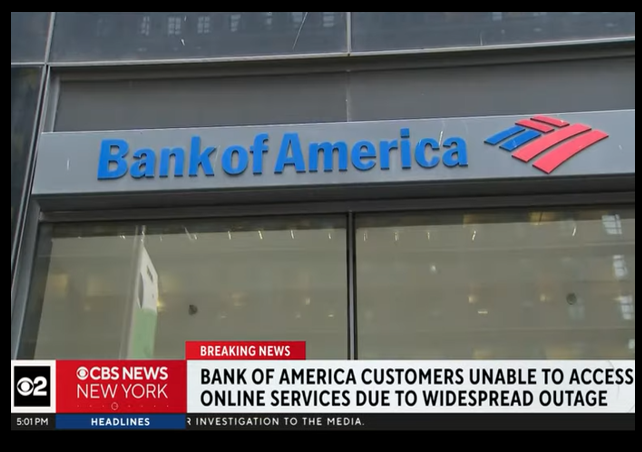

Bank of America’s Outage Impacted Thousands; Some Customers Saw Balances of $0

While the bank says the issue is “largely resolved”, it is difficult to say what damage to customer trust has been done.

Thousands of Bank of America customers have reported disturbing trouble with their accounts, with some seeing account balances of $0, which appear to be related to website and app issues.

Reports of problems spiked around 1 p.m. ET, when about 20,266 outages were reported, according to the website Downdetector.

People are complaining that their account balances are not visible on the app while others say they can access their accounts but that they are seeing a balance of $0.

“App not working and online banking shows yesterday’s balance,” one user said on Downdetector.

“Both the App and Browser access to BoA remain at least partially down for us,” another user said. “Can now see some of our accounts, but not all of them. And the transfer between accounts function remains non-functional for all accounts.”

Bank of America appears to be experiencing an online banking outage: thousands of customers are reporting seeing $0 balances on their accounts despite having money in the bank. https://t.co/OQNZaLtZR3

— FOX 9 (@FOX9) October 2, 2024

The outage impacted customers in many major American cities, and the lack of assuring response is causing anger at the institution.

According to Downdetector, the outage is widespread across the US, affecting the following major cities: New York, Chicago, Houston, Dallas, Phoenix, Los Angeles, San Francisco and Seattle.

Approximately 50 percent of issue reports cited problems with online banking, 41 percent cited mobile banking and just one percent of users reported issues with ATMs.

‘Five accounts show zero balance, over 20K,’ a Bank of America customer shared on Downdetector.

…The silence has sparked fury among its customers, with one woman sharing on X: ‘Could your people release a statement asap about what is wrong with the mobile app.? Showing all my accounts with – – – balance, yet my credit card on the mobile app. has the correct balance!!!’

The bank is now assuring customers the problem is nearly fixed.

In a statement to CNN, Bank of America acknowledged that “some clients are experiencing an issue accessing their accounts and balance information today.”

“These issues are being addressed and have largely been resolved,” Bank of America said. “We apologize for any inconvenience.”

However, Bank of America is offering no details on what exactly caused the problem. The most likely suspect is a software update, similar to what happened this July with Microsoft. The “blue screen of death” appeared at airports, hospitals, businesses, and government agencies.

Some are finding soothing refuge in humor, with references to a particular episode of “The Simpsons”.

The Simpsons predicted that Bank of America would collapse

Was this predictive programming?

THERE IS ONLY ONE ANSWER #Bitcoin pic.twitter.com/0TFi0bC8dx

— MonKa (@Cryptomonk2) October 2, 2024

Hopefully, this will get resolved soon, and the outage will not due to a more serious security threat.

Meanwhile, it is difficult to say what damage to customer trust has been done.

Donations tax deductible

to the full extent allowed by law.

Comments

A couple of years ago my Citizen’s Bank debit card suddenly stopped working. Turned out a software update borked 10s of thousands of people’s cards. I had to visit a local branch to get it reactivated, and apparently they did not communicate the issue to even their branches.

These kinds of issues are not new, and will continue to crop up from time to time in today’s world, and they will try their damnedest to hide the issues.

If they’re lucky, it’s a display issue and the computer hasn’t just emptied their accounts.

‘HAL restore my account balance’

‘I’m sorry Dave, I can’t do that.’

$0 balances makes a more clickable news story. Anxiety is the trade emotion.

“The most likely suspect is a software update, similar to what happened this July with Microsoft. The “blue screen of death” appeared at airports, hospitals, businesses, and government agencies.”

Come on now…that’s what’s become commonly known as “fake news”.

I expect better here.

I’m no fan of Microsoft, but even though that issue only affected MS Windows computers, your implication that it was Microsoft’s mistake is false; it was Crowdstrike who released an update to their cyber-security software without properly testing it and broke the world.

