Senate just voted to table the Boehner bill. No surprise, but the vote was 59-41, which means some Republicans voted to table it. (Added, the Republican votes to table were DeMint, Hatch, Lee, Graham, Vitter, Paul,)

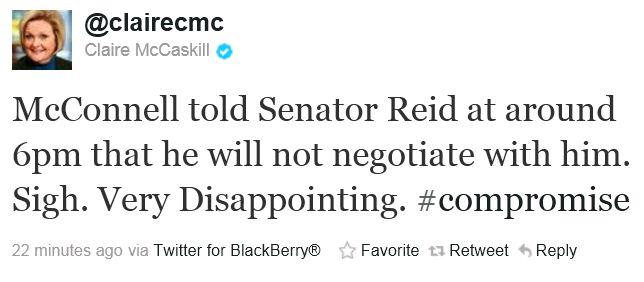

Claire McCaskill is complaining the Mitch McConnell told Harry Reid that he will not negotiate with Reid.

Are we better off that the Boehner bill passed the House? I say absolutely, the narrative is that the House passed a debt ceiling extension and the Senate killed it.

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

I second your “absolutely”

It looks like McConnell FINALLY got the message that we TEA Partiers are sick and tired of him undermining everything that comes out of the House.

It’s time that Boehner tells Reid “Ok. Put up or shut up. We’ve done our job, you want something better, YOU put something on the table.”

McCaskill needs to get her digs in now because she knows she’s going to be TOAST in the next election.

I think Boehner gave that message to Reid quite well when he announced that the bill had passed.

While we wait around for the senate to actually be senatorial, here’s some encouragement regarding the Obama budget plan.

Love it 🙂

That was cute. Thanks!

I would highly recommend that Senator McCaskill try to be as quiet as a mouse. She is on the hot seat in her own state, with TEA Party people ready to point out her ACORN cohorts in her last election, a number of which were convicted of voter registration fraud. Of course, Claire (cheats on her taxes) McCaskill thinks she is still moot.

Professor, again, if you think the narrative in tomorrow’s press, and tonight on the LameStream media channels is that the onus is not on the Reid Democrats, you are still participating in wishful thinking. It will be played that the Republicans bill was just so unacceptable to the Senate that there will be no deal since (you name the reason).

Now Reid has taken to the cameras to say that the Republicans are not willing to “negotiate”. How long can Americans deny that it is Democrats, not Republicans, sending us into a debt crisis? Well, with 51% of taxpayers with no tax liability, thanks to Democrats, they are going to blame the Republicans.

change: the onus IS on the Democrats.

Dick Durbin now pimping for the Reid bill. He should be in jail, not in the Senate.

And here comes Chuckie Schumer. Liar, liar, pants on fire.

I wonder, do you have to be a crook to run for the Senate as a Democrat?

Durbin said the Republicans can’t even tie their own shoes (paraphrasing) and the only game in town is the Reid bill. Duh! That was the game plan all along and the reason Reid tabled CC& B and the Boehner bill.

When you have to take to the cameras to explain why you are socialists, have you really won the battle?

Thank you Paul, Vitter, Lee and DeMint.

This process has been a farce from the beginning. Biden was pretending to negotiate but his real goal was to run out the clock. Canter finally walked out on him. Then Obama pretended to be serious with Boehner, but he was only running out the clock, forcing Boehner to walk away.

Now at the eleventh hour, Reid calls a press conference and says HIS bill is our last chance to avoid calamity before the Aug 2 deadline. It’s all been a charade to get to the very end so they could ram through the Democrat bill and if Republicans fail to pass it in both houses and the markets melt down, who gets the blame?

Democrats masterfully played the Republicans like a fiddle.

When it come to poker, Republicans are lousy at it. The Democrats have been using backdoor and stealth tactics since FDR. They have mastered it.

Remember, the media is going to report that it is Republicans, not Democrats, holding up progress and stupid Americans (the ones that voted for Obama) will believe the progressive supporting media.

It’s the “never let a crisis go to waste” method of governing that the Obamassiah has been using to get his way for 3 YEARS (Obamacare, Porkulus, Anti-Oil Drilling in the Gulf, etc…). Fortunately the TEA Partiers are forcing the Republican Leadership to wise up and say “No, we’re going to THOROUGHLY examine what is coming out before we pass it so we don’t get SCREWED again like you Democrats have done to us MANY times previously with your slight-of-hand and evaporating promises.”

