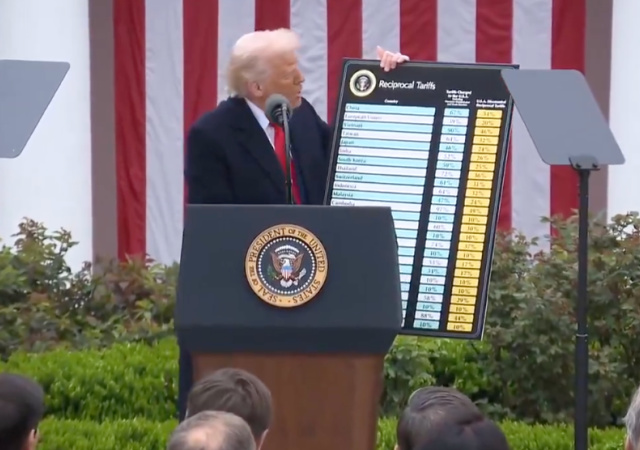

Trump imposes varying ‘reciprocal’ tariffs that punish friendly nations with few trade barriers

Trump’s tariff rates only took into account goods, not services that a foreign country buys from us

President Trump imposed hundreds of billions of dollars in tariffs on the countries of the world, that vary enormously from nation to nation. He calls them “reciprocal” tariffs, but they aren’t reciprocal at all. Trump increased tariffs even on friendly countries that had lower tariffs than we do, which is the very opposite of reciprocity. He imposed 10% tariffs even on countries that we have a trade surplus with, like Australia — which has fewer trade barriers than America does, and has some of the lowest tariffs on Earth.

Trump’s tariffs are kinder to countries that are mean to us than to countries that are kind to us. Protectionist Brazil, which has a left-wing president, was slapped with a mere 10% tariff, while America’s ally South Korea, which has a free-trade treaty with the U.S., was slapped with a harsh 25% tariff. Vietnam, 84% of whose people liked America, has been slapped with a harsh 46% tariff. That big tariff will undermine our foreign policy by making it harder to contain China by moving production from China to its neighbor, Vietnam. The European Union has been slapped with a 20% tariff, while friendly Switzerland has been hit by a 31% tariff and Japan has been hit by a 24% tariff. But Iran, which has repeatedly taken Americans hostage, received a tariff of only 10%.

As journalist Josh Barro explains, “The tariffs are not reciprocal — the ‘reciprocal’ rates are based on trade deficits, not tariffs (or non-tariff trade barriers), *and* then tariffs are even imposed on countries with which we have a trade surplus. News outlets should not accept the ‘reciprocal’ branding.”

The tariffs also are imposed on territories that have done nothing to the U.S. “Trump’s tariffs target the uninhabited Heard and McDonald Islands,” notes Mike Baker of the New York Times. And Trump imposed a tariff increase on an island that contains a key U.S. military base. “He has introduced a 10% tariff on the British Indian Ocean Territory. The only inhabited island there is Diego Garcia, home to US service personnel. Trump has put a tariff on a U.S. military base.”

“Israel eliminated tariffs on US imports and Trump still slapped it with a 17% tariff,” notes Alex Nowrasteh of the Cato Institute. Heritage Foundation data shows “there are 68 countries with a higher Trade Freedom Score than the US,” but they got slapped with tariffs, too, despite having fewer trade barriers than America.

“American manufacturers say that the new tariffs will cost American manufacturing jobs, hurt their ability to compete,” as shown in a press release from the National Association of Manufacturers. It says “the high cost of new tariffs threaten investment, jobs, supply chains and, in turn, America’s ability to outcompete other nations and lead as the preeminent manufacturing superpower.” Tariffs that increase the cost of imported raw materials wipe out jobs in the auto industry and other manufacturing industries.

Trump’s tariff rates only took into account goods, not services that a foreign country buys from us, “so even though we run a massive services surplus with the world, that didn’t count when they calculated these imaginary ‘tariff rates,’” notes James Surowiecki of The Atlantic.

Economist Scott Lincicome says that “Trump’s reciprocal tariffs: 1) Impose hundreds of billions of dollars in new taxes on Americans without public/congressional input; 2) Are based on secret calculations that have little, if any, connection to actual foreign trade barriers; 3) Ignore all US tariff/non-tariff barriers, which in some cases are quite high; 4) Are justified by a “national emergency” that reflects a total misunderstanding of how trade deficits work; 5) Disregard US trade agreement commitments, including ones made by Trump himself; 6) Will make us all poorer, and likely do real & lasting harm to the US economy (incl in manufacturing); 7) Embolden our adversaries around the world.” Most “American manufacturers hate Trump’s tariffs,” Lincicome says.

