Biden to Americans: Be Very Afraid … of Cutting Fraud Out of Social Security

Biden: “They’re taking a hatchet to the Social Security Administration. … Who in the hell do they think they are?”

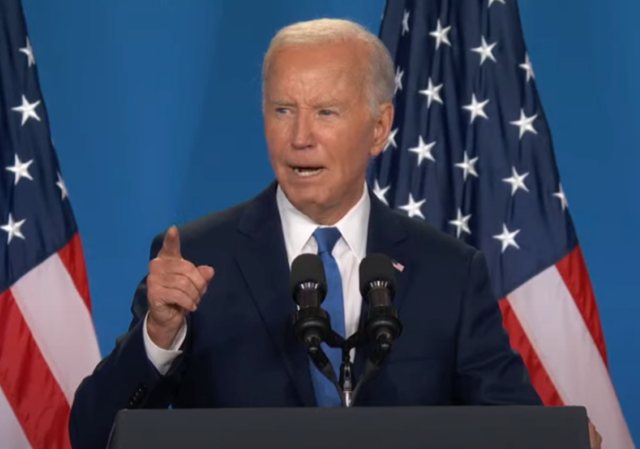

In his first public speech since leaving office, former President Joe Biden did his best to stoke fear, claiming that the Department of Government Efficiency’s efforts to eliminate fraud and waste from the Social Security system are putting Americans’ benefits at risk.

Biden delivered his disingenuous remarks on Tuesday evening in Chicago at an event hosted by the Advocates, Counselors, and Representatives for the Disabled. As per NBC News, throughout the address, Biden referred to President Donald Trump only as “this guy.”

Here are several excerpts from his remarks:

In fewer than 100 days, this administration has done so much damage and so much devastation. It’s breathtaking that it could happen so fast. They’re taking a hatchet to the Social Security Administration, pushing out 7,000 employees, including the most seasoned officials.

People are now genuinely concerned for the first time in history — for the first and only time in history — that their Social Security benefits may be delayed or interrupted. They’ve gotten it during wartime, during recessions, during the pandemic — no matter what they got it. But now, for the first time ever, that may change. It would be a calamity for millions of families, millions of people.

…

Why are these guys taking aim at Social Security now? Well, they’re following that old line from tech startups. The quote is, ‘Move fast, break things.’ They’re certainly breaking things. They’re shooting first and aiming later.

Biden declared the Trump administration wanted to “wreck it [Social Security] so they could rob it” and asked, “Who in the hell do they think they are?”

Ahead of the speech, White House press secretary Karoline Leavitt was asked by a reporter for a comment at an afternoon press briefing. She made it very clear that Trump “is absolutely certain about protecting Social Security benefits for law-abiding, taxpaying American citizens and seniors who have paid into this program.”

Karoline Leavitt: "My first reaction when seeing former President Biden was speaking tonight was, I'm shocked that he is speaking at nighttime; I thought his bedtime was much earlier than his speech tonight."

😂😂😂😂😂 pic.twitter.com/TxLEqceza4

— Julia 🇺🇸 (@Jules31415) April 15, 2025

Fox News’ Brett Baier cut into his 6 p.m. news program, Special Report, to call out the discrepancies between Biden’s claims and those from the DOGE team leaders he recently interviewed.

Baier played a clip of the former president saying, “Folks, imagine the panic that causes if you’re a retiree living alone with only Social Security to depend upon. So now people are overwhelming the phone lines.”

Baier said, “[Former] President Biden in Chicago talking about Social Security there, saying the administration has dismantled Social Security. They have fired, gotten rid of a number of employees, thousands of them in the Social Security Administration.

He continued, “But, in that interview with Elon Musk and his DOGE team, they say they are going after waste, fraud, and abuse in Social Security and also President Trump has said that he will not touch benefits. In fact, Elon Musk pledging that benefits will be protected more by what they’re doing. Obviously, Democrats and [former] President Biden taking the opposite approach here. … ”

Fox News cut into Joe Biden's speech to call out his lies about Trump ending Social Security LIVE.pic.twitter.com/FGiZQWzGeO

— Tim Young (@TimRunsHisMouth) April 16, 2025

The truth is, there’s plenty of fraud within the Social Security system—and it’s not just DOGE that is pointing it out. But sure, let’s pretend they’re the only ones who noticed.

According to an Inspector General audit, the Social Security Administration made ~$72 billion in improper payments over an eight-year period.

