Sen. Adam Schiff’s 2023 Maryland Home Controversy Comes Back to Haunt Him

NO ONE IS ABOVE THE LAW: A senior administration official said that the Federal Housing Finance Agency sent a criminal referral to the DOJ requesting further investigation into Schiff’s mortgage status.

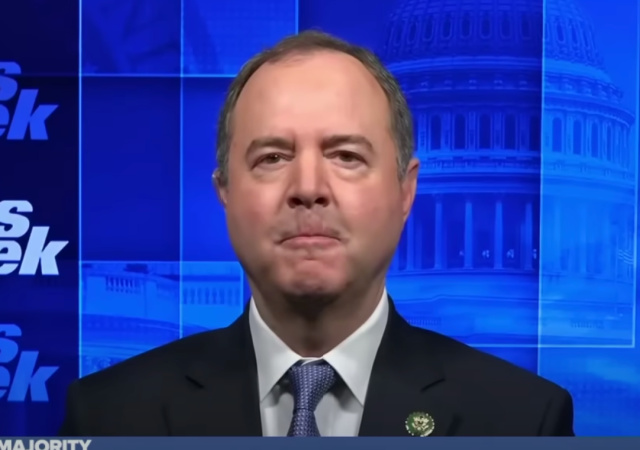

Back in 2023, there were reports that then-Rep. Adam Schiff (D-CA), who was the frontrunner in the California Democratic Senate primary against Reps. Katie Porter and Barbara Lee, faced some scrutiny over his true primary residence.

An insider revealed that Schiff is “rarely at his California apartment,” a modest one-bedroom, one-bathroom unit. This information fueled speculation about his primary residence and his ability to truly represent the Golden State. Specifically, the following details were provided:

Deed records reveal that Schiff designated his Maryland property as his primary residence in 2003 when he purchased it for $870,000.

In 2009, 2010, 2011, and 2012, Schiff refinanced his mortgage and consistently indicated the Maryland property as his primary residence.

Los Angeles County deed records for Schiff’s Burbank condo, purchased in 2009 for $298,000, raise eyebrows as they were notarized in Maryland.

The records feature alterations that replaced “California” and “Los Angeles” with “Maryland” and “Montgomery County,” listing Schiff’s Maryland address as the return address. This inconsistency further fuels doubts about his true primary residence.

Now, following a social media message from President Donald Trump, news reports indicate that the Federal Housing Finance Agency (FHFA) — which regulates Fannie Mae — sent a criminal referral to the U.S. Department of Justice (DOJ) concerning mortgage fraud allegations involving Schiff.

Trump, in a Truth Social post, labeled Schiff a “scam artist” and claimed he obtained a mortgage for a residence in Maryland in 2009 but only designated it as a second home in 2020 as part of a ruse to snag better rates and terms from the company, which has been in federal conservatorship since the 2008 financial crisis.

The president said Fannie Mae’s Financial Crimes Division had uncovered the alleged fraud. Schiff obtained the Maryland property in 2009 while he was a congressman and became a senator in January.

Schiff called the accusations “baseless.”

HOLY SHLIT

“Fannie Mae’s Financial Crimes Division have concluded that Adam Schiff engaged in a sustained pattern of possible mortgage fraud” pic.twitter.com/Z5prRUVQ91

— Libs of TikTok (@libsoftiktok) July 15, 2025

According to the New York Post, a senior administration official said that FHFA sent the criminal referral to the DOJ requesting further investigation.

“It is extremely serious and [Schiff] is not taking it seriously,” said that official — who added that the senator could face a criminal count for each time he paid his monthly mortgage bill.

Trump told reporters on the White House lawn Tuesday that “I would have thought he covered his bases a little bit better than that. Adam Schiff is a low-life, he deserves what he gets.”

Schiff is a former House intelligence committee chairman whose unproven claims about Trump’s ties to Russia enraged Republicans and led to his censure. He also served as chief manager in Trump’s 2020 Senate impeachment trial for pressuring Ukraine to investigate alleged Biden family corruption.

We will keep tabs on the developments. Meanwhile, it’s time to break out the “no one is above the law” retro-tweets.

As Schiff himself has pointed out, no one is above the law. Adam Schiff needs to be prosecuted for his crimes. pic.twitter.com/5H98QePyZq

— LifeLong Patriot (@LL_PATRIOT) July 15, 2025

Donations tax deductible

to the full extent allowed by law.