I’m not so sure that the Democrats are going to come out of this smelling like roses or that the sound that they’ve been making is anything other than nails screeching on a chalkboard.

The Republicans (thanks largely to the TEA Partiers) are finally growing a spine and saying “NO! WE didn’t create this crisis, YOU, the Democrat party, did with your out-of-control spending spree.” It’s time for them to be screaming it from the rooftops EVERY DANG DAY, because the public IS getting the message and it IS resonating.

The TEA Partiers need to hold the line here and now, and I think that they will. I don’t think that Reid’s bill is even going to make it past a cloture vote from a Republican Filibuster in the Senate, let alone see the light of day for a vote in the House.

Reid’s been making this “last chance” speech for a while now, it’s lost it’s luster to the public, because they’ve used the “its an emergency, we’ve got to pass it NOW or there will be DOOM” line just a little bit too often (like Pelosi’s “we’re trying to save the world from the Republican Budget” line which I expect will become VERY mocked come next week by the Daily Show and Colbert Report for it’s sheer stupidity.

The Republicans would get blamed if they found 20 trillion sitting in the closet and was able to pay all the bonds. Republicans will always get blamed. Get use to it.

The best thing would be to go out a apologize to the American people for letting the Dems destroy this country “We’re sorry, we should have worked harder to stop them. Please forgive us”. Take the blame. The MSM would not know what to do.

I don’t understand how this was a compromise. In order to raise the debt ceiling in the future, this bill required a balanced-budget amendment be passed. How can a law require congress to pass a constitutional amendment? How does that even make sense?

It’s actually reasonably simple in legislative terms: the bill itself would have hamstrung the Congress by implementing across-the-board budget cuts of a percentage if congress failed to pass a Balanced Budget Amendment by a date certain.

It’s the same sort of language that the Congress uses against the States ALL the time for highway and other funding. “Pass [X] law, or all federal funding provided for [Y] will be revoked.” The SCOTUS has routinely found this legislation to be legal and binding, because Congress isn’t REQUIRING the States to do anything, they’re just attaching a string to the federal purse. The Republican Leadership was just passing it to bind the Congress in it’s future actions. The string here just happens to apply to Congress itself. It could be REMOVED, but that would require a SECOND piece of legislation removing it, passed by both Houses (which the TEA Partiers won’t allow) and signed by Obama.

I understand from a legal perspective how it occurs, I just don’t understand how the TEA party members expect this to be seen as anything other than a minority using a crisis to force a constitutional amendment. Don’t get me wrong, I agree with the idea of a balanced budget amendment, but to suggest that it is the will of the majority is just insane.

TEA Party members understand that we cannot continue spending like drunken sailors. They understand that when you get in fiancial difficulties, you don’t call your credit card company and ask them to raise your limit. What is so hard about that for you to understand?

And guess what, the Republicans are the majority in the House.

Considering the rate the US gets on the debt it issues, raising the debt ceiling is more like getting a mortgage than a credit card limit increase. The way to get out of financial straits is not to stop paying bills you’ve already accumulated, it’s to stop buying new things and pay the bills you already owe. Take out a home equity line of credit, do what you have to to not default (and while I realize raising the debt ceiling may not cause us to default on issued debt, failing to pay contractors, like failing to pay your utility bill, can be just as damaging), get a second job to raise revenue, and cut extra expenses. I agree with the original goals of the TEA party, but the members that were elected have no real understanding of the financial markets or the US economy, and they’re playing with fire to try and get their way (a way I agree with, but not at this cost).

And arguing the Democrats are the ones who are exploiting this crisis is just dishonest, considering they aren’t getting anything from it. They offered a clean deal (in which neither side would actually benefit considering taxes and spending, the main things they fight over, wouldn’t be touched), and even offered deals in which spending is cut, with no new taxes raised, they lose the implementation of their philosophy in such a deal. That I agree with the fiscal policy of the Republican party, and yet I cannot support their way forward because it clearly wont work, is an absolute embarrassment to them.

Replying to AWing1: (and I’m trying something with tags so bear with me please).

The larger problem is that the government has not (in the recent past) HAD to deal with paying off what it had already borrowed. They have just gone ahead and extended their own credit line, even when Congress has promised they would reign in spending in program growth.

