Harris Announces ‘Economic’ Plan: Price Controls, $25K for First Generation Homeowners, $6K Newborn Tax Credit

*rubbing temples so hard my nails are digging into the skin*

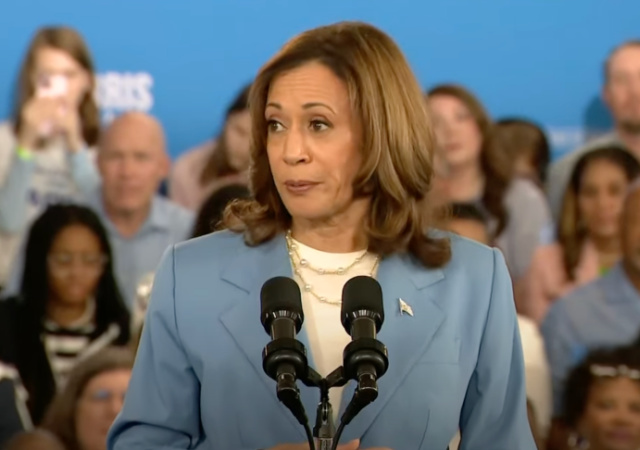

Presumptive Democratic presidential candidate Vice President Kamala Harris announced her socialist economic plan during a rally in Raleigh, NC.

Harris’s press team emailed the proposals, but to the shock of no one, it contained vague details.

Well, Harris didn’t provide any details during her speech. Not shocking.

I’m basically copying and pasting from the email. My comments are in bold.

Housing

- $40 billion innovation fund to spur housing construction (This is to FIND SOLUTIONS…WTAF?!)

- Tax incentive to build starter homes (What qualifies as a starter home?! Also, stop inflating demand! You’ll end up with too much supply!)

- Expand tax incentive for businesses that build affordable rental housing (Again, stop inflating demand! You’ll end up with too much supply!)

- Cut red tape and needless bureaucracy (I laughed way too hard when I read this.)

- $25,000 for first-generation homeowners (House prices just went up!)

- $10,000 tax credit for first-time home buyers (Another way to repeat 2008!)

- Demand construction of 3 million new housing units (Remember what I said when you interfere with supply and demand!)

Medicine

- Cut insulin prices to $35 for everyone (Trump did it for Medicare seniors)

- Cut out-of-pocket expenses for prescription drugs at $2,000 (Stop with price controls!)

- Accelerate the speed of Medicare negotiations over prescription drugs

- Increase competition and demand transparency in the health care industry, starting by cracking down on pharmaceutical companies who block competition and abusive practices by pharmaceutical middlemen who squeeze small pharmacies’ profits and raise costs for consumers. (You increase competition by getting the government out of the market!)

- Cancel medical debt (For crying out loud…)

Grocery Stores

- Lower prices through

socialismprice control (Reminder about supply and demand!) - Set clear rules of the road to make clear that big corporations can’t unfairly exploit consumers (That sentence gave me a headache. Again, get out of the market to open competition. The consumer (should) determine the price of a product or service.)

- Secure new authority for the FTC and state attorneys general to investigate and impose strict new penalties

Taxes

- Cut Taxes for Middle-Class Families with Kids: $3,600 per child tax credit for middle class and the most hard-pressed working families with children. (Define middle-class lady because quite a few people I know are “middle class,” and they don’t get crap.)

- A New $6,000 Child Tax Credit for Families with Children in the First Year of Life (Only for middle-income and low-income…no idea what amount qualifies for those categories.)

- Cut Taxes for Frontline Workers: “They will expand the Earned Income Tax Credit to cover individuals and couples in lower-income jobs who aren’t raising a child in their home, cutting their taxes by up to $1,500.” (Um, who qualifies as a frontline worker??)

- Cut Taxes To Help Americans Afford Health Insurance on the Affordable Care Act Marketplace, saving an average of $700 on their health insurance premiums, totaling over $6,000 per year in savings the Affordable Care Act is providing. (Huh?!!?)

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

Has she seen the national debt? This spending crap is very inflationary too

Yesterday.

“What’s the asking price for this house?”

“$325,000”

Today,

“What’s the asking price for this house?”

“$350,000”

Exactly. Consumer subsidies do not benefit consumers. They always benefit producers, who raise prices to consume the subsidy. If you are not eligible for a subsidy you’re doubly screwed.

The national debt problem is easily solved, all she has to do is just cancel it like JB is doing with the college loans.

