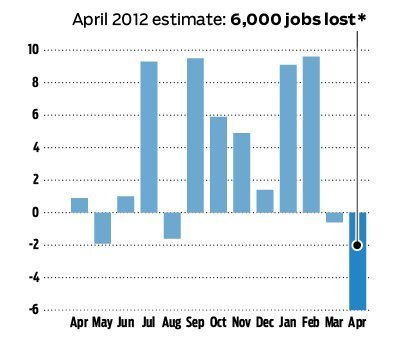

Maryland’s loss of 6,000 jobs was the largest of any state in the nation last month. Some have been quick to write off the figures as a product of unusual weather patterns affecting seasonal hiring practices, but there is a growing belief that the Maryland economy is not as solid as once thought. In addition to April’s figures, the employment numbers from March, which originally posted a gain of 1,500 jobs, were recently revised and now show a loss of 600.

Although Maryland’s unemployment rate now sits at 6.7%, well below the national average of 8.1%, a number of factors have some worried about the stability of the state’s economy. Among them, the unpredictability in Europe, the state’s dependence on big funding from the federal government, and the recent income tax increase which passed in the Democrat dominated state legislature.

From the Baltimore Sun:

Richard Clinch, director of economic research at the University of Baltimore’s Jacob France Institute, agrees that seasonal adjustments are “wreaking havoc” on the numbers. But the new revisions switching Maryland from gains to losses in March troubles him. When the economy is recovering, revisions tend to add, not subtract, he said.

“I’m worried that the recovery doesn’t have legs,” he said, pointing to more economic problems in Europe, which could ripple across the Atlantic.

Clinch said Maryland politicians’ special-session decision this week to raise income taxes for the highest earners leaves him feeling pessimistic that the state — a big recipient of federal largesse — will be able to chart a smooth course through the choppy waters of looming budget cuts in Washington. Maryland has yet to deal with its own structural budget deficit, and state leaders missed an opportunity to take a harder look at spending, Clinch said.

“The Maryland economy going forward, I think, is going to be quite fragile,” he said.

The new income tax increase may also hinder the economy at a time when private sector job creation is imperative for the state. (Emphasis mine).

Kathleen T. Snyder, president of the Maryland Chamber of Commerce, said the tax increase will have a direct and possibly unintended effect on some businesses because taxes on revenue earned by limited liability companies and other common entities are paid through their owners’ personal income tax returns.

It’s not yet clear what the significance of the last two months is, but it should certainly be on the minds of Maryland voters as we inch closer to November. Ultimately, it could prove to be a valuable area of critique for Republican candidates to use against their Democrat counterparts in Maryland, including the newly discovered candidate for U.S. Senate, Dan Bongino.

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

It must be tough to cook your books and not be able to print money like Washington does.

Amazing how everyone who hikes taxes discovers it doesn’t work, yet it seems that everyone who hasn’t is clamoring to do so. Is it arrogance or is it the lemming effect?

Some are just stupid. Lots of voters are, and lots of politicians are, too.

But among the governing, economic, and social elites, its largely a mix of theological and civic religion. Theologically, they believe blue model economics is morally superior, and that it works, and no amount of bad results or experience will put them off it because its not about outcome, its about faith. Results are not the purpose, spiritual comfort is. As a civic religion, all right minded and respectable people wear the trappings of the faith for social acceptance. To do otherwise would be scandalous.

The same applies to modern environmentalism. The “peace” movement, too.

Too true!

I agree with your comment, but IMHO there is more to it.

Disasters on a politician’s watch are no longer career-ending. Today’s elites do not get punished much when they screw up, and they know it.

They don’t necessarily get punished by the voters. For example, despite the Republican wave in the last election & despite California’s extreme problems, every single statewide office there went to Democrats.

They don’t get punished by the system, i.e. by each other. Despite her performance as Speaker, Pelosi remains the Democratic leader in the House. Jennifer Granholm’s blatant failure in MI (remember how we needed to amend the Constitution so she could be President?) is followed by a cushy UC Berkeley appointment where she pontificates about leadership to the MSM. After Reagan, we had two failed RINO Presidents, but the Establishment continues to get RINOs nominated. Defeated Congresscritters of both parties make seven-figure incomes as lobbyists.

I don’t dispute your remarks about theological/civic religion, but the behavior of our political elites also involves cold-eyed self-interest.

It’s not a new thing. Kucinich put Cleveland into bankruptcy when he was mayor and look how long they sent that train wreck to Congress.

The Dems count on people being sheeple.

“Is it arrogance or is it the lemming effect?”

Well…yes.

And there is nothing more suicidal than an arrogant lemming.

I think it wise not to respond with the first wisecrack that entered this feeble mind–I wouldn’t want to be banned!

i live in baltimore. me and my wife were thinking of settling long term here. then they raised taxes. we are now looking to move to another state.

nevermore.

i always find it odd politicians raising taxes under the qualification of “it was the hard choice”.

that’s not the hard choice. the hard choice is to learn to live within one’s means.

When the democrat controlled legislature and governor passed the “millionaire’s tax” several years ago, tax revenue DECREASED. These people voted with their feet.

Since Martin O’Malley became governor 6 years ago, after a stint as Mayor of Baltimore, he has asked the democrat controlled legislature to increase spending every year. He calls this “fiscal responsibility”.

