On August 14, 2009, I tried to sound the alarm as to where Democrats’ health care proposals were heading.

At that time I was dealing with the precursors to what became Obamacare. The congressional language distinguishing the mandate as a penalty and the political arguments that it was not a tax had not yet coalesced.

The Supreme Court’s decision upholding the mandate as a tax proves me to have been more right than I realized at the time:

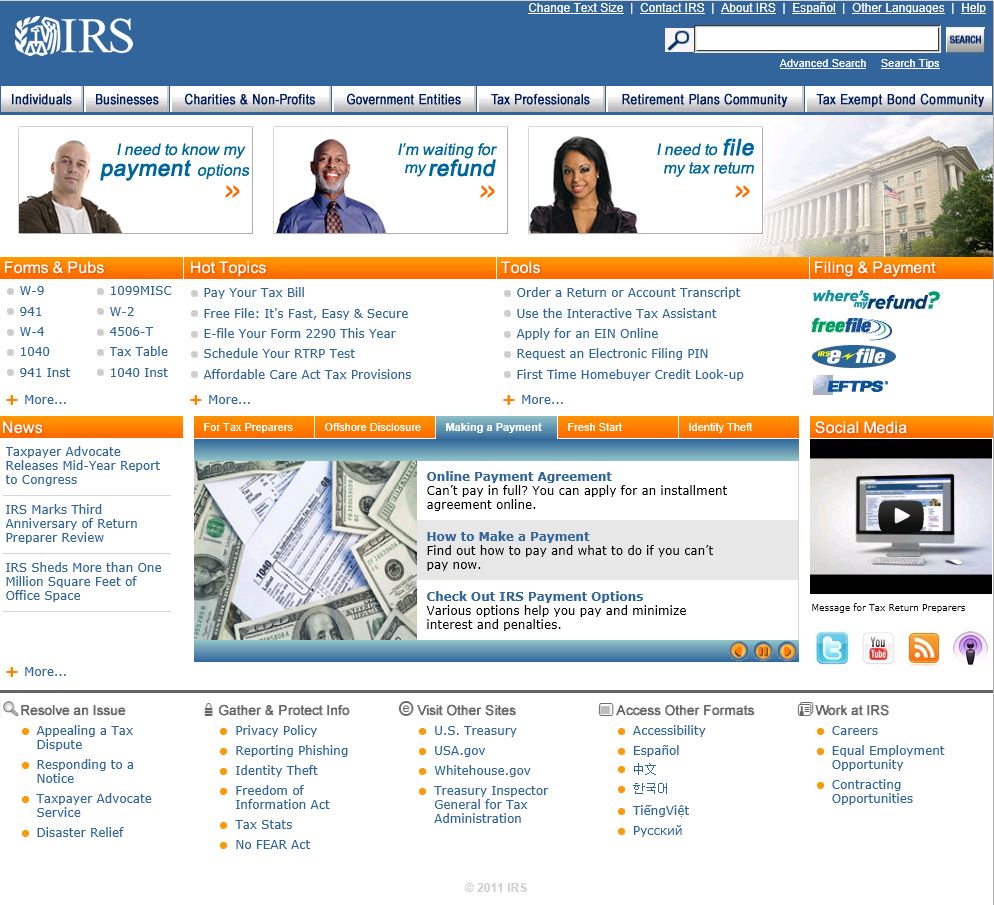

IRS The New Health Care Enforcer

People often joke that government-run health care will have the efficiency of the motor vehicle department, and the compassion of the Internal Revenue Service. This joke will become reality if present Democratic health restructuring proposals are enacted.

Under both the House and Senate Health, Education, Labor and Pensions (HELP) Committee bills released to the public, the Internal Revenue Service will play a key role in monitoring and enforcing health care mandates against individual taxpayers. Yet the introduction of the IRS into the health care system has received scant attention….

These provisions should have people interested in privacy greatly concerned. While income information already is reported to the IRS, the IRS traditionally has not received personal health care information about individuals.

The IRS involved in health care monitoring and enforcement. Somehow, I doubt that most supporters of Democratic health care restructuring concepts will like this detail.

My follow up post was Taxing Your Mere Existence:

What a bizarre concept is a tax to enforce a health care mandate. If you buy a computer at a store, you expect to pay a sales tax; but do you expect to pay the tax for not buying a computer? If you earn income at a job, you expect to pay taxes on the income; but do you expect to pay taxes for not working?

Meet the new health care enforcer:

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

Are you prescient, or simply good at what you do? heh.

