Russia Throws Venezuela a Lifeline as the Socialist Country Flirts With Default

Restructure of debt saved Venezuela…this time.

I’m seeing conflicting reports: Venezuela defaulted, Venezuela didn’t default, Venezuela is about to default.

What’s the truth? Venezuela ALMOST defaulted, but Russia came in at the last second to restructure the $3 billion debt the socialist country owes Russia.

S&P Global Ratings said on Monday that Venezuela defaulted after it missed a debt payment. But that all changed on Wednesday. From The Wall Street Journal:

“Reducing the debt burden to the republic from the restructuring of liabilities will allow the funds that have been freed up to be allocated to the country’s economic development, to improve the liquidity of the debtor, and to increase the chances of all creditors to recoup credits provided to Venezuela,” the Russian finance ministry said in a statement.

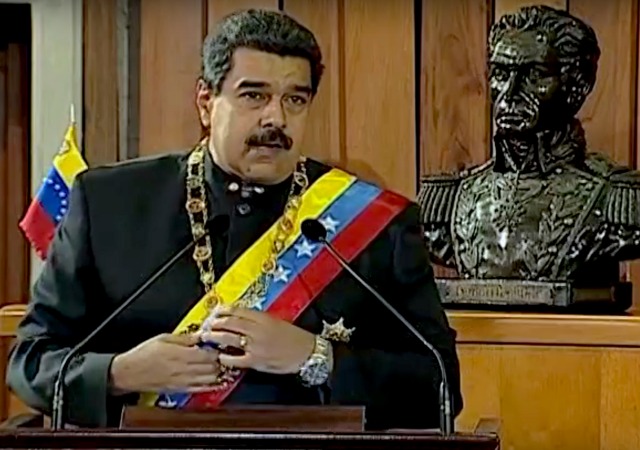

The agreement comes just as Venezuela’s cash-strapped government teeters on the edge of a default on some $150 billion in outstanding debt. Struggling with a crumbling state-led economic model, President Nicolás Maduro’s administration is seeking to renegotiate payment terms with its creditors in an effort to free up import dollars needed to resolve chronic shortages of food and medicine.

“Venezuela is advancing toward the recomposition of its external debt, to the benefit of its people,” Mr. Maduro’s top economic adviser, Simon Zerpa, said in a Twitter post, lauding the deal with Russia.

PdVSA, Venezuela’s state owned oil and natural gas company, claims “it made an interest payment on a bond that matures in 2027.” The government said it has also mailed the coupon payments for the 2019 and 2024 bonds.

Forbes reported that Venezuelan bond holders “received principal payments on PDVSA 2017s and 2020s” bonds. Another person said that on Sunday, Russia saved him “with support for his position in PDVSA 2020 bonds.”

These moves have saved Venezuela…for now. Forbes continued:

The Emerging Markets Trade Association — a group of emerging market specialist banks and traders — agreed on Wednesday to continue trading bonds with accrued interest instead of flat. Investmen firms trade bonds flat typically if bonds are in default, and trade bonds based on interest payments due if bonds are believed to be paid at some point. In other words, the market thinks Venezuela will service its debts, though risks remain.

At this point, bond holders have not agreed to call the bonds, nor accelerate, a term used in the market to mean that the key lenders to PDVSA and the sovereign have agreed to demand immediate payment of principal. That is the key thing to watch for. The rating agency downgrades and jumps in prices on Venezuela’s credit default swaps have not been accurate indicators to gauge a true Venezuela default.

IF Venezuela defaults (and I seriously doubt Russia would allow that to happen…then the Kremlin would lose control of the oil rich nation) it could cause even more problems in the socialist country that is already suffering a humanitarian crisis.

PdVSA is the ONLY lifeline left in Venezuela. The oil in the country is the one thing that has kept it afloat. If the country defaults then investors could “seize the country’s assets — primarily barrels of oil – outside its borders.”

Without this income, everything would go to the last level of Hell. As it is with the oil, Venezuela is broke and people have no access to food or proper medical treatment. Officials can blame U.S. sanctions all they want, but socialism caused this. From CNN Money:

It fixed — or froze — prices on everything from a cup of coffee to a tank of gas in an effort to make goods more affordable for the masses. For years, Venezuelan leaders also fixed the exchange rate for their currency, the bolivar.

Those moves were among the driving forces behind the food shortages. Farmers couldn’t sell at low prices without going out of business because their cost of production was much higher. Importers also couldn’t afford to ship in food, knowing they would have to sell at much lower prices than what they paid for at the port.

When food shortages grew worse, an illegal black market emerged where venders sold basic foods at vastly higher prices than the government’s artificially low prices. Inflation soared, making the bolivar almost worthless.

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

3 million ?

that’s chump change to these kleptocrats who don’t pay their bills and starve their people – where is Koobah ?

It’s 3 billion, not 3 million. An error by Legal Insurrection.

Still “chump” change…..just like Obama Chump Change….

So long as it’s Russian money and not American money I don’t care how much they throw at Venezuela.

I wonder how long the Russians are going to put up with not being paid while all of the money is going to the money-grubbing capitalists.

Someone in the Kremlin is going to figure out they’re being played for chumps.

Maduro certainly looks well-fed, doesn’t he.

Like Kim Jong-un!

Maybe he could pawn some of that bling to help out.

Remember the video of him addressing his people recently and he grabbed an empanada and ate it while his people don’t even have cake aka Marie Antoinette

I know. I thought it was a typo, 3 billion..

Mostly, the Russians bailed out JP Morgan and Goldman Sachs, both of whom were heavily invested in Venezuelan bonds. Collusion!

Sounds like good news for all the US companies that are owed money by Venezuela. There is a lot of litigation still in the works regarding Venezuela’s nationalization of US company assets.

With that outfit, Maduro should be on the next cover of GQ.

Might as well burn the money.

Happy to see Russia flush their money away like this.

China has been doing the same.

“Kremlin would lose control of the oil rich nation”

I just don’t see the benefit of this control you speak of. Venezuala as it is barely able to export oil.

Having a country in Latin America in your pocket is a significant potential benefit if you are a competitor of the US. Having the country with the largest proven oil reserves in the world in your pocket has great potential for the future. The S̶o̶v̶i̶, er Russians are thinking strategically, not tactically.

Just saw this yesterday….

U.S. to Dominate Oil Markets After Biggest Boom in World History Bloomberg | Nov 14, 2017 20:35

U.S. will dominate oil and gas after historic shale boom, IEA says – Oil prices likely to be stuck in $50-$70 range until 2040 Published: Nov 14, 2017 7:12 a.m. ET

https://www.marketwatch.com/story/us-will-dominate-oil-and-gas-by-2025-after-historic-shale-boom-iea-says-2017-11-14

Good luck to Russia and their V, they’re gonna need it as they drown in oil.

It’s past time to flood Venezuela with liberator pistols.