Tim Walz’s Minnesota Economic Record is Depressing

Big government. Big spending. Big tax increases.

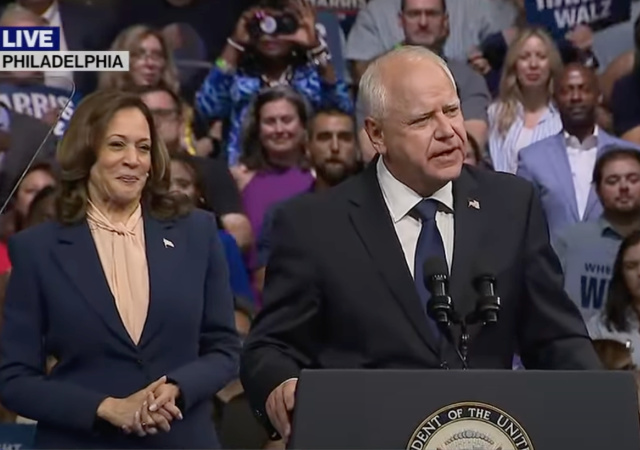

Let’s examine presumptive Democratic vice presidential candidate Minnesota Gov. Tim Walz’s economic record during his tenure.

Minnesota had “some business growth and retention victories.” Walz passed the highest state child tax cut, and the state has its lowest unemployment rate ever.

Walz vetoed the “legislation that set minimum pay rates for Uber and Lyft drivers and provided them greater protection against being fired.” He negotiated with the companies to keep them in the state.

The Mayo Clinic invested $5 billion to expand its Rochester medical campus.

Yeah, that’s where the positive news stops.

Taxes

“There are cases where businesses are expanding here and putting up new facilities, but by and large, we are seeing growth elsewhere and it’s partially because of our high-tax climate,” Doug Loon, chief executive of the Minnesota Chamber of Commerce, told The Wall Street Journal. “We are No. 1 right now in the corporate tax in the country.”

Well, um, Minnesota has a 9.8% corporate tax, making it the highest in the U.S.

So yeah, Loon, your state is #1 in corporate tax, but not in a good way.

In 2019, Walz wanted to increase taxes by $1.3 billion to pay for new $2 billion in spending. He had to compromise for $330 million in tax increases. He wanted high gas taxes and vehicle fees, but the legislation rejected both.

Walz proposed an 11.25% corporate tax in 2021. The GOP-controlled legislature said no. He also wanted to add “a new individual income tax rate of 10.85 percent above the top rate of 9.85 percent, a surtax on capital gains and dividends.”

Walz no longer had to compromise in 2023 when Democrats took over the legislature:

He signed HF 1938 raising taxes on businesses with foreign income, reducing the standard deduction for high earners, and imposing a new tax on investment income. At the same time, he handed out an array of low-income credits, a one-time rebate, and special-interest breaks for e‑bikes, green aviation fuel, film production, and other items.

The same year, Walz hit the middle class with HF 2887, which raised taxes and fees on vehicles and transportation. The increases included indexing the gas tax for inflation, increasing vehicle registration taxes, raising fees on retail deliveries, and raising sales taxes in the Twin Cities area.

The governor hit the middle class again in 2023 with a large tax hike to pay for a new paid leave program. The legislation imposed a 0.7 percent tax on wages to fund the program’s benefits, but then new legislation in 2024 increased the tax rate to 0.88 percent of wages. The tax will raise $1.2 billion the first year of operation and rising amounts after that.

Jobs

So, Minnesota has low unemployment. Great.

However, the state hasn’t grown much in population since 2020. The state’s GDP ranks 45th in the nation for real GDP growth.

That leads to low job growth:

The state’s job growth has also been significantly slower than the national average, according to Bureau of Labor Statistics data. Nonfarm payrolls have grown 1.4% since Walz became governor through June, compared with 5.7% for the U.S. overall.