Now, you can argue that tax increases would be the same as getting a second job. However, this is the proper analogy: Tax increases are like getting a second job, THAT IS SO FAR AWAY that you spend more in gas to get there and back than you make at said second job. (the economy killing factor).

Ok, now the “clean bill” business: Horse-hockey (and I thought so when Paul Ryan did it as well, but I didn’t get the detail until too late to call Rep. Ryan out on it). Reid’s “savings” in large part are completely illusory. They make certain assumptions that he knows for a fact will not occur (like winding down Afghanistan, Pakistan and Iraq). It’s NOT going to happen, and he KNOWS it.

As for Cut, Cap & Balance, the Democrats are partially exploiting the manufactured “crisis” by trying to get a debt-limit increase that gets them through the next election cycle so they don’t have to justify it again before they go before the voters (which polls badly for the Democrats). Further, they’re terrified of even DEBATING CCB for the simple reason that a majority of the country DOES support it (not necessarily a super-majority, but I’d bet money that it’s closer than you think). In fact, I would bet that you could probably get 34-35 states to rather quickly pass a Constitutional Amendment (quickly being within 8 months) if drafted properly. The Democrats are playing games with “tabling” the bill rather than actually voting it down because of the horrendously bad sound-bytes that it would create of the Democrats and exposing 26 of them as FLAMING LIARS for priorly campaigning on support for a Balanced Budget Amendment during the Bush Years when they were screaming about spending that was going to “tax expenditures” (read: the “Bush” tax cuts, prior to their own binge, which they now want us to forget about, by blaming … “The Bush Tax Cuts”).

A LOT of the TEA Partiers are a lot more business savvy than the media gives them credit for, and understand a form of economics that the media simply loathes. The MEDIA has tried to sell Keynesian economics for a VERY long time. The TEA Partiers largely understand that Keynesian economics simply doesn’t work without a back-end economy driver (like a war). The TEA Partiers get derided by economists exactly BECAUSE those economists have a vested interest in Keynes’ theories NOT being proved wrong, because then those economists would be out of a job. The moment that cutting spending actually works, all those PhDs in Economics based on Keynesian economics become scratch-paper.

YAY! It worked……

@Chuck Skinner, you honestly believe we’ve hit the top of the Laffer Curve at a 14.1% effective tax rate? I would love to see even one peer reviewed study that suggests the Laffer Curve tops out anywhere near even 25%. You’re a joke, and absolute joke.

(Historical effective tax rates, represented by total receipts as a percentage of GDP http://www.taxpolicycenter.org/taxfacts/displayafact.cfm?Docid=205 )

As I’ve said before Awing1: stop being a jerk. You want to argue with me, it behooves you not to call names if you want people to take you seriously.

That being said, it’s not the Laffer Curve itself that’s the problem, it’s the distribution and the particular tax codes as written, because you need to be looking at a Laffer Curve Specific to each tax bracket. When you weed the “ultra” rich out of the tax curve, you see that the effective tax rate is actually much higher than 14% on those making between $150K and $1.3 Million, actually about

YOU cite it as 14.1%. It’s not. It’s AVERAGE 14.1% for the highest QUINTILE (20%) of earners (at least as of the most recent data available). For the Top 1% (Those “millionaires” that Obama keeps harping on) it’s 19.7% for income taxes ALONE. Include the TOTAL tax burden, it’s 31.4% (see http://www.cbo.gov/ftpdocs/88xx/doc8885/12-11-HistoricalTaxRates.pdf for details, the most recent HARD DATA available).

Further, it’s those Top 10% (those making about $250K)Obama wants to tax MORE that are paying a 27.1% combined total tax rate that routinely create JOBS, and are generally taxed under PERSONAL Income Tax Rates as sole proprietors. That being the case, that $80 THOUSAND dollars that they’re carrying in tax burden could create an AWFUL lot of jobs if they were taxed at a lighter rate.

So, care to continue being a jerk, now, or are you going to come back with some actual FACTS to back up your sneering that I’m a joke?

Oh and one other note: I wouldn’t trust the Brookings Institution numbers without actually doing the MATH on them yourself. Bookings has a VERY Liberal lean to their “non-partisan policy” pieces.

Considering I didn’t say who we need to raise revenue from, only that we need to get a “second job”, raise taxes in general, your argument simply puts words in my mouth. When you stop making things up, I’ll stop being a jerk.

