Harris Announces ‘Economic’ Plan: Price Controls, $25K for First Generation Homeowners, $6K Newborn Tax Credit

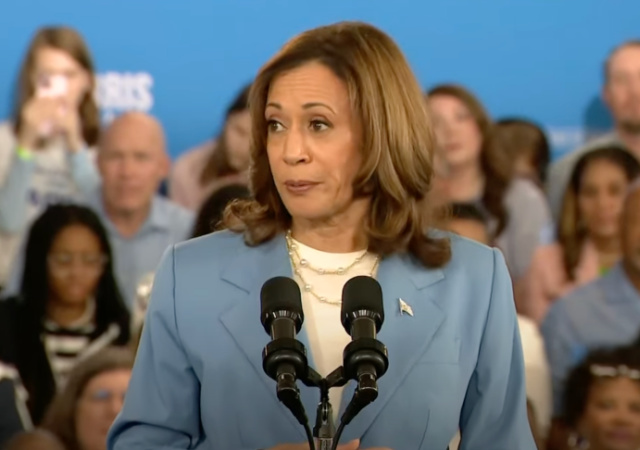

Presumptive Democratic presidential candidate Vice President Kamala Harris announced her socialist economic plan during a rally in Raleigh, NC.

Harris’s press team emailed the proposals, but to the shock of no one, it contained vague details.

Well, Harris didn’t provide any details during her speech. Not shocking.

I’m basically copying and pasting from the email. My comments are in bold.

Housing

- $40 billion innovation fund to spur housing construction (This is to FIND SOLUTIONS…WTAF?!)

- Tax incentive to build starter homes (What qualifies as a starter home?! Also, stop inflating demand! You’ll end up with too much supply!)

- Expand tax incentive for businesses that build affordable rental housing (Again, stop inflating demand! You’ll end up with too much supply!)

- Cut red tape and needless bureaucracy (I laughed way too hard when I read this.)

- $25,000 for first-generation homeowners (House prices just went up!)

- $10,000 tax credit for first-time home buyers (Another way to repeat 2008!)

- Demand construction of 3 million new housing units (Remember what I said when you interfere with supply and demand!)

Medicine

- Cut insulin prices to $35 for everyone (Trump did it for Medicare seniors)

- Cut out-of-pocket expenses for prescription drugs at $2,000 (Stop with price controls!)

- Accelerate the speed of Medicare negotiations over prescription drugs

- Increase competition and demand transparency in the health care industry, starting by cracking down on pharmaceutical companies who block competition and abusive practices by pharmaceutical middlemen who squeeze small pharmacies’ profits and raise costs for consumers. (You increase competition by getting the government out of the market!)

- Cancel medical debt (For crying out loud…)

Grocery Stores

- Lower prices through

socialismprice control (Reminder about supply and demand!) - Set clear rules of the road to make clear that big corporations can’t unfairly exploit consumers (That sentence gave me a headache. Again, get out of the market to open competition. The consumer (should) determine the price of a product or service.)

- Secure new authority for the FTC and state attorneys general to investigate and impose strict new penalties

Taxes

- Cut Taxes for Middle-Class Families with Kids: $3,600 per child tax credit for middle class and the most hard-pressed working families with children. (Define middle-class lady because quite a few people I know are “middle class,” and they don’t get crap.)

- A New $6,000 Child Tax Credit for Families with Children in the First Year of Life (Only for middle-income and low-income…no idea what amount qualifies for those categories.)

- Cut Taxes for Frontline Workers: “They will expand the Earned Income Tax Credit to cover individuals and couples in lower-income jobs who aren’t raising a child in their home, cutting their taxes by up to $1,500.” (Um, who qualifies as a frontline worker??)

- Cut Taxes To Help Americans Afford Health Insurance on the Affordable Care Act Marketplace, saving an average of $700 on their health insurance premiums, totaling over $6,000 per year in savings the Affordable Care Act is providing. (Huh?!!?)

CLICK HERE FOR FULL VERSION OF THIS STORY