Will Tax Reform Hit the Same Road Bumps as Obamacare Repeal?

Obamacare repeat?

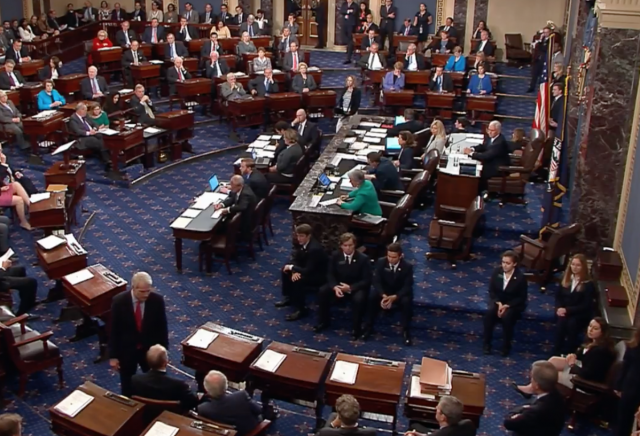

The House passed a 2018 budget resolution last week along with the Senate Budget Committee, two crucial steps to start tax reform. It’s an opportunity for President Donald Trump and the Republican lawmakers to hold a promise after they couldn’t repeal Obamacare.

The GOP has the majority, but just like with Obamacare, there are divisions within the party that could prevent tax reform from happening.

The top concern is to make sure that the middle class will not have to pay more in taxes.

Child Tax Credit

The child tax credit is one of the main things within the nine-page framework that has worried Republicans. From Bloomberg:

As one example, the lack of specifics on how much to raise the child tax credit by has led to “frustration” among GOP lawmakers, said Representative Chris Collins, a New York Republican and ally of President Donald Trump. The early concern previews the political arguments that will surround tax legislation as Congress focuses in on it.

Collins said more specifics about GOP plans to increase the child tax credit would make the benefit for middle-income families clearer. Instead, Republican lawmakers are fending off attacks that some middle-income families would be hurt because the plan calls for eliminating dependent exemptions and the state and local tax deduction.

“We are committed, the Republicans are committed — middle-income earners and even upper middle-income earners are not going to pay more in taxes, whether you live in Alabama, or whether you live in New York or New Jersey,” Collins said during a Bloomberg TV interview on Friday.

This is what the framework says:

To further simplify tax filing and provide tax relief for middle-income families, the framework repeals the personal exemptions and significantly increases the Child Tax Credit. The first $1,000 of the credit will be refundable as under current law.

In addition, the framework will increase the income levels at which the Child Tax Credit begins to phase out. The modified limits will make the credit available to more middle-income families and eliminate the marriage penalty in the existing credit.

The framework also provides a non-refundable credit of $500 for non-child dependents to help defray the cost of caring for other dependents.

Kyle Pomerleau of the Tax Foundation considered the vagueness within the framework “a double-edged sword” because it increased fears of a tax hike on the middle class, but it also allowed leeway to the tax writing committees. He offered his advice on how to make the child tax credit work:

The first is to raise the income threshold subject to the lowest tax rate to make sure it applies as broadly as possible. The second is to boost the size of the child tax credit, which is currently $1,000 per child under 17. He said a $500 increase may be a starting point, but that may rise in the Senate, where Florida’s Marco Rubio and Utah’s Mike Lee have proposed a $1,000 boost.

That could ease some of the concerns about tax increases on the middle class, Pomerleau said.

Sen. Rand Paul (R-KY), who voted no on the Obamacare repeal bills, has dropped hints that he would not approved of tax reform because he believes the framework “cuts taxes for wealthy earners and the poor, but doesn’t do enough to cut taxes for the middle class.”

This is a GOP tax plan? Possibly 30% of middle class gets a tax hike? I hope the final details are better than this. https://t.co/lcjkI4YRz8

— Senator Rand Paul (@RandPaul) October 2, 2017

The analysis from TPC shows “that by 2027, almost 30 percent of taxpayers with income between about $50,000 and $150,000 would see their taxes increase.” The center found that “about 25 percent of taxpayers would see higher taxes” by 2027.