Conservative economist Mark Perry hates the tariffs. “The effects of Trump’s tariffs? Lower economic growth, higher inflation, higher unemployment, the destruction of wealth, and a tax increase on American families. It will deal a blow to the rules underlying the global trading system and further empower China,” he says.

The public is mostly opposed to the tariffs. “The most surprising thing about the current trade wars is how little political constituency they have. Even the seeming obvious supporters (unions, manufacturers) tend to be against them. The trade wars are a project driven almost entirely by political elites,” says researcher Judge Glock.

The tariffs aren’t needed to keep good-paying manufacturing jobs. There are more auto factories in the U.S. now than in 2015, one illustration of how America did NOT deindustrialize and does NOT need big tariffs to compete with foreign producers.

America does have a shortage of skilled manufacturing workers, but that has nothing to do with a lack of tariffs, but rather, a woke educational system that fails to teach useful skills used in manufacturing. America’s misplaced educational priorities, not harmless trade treaties, are the biggest impediment to U.S. manufacturing. U.S. manufacturing output has grown, but the government’s bias in favor of college & against trade school harms manufacturing. As Mike Rowe of Dirty Jobs explains, “For every five tradespeople that retire this year, two replace them.”

Tariffs on raw materials and inputs wipe out jobs. Past tariffs on steel and aluminum “resulted in 75,000 fewer manufacturing jobs in firms where steel or aluminum are an input into production,” note two economics professors, by subjecting those firms to “increased costs of inputs” that made their products less competitive. That is far more than the paltry number of jobs gained in the U.S. steel industry due to tariffs on steel, only about “1,000 jobs.”

U.S. tariffs also trigger retaliatory tariffs from other countries. In response to Trump’s earlier, much more limited tariffs on metals, Europe imposed tariffs on $28 billion worth of U.S. goods, and Canada imposed tariffs on $21 billion worth of U.S. goods.

The tariff rates imposed by Trump made no sense. As The Atlantic‘s James Surowiecki notes, the Trump administration’s “fake” reciprocal tariff rates “didn’t actually calculate tariff rates + non-tariff barriers,” as you would do to calculate a reciprocal tariff. And “In calculating the tariff rate, Trump’s people only used the trade deficit in goods. So even though we run a trade surplus in services with the world, those exports don’t count as far as Trump is concerned.”

This post originally appeared on Liberty Unyielding and was reposted with the author’s permission

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

I wonder if there is a reason for those tariffs. Am I supposed to believe they are simply nonsensical? That the silly orange man is doing silly things? Or worse yet, evil things that hurt our country?

Maybe. Trump put 17% tariffs on Israel, even though Israel doesn’t put tariffs on American goods. And Trump put more tariffs on Israel than Iran. And Trump put tariffs on islands where no one lives, just penguins. So I hope the reason is that Trump is just doing silly things, and not evil things. But I am beginning to wonder.

That’s disingenuous. Israel sought to lower their long standing tariffs the day before. Of course they didn’t alter any other protectionist policies like import restrictions on Agricultural products or their direct and indirect subsidies to their domestic corporations.

Trying to argue that tariff rates alone represent the totality of ALL protectionist measures other Nations use to impede free trade with the US and harm our workforce is very simplistic and very inaccurate.

Israelis pay an import duty on nearly all purchases from abroad over a fairly low threshold. (For Amazon it’s any purchase or group of purchases totaling $75) regardless of country of origin. Israelis traveling abroad can bring back up to $200 of goods. If you exceed the threshold you pay duty on the whole purchase back to the 1st dollar, not just the amount by which total exceeds the amount that would have been exempt. I don’t know if that’s considered a trade restriction or not.

Can you tell me more about the agricultural restrictions?

In general Israeli ‘food’ laws are largely harmonized with EU laws/regulations which are way more restrictive than the US. (Might be better if the US looked to adopt some of the EU regs but that’s a separate thing). Add to that the requirement of Kosher certification for beef, poultry and other meat products. Most grocers/hotels/restaurant won’t offer non Kosher products due to smaller demand. They also have import restrictions on other products like grapes to protect domestic companies.

The issue of GMO restrictions is another barrier, though with MAHA, we may see some.reform to US production. Israel also historically had fairly high tariffs on dairy, apples, wine and some other products that directly compete with their smaller domestic producers.

Protectionist policies don’t end at tariffs. Import restrictions,.direct subsidies and indirect subsidies for domestic producers are all just as much impediments to ‘free trade’ as tariffs. The fact is all these Nations had a long standing history of placing barriers to US products that harmed US workers. Ending them the day before the Trump Tariff go into effect is nice but doesn’t address the lasting harm on US workers and US producers.