“We are not improving our economic performance and are actually falling backward,” Loon said. “We are not competing well with other states and we are on the backside of most indexes, meaning we are not competing well around the country.”

Eric Gibson, chief executive of a Minneapolis sign-manufacturing and -installation company, voted for Walz in 2018 and 2022. He doesn’t know how he will vote in 2024.

Gibson supported Walz because he sounded pro-business, but his actions proved otherwise:

“I was very supportive of him when he first came in because he sounded very pro-business and said the right things,” he said. “But it has become much more expensive to do business in Minnesota since Walz has taken over.”

With his employees split roughly evenly between facilities in Minnesota and North Dakota, Gibson said those outside of Walz’s state are about $800 to $1,500 less expensive to employ per year per employee because of lower wages, taxes and regulations. “With 120 employees, that starts to add up quickly,” he said.

Walz’s support for indexing the state’s gas tax for inflation also bothered Gibson. “That makes it more expensive to do business in Minnesota,” he said.

Bill George, a former Medtronic chief executive, claimed businesses would sprout in Minnesota because people like living in the state:

“It does have a high tax base and that has contributed to strong educational systems, the arts, the environment and the quality of life,” said George, a Minnesotan who considers himself an independent voter and plans to vote for the Harris-Walz ticket.

“You can always talk to Tim, if there is an issue, and you can resolve things,” George said of his experience with the Minnesota governor.

Yeah, the data shows that quality of life outweighs all the taxes and regulations, George.

In fact, IRS data showed that Minnesota loses “about ten households earning more than $200,000 for every six that it gains, which is the fifth worst ratio among the states.”

Illinois will always be my home, and I miss it. I’ve been away since 1996, but leaving is never easier.

However, I love my money and freedom more.

Spending

The Cato Institute pointed out Walz’s insane spending, raising general fund spending by 36% from 2022-23 to 2024-25.

The 2024-25 budget proposal totals $65.2 billion, the largest in Minnesota’s history. It includes $8 billion in tax cuts. But, as we normies know, you cannot spend more than what you bring in.

(That was my main problem with Trump’s tax cuts. The administration didn’t cut enough spending.)

The proposal also includes “an increased capital gains tax and reducing the state’s tax on Social Security benefits for lower income beneficiaries, while keeping it in place for higher income households.”

Green Energy

Walz demanded Minnesota’s electric utilities move to carbon-free energy generation by 2023:

From there, the requirement would increase to 100% by 2040, with a requirement that 55% of all total retail electric sales be generated or procured from eligible energy sources by 2035.

A report by the Minnesota-based Center for the American Experiment criticized the proposal, saying it would cost $313 billion through 2050 and create capacity shortfalls in the electric grid that would result in blackouts because of output fluctuations from wind and solar energy sites.

COVID

Walz instilled some of the worst COVID restrictions in the country. He set up a hotline so people could snitch on their neighbors who violated any rules.

To make matters worse, Walz’s administration had no oversight concerning pandemic programs:

Minnesota Republicans criticized Walz’s administration for lax oversight of pandemic programs that cost millions of taxpayer dollars. Federal prosecutors charged 70 people for their role in a $250 million scheme to defraud federal food programs that funded meals for children during the pandemic.

Known as the Feeding Our Future scandal, it was one of the country’s largest pandemic aid fraud schemes. Minnesota’s Office of the Legislative Auditor, a nonpartisan watchdog, said in a June report that Walz’s Department of Education “failed to act on warning signs” and was ineffective in using its authority to respond to the fraud scheme.

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

With his record he’s the perfect running mate for the vacuous idiot. Two empty suits with no positive accomplishments between them

its allll fake money that has to REALLY be paid back by the middle class

go to the flat tax NO EXCEPTIONS system

nothing more fair and equitable than that!

Walz through tire fire smoke and lie about his military career.

Googly moogly, Jethro…he is our man!

forget about all that! joy!! joy!! joy!!

This entire article will have to be censored by the EU!!