California Democrats Nuke ‘No Tax on Tips’ Proposal Shortly After Harris Adopted Trump Plan

Anyone who thinks that a Harris administration will enact any tax break, especially one for the hard-working American middle class, should keep this development in mind.

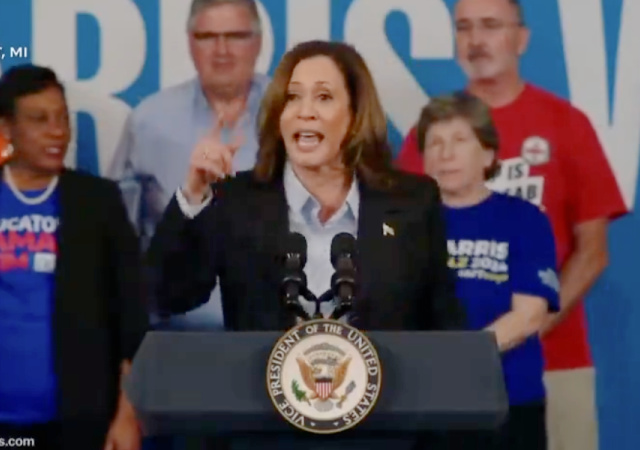

Legal Insurrection readers may recall that Elizabeth Stauffer reported that the Democrat’s presidential candidate, Vice President Kamala Harris, had made President Donald Trump’s ‘no tax on tip’ her own.

SHOT:

During a campaign rally at the University of Nevada at Las Vegas on Saturday, Vice President Kamala Harris surprised supporters by coming out against taxes on tips. She told the crowd, “When I am president, we will continue our fight for working families of America, including to raise the minimum wage and eliminate taxes on tips for service and hospitality workers.”

Because Las Vegas is dominated by the service and hospitality industries and tips make up a large portion of the average worker’s income, the crowd was delighted by the proposal and roared their approval.

CHASER: California Democrats rejected a proposal shortly after she claimed Trump’s position.

California Senate Republicans advanced amendments to protect hospitality and service industry employees with a state tax exemption on tips. Legislative Democrats refused to consider the issue and summarily killed the proposal without discussion or debate.

…“It is deeply disappointing that the legislature chose not to consider a proposal that could have provided much-needed relief to California’s workers,” said Senator Rosilicie Ochoa Bogh (R-Yucaipa), who put forth the amendment. “With Californians facing one of the highest costs of living in the nation, our service and hospitality industry employees are particularly burdened by a tax system that leaves them struggling to make ends meet. They deserve better, and today’s decision is a missed opportunity to support those who need it most.”

The proposal, which was aimed at addressing the unsustainable tax burden placed on workers who rely heavily on tips, would have exempted those tips from state income taxes and allowed hospitality and service industry employees to take home more of their earnings. Proponents of the policy point to not only relief for taxpayers as a benefit but also increased spending that would result from those tax breaks and serve as an economic driver to lift all sectors of the economy.

Anyone who thinks a Harris administration will enact any tax break, especially for the hard-working American middle class, should consider this development.

Kamala just announced she is stealing President Trump's "NO TAX ON TIPS" proposal.

But like everything else she says, it's a pure political calculation she'll never actually do — but President Trump WILL. pic.twitter.com/8MiJ8eFreu

— Trump War Room (@TrumpWarRoom) August 11, 2024

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

California Democrats are (if anything) more desperate not to leave any money on the table than waitstaff are.

The proposal is stupid. Income is taxed

Why should people getting tips be exempt? They would also end up with reduced Social Security benefits due to low reported earnings.

Democrats cut taxes for lower and middle income residents? This constitutes a dystopian nightmare for Leftists everywhere, particularly in California.

Saw that coming.

There is nothing that they won’t steal.

Used to be a full time pizza delivery driver.

Under the current system, x% of personal car expenses – to include gas, insurance, maintenance and repairs, etc., – where X is the percentage of miles driven delivering vs total miles driven – is deductible.

However, to claim that you have to jump thru quite a few hops. Like an 18 wheeler driver, you must keep ALL receipts, keep a daily handwritten log book of miles driven and expenses.