Social Security isn't failing. It's being robbed. pic.twitter.com/tY6lercMQD

— DOGE NEWS- Department of Government Efficiency (@realdogeusa) February 19, 2025

Not even Democrats were happy about Biden’s return to the limelight. One Biden campaign operative who wished to remain anonymous told Politico: “It takes a special level of chutzpah as the man most responsible for reelecting Donald Trump to decide it’s your voice that is missing in this moment. The country would be better served if he rode off into the sunset.”

🚨NEW: Stephen A. Smith ROASTS Joe Biden after speech🚨

"Waste of time. Fell on deaf ears. I watched about five minutes of it. I didn't really have much interest in it. Because he’s no longer the president."

"When he was the president, there were some things that he did, like… pic.twitter.com/FTjJQ3MUXe

— Jason Cohen 🇺🇸 (@JasonJournoDC) April 16, 2025

Two sources who were “familiar with the matter” told the New York Times that Biden was paid for the address, and that “he is expected to participate in more speaking engagements in the future.” Something to look forward to.

Biden’s full address can be watched below.

Elizabeth writes commentary for Legal Insurrection and The Washington Examiner. She is an academy fellow at The Heritage Foundation. Please follow Elizabeth on X or LinkedIn.

Donations tax deductible

to the full extent allowed by law.

Comments

The administration that a majority elected.

Considering the Social Security is going to be bankrupt well before many of us could even begin to collect, I don’t think we should give a crap about it at all. Get rid of it.

Sure, Get rid of it. Many of us have been paying into SS for our entire lives. Get rid of it and Trump and his followers can kiss the rest of their elected lives goodbye. Do this and the Dems will rule this country for the next generation. Maybe two.

>Many of us have been paying into SS for our entire lives

You realize that money has already been spent? The only way someone is getting Social Security benefits today is by robbing younger workers who have little chance of collecting anything when the entire system collapses.

A revitalized economy will allow SS to continue.

Do you understand what you’re saying?

That the people collecting today–the 65 year olds should BECOME that generation of younger workers who don’t get anything. People who are going into retirement, onto fixed incomes should take up the slack.

Instead of weaning the people with their best earning years AHEAD of them off of it now.

Current projections are that the SS Trust Fund will zero out about 2034. At that time, absent new laws to collect more tax money or reduce the amount paid out (e.g. by increasing the retirement age), those collecting SS will still have about 70% of their current payout.

I’ve paid into it my whole life too. I’ll never get a dime from it. Think the younger generations care if social security burns to the ground? We know we’re getting ripped off.

Hey retard, they’ve spent every cent you paid in, ever since I paid in and as every cent that everyone else who’s working right now ever paid in. There is no money in Social Security. It’s going to go bankrupt in just a couple years. Why the hell would I want to keep paying into something that will never ever pay back?

An how the heck is Social Security going to be funded. Just how when there’s more money going out of Social Security than coming in and the federal government is sitting on $36 TRILLION in debt owed to the bankers, foreign countries. And on top of that apparently the BILLIONS in fraudulent payments out of the system. The government doesn’t have any money left to prop up Social Security, Either it gets fixed now or goes completely broke by the end of this decade.

Yeah, you’ve paid in all your life. I’ve paid in all my life. Everyone has paid into the Social Security system. It’s the law. Everyone pays but not surprisingly members of Congress have exempted themselves and pay into their own personnel, private pension fund. In any case, they spent all that money on other things and it isn’t there for you, or me, or anyone else to collect in the future. The money simply doesn’t exist. The Social Security Trust Fund is empty and has been for a long time. It’s just a big Ponzi Scheme at this point and like all Ponzi Schemes will sooner, rather than later. go belly-up, And when it does everyone will be sitting there with this bewildered look on their face wondering what just happened.

Your post should receive no down-votes.

SS is a scam and has been, since its wretched inception. The federal government should not be in the business of taking savings from current workers to pay for benefits for retirees.

If the program is to exist, beneficiaries should be reduced to a small pool of recipients whose eligibility is determined by income levels and circumstances.

Oh gawd… cause that’s exactly what we need… another bloated poorly run entitlement program

If we cut out the fraud within the system, it will be sustainable for years to come.

Social security will not disappear any time soon. Although I thoroughly approve DOGE’s efforts to root out waste and fraud and every penny saved is one earned, it will not rescue the plan. The problem is that years ago congress, craven cowards that they are, broke into the trust fund and stole the money for other government purposes.

Eventually, congress will have to actually solve the problem. Means testing, re-establishing the trust fund and insulating the fund from further raids by legislative action, and then directing tax revenues from some designated source into that fund, would supplement DOGE’s effort.