Read your reply. Don’t expect Israel to destroy their country by importing non-kosher food. The U.S. is perfectly capable of producing kosher food & in fact I can buy kosher food from the U.S. in the convenience store across the street.

Beef in particular is mostly imported, much of it from south and Central America.

Complaining that we don’t import non-kosher beef is like complaining we don’t import enough rosaries.

You misunderstand me. I don’t expect that Israel or any other Nation should choose to do anything but set the trade policies that they feel make the most sense for their Nation overall regardless of.the impact upon Nations wishing to export to them. Each National Gov’t should put the overall well being of their own Citizens as their highest priority.

Of course the USA is free to do the same. The USA is also free to determine whether policies of other Nations diplomatic, military and yes economic/trade policies constitute the actions of allies, neutrals or foes. I would submit that ‘most favored Nation’ trade status with low tariffs should be reserved for Nations who act in favor of the USA in all three areas. Nations which choose another path should be in another category.

I get your point about each nation protecting its own interests and yes, dairy (domestic as well as imported) is costly here. On the other hand it makes no sense to me to penalize a trade partner for not importing things it doesn’t want or need, and doesn’t itself produce in competition with the U.S. and doesn’t import from elsewhere.

IMO the USA should impose a baseline 10% tariff on ALL imports. Then add a baseline tariff for goods transported to the USA on NON US Vessels; start low maybe 2% then add 1% per year. That creates big incentives for investment in US shipyard revitalization and new build US Vessels.

Both of those also act to generate revenue, mitigate non tariff protectionism and mitigate arbitrage opportunities via shady acts to move goods/commodities from a high tariff Nation to a low tariff Nation for eventual shipment to USA and avoid hire tariff on Nation of origin.

My opinion, but seems the direction the Trump Admin is going, is that the USA will move to use baseline universal tariff as a revenue source + spur domestic production. Then set a basic retail level only VAT of 10%. The combination would allow us to junk the entire tax.code. set a flat tax of 10-15% and apply it to everything. Retain a standard deduction of $15K with no other deductions and no refundable credits. Set the same % for capital gains and labor +capital are taxed = which blunts much of the socialist/commie rhetoric. End estate taxes, give a $3 million exemption on individual inheritance and tax at flat income tax rates.

Combined should be plenty of revenue. Far simpler, easy to understand, hard to manipulate/rent seek, huge reduction in compliance costs, less ‘friction’ impacting the US economy.

The rest of the World will have to come to.terms with reality that the center/right populism of MAGA/Tea Party is ascendant. The modern movement began with Ross Perot in ’92 and has gathered steam since. The broad middle-class that do the jobs that keep the Nation running, send their sons to the military, coach little league, donate to local charities, pay taxes…have had enough of the rest of the World taking advantage of the USA and making their life harder. If our ‘allies’ don’t want to open up their economy to US products in a fair competition (free market) they won’t be viewed as ‘allies/friends’ and may find our markets closed to them or the entry fee of a tariff. Competition is fine but totally closing off markets with import bans or quota restrictions, no matter the reason, is not to be tolerated without countervailing consequences in return.

There is no need to tarrif countries you have sanctioned such as Iran or Russia as we do not buy from them.

The penguins have a fishing industry.

The universal 10% base tariff was imposed on every potential trade relationship. Don’t overlook the potential for a form of arbitrage with goods shipped from high tariff point of origin to a low tariff trans shipment point for final export to the USA., especially with commodities. Nor the potential for further economic sanctions being imposed or lifted based on future realities.

To be clear ‘I’ didn’t impose any sort of tariff and if you believe Russian or Iranian crude, Nat Gas, minerals or other commodities wasn’t used somewhere in the supply chain to create goods in other Nations that are exported to the USA you’d be wrong. We do ‘buy’ from them just not directly.

Beginning to wonder? You have TDS and the man could cure cancer and you would begin to wonder.

More full of sh*t with every comment you make.

There is a reason. It’s just not a good one.

There is reasoning behind this. Part of it is other countries using proxies in countries, such as Vietnam to avoid U.S. Tariffs. Trump is using this to get the players to the table. Not evil, not silly.

I think the author way over simplified. Japan doesn’t charge a tarrif but the do charge a 10% tax in addition, the yen versus the dollar amazing stays very week so the price of the goods shipped to Japan basically increase the price by 50% ish. So basically no one in the Japan market but a few rich people will ever by a US made car.

Who exactly in this admin cooked up the per country tariff rates. I doubt Trump did it himself.