Also, Heritage provides the same numbers. http://www.heritage.org/budgetchartbook/current-tax-receipts

Why did you provide a link to Heritage talking about tax burden as a percentage of GDP? That wasn’t what I was discussing AT ALL.

I was discussing the tax burden imposed on the INDIVIDUAL based on effective TOTAL tax rate, not as a function of GDP (although I do think that Federal spending SHOULD be capped as a percentage of GDP).

And OK, since you teed it up for me so nicely, let’s hear you say it: WHOM do you think we should raise taxes on and by how much?

The long and short of it is that, no matter how many times we are promised that “spending cuts will happen and tax increases will go to pay off debt” it NEVER happens. Invariably Liberals (of EITHER party) say “we have to create this program for the benefit of society.” The Liberals just borrow, and spend, and then say “oh, well we’re out of money, we need to borrow MORE.” The time has come to stand up and say “Hell NO!” It’s time to peel back the layer-upon-layer of programs that were created to be “compassionate” but have just created a underclass that constantly suckles at the government teat, often without giving ANYTHING back.

The prescription drug benefit signed under Bush is a disaster, the SCHIP expansion where a family of four making $80K annually can get FREE health care for the children is a desecration and insult to those who are truly needy, Obamacare is a debacle in progress, Social Security has been perverted beyond ANYTHING it was ever sold as (it’s not a “safety net” like we were promised), and the Great Society has made an enormous segment of the population even further beholden to the government for their very daily existence.

If we can’t peel some of these programs back, those (Liberals) who administer them will continue to use them to enhance their own power at the expense of the ever-shrinking group of taxpayers. The ONLY way to do so, is to use the leverage that we’ve got now, because there’s no guarantee that we’re going to be able to keep the power we currently have.

The highest federal tax rate for FY2010 was 35%. The highest state tax rate, found in Hawaii, is 11%. That makes the highest income tax rate around 46%. I’ve not seen a single tax policy or economics expert suggest that the revenue maximizing peake is below 60%. And these are just nominal rates, actual rates are inherently much lower because of the various deductions and tax credits available. The argument that an increase in taxes will lower revenue at our current rates is absolutely laughable, no academic study supports it, and that is why you are a joke.

Who should we raise taxes on? In my opinion, we should eliminate the myriad of corporate and perhaps even personal deductions and tax credits. If nothing else, it will save the country hundreds of millions on tax professional-related expenses. But that’s just me.

It’s of course impossible to argue against such speculation as the accusation that we can’t stop spending through legislation. However, I can argue destroying the economy by refusing to raise the debt ceiling is not the answer. No matter how you slice up who we pay and who we don’t, by not paying someone that the law requires we pay, we will have irreversibly harmed our economic system. The argument that raising the debt ceiling is giving something up to Democrats makes no sense, the debt ceiling must be raised for America, not for the Democrats. Failing to do so will harm the majority of Americans, from those with credit card debt and mortgages, to those with investments in the equity and debt markets. Calling the debt-limit increase a give to Democrats is essentially calling the entire country Democrats, and I for one am quite offended by such an accusation.

Also, I provided the Heritage numbers because you said this:

“Oh and one other note: I wouldn’t trust the Brookings Institution numbers without actually doing the MATH on them yourself. Bookings has a VERY Liberal lean to their “non-partisan policy” pieces.”

How exactly is that not “what I was discussing AT ALL. “?

The highest Income tax rate is nominally 35%. The highest Total tax rate is actually going to be quite a bit higher, because you have Income PLUS FICA (7.65% you’re paying and 7.65% that the employer is “paying” that they’re not paying you up to $106,800), on which 1.45% is UNCAPPED, and again your employer is “paying” 1.45% that they’re not paying you.

So, Maximum federal tax burden is, actually 38% plus a variable percent based on income because of the previously aforementioned FICA Cap depending on exact income of the person examined. That’s before we even START adding state and local taxes in, which raise the burden even higher (and you need to add ALL the taxes – state income taxes, local income taxes, property taxes, school board taxes, water & utility taxes, special assessments, local bond taxes, Millages and a whole host of others too numerous to list).

For those individuals who own corporations (or stocks), it’s actually even higher than that, because the profits of the corporation are taxed once BEFORE they are distributed to the Individuals in the form of dividends or added-value to the stock.

