Inflation Cools Slightly While Real Earnings Increase

Unfortunately, a lack of October data means I cannot compare and contrast.

November’s consumer price index (CPI) and real earnings reports show some decent results.

Consumer Price Index

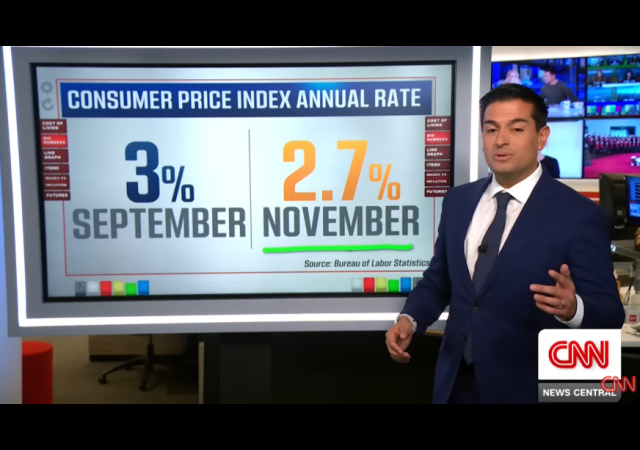

The latest statistics show inflation cooled slightly in November regarding the all-items index, rising 2.7% for the past 12 months ending in November.

Items, excluding food and energy, increased by 2.6%.

It’s hard to dissect these reports, though, because the Bureau of Labor Statistics couldn’t gather October data due to the shutdown:

The shutdown made it impossible for Labor Department workers to collect some of the data they normally would have to compile the report on the consumer-price index. Even before the release, economists cautioned that workarounds that the agency used to deal with the collection issues may have biased the November figure downward, causing inflation to be understated.

Normally, such a big change in the inflation reading would jolt markets. But investors took the data with a grain of salt. Interest-rate futures that predict Federal Reserve rate cuts moved only slightly. Stocks were moderately higher in morning trading.

“I think you largely just put this one to the side,” said Alan Detmeister, an economist at investment bank UBS. “Maybe this report gives a minor downward sign for overall inflation, but the vast, vast majority of this is just noise and should be ignored.”

However, 2.7% is better than the 3% we saw in September!

So, overall, we saw inflation down.

But individual prices went up. I so wish I had October data because this is annoying. I hate copying and pasting instead of comparing the stats:

The index for food increased 2.6 percent over the last year. The index for food at home rose 1.9 percent over the 12 months ending in November. The meats, poultry, fish, and eggs index rose 4.7 percent over the last 12 months. The index for nonalcoholic beverages increased 4.3 percent over the same period and the index for other food at home rose 1.3 percent. The cereals and bakery products index increased 1.9 percent over the 12 months ending in November and the fruits and vegetables index rose 0.1 percent over the year. In contrast, the index for dairy and related products decreased 1.6 percent over the same period.

—-

The index for energy increased 4.2 percent over the past 12 months. The gasoline index rose 0.9 percent over this 12-month span and the fuel oil index increased 11.3 percent over the same period. The index for electricity increased 6.9 percent over the last 12 months and the index for natural gas rose 9.1 percent.

Other important categories also increased:

- Shelter – 3%

- Medical care – 2.9%

- Household furnishings and operations – 4.6%

- Recreation – 1.8%

- Used cars and trucks – 3.6%

Real Earnings

On the plus side, real average hourly earnings for all employees went up 0.8% in November. The data showed no change in the average workweek.

Earnings growth has outpaced inflation this year and the average American's weekly paycheck now buys 1.6% more than in Jan, after falling 4.0% under Biden – what a difference a president makes… pic.twitter.com/bVOJ0NhDag

— E.J. Antoni, Ph.D. (@RealEJAntoni) December 18, 2025

Donations tax deductible

to the full extent allowed by law.

Comments

Except for gas down five to ten cents a gallon in my area, I’ve not noticed, Grocery prices are appalling.

PS: with all of those wonderful tariffs bringing in (Carl Sagan voice) HUNDREDS of BILLIONS of dollars, will I see my income tax cut?

I think we all know the answer to that.

We are what trillions upon trillions in debt

Cut Trump some slack, he’s trying like no one ever

At least the military will get $1776

Gas is down nearly a dollar in central tx and 70 cents in Wisconsin

Beef is still high but my butter, eggs, chicken much lower

Oy vey, so much winning. What’s a good sh*tlib to do?

“Unfortunately, a lack of October data means I cannot compare and contrast.”

While that may indeed be true, all you really need to know is that Obama/Biden are not in power eating into the economy like acid.

The American people are more than capable of righting the economic ship as long as the jackboots of government aren’t stomping on our throats.

Or, wage inflation increases. Wages are prices too.

BY the way Mary, this is not a “slight “ earnings contrast , listen to Kudlow and others

This is a major decrease in inflation , and it doesnt even encompass the Christmas shopping numbers in Nov and December

Just like the employment numbers, you look at 68,000 new Jo s, but they are ALL in the private sector, the loss of jobs a has been primarily in the public sector….

The thing about inflation is that when it is 0, prices most likely don’t go down.

The problem is that under Biden, they spent way too much money they didn’t have and now, it’s gone.

rinos rule the gop and they too care little about finances ..except when it comes to posturing for their voters

lefty is evil

until /unless america stops or at least defeats its welfare state

the prices will always go up and quality goes down

gov control defeats innovation and causes smaller companies to not be able to compete as regs demand more employees etc just to satisfy gov demands…not the customers

its estimated that around 40% of inflation is created by the government

( I think its higher)

In writing “The Determinants of Inflation,” Kritzman and colleagues from State Street developed a new methodology that revealed how certain drivers of inflation changed in importance over time from 1960 to 2022.

In doing so, they found that federal spending was two to three times more important than any other factor causing inflation during 2022.

Specifically, their results showed that:

42% of inflation could be attributed to government spending.

17% could be attributed to inflation expectations — that is, the rate at which consumers expect prices to continue to increase.

14% could be blamed on high interest rates.

https://mitsloan.mit.edu/ideas-made-to-matter/federal-spending-was-responsible-2022-spike-inflation-research-shows

leftist policies no matter who does it…is the killer of freedom(s)