As a young adult, I used to think “Who the hell do we owe all this money too? Just stiff ’em. They’ll never go against the US Military!”

Then I grew up and now think, “Who was I kidding? I wouldn’t trust the US Military to properly load a potato gun!”

Also notice there is nothing in those “tax credits” and money giveaways that saying anything about being restricted to American Citizens.

Actually, their intention with this is to destroy any nice suburbs by forcing them to take in tons of low income and welfare recipients. Barky was very big on this, trying to force suburbs to have their zoning laws changed (by force from the feds, if needed) in order to allow high density housing and ghetto districts in all of the nice places people like to make money in order to escape to.

No problem. As long as majorly affluent areas start first. Martha’s Vineyard, The Hamptons, West Hollywood, etc….

This probably sounds impressive to people who don’t understand what it means (like me). Bring down prices and cut taxes; although I don’t know how.

Does that apply to children born alive from botched partial birth abortions (that leftists LOVE!!!) before the ghouls let them die on a shelf??

Is there a $3,000 Child Tax Credit for an aborted baby? (I would love to hear someone ask leftists this question – over and over and over – just to hear them try to answer it)

Are you suggesting that Planned Parenthood would be completing both the victim’s birth and death certificates?

If you’re willing to murder babies and sell them, what’s a little paperwork?

While gruesome as hell, you’re not wrong….

b/c the rinos refuse(d) to be fiscal conservatives the lefty agenda has thrived

no negotiating with economic terrorists aka the dnc aka socialist >>communist loving garbage

forcing companies to do anything will result in more shortages of products

which will lead to higher prices

which will lead to higher subsidies

be it trump or leftists

My economic plan – End all foreign aid, we can’t afford it. Delete federal agencies in their entirety until we have an annual expenditure under the 1900 budget. Cut taxes across the board. Auction federally held land not used as a military base as of 2000 to US Citizens, with the funds immediately paying down the debt.

If we reach a point where there is a surplus, it must be refunded directly to the taxpayers proportional to the net amount paid in.

Kommie-La Harris economic plan:

“It’s not that I want to punish your success …“

We’re lucky she didn’t call us “Comrades”

Yes she does

Just in case anyone wanted to question how much of a communist she is.

If people thought inflation was bad, wait until they get to experience those Soviet style empty grocery store shelves. I hope she at least gets us some vodka.

Screw that. I brew my own mead and wine. And soon I’ll be using the still my wife bought me for my birthday to start producing Barenjager!

Sorry comrade, only state licensed brewing allowed.

When non-state licensed breweries are outlawed, I become an Outlaw…. And I’ve got enough M995 and M855 to make my displeasure known ifwhen they come calling.

I’m always curious about who benefits from these schemes. I made too much to get any of the three covid checks, but I had to laugh when phonies I knew driving Land Rovers and going on fancy ski vacations mentioned their covid windfalls.

Actually, the best economic plan a president could espouse would be to look at the one Harris has proposed and do the exact opposite.

Taking a chainsaw to the bloated leviathan that is our federal government is the answer. Close entire departments and return authority to the states. Fire tens of thousands of useless employees. Remove the government’s ability to tax our income.

And certainly keep this drunk moron away from the White House. She’ll get us all killed.

We don’t need to remove the government’s ability to tax income, we just need to return to the traditional (and legal) meaning of the word “income”.

Income is, essentially, money gained from nothing. You buy a stock, the stock goes up, you sell the stock, The difference between what you bought it for and what you sold it for is “income”. Or, you own some land, you sell some of that land, the difference between what you bought it for and what you sold it for is “income”.

Income is NOT trading your time & skills for dollars. That’s a barter system that just uses dollars as the barter medium. You make widgets, but you need a sprocket. You don’t know anyone who makes sprockets that also needs a widget. So, you barter the cost of a widget to a whatchamathing maker (that you don’t need) for $X dollars. Then you go find a sprocket maker who will accept $X dollars for said sprocket. He goes on to find and barter the $$ for what he needs. It’s just a barter system. In the end, the whatchamathing maker, the sprocket maker, and the widget maker all have what they need.

That was never the definition of “income”.

And I know you didn’t mention the 16th amendment, but someone is bound to eventually, so let me point out now that the 16th was only needed to allow Congress to tax income derived from property, such as dividends, rent, and interest; there has never been any doubt about Congress’s power to tax income from working.

She’s wearing her almost $40,000 necklaces to lecture about economy.

https://ireneneuwirth.com/products/one-of-a-kind-pearl-gumball-link-necklace?variant=32254196547636

Can we revisit the fallout of how Biden moratoriums on housing during Covid?