Almost no one does that. Not least because for many drivers you can skip the 80 hours of paperwork per year that requires and just not declare your cash tips to come out approx. the same results. So they don’t feel guilty about paying the same in tax as if they worked an unnecessary (in their view) 80 hours every year. Downsides of course being possible but unlikely audit and lower reported gross income affecting credit scores and SSN on retirement.

Now tipped waitstaff would totally benefit cash wise, and this would be a boost to any family with someone working on tips. It helps out a lot of working class families, helps out the struggling restaurant industry, requires no increased paperwork or govt employees, and… lets face it a lot of cash tips are already not being reported so there’s not really a huge revenue loss of tax income. If you’re “for the working stiff” supporting this should be a no brainer, but I suspect the California legislation nixed it because they think the proposal has Trump Cooties.

You have correctly identified an overlooked part of income tax: the time, anguish and expense put into tax preparation is part of your tax burden.

One of my “surefire fixes that will never happen ” for the income tax system is requiring elected officials to prepare,personally and without any assistance, their personal income tax returns. Severe penalties for violation.

Before the end of the session, we really could file on a three by five card.

Thank you.

It also occurs to me that with all the Uber, etc., drivers out there there’s a lot more folks out there who if they want to be compliant also need to follow guidelines designed for professional truck owner/operators and not folks just using their personal car to work a side job.

I wouldn’t be surprised – if Trump can Beat the Cheat this time out – if tax simplification happens finally. He’s already on record as admitting it’s so complex it’s an unfair advantage to rich folks. There’s no hope of that if Harris becomes the new Puppet In Chief.

We have the figures from AAA on the average cost/mile of owning and keeping operational a personal vehicle. It wouldn’t be a stretch to offer filers the option of bypassing the normal documentation requirements and just document the miles driven on the job and applying an official average to reduce taxable income by that means of calculated expenses.

My experience with a business that required a fair amount of travel was that the IRS mileage expense allowed was quite adequate to cover actual costs. At the time it was around 55-cents a mile, now I see it is around 65-cents. I used my personal vehicle, a Ram 2500 diesel, and did not lose money by using the allowance. [Somewhere back then, when I wasn’t looking, I got old, and decided to retire.]

I always tip in cash and tell the server that how they handle it is between them and their accountant. It always gets a knowing smile. I hear that IRS has a formula for assigning “tips” based on the W-2 wages for servers now.

Logic and sense? Surely, you jest. And I did not call you Shirley.

A tip is a gift. The only gifting is from the people to the state…. more like grifting from the state.

Keep in mind that Trump’s no tax on tips was in response tho Joe and Kamala’s SITCA proposal to get after tip workers.

https://www.atr.org/biden-harris-irs-targeted-tipped-workers-with-heightened-scrutiny/

the time is now

no more income tax

flat tax no exception

consumption

you buy it or sell it it gets the flat tax

Removing tax on tips would just mean I tip less. I’m not paying after-tax money to someone who is getting it as tax-free income.

So, you support someone else paying a tax on money that you already paid a tax on?

Two wrongs do not make a right!

Repeal the 16th Amendment!

Could state of CA enforce its own state income tax on tips income?

Doesn’t matter.

I live in California. It is all about virtue signaling.

Every sentient creature, including cattle in the fields, and even some insentient things like rocks in the road knew that a Commie Democrat had zero intention of carrying through on a campaign promise not to tax something. The Party of Filth only knows one thing: looting via tax laws.

Because California like Orleans Parish, needs to nickle and dime everyone for everything.

My guess is that the Democratic party tested Trump’s “no tax on tips” proposal and found it to be overwhelmingly popular. So Kamala just adopted it – or did she? Harris is quoted as proposing to “… eliminate taxes on tips for service and hospitality workers.” I believe that tips are frequently given to workers other than “service and hospitality” workers. In the construction trades say for replacing my roof, I will tack on a tip. Under Trump this will be come tax free, but under Harris – I don’t think so.

Second, we need to get our laws aligned what is either generally consider moral or easily enforceable. Taxes on tip, in my opinion, is neither. This will let people who receive tips live a more honest life and for the IRS to quit chasing the wrong people.

A Harris policy proposal is like English weather. If you don’t like it, wait 15 minutes: it’ll change.