I’m not against tariffs but I’d like if they were reciprocal or at least make sense which if this article is to be believed they are not. I also feel uncomfortable applying them all at once. I’d rather start with China, EU, Mexico and Canada which probably are our biggest trading partners and would have the biggest bang for the buck

The one thing we have to do is pull back the manufacturing of critical goods unto this country. It borders on criminal that some many of the medical supplies and drugs we require and manufactured elsewhere, especially in China. We need to claw that capacity back into this country as well as some of the manufacturing capacity for semiconductors which our country as it is now is dependent upon.

Whatever has the biggest “bang for our buck” as you put it, also has the potential to hurt the US consumer the most in the short term.

We also know that a ton of our imports come from China while we export very little to them.

A quick example shows why the same % tariff is not seeking to balance trade.

Let’s say for every 1 million worth we export to China, we import 10 million worth.

A 10% tariff on Chinese goods here would balance trade with a 100% tariff on US goods in China (only as far as tariffs are concerned though…there are many other factors).

There’s a lot that people are deliberately ignoring to react or get others to do so.

It might be nice for Trump to give an address to the nation and reassure that the current stock market reaction is to be expected in order to make things right. Then bring out the receipts! Show his 1988 snippet on Oprah speaking about tariffs. Show Pelosi and Schumer years later saying much the same. Even Obama. But like Biden, they had decades to address the issue, but did nothing. Only Trump has remained consistent and only Trump is actually doing something they only gave lip service and performances about.

How’s this for reassurance:

Minecraft The Movie is on pace to make $135 million.

March jobs came in at 228,000.

Prices are trending downward, not upward.

Stop paying attention to the stock market. It is massively overinflated.

Many are paying attention, even if misplaced, and it would satisfy their more simple approach to these issues and reinforce the overall hypocrisy of today’s critics.

Excellent article. Thanks for posting. This needs to be shared with other conservative blogs.

No, it doesn’t. Conservatives need to break away from the stupidity of “free” trade.

Since free trade is what Trump is pursuing I’m not sure why you’d think that.

Tariffs are the stick.

The carrot is getting them reciprocally removed.

Which leads to free trade.

Tariffs are not the only trade barrier. Just try selling dairy products to Canada.

Beef to Europe as well.

Or imported baby formula in the US during a shortage during the Covid era.

Funny countries all over the world, and there is a list out, came hat in hand already.

https://www.youtube.com/watch?v=JrTBU7Nsdus

Tinfoil hat libertarian?

The tariffs as proposed and soon to be implemented do not, by themselves, make a lot of sense.

Like many things with Trump, it pays to watch what the ultimate objective is. Here, the immediate goal is to create an unsustainable position for the other countries. Such unsustainability creates negotiating leverage, and the ability to get something else instead. Why is that needed? Well, in most places these really aren’t reciprocal to start with.

The long term goal is to have higher tariffs with trade unfriendly countries and lower ones with favorable trade relations. See the number of countries that have already indicated they want to negotiate a deal.

Like any strategy, there are trade offs. Market disruption is a two-way street, and risks business uncertainty and unrest at home. Less favorable relations with those that have strong US support is another.

“America does have a shortage of skilled manufacturing workers, but that has nothing to do with a lack of tariffs…”

Actually, it has to do with the fact that we no longer do much manufacturing. Between 2000 and 2010 manufacturing jobs in America plummeted 34% – a loss of more than 5.8 million jobs. What good would it do to have manufacturing skills if there are no manufacturing jobs available?

I have a problem with the phrase skilled manufacturing jobs. What do they mean by it?

There are many manufacturing jobs that someone can do with very little training. I worked for American Motors jeep for 1 summer back in 1974. Yes auto manufacturing has changed but I was able to do sheet metal work including spot welding with essentially no training and I was moved from one job to another because I wasn’t yet in the union. At that time that job would have been classified as a skilled manufacturing job. So I;m willing to bet that not all manufacturing jobs classified as skilled requiring long periods of training or apprenticeship.

You are missing machine design, manufactured and maintained by American’s. Part of my career was in producing automation. Those skills have in large part disappeared as all that work went to China. My expertise has not been passed a a new generation, I think that is the case across the industry.

And then there is the issue who are producing inventions, those come from actually working in the field. No experience = no inventions.

I’m not exactly missing it..hehe.. but you’re correct machine tooling is very important and very skilled.

The primary goal of the Trump Tariff regime is ending the panoply of protectionist trade policies deployed against US exports by all these Nations. These range from tariffs to import limits on particular products. There’s also the various direct and indirect subsidies flowing from these Gov’ts to underwrite their corporate interests and prop up their economies at the expense of US workers. The secondary goal is revenue raising.

This article encapsulates the faux libertarian/free trader arguments that always minImalize or ignore the impact of full array of protectionist measures used to unfairly interfere and decrease the competitiveness of US exports. Y’all fakers always operate from the false premise that actual free trade existed prior to Trump Tariff. That’s BS, you know it, we know it. Lying and deceit are not the basis of good faith arguments/discourse.