You have to trace the money ALL the way through the system, from the point where it is generated (either by labor or by investment) to the point where it is paid out to the final recipient. Looking at just the “income” tax portion of it only shows you part of the picture.

As for raising the corporate tax rate and eliminating corporate deductions and personal deductions, you do realize the excess drag upon the economy that is going to create, right? Meaning MORE unemployment, and thus LESS revenue to the treasury. Because if you raise that corporation’s taxes 100K actual dollars, lets say they lay off 3 people they were paying $33K each. This in turn will cause the state to have to raise it’s unemployment assessment, leading to even MORE layoffs (micro-economic causes with macro-economic effects). You may have generated a nominal amount of temporary increased FEDERAL taxes, but you’ve also now generated 3 individuals drawing on unemployment insurance FROM the government (short term State, long term Federal) (likely costing MORE in revenue than you’ve raised).

Short version: Every dollar you have to pay the government is a dollar that CAN’T be used elsewhere in the economy either to pay someone or to purchase goods or services.

And now let’s actually TALK about those tax policy or economics experts who you said you said you hadn’t been able to find. First I’m saying it (I hold a Juris Doctor Degree, cum laude with a Concentration in Tax Law). Having spent twenty-five of my ninety credit hours studying tax law and policy in order to be granted my degree. But, you don’t have to believe me. I didn’t have ANY problem finding several who think the number is lower than 60% on the Laffer Curve. Some examples (not NEARLY the entire list):

– Bruce Bartlet (Forbes): “I would hate to venture a specific number…. I would, however, say that I think the top rate could be quite a bit higher than it is without significantly impairing incentives or leading to excessive amounts of tax avoidance. I think 50 percent is an important threshold and I would be very reluctant to go higher even if it raised net revenue….”

– Greg Mankiw (Robert M. Beren professor of economics, Harvard University; former chairman, Council of Economic Advisors): “My guess is that that the short-run answer and the long-run answer are quite different. For example, if you raised the top rate from 35 to, say, 60 percent, you might raise revenue in the short run. Over time, however, you would get lower economic growth, so the additional revenues would fall off and eventually decline below what they would have been at the lower rate…. I will pass on offering a specific number, as it would require more time and thought than I can offer just now, but I will opine that I think the long-run answer is actually more important for policy purposes than the short-run answer.”

– Larry Kudlow, host, CNBC’s The Kudlow Report: “Personal income tax of 15-20%, business, sales tax rate of 8-10%. I can make some generalizations which would suggest, in terms of just the personal income tax rate, 91% was too high, Reagan cut it to 28…. We’ve done pretty well in the economy these last three decades, apart from this Great Recession, which is more financial related. Maybe it’s a range of 35-40%, it seems like that worked pretty well. If you started encroaching on 50, that would cause trouble…. Once you get into the 40 or 45% range, in my view, you’re risking a long-term revenue slowdown and a long-term growth slowdown.”

– Donald Luskin, columnist, SmartMoney.com, National Review: “19%… I am saying that the way to maximize the take from personal wage income tax is with a 19% rate on that tax.”

– Stephen Moore, senior economic writer and editorial board member, Wall Street Journal: “The revenue maximizing rate is probably around 40 or 50 percent. But the growth maximizing rate, even given the current deficits, is probaby about 20 percent. So the goal is to get the rate down to 20 to 25 percent. For cap gains the revenue maximizing rate is between 15 and 20 percent.”

(this final one below is my argument, which you keep dismissing)

– Martin Feldstein, George F. Baker Professor of Economics, Harvard University, former chairman, Council of Economic Advisors: “Why look for the rate that maximizes revenue? As the tax rate rises, the “deadweight loss” (real loss to the economy rises) so as the rate gets close to maximizing revenue the loss to the economy exceeds the gain in revenue…. I dislike budget deficits as much as anyone else. But would I really want to give up say $1 billion of GDP in order to reduce the deficit by $100 million? No. National income is a goal in itself. That is what drives consumption and our standard of living.”

I think this statement rather simply demonstrates the flaw in your thinking:

“Because if you raise that corporation’s taxes 100K actual dollars, lets say they lay off 3 people they were paying $33K each.”

You do realize that corporate taxes are on profits, not revenue, correct? Because when that is the case, increasing the real taxes on a corporation 100K does not result in them reducing expenditures by 100K.

Also, the majority of the people you quoted were columnists, and the two economists quoted explicitly stated they were guessing.

