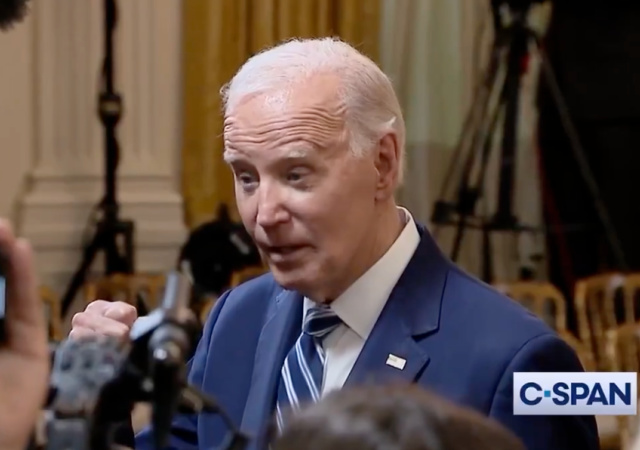

U.S. Appeals Court Blocks Biden’s $500 Million Student Loan Forgiveness Plan

See? You cannot cancel student loan debts.

The Eighth Circuit Court of Appeals blocked former President Joe Biden’s $500 million student loan forgiveness plan.

The three-judge panel agreed with Missouri and the other states that joined the lawsuit (Arkansas, Florida, Georgia, North Dakota, Ohio, and Oklahoma) that Biden and his Education Department overstepped their authority.

The judges also concluded that the plaintiffs satisfied the tests to receive the preliminary injunction:

- Threat of irreparable harm to the movant [party that makes a motion in a case]

- State of balance between this harm and the injury that granting the injunction will inflict on the other parties litigant

- Probability that the movant will succeed on the merits

- Public interest

The Education Department published the Saving on a Valuable Education (SAVE) plan after the Supreme Court struck down a previous student loan forgiveness plan.

SAVE reduced “the amount of income subject to loan payments, eliminated interest accrual, and expedited loan forgiveness for most borrowers.”

The plan also canceled some of the outstanding balances after the person paid towards the loans for 120 months.

The judges concluded (deleted citations):

We agree with the district court that at least one state, Missouri, has standing to sue due to financial harms to the Higher Education Loan Authority of the State of Missouri (MOHELA), and its standing is sufficient to resolve this appeal.

As the Supreme Court previously held, Missouri suffers a cognizable financial harm when the Secretary enacts a plan that discharges student loans and closes accounts serviced by MOHELA. The SAVE Rule does so — it leads to loan forgiveness and closure of accounts serviced by MOHELA in as few as ten years of repayments. Once an account is closed, MOHELA loses future fees for servicing the accounts, which reduces its profits and ability to fund education in Missouri. Under the SAVE Rule, around 28,000 accounts held by MOHELA have already been closed, with 53,000 more identified as eligible for forgiveness. “This financial harm is an injury in fact directly traceable to the Secretary’s plan” and redressable through the relief sought by the states. Nevertheless, the federal officials assert Missouri lacks standing because the SAVE Rule provides some benefits to MOHELA and MOHELA has also requested some accounts it previously serviced be transferred to other loan servicers. We disagree.

The judges went further than the district court, which enjoined “the entire rule and the resurrected REPAYE [Revised Pay As You Earn] forgiveness.”

In other words, the judges blocked the administration from canceling more debt or allowing certain provisions to act independently.

The Education Department also cannot bring back any old repayment plans.

Biden and his cronies tried so hard to cancel student loan debts during his term. The courts kept shooting him down and yet…they kept trying.

This case should be the end of it. I say should because you know another Democratic administration will try to resurrect all of this.

I don’t want to subsidize anyone’s student loans. I chose Oklahoma State University because I could live at home, pay tuition out of pocket, and graduate debt-free.

Donations tax deductible

to the full extent allowed by law.

Comments

Ha ha ha ha ha…. the grifting dotard gave away hundreds of millions (illegally) to buy votes. The word-salad-spinner blew through almost $2 billion with her campaign of ‘joy’. And STILL they lost just like that drunken wh*re Hillary Clintoon.

Priceless!

Hahaha. This is going to leave a mark and I love it.

Standing headline,

BIDEN WRONG AGAIN,

I’ll just go ahead and say it: I don’t miss that man one single bit and I can’t wait for tomorrow when my memory of him will be incrementally dimmer.

Is Joe still with us? Room temperature yet?

Unfortunately he’s still around. He popped into a diner in Delaware for breakfast a day or two ago.

Children of the elites don’t need free taxpayer money. They can let daddy pay it off.

Isn’t it $475 Billion?

Million … billion … it’s all the same for the federal government.