If y’all think this is gonna pinch your protectionist measures wait till the next round. I suspect there will be an additional set of baseline tariff on imported goods that are NOT transported in US Merchant Vessels. Probably will begin with a 2%-3% then escalate upward on an annual basis by 1%. The goal there is to slowly rebuild US Shipyards and expand our Merchant Marine Fleet to remove another foreign vulnerability in our supply chain. Unless the rest of the.World’s Navies are gonna fill the void of the US Navy if we choose to prioritize defense of US Merchant Vessels then you got zero grounds to complain.

Building ships is one major area where we no longer have skilled workers and require them. As such it takes upwards of 10 years I believe to build an aircraft carrier. We are losing ground to the chinese very fast in this area.

True. Which is why the imposition of an escalating tariff on goods transported on NON US Vessels will create incentives for massive investment in refurbishment of US Ship Yards. Both the build out of facilities and ship building will create solid,.well paying jobs for US workers. Gradually raise the tariff to account for the lag but insist on it due to the history of transport companies choosing to abandon US shipyards which created the decline in workers. Call back the old hats to supervise and OJT a new generation the first couple years. Then there’s the crewing aspect of our increasing US Merchant Fleet which are also a well compensated job and probably less likely to ram into bridges shutting down US ports.

You continue the same, incorrect arguments. The tariffs are mainly designed to create a balance in trade between the US and each individual country.

The ‘free market’ according to both Smith and Ricardo is supposed to achieve a balance of trade IF there is free trade. When Protectionist policies are implemented; tariffs, import restrictions, subsidies both direct and indirect are deployed they interfere with ‘free trade’.

That’s the history of the post WWII era and especially so in the post cold war era. Our ‘allies’ cut defense spending well under 3% of GDP and doubled down on subsidies to support their domestic producers. We haven’t yet addressed the imbalance resulting from the imbalance in defense spending.

The Trump Tariffs are in fact designed to get other Nations, including our ‘allies’ to reduce/eliminate ALL the different protectionist policies they have used against US exports to the detriment of US workers. This will eventually increase US Exports and as consumers adjust/switch to domestic alternatives increase US manufacturing jobs, which is the real measure of economic strength.

I trust Thomas Sowell more than Trump.

Oh a passive aggressive appeal to authority, how original. Now tell me where the same level of righteous indignation was from you and other surrogates of globalist agenda the BEFORE the Trump Tariff regime was imposed? Where was the same level of vitriol directed at the protectionist policies of other Nations? Lots of ink getting spilled to bash the Trump Tariff regime that, to be very clear, was applied in RESPONSE to the preexisting protectionism of other Nations.

Tell me this …what is your plan to get these ‘friendly’ Nations our ‘Allies’ to end their multi-decade protectionist policies…ALL of their protectionist policies mind you…. tariffs, import restrictions, direct and indirect subsidies… and/or mitigate them to eliminate the impact on US manufacturing/industrial workers?

I love Thomas Sowell’s writing, he is a gem, yet is skills are nowhere near what I see in Trump. Your TDS blinds you to truth. In any event, you do not compare favorably to either.

He’s never read Sowell. He saw a post on some mother jones type site about it and ran with it.

Trump trusts Thomas Sowell less than you do?

So anything that’s not Pax Americana pays the price? See that’s not going to fly. Even friendly nations suffering the minimum tariff e.g. Australia, let alone Norfolk Island – Australian territory, or Heard and McDonald Islands – also Australian, are murmuring about responses. In the short term it’s WTO complaints about America violating the free trade agreement etc. In the long term it’s full trade war – reciprocal tariffs levied at 23.5% – Trump tariff plus current peak sales and local taxes. Carbon taxes could be applied, and American subsidies on agriculture and other industries can be factored in too. While Mexico and Canada don’t have any choice but to roll over, for many other countries America just isn’t that important.

Leaving aside the fact Trump’s tariffs are not only not reciprocal, they’re not even grounded in reality, it’s suspected these tariffs will not be the end of American protectionist efforts. If friendly countries do not provide carte blanche to American exports then more penalties will likely ensue. hence trade war as above, and this is allied and friendly countries mind you, not hostile powers like China.

Note too that American consumers are already complaining about the impacts e.g. Big Mac prices rising because imported beef costs more and American beef isn’t available. If Trump fails to thread the needle correctly then he’ll lose America allies and friends by ‘World Trade War 1’ with exports drying up and imports costing a bundle. And if he decides to take his toys and go home i.e. remove the USN from non-US territory, then Russia gets a free pass in Europe, while China gets a free pass in much of Asia and Oceania, if it can stretch that far. Who benefits from and Orwellian world?