Further, in the future, if you’re going to plagiarize a work (particularly from a news source like WaPo http://voices.washingtonpost.com/ezra-klein/2010/08/where_does_the_laffer_curve_be.html), I suggest you at least cite it, or did they not cover intellectual property law at your law school?

Also, when the government taxes, and then spends, that money IS reintroduced into the economic system. I’m not arguing for a tax and spend system, but what you’re essentially arguing for by stating “Every dollar you have to pay the government is a dollar that CAN’T be used elsewhere in the economy either to pay someone or to purchase goods or services.” is a government in which they spend but do not tax, in other words the government we’ve had for decades.

Another also: The issues with various ancillary taxes and deductions creating a fluid real total tax rate is exactly why everyone, including the Heritage Foundation, uses revenues as a percentage of GDP as a substitute for real tax rates. And considering capital gains (the increase in stock value you mentioned, at least increases incurred over a 12 month or greater period) are taxed at 15%, it’s hardly fair to argue they increase the 35% tax rate, they are considered separate income. I suggest you take more CLE classes on tax law.

Finally, please show me where you have argued, as Feldstein has, that the concern is with the cost to GDP, not to revenue. The only argument I see that you have made concerns the net effect on government revenues. It’s nearly impossible to argue against a moving target on the comment section of a blog post.

OK ASSHOLE. Since you’re going to BE an ASSHOLE, I’m going to CALL you out as an ASSHOLE.

Yes, I realize that corporate taxes are on profits and not revenue. In this instance, they’re not necessarily different things depending on the type of corporation, the particular business structures and the particular tax position of the company in question. The more important fact is that increasing real taxes on a corporation by 100K would actually result in reduction of expenditures of MORE than 100K because that money has to come from SOMEWHERE. Either that means that the corporation has to generate the cash by selling assets, or it has to cut expenditures. A corporation doesn’t simply have more money because the government says “you must give us more.”

As for the Laffer Curve, EVERYBODY is guessing. You said tax policy and economic experts. Every one of the people on there, columnist or not, IS an expert in the field of either tax policy or economics.

And, ASSHOLE, as for the quotes, they’re properly attributed to the person who SAID them. For the purposes of THIS discussion, the notation of who said them is sufficient. This isn’t an academic paper, and I’m not claiming credit for interviewing these individuals personally, nor for these being my own thoughts. Would it have been nice for me to say, these happen to be from a WaPo piece? Sure. Is it necessary for the purposes of THIS discussion? NO.

Your ASSHOLE Ad hominem and collateral attacks are REALLY getting old.

As for taxation of the government and money reintroduced to the economy, the spending of the government, IN LARGE PART does not create any tangible benefit, neither creating a good or service, nor creating wealth by reinvesting. IN LARGE PART the money goes to “administration” (policy writers, analysts, enforcement officers, administrative systems) to create policies that usually HINDER GDP growth in favor of some other “value” (environmental conservation, social order, etc…). The only ones that I can think of right now that are Constitutionally mandated are National Defense, regulation of commerce, promoting Progress of Science and useful Arts, and constituting Tribunals inferior to the Supreme Court.

And apparently you haven’t been PAYING ATTENTION throughout this ENTIRE argument: What I’ve been arguing for is SEVERELY LIMITING SPENDING OF THE GOVERNMENT. I have not ONCE argued for a system where the government CAN’T tax. I’ve argued that taxes are too HIGH, that the taxing distribution is too SKEWED AGAINST HIGH INCOME EARNERS and that we’re spending money on the WRONG THINGS, but never that the government should not be allowed to tax at all.

As for WHY everybody uses percentage of GDP as a substitute for real tax rates, it’s because it MAKES THE MATH REASONABLY EASY. It’s a hold-over from the past when we didn’t have computers that could crunch the numbers. Treasury HAS the information to generate what the true distribution of tax rates is (and I would LOVE to see it as a bell-curve chart, both total and subdivided into quintiles and smaller sub-groupings). Generating it would be simple. Take total tax payment divided by total income and then do a count function of how often a particular percentage occurs. It will NEVER happen though, because if it were shown, the public would rebel at the enormous weighting of the distribution toward the top 10%, and anyone NOT advocating for flattening the tax system would likely be tarred and feathered.

