Stock Market Sinks after U.S. Credit Rating is Downgraded from “AAA” to “AA+”

How much lower can it go? With Biden, the Mariana Trench of depths is possible.

The timing of the indictment of former President Donald Trump could not be more suspicious.

Not only is the event taking the media heat off the Biden news related to alleged foreign influence peddling, but it is also providing a distraction from a historic credit downgrade for this nation.

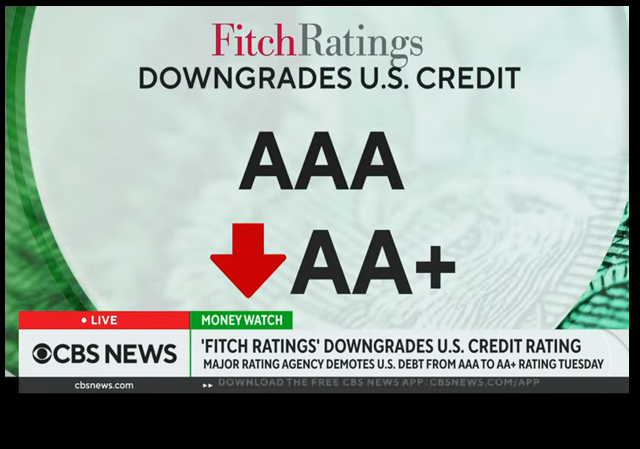

Fitch Ratings downgraded the United States’ long-term foreign currency issuer default rating to AA+ from AAA on Tuesday, pointing to “expected fiscal deterioration over the next three years,” an erosion of governance and a growing general debt burden.

“The repeated debt-limit political standoffs and last-minute resolutions have eroded confidence in fiscal management,” said Fitch.

In May, the agency placed the nation’s AAA rating on negative watch, blaming the debt ceiling fight. At the time, lawmakers in Washington butted heads over an agreement that would keep the federal government from running out of money. President Joe Biden signed the debt ceiling bill on June 2, just days away from the “X-date” on June 5.

The country’s recent debt limit feud was mentioned again in Tuesday’s downgrade.

“In Fitch’s view, there has been a steady deterioration in standards of governance over the last 20 years, including on fiscal and debt matters, notwithstanding the June bipartisan agreement to suspend the debt limit until January 2025,” the ratings agency said.

I highlighted the last 20 years portion of the Fitch analysis. Both parties have kicked the fiscal responsibility can down the road and right off the cliff for the past 2 decades. However, under the clearly deteriorating Biden presidency, the rating firm feels free to offer its honest assessment.

Fitch Ratings Inc. is an American credit rating agency and is one of the “Big Three credit rating agencies,” which currently has assigned “stable” forecasts. The other two are Moody’s (the US still has a AAA rating there) and Standard & Poor’s (which shares Fitch’s AA+ assignment).

Several other nations retain the AAA designation.

Economies with the highest credit rating at S&P Global Ratings, Fitch and Moody’s Investors Service include Germany, Denmark, Netherlands, Sweden, Norway, Switzerland, Luxembourg, Singapore and Australia. Canada is rated AAA by two of the ratings companies.

Stocks fell on the news.

The Dow closed 348 points, or 1%, lower in Wednesday trading. The S&P 500 fell 1.4% and the Nasdaq dropped 2.2%, marking its worst performance since February.

The 10-year Treasury yield hit its highest level since November. Bond prices and yields move in opposite directions, so falling Treasuries boost yields.

Tech megacap stocks like Amazon, Meta, Microsoft, Tesla, Nvidia and Apple led market declines. Because the tech sector is so forward-facing, it’s particularly sensitive to interest rate changes.

The Democrats were quick to blame the Republicans for the downgrade.

In a statement, press secretary Karine Jean-Pierre said the White House “strongly” disagreed with the decision to downgrade, saying that it “defies reality to downgrade the United States at a moment when President Biden has delivered the strongest recovery of any major economy in the world.”

“And it’s clear that extremism by Republican officials — from cheerleading default, to undermining governance and democracy, to seeking to extend deficit-busting tax giveaways for the wealthy and corporations — is a continued threat to our economy,” Jean-Pierre said.

Our “expert” economists are outraged at the new rating. They also believe that the move will not have any significant impact in the long term.

High-profile economists including former U.S. Treasury Secretary Larry Summers and Allianz Chief Economic Advisor Mohamed El-Erian lambasted the Fitch decision, with Summers calling it “bizarre and inept” and El-Erian “perplexed” by the timing and reasoning. Current Treasury Secretary Janet Yellen described the downgrade as “outdated.”

Goldman Sachs Chief Political Economist Alec Phillips was also quick to point out that the decision did not rely on new fiscal information and is therefore not expected to have a lasting impact on market sentiment beyond immediate shock selling on Wednesday.

Phillips said the downgrade “should have little direct impact on financial markets as it is unlikely there are major holders of Treasury securities who would be forced to sell based on the ratings change.”

“Fitch’s projections are similar to our own — they imply a federal deficit of around 6% of GDP over the next few years — and Fitch cites CBO (collateralized bond obligation) projections in its medium-term outlook, so the downgrade does not reflect new information or a major difference of opinion about the fiscal outlook,” he said in a note Tuesday.