Deficit

Second, what about the deficit? Sen. Bob Corker (R-TN) has said he would not vote for a tax bill that adds any money to the deficit. According to The Hill, he’s not the only one:

“The numbers are really uglier than almost anybody around this place seems to have digested,” said Rep. David Schweikert (R-Ariz.), a member of the tax-writing Ways and Means Committee.

Republicans for the most part have rallied around the tax proposal, which is backed by GOP leaders in both chambers as well as the White House.

The tax plan could cost the government $1.5 trillion in revenue over the next decade, but advocates argue that would be made up for through economic growth unleashed by the corporate and individual tax cuts included in the plan.

White House Budget Director Mitch Mulvaney countered Corker by saying that a higher deficit will add growth. From Bloomberg:

White House Budget Director Mick Mulvaney is signaling similar flexibility, saying on CNN Sunday that decisions about deductions remain up in the air as “the bill is not finished yet.” He took it a step further, by adding that a tax plan that doesn’t add to the deficit won’t spur growth.

“I’ve been very candid about this. We need to have new deficits because of that. We need to have the growth,” Mulvaney said. “If we simply look at this as being deficit-neutral, you’re never going to get the type of tax reform and tax reductions that you need to get to sustain 3 percent economic growth.”

Donations tax deductible

to the full extent allowed by law.

Comments

frankly I hope so. Congress can only make the tax situation worse. And Corker — saying he wants to reduce deficits. Someone should tell him that is done by REDUCING SPENDING. He gets the gold for the 1000meter moron.

Corker is just a corrupt member among other of rats of the organization we call the GOPe.

The guy is no better than the sleaziest minor city bureaucrat on the take. But he is a United States Senator that WE elected. Hard to believe.

But not so hard to believe we’re now running him and his ilk out of town.

The answer is unequivocally YES. Tax reform will meet the same fate as the repeal of Øbamacare.

Why? Let me count the ways. First, there is NO effective Republican leadership in the Congress. Passing the tax plan would involve getting something done. Why do something when you can spend your time bloviating, pontificating, and talking down to the people who elected you.

Second, if Trump says black, they’ll say white; if Trump says day, they’ll say night. They still can’t (or won’t) accept the fact that Trump was elected because the American people want change. The Republicans in this Congress will do ANYTHING to prevent Trump from carrying out his mandate.

If somehow we could get rid of Ryan and McConnell and replace them with people who have a new vision for this country, we might have a chance. But so far, it appears that the swamp is undrainable.

And, much to my dismay, Trump prefers Twitter over the bully pulpit.

I wouldn’t say there were “road bumps” impeding Obamacare repeal. The disaster went very smoothly—both parties cooperated to keep us shackled with it. The only difference is that the Dems are pretending that Obamacare is good, and the Repubs are pretending that they want to kill it. But pretenses are advertising, they’re not road bumps.

There was indeed a ‘road bump.’

In fact, it was a mountain: Mount Trump.

Have you been hanging out under that rock with Rags? Trump did nothing to stop the Congressional actions to change Obamacare. He was willing to accept almost any changes, no matter how minuscule. The mountain that is blocking Obamacare repeal is the CONGRESS, including the REPUBLICANS.

I’ve found the best way to approach the Republican’s efforts in Congress is to keep your expectations low.

That way you’ll never be disappointed.

Keep your expectations low, but keep your anti-GOPe primary votes high.

It is my understanding that the House has passed 274 pieces of legislation while the Senate has done nothing. I suspect this Tax Reform will fail and make it 275.

Yes.

True and just tax simplification & reform will NEVER be done, because:

1. Tax planning and return preparation has become such an enormous industry, especially for the legal, accounting and software sectors.

2. Taxes have become interwoven with the WELFARE STATE by the fiction of the “Earned Income Credit”.

3. Taxes have become so unalterably coupled with targeted policies to encourage or discourage specific consumer spending or saving.