Again, ASSHOLE, with the discussion of Corporate Stocks, you weren’t paying attention to my argument. Corporate Profits are TAXED TWICE. Once at the Corporate level when the corporation earns the profits, and then once at the PERSONAL level when the income is distributed. And, as you so astutely pointed out, if you hold the investment vehicle (the stock) for less than 12 months, YOU PAY ORDINARY INCOME RATES. That means (drum roll please) you have to ADD the prior payment by the corporation to the individual payment to determine the total taxation of the corporate profit paid to the individual. Is it ALWAYS going to be 35%+? No. Is it ALWAYS going to be 15%+? Again, no. However, if the new proposals go into effect for “carried interest” then the total tax rate for those individuals making their income from carrying the share of a partnership transacting in stocks might be up to 70% of the total income generated. (35% Corporate rate paid by the corporation, followed by 35% Individual rate paid by the person).

The ENTIRE point of Cut, Cap and Balance, from the beginning, is that the government largess is a drag upon the economy. That the government being so large, and eating up such a large percentage of personal income (or, if you prefer, GDP), PREVENTS the economy from growing. I actually don’t CARE about government revenues, so long as government SPENDING is, for the most part, kept within those government revenues. Does that mean that Congress can NEVER go into debt? No. But neither does it mean that Congress should be allowed to simply add debt upon debt upon debt. Congress, like everybody else, has to learn to PRIORITIZE. Something SOMEWHERE has to give. Raising taxes WON’T do what the professed claim is (reducing debt), so the ONLY way left is to reduce spending, and if the Congress isn’t going to be disciplined, then they need an outside constraint IMPOSED upon them.

Finally, I’m through. You’ve pissed me off enough that I’m not coming back to this thread. If you want to consider that a “win” for your argument, go ahead. It doesn’t make you any less of an ASSHOLE.

I don’t ask for much from commenters, but I would appreciate people not calling each other “A–holes”.

“I agree with the idea of a balanced budget amendment, but to suggest it is the will of the majority is just insane.”

Well, according to a Mason-Dixon poll, 65% of those polled support a balanced budget amendment while only 27% don’t. I think 65 is greater than 27 making it a solid majority that you seem to think are insane.

Sorry, I meant super-majority, considering that, plus 3/4th’s of the states, is what is required to pass an amendment.

Also, I said the people claiming it is the will of the majority (meant super-majority, but nonetheless) are insane, not people that support a balanced budget amendment. I’ve told you before and I’ll tell you again, don’t put words in my mouth and try to argue against statements I haven’t made, particularly considering you quoted me in your post, so I know you read what I wrote.

Awning1, if you don’t thnk the Democrats are expoliting this issue, then explain why they are not even willing to let the Boehner bill come up for a vote. Explain to me where Obama’s plan is that he promised was “all down on paper” said at a presser he would give it to reporters and when the reporters asked Jay Carney for it yesterday (since it has never materialized) Carney rebuked them for even asking about it.

Oh, yes, the Democrats are getting something for their efforts. They are getting to continue raising the debt limit, continue their welfare programs (notice, they never talk about cutting welfare, only Social Security), they get to play benevolent uncle providing for all those Americans who are not willing to provide for themselves. And they get to continue with Cloward and Piven. If you think the Democrats are doing such a bang up job, why is Obama’s approval rating now down to 40%?

Funny how we were rocking along, with the DJIA at a healty rate, unemployment at approx. 5% and then the Democrats took over in 2007 and look where we are now.

Talk about idiots: Paul Tonko (D-NY) just told Greta that gas prices are high because of the tsunami.

Let’s see: Bush had two major hurricanes that shut down gulf drilling, wiped Mississippi towns off the map and destroyed New Orleans, a major tsunami and what were gas prices when he left office?

Tonko also says that Obama hasn’t been able to do anything about the economy he “inherited.” Obama didn’t inherit anything. He spent almost a billion bucks to get the job.

What liars.

Wait till the Senate sends over their utterly reasonable (per the press) “compromise” at the very last minute which includes exactly 2% of the Boehner plan intact, and the House fails to pass it immediately without question. All previous House work will be instantly forgotten by the press and republicans will be painted as devil obstructionists who won’t do anything as the economy is about to burst into flames.

The narrative has been set for weeks, facts will not interfere. We keep expecting the press to report honestly, as if some new additional facts will open their eyes and tickle their consciences. It won’t. See Operation Fast and Furious or the New Black Panther case.