I think of it a little like the Strategic Petroleum Reserve. Biden drew down the reserves for political reasons. Now it has to be re-filled, but not until the price of oil is right. Soon, congress will be forced into actually fixing the problem. Same with social security.

We all want our government to run smoothly. I, for one, am sick of everything being focused politically in congress. It’s time to stop throwing bombs and playing Chicken Little, roll up the sleeves, and sit down to solve the problem once and for all. The party who makes the first step towards establishing a bipartisan approach to Social Security’s fiscal peril, will be in the catbird’s seat with the voters.

Social Security is on the ropes financially, but it isn’t going anywhere. It will be repaired.

Nice solution! Going by your “Logic” we’d just get rid of EVERYTHING that the DEMOcrats/rinos have destroyed! Why not just give illegals a CARD – ANYTHING they want is FREE to them! Make their lives less of a hassle – same for the US Citizens committing massive FRAUD! Just SIGN UP that you’re going to cheat, steal, obstruct, or destroy!! Oh wait, they already have that – called the DNC!!

Somebody forgot to tell Dementia Joe that he isn’t president anymore. Angry old senile man shouting at the wind.

“Two sources who were “familiar with the matter” told the New York Times that Biden was paid for the address, and that “he is expected to participate in more speaking engagements in the future.”

Sounds like they’re now stuffing money up the hole vacated by the hand and arm.

I’m a millenial.

I plan my retirement as though Social Security doesn’t exist, because I don’t believe I will be able to collect it.

The government simply stole that money.

Outstanding plan!

I’m a boomer and I planned my retirement the same way. I didn’t expect SS to be here.

Now I’m retired. I started collecting SS as soon as I could instead of deferring it. Why? Same idea. I don’t think it will continue to be here so I’m going to get back as much as I can while I can.

I’m a late boomer and planned like there was to be no SS. Started buying rental real estate 36 years ago. Waited until I was 70 and a half to collect SS as they can be rather insistent. Something has to be done for SS- hint, it will be. Too much political dynamite not to.

All the hysteria about SS going bankrupt has been a LIE to cover up the THEFT and misuse of the funds! I’d place it somewhere up a few rungs from “climate doom” and “green energy”! What has been shown recently is the magnitude of fraud! Two kinds of FRAUD – one is actual CRIMINAL fraud of someone filing false claims. The other is OFFICIAL FRAUD that bestowed benefits on KNOWN ILLEGALS! The first should result in a Prison Sentence. The SECOND should be considered TREASON and – you know!!!

The DEMOcrats have reached such a level of desperation that they wheeled out Joe to scare monger a little bit – only a BIGGER IDIOT than JOE would believe anything JOE says!

No one is discounting the impact of fraudulent payments but that wouldn’t have saved the SSA system from the mathematical realities it faces. By all means find and prosecute every instance of fraud, sieze.assets to recover as much funding as possible, set the guilty to work and garnish their wages but don’t blame the looming SSA shortfalls on it.

In a decade +/- all the excess contributions made to SSA that were for decades LOANED to the general Treasury will have been repaid to SSA with interest. From that point the current revenues of SSA taxes will generate enough revenue to fund about 75% of what the total benefits are projected to be at that time.

The real problem is less workers to each beneficiary. In ’86 taxes were raised (yea for Gen X and younger) and the full retirement age was increased for these same groups paying higher SSA/Medicare taxes. Didn’t solve the long term math problem of Boomer era retirement. Several different reform efforts were made, all refused by AARP and the Silent Gen and Boomers. Instead Congress actually loosened up access to benefits in some ways. This Congress they ended the ‘windfall’ provision as one example.

Bottom line is the current benefits are gonna be cut by 25% ish if we.do nothing. Younger generations have already stepped up to pay higher SSA/Medicare taxes their entire working life and had their full retirement age increased. Time for Silent Gen and Boomers receiving benefits to be willing to feel more pain than they’ve done previously. Especially since they largely blocked prior reform efforts and that doing nothing costs them an automatic 25%. If whatever reform is proposed doesn’t have more/less equal pain among generational cohorts then I will oppose it for whatever that’s worth.

I’m GenX and did the same thing. Then got screwed when I had to use my savings for an open heart surgery and continuing issues. I’ll never get that money back and now I (and my wife) are stuck with SS as our only backup.

Whereas if you hadn’t had the money, the government would have paid for the surgery? Yeah, really gives America an incentive to work hard, doesn’t it?

So why didn’t you have Health Insurance? Make too much for o’crap-care? Make too little to afford the alternative? There was a time when CATASTROPHIC INSURANCE was the way to go for that – cheap – high deductible, but protected you from a Life Destroying Event! But then that jug eared jesus “SAVED” everyone – everyone except those who did the right things in life!!