O’Malley left Baltimore in worse shape financially when he left to be governor than when he became Mayor.

Maryland politics is controlled by 3 subdivisions: Baltimore City, Prince Georges County and Montgomery County. The City is infested with the “takers”, while these 2 counties are infested with Washington, DC government workers, most of whom are the higher paid bureaucrats.

If DC were to fire many of its employees, Maryland would be a disaster area.

I departed Maryland earlier than within the last two months and for reasons other than the unusual weather. The arrogant government jackals, and confiscatory taxes redeployed to purchase their continued survival, drove me out. Of my numerous stories, the most recent involves my returning to take possession of my mother’s car upon her death. In brief, I drove it to my new state where I retitled and retagged it, destroying the Maryland tags in the process. Maryland has sought $1000 from me for not returning the tags to its DMV and is now prevailing on the Federal Govt. to effectively include this ‘liability’ as part my federal income taxes. I warn people about Maryland whenever I have the chance, and am appreciative of this opportunity to perform a public service.

Thanks for the info, which implies a larger point:

Even though exit taxes are considered illegal afaik, IMO the failing blue states would love to impose them—and Washington Democrats would help if they had enough power.

According to US Debt Clock.org: Argentina, Australia, India, and Mexico have a Public Debt to GDP Ration of 30% or more. Brazil, Canada, England, France, Germany, Spain, and the USA have a ratio of 50% or more. Greece, Ireland, Italy, Japan, and Portugal are at 100% or more (Japan is at over 197%). By contrast China is at 13.9%, Russia at 10.7%, and Saudi Arabia is 10.06%.

Review their External Debt to GDP Ratio: Argentina and Japan 30% or more. Japan, Canada, and Russia 50% or more. Australia, Italy, and the USA 100% or more. France, Germany, Greece, Portugal, Spain 200% or more. England is at 486.8%. And, Ireland is 1,244.4%. The nations with a ratio below 30% include Brazil, China, India, and Saudi Arabia.

Go to the same website and look at the current debt/revenue levels for the USA. Use the “Debt Clock Time Machine” feature (upper right corner) and see the projections to 2016.

Isn’t the debt level for cities, counties, and states at or near record levels?

The last article I read stated that personal debt had increased to a record level, while savings were at quite a low level. Then, consumers had eased credit purchases for awhile, but more recently the use of it has increased.

The number of people who are either unemployed or underemployed has not appreciably changed.

The devaluation of assets (For many people, the primary one is their house. Besides, who’s going to buy them, anyway?) has not reversed.

From time to time, are there not articles dealing with the decay of our nation’s infrastructure and not just the present-day needs, but also those of the future?

I find it puzzling and deeply troubling that anybody could think of using the term “recovery.” How can it be that there are so many who seem to have a rejection of significant austerity measures? If you can demonstrate to me how my thinking is mis-guided, I would greatly appreciate your doing so.

Several years ago, the liberal Democrats decided to implement a millionaire’s tax with hopes of bringing in an addition $106 million dollars. Guess what happened? A lot of the millionaires left the state!

The higher tax rate netted $100 million less than what the millionaires paid the year before. Not only did they lose the income tax on many of the missing millionaires, they also lost the sales tax money that those millionaires spent in the state. Businesses also lost sales to those missing rich people that left. You wonder how many businesses left too, so owners could avoid the tax. Finally, the millionaire tax caused many rich people and businesses not to move to Maryland. Why move to a hostile tax state when you have better options like PA, DE and VA?

Things will really get worse when the Federal Government finally starts firing people in mass. The days of spending over $100,000.00 a second will eventually halt. When that happens, MD will be screwed due to the high spending by it’s liberal legislature. There won’t be money to pay the bills when they can no longer tax fired federal workers. Many of the rich and private sector businesses will be long gone. The tax burden will be left on the rest of the people living in MD.

http://online.wsj.com/article/SB124329282377252471.html

My wife and I left the Emerging Peoples Republic of Montgomery County as soon as I retired. We moved to West Michigan – no state taxes on pension, lovely people (who speak English), great weather, low crime, good local health care facilities, no traffic.

Never looked back, never missed a thing about Maryland (other than friends)and have extended and enriched out lives to a degree we can’t believe.

Martin O’Malley was as bad a musician playing with young guys in an Irish Band at Ireland’s Four Provinces in D.C. as he is a politician (or maybe not).

Good luck all of you trapped in Maryland – hosta la vista!

I live in Maryland, and have since 2004. You MUST keep in mind that MD politics are dominated by the city of Baltimore, Ann Arundel, Montgomery, Prince Georges, Howard and to a lesser extent, Fredrick and Cecil counties. Those counties are all deep blue…and have the majority of the population, most of whom work for some government entity, whether federal, state, county or municipal. It’s in the interest of the voters of those counties to expand the scope of ALL levels of government, at the expense of the private sector.

I think what you’re seeing now in MD is the tipping point…the point beyond a state’s economy can no longer support the massive level of government. I will start of new job on Monday (tomorrow) for a company in Maryland that during my interview process was talking about moving to Florida…to avoid the huge increase in taxes and regulatory burden that is part of doing business in Maryland…

For those interested in Dan Bongino, check out his website, and especially this interview with Dennis Miler.