CA Gov. Newsom Throws Hollywood a Lifeline in Form of a Massive Tax Credit

Times are getting desperate in California, especially in Hollywood.

Production levels have plummeted and are down around 40% since 2022.

The film and TV production drought plaguing the U.S. entertainment industry appears to be “here to stay,” according to a sobering new report by ProdPro.The tracking company found that production in the United States was down about 40% in the second quarter of 2024 compared to peak-TV levels of filming activity during the same period in 2022. For nearly two years, Hollywood has suffered a stark decline in film and TV shoots that has prolonged mass unemployment and mental health crises among entertainment workers.

Bidenflation and Hollywood obliviousness have hit hard, and production costs have skyrocketed, making it increasingly difficult for films to turn a profit.

This is influenced by a number of factors in the industry right now, such as the rise in salaries for actors, the increasing importance of special effects, and the prevalence of established IP films, which require money to be spent on buying the rights to the property.All of these conditions mean that movies like Indiana Jones and the Dial of Destiny, a legacy sequel to one of film’s most successful franchises, was projected to have lost Disney almost 100 million dollars despite raking in 385 million at the box office. It’s budget? A horrifying 300 million dollars.

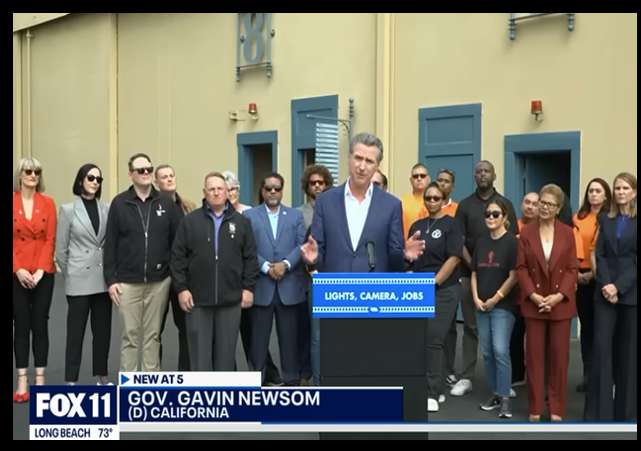

Given the industry’s importance to California, both in terms of revenues and prestige, Gov. Gavin Newsom has unveiled a proposal to more than double the annual amount of money allocated to California’s film and TV tax credit program.

The governor declared his intent to expand the annual tax credit to $750 million, up from its current total of $330 million, which would make California the top state for capped film incentive programs, surpassing even New York. If approved by the Legislature, the increase could take effect as early as July 2025 and span five years….The announcement comes as Newsom and other elected officials have been under increasing pressure to act as Hollywood has struggled to rebound since the pandemic and last year’s dual strikes by writers and actors.Productions have increasingly opted to film in other states because of higher tax incentives, putting a damper on California’s signature film and TV industry. Underscoring the state’s competitive disadvantage, about 71% of projects that were rejected by California’s film and TV tax credit program chose to film out of state, the governor’s office said.

I wish the Democrats in the state would connect the adverse impact of excessive taxes on other industries, as well ash show other business enterprises the adoration and respect the film industry gets.

“Increasing the film tax credit is critical to keeping Hollywood in California because of the enormous benefits this industry provides for our workers and small businesses,” said Assemblyman Rick Chavez Zbur, a Democrat representing the Hollywood area, who signaled support for the proposal.Industry workers on Sunday also highlighted the psychological effects of leaving home to work in other states.“Many directors are being forced to leave California and often the country for work. To repeatedly make the hard choice between work and home is psychologically painful and damaging to marriages, families and communities. I know because I traveled the entire 16 years of my twins’ lives,” said Millicent Shelton, a California-based director and member of the Director’s Guild. “Governor Newsom has taken bold and decisive action, stepping forward on behalf of the creators, crafts people, actors and small business owners who depend upon this industry for their livelihood.”

The tax credit is slated to be part of the January budget deal. At this point, I will be interested to see how big the deficit in 2025 will be.

Meanwhile, those Californians not in this privileged industry are not thrilled at the seemingly special treatment.

Furthermore, the tax credits, which provide a set reduction in final tax bills, may actually hurt the state fiscally.

Economists have largely voiced skepticism, warning that states receive a poor return on such investments. Studies have shown that tax revenue generated by film incentive programs amounts to a quarter, or even a dime, of every dollar invested, and in some cases each job created can cost taxpayers more than $100,000.A 2023 report from the New York State of Department of Taxation and Finance found that the return on its incentive program, which has an annual cap of $700 million, was between 15 cents and 31 cents on the dollar. “The film production credit is at best a break-even proposition and more likely a net cost” to the state, the report said.Joseph Chianese, a senior vice president and production incentives practice leader at Entertainment Partners, a Hollywood management firm, said in a statement that California’s existing $330 million annual cap could put it at a competitive disadvantage when other states and countries have higher limits.“Producers prioritize stability in incentives, especially in terms of legislative consistency, transparent processes and reliable funding,” he said.

If Newsom is banking on this move to help him with his 2028 presidential aspirations, he is likely to be disappointed.

CLICK HERE FOR FULL VERSION OF THIS STORY