If America isnt important for import or export then tariffs will have no effect. That swings both ways.

The same European ‘allies/friends’ you claim will turn their backs on the USA b/c we imposed tariffs in 2025 in response to long-standing tariffs and other protectionist policies are.same.ones that chose to cut their defense spending below 3% GDP to subsidize their domestic economy. Sucks to be them b/c if Russia is a problem it is a European one.

This ain’t 1955 or even 1995. The days of US military adventurism are coming to a close. The world is far different than you seem to realize. The USA is not gonna be the ‘world police’ and sure as heck isn’t gonna do it for ungrateful Nations who are our economic competitors using protectionist policies to harm US workers and US producers.

We are moving back towards a far more Jacksonion foreign policy re military intervention and returning to the wisdom of George Washington’s warning about ‘entangling alliances’ with a large dash of a far more muscular implementation of the Monroe Doctrine. The USA under MAGA/Tea Party/center right populism is refusing to willingly be the ‘mark’ for the rest of.the world.

Where we have ‘allies/friends’ they won’t impose protectionist barriers on our products, they won’t seek to undermine basic values of Western Civilization like free speech, won’t seek to jail political opposition, won’t try and harm US based internet platforms with Cray Cray woke speech codes, won’t imprison folks for silent prayer, won’t interfere in our elections, won’t set up Covid camps….one or more having occurred in the UK, the Nations of the EU, Ukraine, Australia…

Genuine questions.

If tariffs are so bad, why do so many other countries have them?

I get that conservatives don’t like tariffs because they put a finger on the scale of who wins and loses in the marketplace. But we’ve already done that to the detriment of American companies by requiring minimum wage, OSHA, and other regulations. Not saying I want a world without those things, but other countries don’t have do deal with those costs and impediments. China being able to basically have slave labor comes to mind. How do our companies compete with that without a helping hand?

I haven’t seen any statements from our labor unions regarding the tariffs, wonder how they feel about them?

One of the things covid showed was that we lack many critical industries in the US and depend on other countries for critical items. Isn’t it worth some pain to try to bring those things back to the US?

Adam Smith explained that one 250 years ago. Special interests v the general interest. I’m not sure whether Smith coined the term “special interest”, but it means the few who would benefit from a policy that would hurt everyone else equally.

Imagine a bill to impose a $1 tax on everyone, to benefit people whose names start with X. The Xs would all lobby for the bill because it would make them each thousands, but who would bother to lobby against it?

For any given good or service, there are a few producers and many consumers. A tariff or other protectionist policy is worth a lot of money to the producers of that good or service, and the cost is spread out among all the consumers. That means each producer profits enough that it’s worth while for them to get together and lobby for it, but the cost to each individual consumer is too low for it to be worth them getting together and lobbying against it.

And that’s even if the consumer understands why prices have gone up. He may just blame “inflation” or greedy shopkeepers.

What you’ve just said is one of the most insanely idiotic things I have ever heard. At no point in your rambling, incoherent response were you even close to anything that could be considered a rational thought. Everyone in this room is now dumber for having listened to it. I

Trump will succeed in proving to allies that the US is completely unreliable. Watch the clamor grow for nuclear weapons by countries that previously relied on the US. There’s your unintended consequence.

Because dementia ridden Biden was reliable…

Biden helped destroy trust in the US, as you imply. But it’s a clever comment, irish. You’ve managed to lower Trump to the same level as Joe Biden.

No, Trumps will succeed in teaching users that we will no longer put up with their crap.

So they will go with MAD as policy to prove that they are trustworthy? Makes perfect sense.

No. They will go with MAD to protect themselves in the absence of an American world order.

Oh there’s already some of us that think the NNPT should be revisited. The bigger issue is that countries that should be trustworthy largely have voters that refuse to tolerate (nuclear) self defence, or even nuclear power, while countries that aren’t trustworthy, and don’t need to worry about democracy, would rush to get them, if they could.

Example NZ. They want to be an defense ally but won’t tolerate visits by our subs or aircraft carriers because they are nuke powered and may be carrying nukes. Yet the wanted to be protected under our nuclear umbrella too.

No, they don’t want to be protected by nuclear weapons.

New Zealand is almost unique in the world as a major country that has no natural enemies. They’ve long believed that they had no real need for a defense force, and therefore not made it a priority. And when they turned against nuclear weapons because of lefty propaganda against them they turned against them completely. They started by protesting against France, and then eventually decided to extend that policy to the USA too.

Before income taxes, Tarriffs and customs duties were used by governments to raise taxes. The US has a huge budget deficit that is unsustainable.. So this is a tax without calling it a tax. Outside countries won’t be paying tariffs, you, the US consumer will be. As to the rates applied to different countries, those countries have a US defence guarantee, so it’s a way of getting them to pay more for their defence.