In the immortal words of America’s favorite philosopher, George Washington “Bugs” Bunny, “What a maroon”.

I like my former presidents one way – silent.

Maroon? I’m offended!

If you don’t know what the word means, look it up. I reckon the only reason Bugs Bunny cartoons that still run on TV haven’t had that word censored out is because nobody knows the origin of the word!

What is wrong about a term that simply describes color, it is more accurate than black. Its use with Jamaicans is associated with them beating the United Kingdom.

While I am aware of the meaning of Maroon that I surmise you are referring to, I don’t believe the Bugs’ writers intended that reference or were even aware of it. Moron was considered in some circles an insult too blue to use in movies or on TV, hence the intentional mispronunciation, much in the same way he would say imBESSel.

Anybody wonder why we still haven’t seen any ‘Miss me yet?’ memes with Biden’s picture? No, I thought not.

Okay, DJT may be “this guy” but Biden is the “Big Guy.” I think I’d rather be “this guy”

Biden is the crooked Big Guy, founder of the Biden Crime Family- Syndicate.

“throughout the address, Biden referred to President Donald Trump only as “this guy.”

Doesn’t even come CLOSE to rolling off the tongue like “Crooked Joe Biden.”

Waste and fraud describes Biden and Obama to a T. I don’t want Biden to ride off into the sunset. I want him to drop dead as soon as possible (and take Dr Jill with you).

“Waste and fraud describes Biden and Obama”

Biden’s a waste and Obama’s a fraud. Or is it the other way around?

I think they’re interchangeable…

My original thought (yes I have them) was applying both waste and afraid to Biden but after I posted the comment I saw that it fit both of them and yes they’re interchangeable.

Like JR

The Dems have been claiming Republicans want to dismantle SS since forever. Its a favorite boogieman of the Left, and just as true now as it ever was.

Who thinks it was a good idea to have this desiccated and demented old man speaking in public? For money? Got to wonder.

As if he’d ever do anything for free.

They’re going to have to pay him to appear at Arlington for his own funeral.

I was a pallbearer for a dear friend at Arlington, ww2 fighter pilot. I wonder how much undeserving DEI trash is there now.

I want to know who’s stupid enough to pay money for him to speak?

In less than a decade the SSA trust fund runs out. Every penny contributed since it began will have been paid out to beneficiaries. All the funds borrowed by the general Treasury will have been repaid back to the SSA trust fund with interest. At that point there is projected to be enough revenue from SSA taxes annually to provide roughly 75% of the benefit amount.

The Boomers and Silent Gen followed the AARP like the pied piper and wouldn’t let us make any changes to the program to extend it. Most folks Gen X and younger have long since come to terms that SSA benefits would be reduced if we got them at all. At this point I don’t feel any need to make any sacrifices for older generations who opposed reforms decades ago when they would have been less painful. By all means root out the fraud and put the criminals in jail but telling Gen X and younger to delay full retirement or take less so that Boomers/Silent Gen don’t take some of the pain they created by refusing to support reforms? Nah.

As a recipient, I understand what you’re saying. If I had my druthers, I (and my contemporaries) would have seen SS withholding increased much sooner than it was. If I REALLY had my druthers, Congress wouldn’t have begun raiding the trust fund decades ago so it would still be solvent.

.

Here’s the issues for me.

1. Gen X began paying the higher SSA tax in HS. Our entire adult working life we’ve been hit with far higher rates of SSA tax.

2. Our retirement age has already been raised.

3. Silent Gen and Boomers blocked further reforms. I suspect that when the day of 25% cuts arrive they will howl the loudest.

What would I change to.fix it? Easy reinforce the concept that SSA is an Individual benefit based on lifetime work history.

1. End option of claiming Spousal earnings. Modify current benefits to reflect that.

2. Make full retirement age 70 for anyone umder age 66.

3. End early retirement option. If you are incapable of working then there’s SSA Disability IF you qualify otherwise suck it up.

4. Extend the lifetime working years from 35 to 45. A working life from age 18 -69 gives you 52 years to get in 45 years to make.sure you don’t have any 0 in the annual earnings column. That gives 7 spare years for care of young children/college.

5. Increase minimum years of work to qualify for SSA from the current ten years to 30 years of full-time employment.

6. Restrict benefits to US Citizens.

7. Whatever % of benefits that current revenue won’t support after these changes gets built into cuts to current beneficiaries so the pain is spread among each generational cohort.