Now, quadrillion is where they start to take it seriously. At least, for this decade.

So I take it that there’s no clawback of the debt that has already been forgiven under Biden’s illegal plan, right?

This is not a decision on the merits, merely an injunction. But to get the injunction the court had to decide who is likely to win on the merits, and it says the plaintiffs’ reading of the statute seems better than the federal government’s reading, and likely to prevail if it goes to trial.

But government debt is an imaginary number.

That’s why Missouri had to show standing. It had to show that it is losing actual money through these plans, money that would have gone to education in that state.

The net effect of govt subsidizing and loaning to “make college more affordable” historically is actually “to make college more expensive”. There’s no downside to a uni that increases its bureaucratic staff beyond all reasonable needs – raising tuition every year like compounding interest – because govt is there to ensure there’s no loss of income resulting from unreasonable tuition price gouging.

This is true, but irrelevant to the legal questions here. You are explaining why these schemes are bad policy. The court decision explains why they are probably not authorized by the statute, even though some very similar plans are authorized and may continue.

Yes, we know the stupid pedophile bastard couldn’t figure it out the first couple of times, so the scotus head to dick slap him again

This is not a SCOTUS decision, and it has nothing to do with any previous SCOTUS decision. It’s a circuit court opining on the likely interpretation of a specific statutory clause. Loan forgiveness is allowed on one kind of repayment plan, but not on another, even though for 30 years everyone has been assuming it’s allowed for both kinds of plan.

He violated a SCOTUS decision multiple times, Pretty certain that the current government will finally drop this theft and tell the losers that they signed the loan, they have to pay it off.

Stop lying. No, he did not. Not even once.

Yes, you can. Did you read the decision? It explicitly acknowledges that the secretary of education can forgive student loans, when the statute authorizes her to. Which is all that the previous administration ever claimed.

Nobody ever claimed that the president, or the secretary, has some sort of inherent power to forgive loans. No one claimed that. Anyone who claims that that is what this case was about is an outright, brazen liar.

The case is entirely about statutory interpretation. As the court explicitly says, the statute does authorize the secretary to forgive loans that are on an Income Based Repayment (IBR) plan, at the end of the plan’s 20- or 25-year term. And as the court also acknowledged, for the past thirty years, including under the Bush and Trump administrations, the Department of Education has consistently understood that language to apply to Income Contingent Repayment (ICR) plans as well. The plaintiff states were surely aware of this practice, and never made any objection.

Only now, when the previous secretary relied on this interpretation to introduce ICR plans with much easier terms, and forgiveness at their end, did the states bother to read the statute carefully, and realize that the authority to forgive loans only applies to IBRs and not to ICRs.

However, the court says, the statutory language seems plain when you read it carefully and without assumptions. Since 1994 everyone seems to have been reading it wrong, and the states now seem to be reading it correctly.

Or at least that’s the likely outcome of a full trial on the merits, which means the states should get an injunction now. If the Department still thinks it can win at trial, it’s welcome to try, but in the meantime it has to stop these easy ICRs and restructure them so that the full loan is repaid by the end of the 25 years. It can continue forgiving IBRs, as the statute says.

Ooh, you came so close –so close, but you couldn’t stop yourself from defending evil.

Shut up. Just shut up already. You contribute nothing of value, just hatred and slander.

IMO, this episode was an attempt to payoff a core d/prog constituency. We will see.more of this in the future as d/prog rally around their coalition. I suspect that when SSA reform comes to the table and before long it must, the idea of returning SSI to an individual benefit and in truths # of years worked to qualify from 10 to something more reasonable like 20 or 25 will be opposed by d/prog. With full SSI retirement age at 67 there’s plenty of time to get 25 years of work in from age 18. 18+25 = 43. 67-43= 24. So even if woman got married at 18, had 3 children 2 years apart she could delay entry into the workforce until the youngest child turned 18, graduated HS and then have 25 years until full retirement age to get the needed 25 years of work to qualify for SSI.

Of course it was. That doesn’t make it illegal. Its legality depends entirely on what the statute authorizes. The way everyone seems to have understood the statute for 30 years, this was legal. The way it’s actually written, it isn’t, or at least seems not to be.

Ok. Not sure where you are going with this as I made zero reference to the legality of it. Though IMO it is not permissible absent explicit authority which doesn’t exist.

The authority was claimed to come from a statute. The court says the government (and everyone else) has likely been misreading the statute for a long time.

Pay back your f’ing student loans deadbeats.

Possibly the best education they could get.

Democrats promise but can’t deliver. Plus, it hits close to home. The pocketbook.

Hopefully, this is the last great beatdown of this fossil! Don’t go away mad Joe, just go away. And STAY away!