Comments

It seems that mortgage fraud is quite popular among Trump’s enemies…

The fact that he is now a pencil necked Senator means that it didn’t hurt him nearly enough.

As opposed to a blubber-necked congressman like Jerry Nadler.

Nail his scrawny lying ass. Puhleeeezeeeee,

Wouldn’t hold my breath with Blondie running things

What about the statute of limitations??

How about we dispense with that issue by claiming his misrepresentations were made in conjunction with the commission of a felony, the exact nature of which we are unable to articulate?

Make them live up to the rules, and when they weasel, throw the book at them good and hard. No more play nice with them.

“…the senator could face a criminal count for each time he paid his monthly mortgage bill.”

This. Please make it so.

Sound familiar?

What’s good for the goose is good for the gander, yes?

Hey — TJV is an expert at “counting felonies” — perhaps he could tell us how many felonies this adds up to?

Oops. I suspect Schiff isn’t the only political figure elected to Congress who effectively abandoned actual residence in the State/CD which elected them. While you don’t have to reside IN the CD to be elected to the HoR you do have to reside in the State just like the Senate. Wonder how many other longtime DC politicians are busily reworking mortgages this week? Kinda like when it was revealed that Clinton nominee hadn’t paid SSA taxes for her housekeeper or nanny or whatever. Anecdotally, I recall a rash of folks hastily getting things squared away on that front.

Note that you only have to be a resident of the state on election day. If you’re not expecting to run for reelection in two years, you can move out of the state the day after the election, and still take up your seat in January. A senator-elect could even move out with the intent of returning in five years so as to seek another term.

Which makes mortgage important evidence. If the mortgage was approved based on ‘owner occupied primary residence’ it would seem to indicate the individual submitting the mortgage application was a resident in the jurisdiction where the home is located. One could submit supplemental info informing the lender of a change in primary residence but if not then there’s an inconsistency between elections filing forms and mortgage.

There is such a thing as a dual resident. You can be a resident of two states, and owe taxes in both. You can only vote in one of them, but as I understand it you can pick either one.

Umm. I live in one state and own a house in another state. My official state of residence was determined by my car insurance company, based on where my car is garaged on the majority of days.

From this, I must have a drivers license in the same state, and auto tags. And from this, voter registration.

Nope you can’t legally be a simultaneous resident of two different States or even two different Counties within a State. You can only be a legal resident in one jurisdiction at a time. Doesn’t matter if you own property or rent. In a situation were you have a home in City and a second home in the Countryside you are a ‘resident’ of whichever is the ‘primary residence’. That is the location you spend the majority of time in ‘residing’. Any other locations ain’t the primary residence. It’s on a mostly honor system until a stink gets raised.

Lots of things are tied to this rule. Drivers License, most States REQUIRE application for a DL to reflect the address if you claim you are a resident after 30 days. Same for Vehicle registration. If you move from State A to State B then you are no longer a legal resident of State A. School zoning is another thing based on primary residence address. Same for voter registration. Didn’t update your physical address change then your registration is now invalid b/c it doesn’t reflect the correct address and precinct/district/CD assuming you didn’t move next door down.

Property tax and mortgage rates are the big ones. Can only have one primary residence to get the lower rate for owner occupied and any homestead exemption on property taxes or in some States the in state v out of State rate. See Tuition as another example.

When I was in El Paso my primary residence was in TX and I owned property in FL and NM. Paid Cray Cray high non owner occupied and non State resident property tax on the FL and NM properties. Same for federal income tax, the IRS wants to know what your State of residence is and local address to see whether the potential claims of SALT deduction would be valid.

I suspect there’s still a number of NY residents who buy property in FL and attempt to minimize taxes by claiming FL (no income tax) as primary residence but still live the majority of the year in NY. Used to be quite the common hustle not too long ago.

Bottom line is as long as Schiff fixed all the other things in his life that touched upon residing in CA for the day of the election he’s good. I suspect he didn’t correct his mortgage and that would demonstrate he believed he wasn’t a CA resident. It isn’t a minor technical issue when we’re discussing basic qualifications to become a candidate. He either was or was not a legal resident of CA on election day and his word isn’t enough to override other evidence to the contrary, assuming that evidence exists.

