August Layoffs Hit Highest Total for Month in 15 Years

“The year-to-date hiring announcements of nearly 80,000 is the lowest total in history going back to 2005.”

Outplacement firm Challenger, Gray, & Christmas announced that August hit its highest layoffs in 15 years.

Announced job cuts totaled 75,891 for the month, lurching 193% higher than July. Though the total was just 1% higher than the same month in 2023, it was the highest number for August going back to 2009, as the economy was still escaping the worst of the global financial crisis.

On the hiring front, companies said they were adding just 6,101 new workers, up by nearly 2,500 since July, but down more than 21% from August 2023. The year-to-date hiring announcements of nearly 80,000 is the lowest total in history going back to 2005.

“August’s surge in job cuts reflects growing economic uncertainty and shifting market dynamics,” said Andrew Challenger, the firm’s senior vice president. “Companies are facing a variety of pressures, from rising operational costs to concerns about a potential economic slowdown, leading them to make tough decisions about workforce management.”

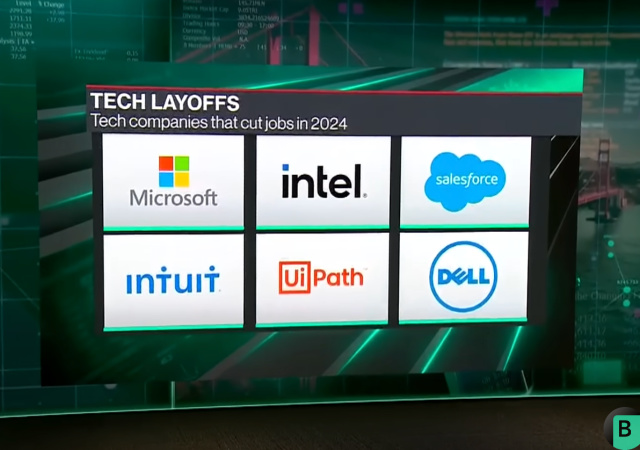

The tech field faces the most layoffs:

Thursday’s report showed the biggest growth in planned layoffs came in the technology field, with companies announcing 41,829 cuts, the most in 20 months.

“The labor market overall is softening,” Challenger said.

Companies announcing job cuts most often cited cost-cutting and economic conditions as the reasons, though artificial intelligence also was listed for the first time since April.

I emphasized that part because the Fed cut rates by 50bps, which it did in September 2007.

What happened next? The housing crash, the banking crash, etc.

I should have done this years ago, but I will take numbers from these companies more to heart than anything from the government.

CNBC noted that the report is “out of sync with government reports.”

Of course, it’s out of sync with the government. The government reports showed a small rise in unemployment benefits and slightly slowing inflation.

But then we learned the BLS had to revise job creation numbers by over 800,000 for the last year because they bloated the statistic.

The Federal Reserve (END THE FED) and Biden-Harris administration love proclaiming that everything is fine and getting better.

Before I go on, I must remind you that no one knows precisely what will happen because of the cut rates. If they tell you they do, they are lying to you.

The best thing you can do is look at the past. Right now, it feels a little like 2007.

So what could happen?

Cutting rates encourages risk. Banks take out loans from other banks. Lower rates make it easier for those banks to get those loans.

The banks are then more open to approving loans.

That seems great because it encourages people to spend, fueling the economy.

We need a balance. As we saw in 2008, everything went haywire, and the bubble popped.

Where do the layoffs come in? Well, you cannot spend (should not spend!) if you don’t have a job or steady income.

The sane thing to do is not to provide loans to people who cannot pay them back. But the cut rates could push those banks and others to take that risk and give those people loans.

For example, with Harris pushing homeownership, the government will likely push banks to approve mortgages for people who cannot afford them.

With the Democrats brainwashing people into thinking we live in a fantasy world where money grows on trees, and everything is bountiful…it can get nasty.

The government could stop spending and printing money and end the Fed. But that’s me in my fantasy world.

Donations tax deductible

to the full extent allowed by law.

Comments

Nothing to see here, move along.

“August Layoffs Hit Highest Total for Month in 15 Years

“The year-to-date hiring announcements of nearly 80,000 is the lowest total in history going back to 2005.”

And yet, Fed raised the rates, not 0.25, but 0.5%, just in case we weren’t listening, AND right before the election “

Mhmmm, curious cats want to know…

Huh?

The Fed cut rates by 1/2 pt, they didn’t raise them.

It’s just those greedy corporation again – saber rattling Dems that refuse to reflect inwardly on their failures

Don’t forget 33,000 Boeing workers walked off the shop floor last week.

The remaining 100k Boeing workers in the US are all taking a 25% pay cut via furloughs until the strike ends. All their contingent staff (security, facilities etc) are also furloughed or laid off as well.

whoops- the engineers union gave them the single finger salute to furtloughs (not sure how many of the 100k fall into that category— so looks like some layoff will be coming soon.

The Fed should still have been raising rates IMO. Until the asset bubble gets taken down and deflated the efforts to prop up asset prices via lowered rates kicks the can but eventually asset prices will come down. Still far too much overhang in the economy from easy lending and mal investment in the decade + of easy money low to zero interest rates. Lots of zombie companies out there. Not to mention a higher rate would constrain (to some degree) Govt spending and the size/growth of Gov’t.

Make Savings Great Again. There’s no real justification that someone shouldn’t get a positive real rate of return on a savings account.. If folks could get inflation + 50 basis points on saving account and inflation+ 150 basis points on a 6 month CD there would be far less stupid loans going out the door. Companies wanting to borrow would be using it to grow their core business instead of wasting it on DEI and other boondoggles precisely b/c borrowed money would be more expensive, too expensive to waste.

My assertion is to raise the deductible amount and max of retirement contributions and employer match AND make the match deductible as well.

Bolsters savings, takes money out of circulation.

IMO that doesn’t do much other than artificially raise asset prices. Basically you’re just increasing the current morning flow from payroll checks into 401K and other vehicles. That adds to the problem of overly inflated asset prices. Doesn’t do diddly for housing prices. Doesn’t crowd out mal investment or punish boondoggle spending. Companies will borrow against the inflated value of their shares. Individuals will do the same. They will put that back into the roulette table.

We need higher interest rates. No one should have to put their retirement $ into risky things simply to gain a small positive real rate of return. If your goal is to take excess money out of circulation then advocating for a return to a gold standard of some form would definitely do it. If folks can redeem dollars they believe to have devalued by over printing for gold things get very real very quickly.

get those robots serving the drinks and other jobs that the newsomes cant control….yet

The biggest problem is not in the consumer sector but in the bank sector as pointed out. If the rate is dropped reducing the cost of loans banks will borrow and enter riskier investments to drive profit. This will be done based on the value of fractional reserves. Fractional banking is the elephant in the room.