I think it’s a little bit of both, Yukio 🙂

Yes a bit of both absolutely. I am sure the professor has a post or two (hundred) somewhere pointing out the bill assuredly leads to the destruction of the private insurance industry while forcing costs of insurance sky high. One thing about Roberts opinion, it reads like a roadmap of all the land mines Nancy Pelosi didn’t want us to discover until they blew up in our faces.

Yeah. It is interesting.

I think it’s been helping to feed some speculation about a Roberts vote reversal– under tremendous pressure. He switched but then hedged his bets and pointed out an awful lot of the bad aspects. That’s the rumor, anyway– after how many hours since the announcement?

The whole conspiracy theory sounds a bit silly to me.

Hey Fuzzy. Good to see you again. 🙂

No, Jacobson was dead-on. It’s a little eerie.

He’s both!

And William, I’ll be linking you up, but in the meantime: ‘Chief Justice Roberts Sides With Court’s Progressives to Uphold Constitutionality of ObamaCare’.

I just received a “Notice of Privacy Practices” from my insurance company. They list the ways in which my information may be disclosed. Many of them are the usual disclosures to doctors, hosptitals, or other healthcare providers, etc. Among other situations, they say they MUST disclose my info “to the Secretary of the Department of Health and Human Services” and HAVE THE RIGHT to disclose my information “to provide payment information to the subscriber for Internal Revenue Service substantiation.” There it is.

The part of the opinion that addresses why it’s supposedly OK to tax you for existing is at page 41-42. Roberts’ reasoning goes that because the government can encourage home purchases with tax incentives, it can also encourage healthcare purchases with tax incentives. He completely ignores that the former incentive is based on a voluntary choice, a home purchase, and the latter incentive is based on not doing anything at all. He begs the question and he does so badly.

The big difference I see is that there is no law that says you can’t pay cash for a house. I just did that last year. I used my pension to buy a house for cash in Florida. But with healthcare, they want to make it a crime for you to pay cash for healthcare.

In Massachusetts, which has the Romneycare mandate, you can claim a religious objection to avoid paying for health insurance and still take the deduction. But, if you paid any money out of pocket for ANY healthcare, including vision and dental care, in the previous year, you have to go before a state board and be approved for the deduction. In other words, the only way you can take the deduction (avoid the higher tax payment for not having insurance) without having health insurance, even with the religious objection, is to not have any medical care AT ALL for the previous year. If you did pay for any yourself (see tomg’s comment at 12:40) then your only hope is to go before a board of state officials and grovel.

Nice, huh?

Rush: “We can’t count on anyone, except ourselves. It’s up to us. We The People.”

That’s what Sarah Palin said when she declined to run for POTUS.

“Voila! A penalty is a tax; non-activity is activity; a commodity is a right; a subject is a free man.” @ProteinWisdom

So…how much is this tax? Is it a flat fee?

Okay, finally found the numbers. For 2014 it would be 1% of your income or $95 per adult. It goes up to 2% or $325 in 2015 and 2.5% or $695 per adult in 2016, etc.

I don’t have insurance and since those numbers are much cheaper than insurance I guess I’ll just pay the fees. That is, until we get a sane government in and the whole tax is repealed.

Put all your assets into a living trust so the feds can’t seize them when you refuse to pay. Leave nothing in your name; not even your car. If you don’t travel, they can’t jack with your passport. If you do travel, well, I guess you’ll have to pay or have your passport withdrawn for failure to pay taxes and penalties. I don’t want government run healthcare and I refuse to pay the tax for refusing to purchase a policy I’m likely to use maybe once a year. Hell, I don’t even like to go to the doctor, especially since I’ve seen first hand the effects of medications. The SCt can say what it wants, but I refuse to submit to being taxed for my inactivity. I refuse to being taxed to pay for illegal aliens to bankrupt our hospitals. I refuse to have the State tell me what government can do to me. This is not Russia or China. This is the bloody United States of America. I didn’t come here to partake of a socialist healthcare system. I left that behind me when I came to America, and I know it sucks. I call this civil disobedience, and it is my right to engage in it as a citizen of the United States, no matter what jug-eared Obama says.

I am not a legal eagle. All I can say is this. Welcome to Socialism, America! The “Enlightenment” is over. This governemtn will expand beyond our wildest dreams. Eminent Domain, now this. A qoute, “In the future the Soviet Union will become like the United States and the United States will become like the Soviet Union.”

