Federal Court of Appeals Stays Corporate Transparency Act Mandating Disclosure of Company “Beneficial Owners”

Law is on hold pending a full ruling by the federal Fifth Circuit court of appeals, likely to issue mid-2025

Under a federal statute passed in 2021 called the Corporate Transparency Act (CTA), millions of entities incorporated under various state laws would have been required by January 1, 2025 to provide detailed information about “beneficial owners,” meaning those who own 25% or more of the company or who direct substantial company-wide operations, to the U.S. Department of the Treasury.

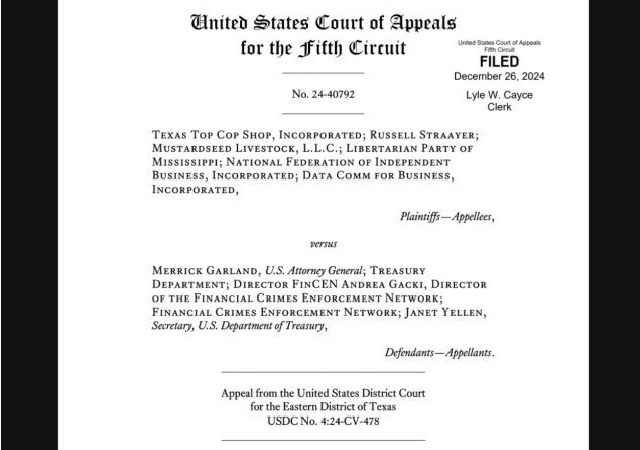

This law was designed to combat money laundering and the use of shell corporations by shady corporate entities engaged in corporate criminal activity, but on December 3, 2024, a Texas federal court enjoined the CTA’s reporting requirements, calling the federal statute “quasi-Orwellian” and holding that the statute likely violates the United States Constitution.

Then, in a double switcheroo, the federal Fifth Circuit court of appeals lifted the injunction on December 23, and then three days later reinstated it. So as it stands now, the law is on hold and corporations do not have to report beneficial owners to the Department of the Treasury.

From Reuters: US appeals court halts enforcement of anti-money laundering law:

A U.S. appeals court has halted enforcement of an anti-money laundering law that requires corporate entities to disclose the identities of their real beneficial owners to the U.S. Treasury Department ahead of a deadline for most companies to do so.

The New Orleans-based 5th U.S. Circuit Court of Appeals reinstated late Thursday a nationwide injunction that had been issued this month by a federal judge in Texas who had concluded the Corporate Transparency Act was unconstitutional…

[I]n Thursday’s order, the court said it decided to keep enforcement of the law paused “to preserve the constitutional status quo while the merits panel considers the parties’ weighty substantive arguments.”

* * *

The injunction had been obtained by the National Federation of Independent Business, which along with several small businesses challenged the law through lawyers at the conservative Center for Individual Rights.

“Given that we have established that the CTA is likely unconstitutional, this intrusive form of government surveillance should be halted until the law’s fate is finally resolved,” Todd Gaziano, the Center for Individual Rights’ president, said in a statement.

Under the law, which was enacted in 2021, corporations and LLCs were required to report information concerning their beneficial owners to FinCEN [the Treasury’s “Financial Crimes Enforcement Network”], which collects and analyzes information about financial transactions to combat money laundering and other crimes.

The measure’s supporters said it was designed to address the country’s growing popularity as a venue for criminals to launder illicit funds by setting up entities like limited liability companies under state laws without disclosing their involvement.

U.S. District Judge Amos Mazzant in Sherman, Texas, on Dec. 3 ruled Congress had no authority under its powers to regulate commerce, taxes and foreign affairs to adopt the “quasi-Orwellian statute” and that it likely violated states’ rights under the U.S. Constitution’s Tenth Amendment.

At first glance, it seems like maybe this law is a good thing, especially since money laundering and other corporate crimes likely finance many illicit schemes including illegal drug distribution and maybe even human trafficking.

But looking at Judge Mazzant’s order, which stayed implementation of the statute in question provides some insight into what he found objectionable:

Legislative ingenuity, dispatched to meet today’s problems, is not measured by any other standard than our written Constitution. Modern problems may well warrant modern solutions, but modernity does not grant Congress a roving license to legislate outside the boundaries of our timeless, written Constitution. See, e.g., Louisiana v. Biden, 55 F.4th 1017, 1032 (5th Cir. 2022) (“The Constitution is not abrogated[, even] in a pandemic.”). The Constitution must stand firm.