The gross federal debt of the United States has surpassed $32 trillion as of June of this year. There is plenty of talk of debt-ceiling limits and cutting waste/fraud/abuse from the budgets, but no action.

The only solutions to this situation appear to be the Biden team threatening Fitch Ratings in some way or encouraging bipartisan cooperation that reduces spending and encourages economic growth. I know which one I am betting on.

How much lower can our ratings go? With Biden, the Mariana Trench of depths is possible.

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

With a retard like Brandon the pedophile in the white house, there is no floor to how low we can go.

The old crook finally did it — he stole the whole damn country.

all of DC, both dims and pubs, agreed that the National debt would go to 36 trillion by Jan 2025

extrapolate that out for 10 years and you’re looking at at least 50 trillion, maybe 55

that will be haircut time, a 25-30 % trim across the board of all government

nothing will be spared, not SSA, not defense, medicare, not anything

that will make this look like party time, which in DC, it is

this is not up for discussion, it will happen and all of DC knows it

Feh. Say 30 trillion to the adults of my childhood and they would have a heart attack. They would tell you the ship would run aground long before now. But you’ll notice it hasn’t. Like pedophiles who argue that “age is just a number,” leftists make the same argument about debt.

The d/prog have and continue to make those BS arguments. The dirty ‘secret’ isn’t the level of debt but the composition of the debt. More folks will be.getting acquainted with this soon.

About 35% of the existing debt is rolling over this year. That’s to say the bonds they sold years ago at low interest rates of less than 2% will now have to be paid out in full or resold at a far higher interest rate of roughly 4% on a ten year as one example.

The interest payments will double, More than double in fact b/c the govt issued mostly short-term debt in the low/no interest rate environment following ’07/’08 housing collapse. We paid $475 Billion in interest payments in FY’22.

The Fed govt is on pace to pay $1 Trillion in interest payments this year (FY ’23) and far more next year. For some comparison these are some of the FY’22 budget items:

DoD $780 Billion, Medicare $765 Billion, Social Security $1.2 Trillion

That number will go higher as more of the older low interest rate debt is refinanced at much higher rates. In the near future interest will be the single largest budget item. This will crowd out other spending priorities.

The end of the road is very visible to those who will pull their head out the sand and look up. Unfortunately, the d/prog won’t and many folks on ‘our’ side want to keep kicking the can; see resistance to reform of Social Security.

One way or the other this will end. Either b/c the govt will repudiate the debts, raise income taxes on the bottom 65% that pay little to nothing now, a combination or some other event that sparks the crisis that becomes the final straw to break the system.

Most of the nations on that list are not stronger than the US fiscally they just cook their books better…looking at you Germany.

The ratings are a scam.

Wait until the BRICs countries move away from the petrodollar. You haven’t seen anything yet.

“The only solutions to this situation appear to be the Biden team threatening Fitch Ratings”

Not true! Look what else they can do:

“Fitch blames pro-Trump Capitol riots for US credit downgrade”

Emmanuel Goldstein… paging Emmanuel Goldstein… please pick up the white ignominy phone…

One day Biden will pay a price for what he has done.

Not here on earth but in the afterlife.

Burn Biden, Burn.

Not exactly a vote of confidence in Bidenomics …

https://twitter.com/unusual_whales/status/1686783179485491200

But Breitbart has an article up right now saying the rating doesn’t matter

I’m confused

Because nothing seems to matter anymore, the law, the open borders, the courts, the constitution….God….

We as a nation refuse to define what a woman is

Just print some

More damn money

As long as they can seize power. Even if it’s in a burning house.

That’s all it went down?

Well, we’ve known since the spasm of ’08 that rating agencies can be a crock.

It has to be really bad to do this during Biden’s term. Let’s not pretend this wasn’t decades in the making… I’m only surprised they didn’t wait and put his on Desantis near re-election in 2027.

Stock market has no business being at current levels now. I’m on the inside of the rotting beast and I can tell you we’re at 1979 for bleakness. The jobs numbers will be the next to go.

I’d say we are at levels far worse than 1979 because woke corporations have scattered unqualified people throughout their org charts based completely on skin color or gender. The only way that gets fixed is an inordinate number of layoffs/firings that would have far too many of a special demographic included…. (see why that will never be fixed??) The corporate side of America has sabotaged itself in ways that would make the Soviets piss their pants laughing.

“d”Santis… you jest

Fitch will pay for doing this just like S&P in 2011. Soon enough Congress will be passing CRs just to pay the interest on the debt.

Long Version:

• An elderly man noted that he did not get to church that often, and when he did the preacher always spoke about God. He was asked if that bothered him. He responded no, he was always glad to know that God was still important to the church.

• I was told this story by a Senior Manager during my first year out of uni. His point was that effective leadership required understanding the top priorities for your Department/ Division/ Company, and then communicating those priorities on a regular basis.

• Still some of the best advice that I ever received. Along with: You lead your way to success – same Senior Manager.

Short Version:

• It’s the economy stupid.

• Phrase coined by James Carville in 1992, when he was advising Bill Clinton in his successful run for the White House.

***

• DeSantis: Posted about the Economy on his campaign website – for the first time – on Monday (July, 2023).

• Trump: Economic Security is National Security – 2016+.