Bingo! Unbounded Socialism is now Constitutional. It’s just a tax. Get over it. And pay, pay, pay, …

I get Roberts is playing chess (at least Roberts thinks so) and that this decision is very Holmes-like. Yes it is nuanced and has limitations on the commerce clause and certainly on mandates. Yes it may help tip this election to Mitt Romney and may prompt Congress to do some heavy lifting for a change. Still, it is a grave disappointment. He could have gone with the dissent and still written the opinion he did. Rather he wanted to look independent and he is in his heart a Statist.

Roberts and Obama are Tax Men!

Erick Erickson: “On the upside, I guess we can tax the hell out of abortion now.”

You saw it coming 3 years ago…..

Love ya Professor, but this is one time I wish you were wrong….

This is what I was worried about. As a former resident of Massachusetts I knew that if Obamacare was implemented the same way as Romneycare it would not be called a fine, penalty, or a tax. As wte9 says above, having health insurance is a tax DEDUCTION or “incentive” much like the other deductions we are entitled to for having a kid or mortgage interest. Having health insurance, which requires a 1099HC form proving you paid for it for all 12 months of the preceding year for you and your dependents, allows you to take the deduction. Technically, the government is NOT forcing you to have three kids instead of two. The government is NOT forcing you to buy a house and take out a mortgage.

That’s how the mandate works in Massachusetts. It’s a deduction.

Former Obama administration official spikes the football in an ugly way:

http://www.thegatewaypundit.com/2012/06/dnc-executive-director-taunts-conservatives-on-obamacare-decision-its-constitutional-bitches/

I think this decision proves that bullying and intimidation works with the Supreme Court. It worked for FDR, and now it has worked for Obama.

So much for the fearless, independent American judiciary. Welcome to the Third World.

Check out this very interesting bit here from the Scalia dissent. He seems to be suggesting another way to challenge the tax because it is not a “direct tax”:

“…[there is an issue] whether this is a direct tax that must be apportioned among the States according to their population. Art. I, §9, cl. 4. Perhaps it is not (we have no need to address the point); but the meaning of the Direct Tax Clause is famously unclear, and its application here is a question of first impression that deserves more thoughtful consideration than the lick-and-a-promise accorded by the Government and its supporters. The Government’s opening brief did not even address the question—perhaps because, until today, no federal court has accepted the implausible argument that §5000A is an exercise of the tax power. And once respondents raised the issue, the Government devoted a mere 21 lines of its reply brief to the issue…At oral argument, the most prolonged statement about the issue was just over 50 words. One would expect this Court to demand more than fly-by-night briefing and argument before deciding a difficult constitutional question of first impression.”

Sounds like this ruling may have opened a whole can of worms. More lawsuits on the way?

I’ll be needing and relying upon such perception and analysis as yours, in the days ahead.

Be well, Professor, and do good work.

Separated at Birth: John Roberts and…? It is not personal guys, it is just the law…

On a positive note – The Tea Party groups and American For Prosperity in SE PA are already out rallying against this decision today and hosting meetings tonight to discussion the next steps. Time to fight back.

The Central Committee and it’s Poliburo have made their decisions!

This of course ALWAYS helps:

The press must grow day in and day out — it is our Party’s sharpest and most powerful weapon.

Iosif Vissarionovich Dzhugashvili

Tough pill to swollow after reading. Here lawyers take the case as it was sold as an extension of the Commerce Clause but it ultimately judged another way..as a tax.

Sort of like submitting an automobile for approval by engineers using standards for judging that apply to automobiles and being told…never mind..the standards for off road vehicles apply now.

mean really…why listen to oral argument if its going to be refashioned later:

http://www.c-span.org/Events/Supreme-Court-Hears-Argument-on-Individual-Mandate-Provision/10737429100/

If you earn income at a job, you expect to pay taxes on the income; but do you expect to pay taxes for not working?

Strawless? meh, the quota of bricks shall not diminish.

I believe it ends up working like this

You have HC = ObamaTax is refunded in the form of exemption

Dont have HC = no refund for you, you pay ObamaTax

I could be wrong, but that is how I am interpreting it

Actually there is no law that say’s you must file a tax return, not filing a return is not an attempt to defeat or evade tax. IF you pay tax on your gross income you are good.

If the IRS contacts you and requests that you file a return then you must… because if you do not THEN you are in violation of willfully failing to file a return or supply information.

Now, under Obamacare you will be required to file a return even IF you have no income.

Failing to do so and the IRS must assume that you are not abiding by the requirement to carry health care coverage and are liable for paying the ObamaTax (plus interest and penalties).

Just Be -becomes a crime.

Yeah, sorry, I read your comment as questioning taxing a negative.