FWIW Alabama and some other States require a candidate who participates in a primary election to be a resident + be a registered voter on the day of the primary. Doesn’t impact qualification to run b/c one could get ballot access as an Indy.

Not true. How do I know? Because my spouse are married and live together in the house I own on the WA side of the Columbia River, but he is officially an Oregon resident in a condo that he owns there. I vote and register a compact SUV here. He votes there and the pickup truck I own and use here is registered there and titled in both our names.

If WA State wanted to be really tough (it would take a lot of effort — much more trouble than it would be worth), they could force that pickup to be registered in WA because it’s used mostly here. The reason we don’t do that is because to switch registration would entail a) a significant sales tax payment to Olympia, and b) higher license plate fees.

That’s a funky little glitch, but legal residence is not. You don’t “reside” in two places for legal purposes. You reside in one place. Where was Schiff’s legal residence when he was elected? Article I, Section 2 of the constitution says that it must be in California. He has consistently declared his “primary residence” to be in Maryland. This would seem to be something of a problem.

Professional athletes and performers quickly learn that every state in which they play or perform wants to tax a portion of their income. The Rolling Stones, for one, arrange between concert practices in locations to avoid income tax. For US tours, I hear they go to Canada.

If you make enough money (Rush Limbaugh), NY will do all it can to claim you as a resident. California is no different.

There is such a thing as dual residency. Look it up. It’s not common, and people usually try to avoid it because it costs more, but it exists.

Milhouse,

Let’s clarify. There is domicile which is usually

99% the same as residency and ‘residence’ is used interchangeably with ‘domicile’ in common parlance b/c 99% of the time it is effectively the same thing.

Then there’s being considered a resident for income taxation by a second State. This is where a taxpayer earns income in two States. Depending on the tax laws of each State both State Gov’ts may claim some or all of the annual income earned in their State as taxable in their State. Of course some States don’t have an income tax which makes it moot.

Almost nobody would voluntarily seek out this scenario long term. In some States it can get complicated by length of continuous time within the State. A given State may say that 30 continuous days = they claim you as a taxpaying resident. Then you gotta comply with getting a DL and car registration in that State. Gotta pay State and local income tax.

Bottom line is an individual doesn’t really have an ‘option’ b/c the State Statutes determine whether you are considered to be a ‘resident’ based on applying the statute to the circumstances. Voting is based on ‘domicile’ aka primary residence; physical address where you routinely spend the majority of your time. No way a person gets to say I own homes in two States, spend 200 days in A and 165 days in B then get to choose which I vote in. The address where you have a DL and where you claim homestead and where your mortgage is on a primary owner occupied residence IS the domicile and thus the State of residency.

No, generally you can only have one primary residence (often times referred to as domicile, depending on the context). For example, you are a resident of a state, and stay a resident of that state until you establish a residence in a different state. Most of that is intent based, but subject intent is demonstrated via objective facts.

A few jurisdictions invoke the concept of “statutory residence” for tax purposes (New York being one). If you spend more than 183 days in NY, you are considered a “statutory resident” and subject to tax in NY as if you are a resident. That designation applies even if you maintain residence/domicile in different state (sorta the worst of all worlds).

In some situations, the facts a messy enough that you can pick which state you want to be treated as a resident of, but even then, you have to pick one.

You can only have ONE PRIMARY RESIDENCE! The question and EVIDENCE is that he claimed MD as his principal Residence for MORTGAGE FRAUD and the CA residence as his principal Residence for Election Fraud! Now you’ve stated you don’t have to be a RESIDENT except on Election DAY so if that is true then THAT is the most absurd law ever enacted! WHO do you REPRESENT other than the people who elected you?

yes!!!

Payback’s a . . . Hillary

Somehow, nothing will happen to him. Just a guess, and I really hope I’m wrong.

No, you’re not wrong. democrats are never held accountable for their illegal acts and actions. Never. Yeah, they’ll be a lot of republican howls of outrage and yah yah yah about Schiff and his mortgage situation but in the end all we’ll get is crickets chirping in the wind until the next Big Thing™ comes around and then lather, rinse, repeat. But actually hold a democrat responsible? Yeah, just ain’t gonna happen.

WTFF?

Why the hell would someone refinance their house every year?? It’s not as if it’s a frictionless action. There are points and fees … and even with falling rates (and assuming a fixed rate mortgage) it doesn’t make sense … unless there’s some other funny business going on …

The first thing I’d look for is appraisal fraud….it was rampant during that time period with cash-out refi’s.