And that sound you just heard was the American farmer (who’s already barely surviving) parking his tractor

This is socialism 101-who pays for it-the already overtaxed middle class? Remember Margaret Thatcher’s comments about how socialism allows governments to keep on printing money? This is a completely socialist agenda

She passed socialism and went straight to communist price controls.

Flopping, dissembling, but the same fake enthusiasm persists.

hi

Im kamala harris and Im stupid as sh

but Im a box checking misandrist who will lead america to its

female prominence

and I might get to f justin trudont

Not surprising, a crappy speech, filled with lies and clapping seals.

This looks like a wish list dreamed up by economically illiterate d/prog to directly appeal to members of the Millennial gen and gen Z and boomer/gen X socialists.

Where’s the cost estimate? Guess we won’t worry about that little detail nor the actual real world impact as markets respond to disincentives.

And no mention of her crippling capital gains and corporate tax rates. And taxing unrealized gain, won’t that be fun. And prosperity inducing. And what she would do to the energy infrastructure should be censored as obscene.

Yeah this ‘plan’ is flipping asinine. It has zero relationship to any economic reality. Unfortunately there are those who will lap it up.

If you believe you can be a woman just because you say you are, why wouldn’t you believe that you could become rich just because Kamala says you will?

That is really the craziest, most lunatic idea anyone ever proposed in public. It is amazing where these commies want to go. The fact that they haven’t been laughed off of the public stage is a chilling commentary on how sick our society is.

Is anyone else offended that many of the provisions are an attempt to bribe us with our own money?

Not Democrats. That’s SOP for Democrats.

Quote of the whole speech

We will let you keep money you earned

But only if you like your money.

“price controls” the 1970s are back almost.

The 70s. Great cop movies. Crappy economy.

The supermarket business has pre-tax bottom line of under 2% – Kroger and Albertsons are examples. It is a very tough, competitive business. By contrast, Apple’s pre-tax bottom line is 31%. If you vote for a government of politicians who never ran a business (Biden & Harris) or academics (Yellen), this is what you get.

I may be moving houses in the near future. I wouldn’t qualify for a 25k gift from the government to defray the cost of the new house. Therefore I hope to hold out for a 25 k increase in the house I’m selling “because hey, the government is going to pay that for you anyway. “

You should hold out for an additional $125,000. That $25k the government is giving them is just 20% of that $125k. Hell, I would.

I bought this house & property right before the housing market bubble in 2021 for $186,000 (we closed in March, offers started coming in by April). It was a few acres and a brand-new modular home. Basically, a Hobby Farm (which my wife and I are turning it into). Less than a month after closing, getting the keys, and moving in, we had an offer of $480,000 for it. Cash.

I’ll be honest, we considered it. But then we thought, “where the hell would we go? You can’t buy anything around here for less than $500k and we’re already 1.5-2 hours from my work.” So, we ignored the offers even as they climbed to almost $800k.

Anything within 2 hours of DFW that came close to our acreage was well over $1.5m.

She forgot to steal everything from the Kulaks and arrest the hoarders and wreckers

Ben Franklin’s famous retort to a question asked at the Constitutional Convention: ‘A Republic, if you can keep it.’

In 90-days, we’re going to find out if we get to keep it. Gird your loins.

The majority of voters don’t want it.

They want stronger kings and bigger handouts — bread and circuses.

Don’t it always seem to go /

That you don’t know what you got ’til it’s gone…

“Of all the things I’ve lost, I miss my mind the most.” – Ozzy Osbourne

Kamala Klaus.

Instead of ho-ho-ho its kackle-kackle-kackle

“A New $6,000 Child Tax Credit for Families with Children in the First Year of Life”

Double-down on the incentive for anchor babies!

Taxing and spending like mad — the only things the vile Dhimmi-crats excel at.

Well, I suppose they’re pretty good at fomenting racial strife, via dishonest and corrosive demagoguery, victimhood-mongering and incitement.

They have to know that this is economic poison but they know that women don’t know that, and they vote.

The real story: Washington post calls her proposals gimmicky.

https://www.washingtonpost.com/opinions/2024/08/16/harris-economy-plan-gimmicks/

What is a “first-generation” homeowner?

An illegal alien.

Gracias!

Apparently her solution for illegal immigration is to make the U.S. more like Venezuela.

That would do it. Imagine starving Americans crashing Venezuela’s borders.

I’d rather imagine strange fruit hanging from Washington, DC streetlamps.