I agree with your second post though, as do Law Makers – which is why people like Rubio are already hamming in the “the IRS is coming” point.

ObamaTax does mean everyone will need to file a return, if for no reason other then to show proof of insurance. Democrats want that though; they want to monitor everyone at all times…

Let’s all remind ourselves what happens with China’s childbirth laws every time you see some nice 40-something Yuppie sitting down to eat with his/her adopted Chinese daughter(s.) What’s to stop the US Federal Government from taxing any failure to act in accordance with what Big Brother defines as the necessary and proper acts of the land with respect to number of children, which isn’t really that far from healthcare coverage? Forget Broccoli for the moment. Can the Feds declare, as in China, that “overpopulation” is a threat to the US citizenry not to mention Mother Earth (Gaia)and to fellow citizens being burdened with supporting people who selfishly determine to have more than 1.5 children? Under the taxing powers affirmed today by Justice Roberts and the Majority, can Congress pass a law saying that nobody can have more than 1.5 (ok, we’ll round it up to 2) children? They may decide not to force you to abort child 3, child 4 and child 5, but can Congress impose a tax on you for each child you bear over child #2, calling it the Affordable Childbirth Plan?

“can Congress impose a tax on you for each child you bear over child #2, calling it the Affordable Childbirth Plan?”

They always could, and today’s decision doesn’t change that one bit. That argument would literally be the exact same reasoning for the “progressive” tax rate we currently have – just replace “higher income” with “more children”.

Nothing changed for the negative today other then we didn’t get rid of this bill. Everything else was extreme positives.

~ The Constitution took unbelievably gigantic steps toward Conservatism with regards to the Commerce Clause

~ The individual States Rights were re-affirmed against Fed overreach

~ The tax situation really doesn’t change

If they try to put a tax on cheeseburgers, me and my boys are going to the mattresses.

—-

The Romney campaign reports they’ve received over $1 million in donations since the SC announcement. In conjunction with what Darkstar says just above, this could be the event that awakes the sleeping giant, that set of Americans who heretofore have been sympathetic to Tea Party ideas about small government, low taxes, and individual liberty, but have not been particularly participatory in voicing or acting out their support.

I had hoped, rather naively, that the Supreme Court would not decide based on political considerations, and certainly not on personal pique, but perhaps it was a bad idea, after all, for Obama to embarrass the entire Supreme Court on national TV during a State of the Union address. John Roberts may well have just handed the election to Romney by identifying the mandate as not a commerce clause viability, but as nothing more than a tax forced by congressional Democrats down the throats of a public that did not and still doesn’t want it, and that by a large majority – and it’s the biggest tax increase in the history of the world. Good luck defending that, Mr. Obama, et al, and good luck holding on to the White House and Senate. See you in November on Payback Tuesday.

We’ve paid lip service to it, now it’s time to get behind Romney whether you can stand the guy or not. Obama must go. The US Senate must be turned over. I made a small contribution to Romney today (just to save the receipt for posterity, should this prove as historical a moment as it seems), but I plan to sit down tonight to make a comprehensive plan, a target list of how much money I can give, and where it ought to go in terms of candidates and campaigns. Just as important, part of that plan will be which conservative media I ought to support. Top of the list is Legal Insurrection.

Wherever it goes, make a plan and give till it hurts, especially if you’re too young to remember the Carter years which, as bad as I remember them to have been, were a cakewalk compared to the Great Depression, and yet both are distinct possiblities for a repeat of history if we don’t get some common sense conservative adults into office. Scott Walker and Paul Ryan, among others, ought to be our models for risk-taking pols seeking to do the right thing.

Do you hate it when liberals whine?

Are you a conservative?

Will you whine or will you get after it, get organized whatever the extent of your involvement will be, and get these bastards out of office?

Anyone remember when John Edwards, running for President in 2007, was up front about using the IRS to track people and making sure they had annual checkups?

I pointed it out in 2007 (revisited)

BTW, we can’t just support Romney. It’s even more important to work on candidates down-ticket.

I’m signed on to the Elizabeth Emken campaign here in CA as she challenges Diane Feinstein. We have GOT to retake the Senate and increase the majority in the House.

Or look forward to having your colon checked by the DMV.

[…] » How right I was: “IRS The New Health Care Enforcer” – Le·gal In·sur·rec·tion […]

With the unpopular mandate resting on the taxing power and certain to stay an election issue, seems like time to push for an amendment limiting that power. It would be an uphill climb (a pretty steep one), but the Commerce Clause argument was considered an uphill climb at the beginning. “You never let a serious crisis go to waste.”