The ‘raid’ is wrong. It was loaned to the general Treasury. That’s the declining stack of :IOU’ in the trust fund. Every cent + interest will have been paid back to the trust fund in a decade. The $ was borrowed not stolen. The bonds being redeemed will be exhausted in a decade and the program will operate on current SSA tax receipts as a pay go program…. but will only bring in about 75% of the amount needed to support benefit levels.

Here’s a couple of other ideas.

– Remove the income cap on contributions. You make more, you can afford to pay more.

– Find some way to grab SS contributions from executives and hedge fund managers and trust fund babies who get most of their money from capital gains. Maybe exempt the first 100K or 250K but then hit them up for SS.

– I believe there are jobs that are exempt from paying SS because they have their own similar program. F that. Make everyone pay into SS.

IMO the better way to do exactly that is a bit counter intuitive. End the SSA/Medicaid tax entirely. Put both programs ‘on budget’. Now they need general revenue to operate. Those funding requirements will come with a built in constituency with powerful political muscle.

Then reform the entire tax code. Make it simple and transparent. First keep the 10% base tariffs for revenue and incentive to invest in the USA. Add a small tariff for goods transported in non US Vessels, which specifically encourages investment in US shipyards. Add a 10% VAT at retail level.

Next go to a flat 12%-15% income tax. Same rate for corporate tax, capital gains, passive and active income. Scrap the estate tax, give an exemption on the first $3 million of an inheritance, above that is income tax.

Create one standard deduction equal to 2000 hours at federal min wage roughly $15K. No other deductions. No refundable credits. Simple, fair, transparent, no way to game the system to get refundable credits, no way to have special interest groups get special provisions written to benefit them.

Make congress and all federal, state, and local government employees participate. Retroactively.

WTPuck,

Meh…there were several Municipal and County Gov’t that chose to opt out decades ago. Congress gave them the choice and they made it. I don’t have an issue with that.

What I don’t like is the bending of the rules this Congress to allow people to get around part of the disincentive to opt out ‘windfall tax’ provisions. That’s where my proposal for increased work years comes into play to mitigate gamesmanship to work the system.

With proper investment, there would be far more money, Congress filling it with IOUs is the real problem, it was irresponsible.

“In fewer than 100 days, this administration has done so much damage and so much devastation”. Meaning they have cut off the money laundering scheme the Dems have been running.

Yep. Beyond SSA benefit fraud are the discovery of tens of millions of active SSA# that are obviously not supposed to be valid; several million of them for folks claiming to be older than 115, many times that number for folks older than 90.

Possession of an active SSA# is the single most important item needed to Gey access to all sorts of govt goodies outside of the SSA. Starting with refundable tax credits being paid out, housing grants, SBA, Covid cash, all sorts of State programs. Then there’s the potential for voter registration and ballot fraud. Clean up the low hanging fruit on SSA # and lots of problems get mitigated if not eliminated.

Joe Biden:

“They’re certainly breaking things. They’re shooting first and aiming later.”

Also Joe Biden:

“[if] you want to keep someone away from your house, just fire the shotgun through the door.”

That way, you don’t even HAVE to aim.

If I hadn’t grown to dislike him so much, I might feel sorry for him.

PEOPLE!! There’s a SIMPLE FIX to the SS issue! Just treat it like the “Trust” Fund has been treated! I’ve searched high and low – mostly low – for that WELFARE TRUST FUND! IT’S NOT THERE!! Obviously there’s no END to the FUNDING FOR PEOPLE WHO WON’T WORK! Just change all of us old folks who worked all our lives and paid in from SS to WELFARE – there – problem solved! I sort of recall an Article in Our CONSTITUTION that Congress shall not pass any laws to which they are not subject – or something like that! So, can ANYONE explain WHY they are not in the SS System rather than the lucrative, insulting “Pension Plan” they have? Maybe it’s time to just say “Hey, you guys weren’t supposed to get this extraordinary, UNCONSTITUTIONAL benefit so all your reserves will be transferred to the SS System and you can look forward to your check on the 3rd!!

I did not watch Biden. Biden is brain dead so he was likely hopped up on drugs and given a script to read, but had no clue to what he read. The Social Security Fund was long ago stole by the government when the Dems controlled all branches to pay for the Vietnam War. Since then all SS funds has been merged with the general fund and it will never be out of funds since the govt will always pay out. DOGE finding illegal payments is good for stopping illegal payments and having illegals aliens and foreigners to use SSN against the law.

So, Biden must know that the Social Security Checks written to people old enough to get in the Guinness Book of World Records, but never applied, were really going to living Democrats!

All those “really old” people should be invited to come in with proof of their real age for records correction.