The lying little prick was probably living paycheck to paycheck, but he’s struck the grifting mother-lode now that he’s a senator.

Biden did the same thing.

He refinanced his home multiple times, apparently without regard to interest rate fluctuation if the timing is considered.

My theory (only a theory) is that during the refinance process, some LLC of Hunter’s would wire money to the escrow account of the transaction and pay down the existing mortgage, thus making the new loan result in a large cash infusion to Biden.

He apparently netted more than $4,000,000 from refinances on a home originally purchased for $350,000, as a result of at least 20 (maybe as many as 32) refinances.

https://nypost.com/2024/06/25/real-estate/joe-and-jill-biden-refinanced-their-delaware-home-20-times/

I think the standard has been established:

Every stroke of the pen and every strike of a key on the computer and every conscious action (every lick of an envelope to seal it and every crease of a paper) to carry out this fraud constitutes a separate crime.

Let’s call it the Trump Effect.

I believe there are two idiots in New York who brought bogus charges against one of their most prominent developers, and now the unleashed alligator is biting liberals in the ash.

I posted way back then that the DEMOcrats/HYPOCRITES were establishing PRECEDENTS that would later bite them in their butts!! It’s CHOW TIME now!! Let’s see how many COUNTS of FRAUD that Schiff for brains gets hit with! How about Letitia and her “Husband/Daddy”? Will EACH check or payment be a SEPARATE charge? PRECEDENT says it is!! We should be consistent with charging for each incident of FRAUD just like they did with the bogus crap against PRESIDENT TRUMP! Oh, and can the bidens be investigated to make sure THEIR valuations were HONEST at each refi???

How Schiff can say the charge is baseless when he said the Maryland home was his primary residence for purposes of a mortgage in multiple years is a little confusing. Either it is or it isn’t and if he did it to get a lower rate then that is fraud.

I wonder how many politicians in DC have done this.

Schiff is married with 2 kids. As far as I can tell they would have been something like 6 and 11 (?) in 2009. It’s not difficult to see where they went to school (Maryland, it appears) which would mean that their primary residence was there. Obviously, a family of four was not living in the 1 bedroom apartment Schiff holds to claim his Cali residency (though a family of 30 illegals could easily live there … but that’s beside the point) so Schiff is claiming that he lived apart from his family for all those years. Not unusual … but most in Congress would leave the family in their actual home state and just work in Washington (renting a place, say).

I guess the real question is what his IRS records say and what sort of fancy cheating he was doing on his taxes – and we ALL know that he was cheating on his taxes like crazy – because that’s the sort of person he is.

Simples.

Just keep saying “we’ve got absolute proof that Schiff committed fraud” repeatedly in the media.

Doesn’t matter if this proof never actually turns up or appears to have been invented out of thin air.

Hey presto, guilty.

It’s (D)ifferent when they (D)o it.

In 2003, 870k would get you a ritzy house. Did the Russians provide him with the downpayment?

This is going on at every level of government from local to federal. I would love for them to actually do a deep dive on how many people in total are doing this. I know that program is in peril and has been for a long time. These people are the opposite of Robinhood. They are stealing from the poor to make themselves fat pig rich.

After all the mortgage fraud in the lead up to 2008 Congress passed a law that required mortgage paperwork contain a single sheet sign off about mortgage fraud. By signing that it stated that you did not lie about any circumstance concerning your mortgage application. The header had the FBI logo and the penalties for lying. This is the item that if prosecuted will sink Schiff for brains and Leticia James. It’s not a mistake you can rectify by paying taxes. It’s a violation of the Federal law.

Regardless of the election requirements, sounds like he committed fraud to get a better rate.

Funny how the tables being turned the slime complains about this of being political.

Lock his sorry ass up. Send him to Alligator Alcatraz so he can spend his sentence serving his country by keeping an eye on the situation there.

This bulb-headed lying stooge is the “Maryland Man” who really needs to be shiffed off to a Salvadoran super-max.

The investigators should start with, if they haven’t already, the person who actually took the mortgage application from Schiff. Or did Schiff apply online? Same with James. The questions pertaining to residency starts with the original mortgage application. Forms are signed by the borrowers that state their intent to occupy the property as a primary residence, investment property or second home. anything other than a primary residence would incur a higher interest rate.