The current tax proposals would wreak havoc on the employed middle class and middle class retirees (who have saved for retirement) because of the proposed activity against tax deductions, which have become a major part of basic tax planning for the middle class, e.g. mortgage loan interest deduction, local taxes deduction, etc. Any future tax reform planning should recognize that fact, and allow a significant period of changeover, perhaps including an opportunity for any taxpayer to continue on the same tax code for a period of seven years, in order to unwind their targeted financial affairs. Not holding my breath.

Yep. True “reform” isn’t even on the radar. It’s all just dicking with the nobs on the control board.

Such a shame. With a real conservative leader, we could be considering real change. But no…

“With a real conservative leader, we could…”

Which one? McCain, Romney? Bush (pick any of the three)?

Keep that fiction in your head, keep believing the corrupt republican party would pass real reform if there was just the right “conservative” leader. Keep fooling yourself.

Trump is 1000 times more conservative than the pissant republican party.

There will be no significant tax reform. With our congress? … with our fool of a president? … fat chance anything at all will get done on any issue tax reform or otherwise.

So, what do you want Trump to do? I hear people blame the President for the willful inaction of Congress. So what do you want him to do? Should he dissolve Congress and become a dictator? Should he hold the families of Congressmen hostage until they pass his legislative agenda? Exactly WHAT actions do you expect the President to take, here?

I thought he was supposed to be the great negotiator, the great persuader, “The Art Of The Deal” and all that…

How well did “negotiation” work with Adolph Hitler and the Germans, prior to WWII? If someone does not wish to actually negotiate, as is the case with the Establishment political structure in Washington, then your options are usually limited to either going along with them or using force to gain your objective. So, which should Trump use? Let me know when you decide on the answer.

It’s called “leadership”. One of many things he ain’t got.

Please. What you are doing is analogous to blaming the victim of an armed robbery for not being able to talk the robber out of taking his money. You folks really need to come to grips with reality.

Nope. Nothing like your “analogy”.

You are just a poor, delusional cult worshiper who thinks Mr. Establishment is “the ultimate outsider”.

Nuts.

2018 is that far away.

isn’t

All I want for Christmas is an edit button,

Well, it will hit the same RINO Senators. Do the math.

There will be NO meaningful tax reform. Nearly 50% of the taxable entities in this country pay NO taxes. And we are running a deficit every single year, even though we are collecting record taxes in those same years. So, unless we cut expenditures, we either have to continue deficit spending or raise taxes. If deficit spending is allowed to continue, eventually, we will reach the same point that we are at with healthcare insurance, we won’t be able to afford this country’s lifestyle.

Now, Trump needs tax reduction for businesses and the rich, as well as the middle class, to stimulate economic growth. Congress need to maintain the current level of taxation to fund entitlements and subsidies. So, Congress will do nothing in the hope that Trump will somehow go away before the midterm elections.

Tax reform without huge spending cuts is a red herring, at best.

He won’t cut entitlement spending because he’s a big-government northeast progressive populist at heart.

He won’t dare take away anyone’s free stuff.

“…because he’s a big-government northeast progressive populist at heart.”

Another nevertrumper back to sale the tired old cliché.

It still doesn’t work. Everything Trump has done has been the opposite of what you spew.

I guess we’re all Keynesians again.

The whole point of ending the deductibility of state and local taxes is to make people who vote for high taxes bear the full burden, rather than letting them offload some of that burden to those in low-tax places.

If there is a way to snatch defeat from the jaws of victory, the Republican Senate will find it.

The Republican leadership despise Trump, and intend to give him nothing. Whatever bill they end up with will be a meaningless reshuffle of the tax burden that results in no real reduction, or maybe raises taxes a bit. And that probably won’t pass because of the few honest people in the Senate who won’t participate in the fraud. It’s all for show, trying to con the voters into believing they were cooperating with the president, and the evil conservatives killed it.