And it’s also a way of getting us to pay more for ours. And it’s a necessary cost of security.

Foreign countries create goods using labor that gets abysmal wages, no health plans, no safety conditions, child labor, sometimes even slave labor. American businesses compute that their domestically-manufactured products cannot compete, so they transition to importing or offshore manufacturing. Prices go down for Americans, everybody happy. Libertarian free trade.

Except not all products are as discretionary as Swiss chocolates, Temu jewelry, and Ikea furniture, Some of them are existentially crucial. Medicines, data and comm, armament, energy, military. If a foreign country with a grudge decides to stop exporting these to us, we’re in a world of hurt. (Did you realize that the US closed their last lead smelting plant 13 years ago, and now lead for our ammo has to come from China? How f*d up is that?)

Tariffs encourage creation of domestic factories who now no longer have to hit the old depressed price point to be competitive. How do they do this? By taxing Americans to pay more for the imported versions. It’s the mirror image of the previous transition — it can’t work any other way.

Why is it a good idea to make prices go up? The extra cost is for insurance — a surety that if the foreign supply is cut off, we will be able to fill most or all our own need from domestic sources, as opposed to being conquered or exterminated. Insurance is a real cost of business and life, and is never free.

While I agree with your points, how much extra inflation are we going to have, because of sudden price increases on imported goods, like a common purchase, Apple iphones? Cars could be a big problem. How much of a recession might this cause when not everyone can or will pay the increased price and reduced purchases cause layoffs in the related supply chain. (Building new USA factories is far from an overnight process and, as you note, the prices may not be cheaper than the tariff-laden import prices.)

Those consumers unconcerned about a particular price point will still make the purchase. Consumers worried about a price point will substitute another product. The same way a consumer might substitute ground beef instead of purchasing a T-Bone Steak.

Some of those substitute products are already produced in the USA and they will expand production to meet increased demand. Other producers will seek to establish new domestic US production to avoid tariffs. Both of those things create jobs for US workers. Yes new construction takes time to get a new facility built but that creates more construction jobs and increased traffic in surrounding area businesses that support it; lunch counters, gas stations, hotels. The construction project itself will require equipment and tools some newly purchased and some replacement plus purchase of consumables. All that stimulates the economy.

The budget proposal has tax cuts that could be offsetting.

“Offsetting tax cuts” depends on who you are. Eliminating taxes on Social Security would be a very big deal for those who have it 85% taxable now. However, benefits related to the untaxed 50% employer’s SS contribution should be taxed. No tax on overtime pay is suspect, espectially if 1.5 or 2 times base pay. That person is the most able to pay extra taxes; and it would be a nighmare to administer all the redefinition of base pay to overtime that would happen. No tax on tips makes some sense, though.

No tax on tips makes sense because it is an accounting nightmare for the small businesses where tipping frequently occur and is ripe for abuse.

No tax on overtime pay is insane. Conceptually there is little difference between overtime pay and a second job and you wouldn’t propose no tax on a second job.

Taxing SS is okay if you pick a high threshhold for when it become active.

Medicare and SS taxes should not be capped. The more you make the more you can actually afford to pay them.

Something has to be done to tax for ss/medicare/general those whose pay is essentially capital gains. Corporate execs hedge fund managers trust fund babies and so on.

There isn’t a more economical manner in which to say, “I didn’t read or I don’t understand ‘Art of the Deal,'” than to publicly complain about Trump and his tariff strategy.

Just a few points on both the article and the tariffs.

Two of the sources sited are articles from the NY Times and the Atlantic. Neither of which I consider to be objective sources.

In looking up Hans Bader on a google search the most likely profile of the author shows that at one point he was in the civil rights division of the Dept of Education which raises red flags for me.

In some industries that I am personally familiar with other countries do indeed create massive barriers to US products including tariffs and other targeted taxes and all types of import barriers. They also often had massive government subsidies and financing for their comparable exports to the US.

My conclusion is that the author supports the establishment/globalist policies that have shipped American manufacturing to third world nations and enriched a corrupt group of Chinese communists and European globalists.

My prediction is that if Trump holds firm we will have a manufacturing and economic boom. Henry Ford proved that mass producing goods and paying good wages creates a great market and helps to build a strong middle class which is necessary for sustaining a republic like ours.

During WWII men like Henry Kaiser and other showed that we could build and/or convert factories very quickly and astound the world with our production of ships, aircraft, trucks in vast quantities.

Hopefully by 2028 and perhaps as early as 2026 our shipbuilding yards, steel and aluminum factories as well as computer chip facilities will be churning out goods. There is no reason why the US cannot once again produce many or most of the products needed or desired by American consumers.

