14. Because the IRS does not apply IT barcode inventory tags to hard drives

at the time they are placed into service nor when they are removed from computers and

Case l:13-cv-01559-EGS Document 28-1 Filed 08/22/14 Page 4 of 4

deemed excess, I am not aware of any IRS inventory system or other standard process

to identify degaussed hard drives by the name of the IRS employee user from whose

computer the hard drive was removed.

15. Based upon discussions with IRS personnel in the functional area

responsible for disposal of excess property including IT equipment (Real Estate and

Financial Management within Agency Wide Shares Services), at the time surrounding

the 2011 Lois Lerner hard drive failure, the IRS was party to a Memorandum of

Understanding with Federal Prison Industries, Inc. Recycling Business Group (doing

business as and hereinafter “UNICOR”) to handle the destruction of excess IT

equipment located in the Washington, DC area. The point of contact for UNICOR on

that Memorandum of Understanding is zzz , Deputy General Manager of

UNICOR.

I declare under penalty of perjury that the foregoing is true and correct.

Executed on this 22 day of August, 2014.

xx

Deputy Chief Information Officer

Strategy and Modernization

Internal Revenue Service

Washington, D.C.

Case l:13-cv-01559-EGS Document 28-2

DECLARATION OF yy pursuant to the provisions of 28 U.S.C. § 1746, declare and say: 1. I am the Deputy Associate Chief Counsel for Procedure and Administration within the Office of Chief Counsel for the Internal Revenue Service (IRS). 2. Since June 2013, my duties have included coordinating the IRS response to requests for information from four separate Congressional committees investigating the facts and circumstances related to the report of the Treasury Inspector General for Tax Administration dated May 14, 2013 titled “Inappropriate Criteria… .” 3. Attached as Exhibit A is an IRS ITAMS Asset Information Sheet which reflects that on November 12, 2009, the IRS issued a Blackberry device, IRS Barcode A002914041, to Lois Lerner. 4. Attached as Exhibit B is IRS Form 1933 and IRS Standard Form 120 REV., which, when read together, reflect that the Blackberry device, IRS Barcode A002914041 (Line 69 of Form 120), was removed or wiped clean of any sensitive or proprietary information and removed as scrap for disposal in June 2012.

I declare under penalty of perjury that the foregoing is true and correct. Executed on this 22nd day of August, 2014. yy Deputy Associate Chief Counsel (Procedure and Administration) Office of Chief Counsel (IRS) Washington, DC

++++

Note Sonosoft only dealt with IRS Office of Chief counsel

http://www.sonasoft.com/sonasofts-irs-email-archiving/