If you follow a link to the story, that fact is explained there. That sentence is a short summary, which hits the key note.

So you’re OK with people who don’t click every link in every article to drill down to the details getting inaccurate impressions from your reporting.

Roger that.

That sentence doesn’t say Microsoft did it, just “what happened with Microsoft”, and it did happen with Microsoft. Not Linux, not Apple, not Android. It doesn’t assign blame in that sentence, at all.

Thank you, GWB!!!

You understand the terms “implication” and “impression”?

Tim Walz never came right out and said he was a combat veteran, he just implied it. So I guess he’s off the hook?

Leslie can write anything she wants to write…it’s a free country. I was just pointing out a flaw I thought she might want to correct and try to do better in the future.

Apparently she thinks it’s perfectly OK to imply things that aren’t true as long as she doesn’t come right out and say the untrue thing outright.

Roger that. Forewarned is forearmed.

That’s why you don’t give kernel level access to garbage entities like crowdstrike

>>While the bank says the issue is “largely resolved”, it is difficult to say what damage to customer trust has been done.<<

Whatever. BoA had a software problem due to a dodgy update and some server(s) in their network went titsup and the whole thing fell over. The point is that stuff happens. They fixed it. And life goes on. Nothing to see here folks, just what happens in our increasingly computerized society. The only reason it made the news is that BoA happens to be one of the largest banks in the United States with a huge customer base. That is all.

Bet none of their credit card holders saw their account balances drop to $0.

Zero balances? There can be no division over this.

LOL…I see what you did there.

One more reason to bank locally and use our credit union. We have accounts with both and, though we aren’t immune from a disaster, the threat to our accounts isn’t concentrated at one or the other.

Also a good reason to keep a cash stash handy. If the cards stop working we can still buy locally with real money. Now, if only the merchants can teach their cashiers how to make change!

.

Gads. There are still people using Bank of America?

Couldn’t have happened to a more deserving bank.

BANK OF AMERICA: YOU SHOULDN’T BE SELLING GUNS ON THE INTERNET

“He said he told the Bank of America rep, “You need to release these funds.”

Sirochman said he reminded the supervisor that he’d been making and selling guns for 10 years. That he followed every law–both at the national and state level–and that he was regularly audited by the ATF.

He said the Bank of America supervisor responded by simply saying, “It’s in our policy that we can withhold the funds indefinitely for any reason that we want.”

“…testimony by FBI whistleblowers that Bank of America voluntarily handed the FBI records on people who had used its services in the Washington, D.C. area around the time of the January 6 Capitol riot. “Individuals who had previously purchased a firearm with a BoA product were reportedly elevated to the top of the list,” according to a May report.”

Maybe this was their crowdstrike update. I didn’t get an email or text from them; nothing. I guess they still kept their ability to access customers accounts for the FBI, so it’s all cool.

Why is anyone using a Mega Bank? They hate you and this country. Use a local community bank or better yet, a credit union.

Some credit unions are quite large.

BTW, anyone here want to go in on starting a credit union solely for gun owners, gun stores, and gun industry folks? We have a potential 40 million customers right off the bat, I think the number is. (That’s the number I see for households that own guns, so that would be just the joint accounts.)

Lots of people end up using a megabank because at some point it ate the community bank they started out with. This has happened to me at least three times, once via four cascading mergers within three years.

Credit unions are great establishments, but they have limitations. One I have recently discovered is that they can initiate international (e.g., SWIFT) transfers outgoing, but can’t accept them. May not be ideal for gun manufacturers.

I consider this high irony, but Pentagon Federal CU is gun-friendly. In fact, they are the offeror of both NRA’s “affinity” credit card and AMAC’s (the conservative AARP). Back when I worked in the Pentagon, you had to be military to open an account there, but now anybody can.

As a result of Obama’s Operation Chokepoint, there are several relatively new merchant account processors that have since been explicitly founded to be firearms-friendly.

it is difficult to say what damage to customer trust has been done

Which wasn’t that high anyway. Loads of people had taken their accounts elsewhere over the last dozen years due to BoA being woke and other issues.

And, based on a lot of comments seen, folks noted their credit cards worked fine. They evidently broke it in a way you couldn’t get to money you had, but could access credit (which is money you don’t yet have).

Lots of people note that you should have cash available in case of a disaster.

Not lots of people think of this sort of thing as a disaster, but it is one of the possible reasons to keep some cash about.

(I am NOT advocating keeping 6 month’s salary or wages in your mattress or a jar, however. But I’m not a fancy District Attorney in Georgia, so what do I know?)

Good advice. Keeping maybe $2K in cash in an emergency bag to grab as you haul ass out of dodge away from rising water or whatever seems like it would be pretty handy to have.