This page (https://www.sourcewatch.org/index.php?title=Bader_Family_Foundation) notes Education Department’s Office for Civil Rights during the George W. Bush administration, and Trump administration’s U.S. Department of Education as an advisor attorney. Slight difference to being an Obama or Biden civil rights attorney.

Yes some countries do have barriers, but as this piece notes, those with the most egregious aren’t the countries getting hammered the most. Worse, pretty much all countries are getting penalised which suggests this isn’t genuinely about tariffs, but performance. If the tariffs were truly reciprocal then there’d be real data to support the values assigned.

The world has changed a lot since WW2. Trade was vastly lower then, and far far less globalised. America is far more reliant on other countries for products and resources these days. Some of that can be changed, some of it can’t. The problem is the shotgun approach means that some that should be changed, or perhaps can’t be changed, may end up getting changed because nobody wants to trade with America anymore.

“Slight difference to being an Obama or Biden civil rights attorney.”

The whole point of the Swamp is that there was NO difference — not until Trump II. And that goes in spades for DOEd..

Being an advisor attorney can mean a lot of things.

It’s possible that the numbers were adjusted to reduce the pain due to US consumer dependence for those goods, to balance trade, and/or to provide leverage.

Just as an example: a 10% tariff that represents 30 million in imports from a foreign nation is not the same as a 10% tariff by that nation on 10 million in goods exported from the US to their economy.

‘Don’t want to trade with the US anymore’….Which Nations don’t want access to our consumer market at the low price of reducing their own protectionist policies? That seems like foolish hypocrisy especially if we decide to counter their economic blockade of US goods with a blockade of our own choosing.

I agree that US dependence on foreign countries for many goods, even basic goods is dangerous. It’s a National Security issue that we don’t make simple things like effing aspirin. Our vulnerability to supply chain disruption has been made very clear recently.

The Trump Tariff regime is in part designed to change that. Manufacturing and production will come back to the USA to evade the tariffs. That’s good for employment and for a far more reliable supply chain and increases our National Security… which is a very under looked aspect of the Trump Tariffs.

My conclusion is that you’re an idiot.

IMO the incoherence of this program will have second order effects, including increased economic uncertainty. Smaller companies may not have the financial resources to manage well a shifting economic landscape. The tariffs will cause an increase in prices. An 18% S&P 500 drop since mid-February and a 1/3 drop in Citigroup stock, as representative of the financials, is a big deal. A crash in leading financial stocks is a warning that something is “off”. The Democrats have finally been given an issue on a silver platter and the Republicans are likely to lose the House in the mid-terms, as people vote their pocketbooks.

Even if the program is meritorious long term, plants don’t get built and running here in a day and all the “costs” are front-loaded, with the immediate tariffs. For example, Apple can’t just up and build a giant US cell-phone factory here in the near term. So, iphones will now cost a bunch more because of tariffs?

Absurdly early for such predictions. Tell the truth: nobody knows what the effects will be in a year. Not you, not me, not the President’s men, not the small businessmen or big businessmen, certainly not journalists. This has never been done before.

Not even Milhouse knows.

“For example, Apple can’t just up and build a giant US cell-phone factory here in the near term.”

“Apple said Monday [2/24] it will invest $500 billion on expanding US facilities over the next four years, a move that could help it avoid new tariffs on goods imported from China.”

When there’s big money on the line, s* gets real.

Yes, “four years”. The tariffs go into effect now. Also, US manufacturing costs will not be cheaper than China. Therefore, we are looking at a permanent increase in the price structure of all these imported goods. Has anyone seen an estimate of the impact on the inflation rate?

I for one won’t miss iPhones.

Trump is tariff-ying to the Left.

No more hans bader

Who exactly is he? Quick link of his articles is like an average of one every 3-5 years.

Ban the messenger! I no like him. He criticize my god, Donald Trump.

(Reminds me of the leftist tyrants in theme.)

Everyone who can identify and explain US laws that impose import trade barriers, please up-vote this comment.

(Hint: start with baby formula import laws that inhibited the supply of baby formula during the Covid era when Abbot shutdown a product facility.)

The reason for the wide tariff array is so that an entity could not become a gateway for China: https://x.com/zerohedge/status/1908913527412211974

Yep. The universal 10% baseline tariff helps mitigate potential arbitrage, raises some.revenue and helps offset non tariff protectionist policies like import quota or import bans, direct/indirect subsidies. A zero rate tariff seems great until you realize that it doesn’t matter when brake categories of US exports, agriculture for one, faces severe restrictions or outright bans in some Nations…even some supposedly friendly/allied Nations.