In the matter before the Court, Plaintiffs challenge an unprecedented law known as the Corporate Transparency Act (“CTA”). It represents Congress’s attempt to combat bad actors’ ability to cloak their criminal activities in a veil of corporate anonymity. At its most rudimentary level, the CTA regulates companies that are registered to do business under a State’s laws and requires those companies to report their ownership, including detailed, personal information about their owners, to the Federal Government on pain of severe penalties. Though seemingly benign, this federal mandate marks a drastic two-fold departure from history. First, it represents a Federal attempt to monitor companies created under state law—a matter our federalist system has left almost exclusively to the several States. Second, the CTA ends a feature of corporate formation as designed by various States—anonymity. For good reason, Plaintiffs fear this flanking, quasi Orwellian statute and its implications on our dual system of government. As a result, Plaintiffs contend that the CTA violates the promises our constitution makes to the People and the States. Despite attempting to reconcile the CTA with the Constitution at every turn, the Government is unable to provide the Court with any tenable theory that the CTA falls within Congress’s power. And even in the face of the deference the Court must give Congress, the CTA appears likely unconstitutional. Accordingly, the CTA and its Implementing Regulations must be enjoined.

Nice to see a federal district court actually taking the U.S. Constitution seriously.

The court went on to hold that the costs imposed on the millions of corporations under the CTA could never be recovered, because “the federal government generally enjoy[s] sovereign immunity for any monetary damages,” making such damages “irreparable.” And these costs are not small or de minimis:

[a]ssuming that all reporting companies are small businesses, the burden hours for filing BOI [(beneficial ownership information)] reports would be 126.3 million in the first year of the reporting requirement (as existing small businesses come into compliance with the rule) and 35 million in the years after. FinCEN estimates that the total cost of filing BOI reports is approximately $22.7 billion in the first year and $5.6 billion in the years after.

And the court held that the statute likely violates the First and Fourth Amendments to the U.S. Constitution:

the record before the Court contains sufficient facts to indicate the CTA and the Reporting Rule may violate the Constitution…Absent injunctive relief, come January 2, 2025, Plaintiffs would have disclosed the information they seek to keep private under the First and Fourth Amendments and surrendered to a law that they contend exceeds Congress’s powers. That damage “cannot be undone by monetary relief.” That harm is irreparable.

The court also held that the CTA was not valid under the commerce clause because “[t]he CTA does not regulate channels of, or instrumentalities in, commerce,” only formation of corporations and reporting about them. And, “[t]he CTA does not regulate an activity—it creates one.”

The court then issued a nationwide injunction staying reporting under the CTA.

So of course the government appealed. And on December 23, a three-judge panel of the Fifth Circuit lifted Judge Mazzant’s injunction, making the CTA’s reporting requirement mandatory again, because “the government has made a strong showing that it is likely to succeed on the merits in defending CTA’s constitutionality.”

But then, in a surprise “text order” with no accompanying pdf document explaining its reasoning in detail, the Fifth Circuit held that “[i]n order to preserve the constitutional status quo while the merits panel considers the parties’ weighty substantive arguments, that part of the motions-panel order granting the Government’s motion to stay the district court’s preliminary injunction enjoining enforcement of the CTA and the Reporting Rule is VACATED.”

So as it stands now, briefing is scheduled to be submitted in February 2025, with oral argument scheduled in March of 2025. If it takes the Fifth Circuit several months to issue a ruling that means it should come out some time in mid-2025.

Then, of course, however it comes out, the loser will ask the Supreme Court to take the case.

Of course this could all be thrown off kilter by the incoming Trump administration.

We’ll see.

🚨🚨Another insane BOI Update🚨🚨

5th Circuit today has vacated its own motions panel’s decision to stay the District Court’s injunction against enforcement of the CTA.

The takeaway of that word salad?

The injunction is back!! 🎉

Enforcement of the Corprate Transparency Act… pic.twitter.com/459Go7iFGe

— Kevin Henderson (@KHendersonCo) December 27, 2024

Donations tax deductible

to the full extent allowed by law.

Comments

Only question I have is who is on the merits panel

As a board member of a non-profit that would be impacted by this, I’m happy to see the injunction back. We have some folks on our board who have to deal with this in a professional capacity, and their opinion is generally that FinCen and other TLAs want a way to get at this information without having to obtain a warrant since it largely exists in various databases but not under their control.

Doesn’t Form 990 already require this information for non-profits?

Entities that have qualified as tax-exempt (501c3, and the like) are exempt from the CTA, but other non profits (such as HOAs) are not.

Our dysfunctional Congress could not manage even to exclude HOA’s from this statute during its last session. Everything gets thrown to the courts.

Yeah, it’s an HOA.

In Kentucky we have to file basic information with the Secretary of State as board members of an incorporated entity. I’m not sure what’s on our tax forms as we have a management company do our bookkeeping and filing. My impression is that more information would be needed to comply with the CTA.

Yes the 990 does require the list of officers.

Same with partnerships on form 1065

Same with S corps on form 1120S

Same with C corps ( at least the 50% owner)

Same with LLC taxed as partnerships or taxed as S corps

Same with single member LLC’s which are reported directly on the 1040.