Luckily, the public wants spending cut, and even if we go past August 2 for a few days (even a couple of weeks) the world won’t explode, and people will notice that. This whole thing has been an attempt by a White House that knows the economy is heading back into the crapper to hang the blame on the GOP, or failing at that, get them to buy into the failure. Its purpose is 1) give the president someone to blame come November 2012 and 2) limit the triage necessary for Senate democrats (they will lose the Senate, this is about just how badly they lose it).

I meant to include that the last minute plan was tipped this tonight as Reid refused McConnell’s offer to waive the 2 day time wait period.

An ancillary to all of this has been a hail Mary hope that it might prompt a third party push among TEA partiers, or at a minimum, create a split between them and republicans, and within the caucus itself. The likeliness of the outcome, or lack thereof, really, doesn’t make it worth not trying, since a highly motivated TEA party united behind the GOP all but guarantees Obama’s defeat and a staggering loss in the Senate.

Reid can not get enough votes to pass his bill on a motion of cloture. The reports are that Reid will therefore table his own bill.

(How the media will report this should be interesting, because the lack of understanding by the press of the process in the House and Senate is striking.)

The House has scheduled a vote for Reid’s bill at 1:00 pm tomorrow afternoon. This vote will likely be cancelled if Reid’s motion to table his own bill is passed.

So, that means we are in a stand-off situation.

At this juncture, if I were Speaker Boehner and Senator McConnell the message is very simple, the House has passed two bills. Explain that the second bill is based on a compromise negotiated with Reid, and say, we expect the Senate to revisit one or the other of these bills and act.

Then stop talking.

The Democrats and the President will complain, moan, piss and whine, etc.

Republican response – Pass – either CCB or Boehner 3.0 – as is, and resolve the crisis.

We shall see.

Sadly, this all reminds me of negotiating dinner out plans with my now ex-wife.

Want to go to dinner?

Sure.

Where?

I don’t care, you pick.

How about A, B or C?

None of those.

What about J, K or L?

No,

You do want to eat out, don’t you?

Sure, but none of those places.

Where do you want to go?

I don’t care, you pick.

I now go out by myself.

The Republicans absolutely need to let the Democrats explain their budget and their plans to borrow. Borrowing would be easier to justify if we knew what the money was budgeted for.

The Republic is safe. Democrats’ brutality and Republicans’ forbearance undo the former and multiply the latter. Beyond that, what retire05 says.

All the democrats want is to extend this crap past the 2012 election to re-elect Obama. They know that the republicans are willing to extend it for 6 months and no longer, so they make the republicans look like the bad guys by saying that we are cutting spending and not raising taxes. The republicans must explain that the debt ceiling is almost always raised for just a couple of months. If they can’t do that, they will lose and really screw our Country.

I’ve said it before and I’ll say it again: Boehner and McConnell are the WRONG “LEADERS”. We need people with brains and balls and who is not “establishment”.

It Amazes and Baffles Me

“A week ago, the United States House of Representatives sent a bipartisan measure to the United States Senate where it fell five votes short of a majority.

Today, John Boehner sent over legislation that couldn’t even get all the Republicans to support it, didn’t get any Democrats to support it, and will get less support in the Senate than last week’s plan.

And now the Democrats have a talking point they didn’t have with last week’s plan — that this plan is not bipartisan and also that Boehner had to appease the far right, all of which was lined up behind last weeks plan in even greater numbers.

Adding horror and humor upon humor and horror, now Boehner syncophants are telling the Democrats that they’ve got to do something since the GOP has finally done something.

Were these people asleep last week when the GOP did something with Democratic help?

Oh, and some of the same people on our side who’ve been pooh-poohing those of us who said to stick with Cut, Cap, and Balance, suddenly, after the Boehner vote, are lamenting that something wicked this way comes.

Lord, please give me smarter enemies within my own tent.”

Erick Erickson, Red State

Professor, you say:

The House also passed “Cut, Cap & Balance” and the Senate killed both bills by tabling them. The political reality is that Harry Reid is completely boxed in a corner.

He is desperately trying to force Boehner to pass a “clean” extension — one that dopes not require cuts in spending.

But Boehner can and should now say, as I noted elsewhere on this site:

I love the “nomoreblankchecks.com” ad with Claire’s picture right under the post. That’s priceless!

Claire will not be re-elected. EPIC FAIL!