If only there was a panel that found and could prosecute money laundering by and for our elected representatives. Perhaps full departments could be eliminated.

In late 2023, we received notices from our CPAs regarding compliance with the CTA. And during 2024, as the Annual Corporate License renewals were received (WA), there was a sentence or two reminding the entity to file with FinCen.

The deadline to file with FinCen was 12-31-24.

FinCen required a photo ID to be uploaded. Also, they want the filer to drill-down to the individual level of entity ownership, even entities that own/partially own other entities. The good news was that ownership cutoff was 20% so as you dirll-down, it’s more diluted and possibly not reportable.

But, since the deadline was 12-31-24, I would assume FinCen has already collected the data from most filers.

It is now estimated that nearly 30 million legal entities either were unaware or refused to comply.

Like me…. I wonder if they will purge the info if not needed……. I didn’t think so. However, since I am so high on the radar anyway.. licenses and DCM stuff. Now as for the Biden, Clinton, and Obama Crime Families… don’t even ask.

Right on target.

“millions of entities incorporated under various state laws would have been required by January 1, 2025 to provide detailed information about “beneficial owners” … So as it stands now, the law is on hold and corporations do not have to report beneficial owners to the Department of the Treasury.”

Totalitarian bullshit.

All year long we were hounded to comply with this tyrannical violation of our privacy at the point of a gun:

“Those who fail to file by this deadline — or fail to update this information if needed — could face up to two years imprisonment and fines up to $10,000, in addition to civil penalties of up to $591 per day.”

Then, on the day after the deadline has passed, our back-robed nazguls decide, “Wait, you don’t have to do this. It’s quite probably entirely unconstitutional. We’ve already got your private data in our databanks, but hey — no harm, no foul, right? P.S.: This ruling moots any standing you could have had to complain. Happy New Year, suckers!”

This law went into effect three years ago today. There was all that time to beat it down, but no, let’s wait until the exact day after it doesn’t matter and the Swamp has gotten everything it wanted regardless.

Actually they seem to have decided that it likely is constitutional, which is why they initially lifted the injunction. Then a few days later they seem to have said, “We think it’s likely to be constitutional, but what if it isn’t? If we lift the injunction as we said a few days ago, and then it turns out that the law is unconstitutional, millions of people will have suffered irreparable damage. Whereas if we keep the injunction and then it turns out the law is constitutional (as we think it is) then it’s no big deal, the government won’t have suffered much damage from the delay, they can just implement it a few months later than planned.”

It was the motions panel that issued the the Stay on 12.23.2024

It was the merits panel that vacated the Stay on 12.26.2024, (the merits panel is a different 3 judge panel).

My prediction is the CA5 will rule the CTA exceeds congressional authority under the commerce clause, They wont address the 4A issue. ie disclosing ownership without probable cause – note that I am in the minority school of thought on that issue. Similar to requiring DNA samples for the entire population – sorry not the best analogy.

Oral arguments set the last week of March, Opinion issued mid April.

There is no circuit split because the virginia case and Oregan case were not appealed to CA4 / CA9 respectively (at least not appealed to my knowledge)

SC will accept cert and final ruling in Nov ruling CTA is constitutional.

The Treasury Department ruled ever HOA and Condominium Officer and Board member must register. This is not only absurd, it is harmful and dangerous. We have already learned that no amount of information about oneself is safe from Federal functionaries who inevitably consider the public their playthings.

Worse, no amount of information about oneself is safe from Federal functionaries who then proceed to store it in a frigging shoebox out in the shed with a sign on the door that says “Welcome, Global Hackers” in 30 languages.

They made us scan our drivers licenses and upload them for this abomination.

Held off and glad I did

Unfortunately I went ahead and filed. Having spent 42 years dealing with IRS, DOL, etc. on behof clients, I did not want to wait until the last minute only to find the website had melted down, as government websites often do when overloaded before a deadline. The good news is my partner and I have retired and dissolved our LlC as of 12/31/24. We didn’t meet the filing exemption criteria, but there’s not much they can do with the info I reported. I agree with the court about the constitutional issue, and this brings me back to what I said often during the Covid fiasco, the third branch of government, our judicial system, is ill-equipped to timely prevent the infringement of our rights against the rest of the government, all aligned against us. When days matter, courts take years to respond. This reporting law is four years old. How do we fix this abuse in real time instead of years after the fact?

Maybe “beneficial owners” is a legal term that I’m not familiar with, but would “benefiting” not be more accurate? The primary meaning of “beneficial” is “conferring benefits”, which in this case would imply that a company’s shareholders benefit the company, which in a limited way they may do by buying its stock, but the main idea is that the company will benefit them.

I am very surprised the Trump admin passed this law. IT places a large burden on small businesses.