Oberlin College Sues Insurers For Refusing To Cover $36 Million It Paid Gibson’s Bakery For Defamation And Other Torts (Update)

After a six year struggle, in December 2022 Gibson’s Bakery finally was paid by Oberlin College a total of $36 million, representing a judgment of approximately $32 million plus post judgment interest. We covered the payment on December 11, 2022, Finally, The Gibson’s Bakery Family Has Been Paid By Oberlin College.It was a six year struggle for the Gibson family, which saw Grandpa Allyn Gibson and David Gibson pass away after the trial but before the appeals were concluded.

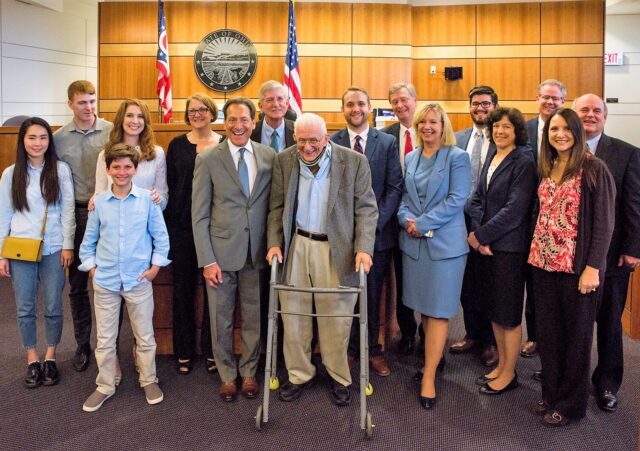

[David Gibson and Allyn W. Gibson at trial][Photo credit Bob Perkoski for Legal Insurrection Foundation]

A jury has awarded Gibson’s Bakery and its owners $11 million in compensatory damages against Oberlin College, for libel, intentional interference with business, and intentional infliction of emotional distress. The punitive damage hearing next week could add another $22 million, bringing the total to $33 million….An obvious question, and one a lot of people have been asking, is whether the college has liability insurance to cover the verdict.Based on court filings obtained by Legal Insurrection Foundation, it appears that the insurer, Lexington Insurance Company, is likely to disclaim coverage for the intentional torts which gave rise to the verdict.The likelihood of refusal to cover the verdict was revealed in a May 1, 2019, Motion to Intervene (pdf.)(full embed at bottom of post) filed by Lexington Insurance Company.The purpose of the motion, according to Lexington, was “for the limited purpose of submitting interrogatories to the jury in order to determine facts at issue in this action that would impact coverage under its policy.”

I then extensively quoted the Lexington Motion, which previewed how it would disclaim coverage and how the nature of the claims and verdict would be important:

Here is an excerpt from Lexington’s motion setting forth the nature of the insurance coverage (emphasis added):

Lexington issued a Commercial Umbrella Liability policy that potentially provides coverage to defendants Oberlin College aka Oberlin College and Conservatory (“Oberlin”) and Meredith Raimondo for certain damages in this action. Lexington seeks intervention in this action for the limited purpose of submitting interrogatories to the jury in order to determine facts at issue in this action that would impact coverage under its policy.The Lexington policy does not provide coverage for “bodily injury” or “property damage” intentionally caused by defendants. While the Lexington policy potentially provides coverage in relation to “personal and advertising injury,” defined to include defamation and/or disparagement in certain circumstances, the Lexington policy excludes any such coverage if “personal and advertising injury” is caused “with the knowledge that the act would violate the rights of another … ,” or if the insured published material it knew to be false. Further, the Lexington policy provides coverage for punitive damages insurable by law, but only where the corresponding award of compensatory damages is also covered by the Lexington policy. In this action, plaintiffs Gibson Bros., Inc., Allyn Gibson, and David Gibson allege that defendants Oberlin and Ms. Raimondo published material that falsely characterized the bakery owned by plaintiffs (“Gibson’s”) as being a racist establishment. While such allegations potentially implicate “personal and advertising injury,” plaintiffs also alleged that the statements were published with malice, were intended to injure plaintiffs’ business reputation, and were part of a purported campaign to harm plaintiffs. If it is established that the defendants knew the alleged statements were false, or if the defendants knew their alleged acts would violate plaintiffs’ rights, the Lexington policy would exclude coverage for any resultant damage. Thus, Lexington seeks to intervene in order to submit jury interrogatories to determine the extent of the defendants’ knowledge in relation to the alleged publications.Further, the Lexington policy provides coverage for punitive damages only when the punitive damages are assessed relative to covered compensatory damages. Here, plaintiffs seek punitive damages for the claims of libel, tortious interference with contract, tortious interference with business, intentional infliction of emotional distress, and trespass. Only the libel claim is potentially embraced by the Lexington policy. Thus, Lexington seeks to intervene in order to submit jury interrogatories and instructions to determine what punitive damages, if any, correspond to each cause of action.

The motion then sets forth Lexington’s inability to gain cooperation as to jury interrogatories from the college:

In particular, Lexington affirmatively requested on several occasions that the defendants submit jury interrogatories and instructions as proposed through this motion. Lexington also inquired as to when proposed jury interrogatories and instructions were due, and was informed on April 27, 2019 by defense counsel for Oberlin and Ms. Raimondo that there was currently no deadline set by the Court and that the deadline would probably be several weeks away. Lexington advised the defendants that Lexington understood the defendants would adopt Lexington’s request to submit jury interrogatories and instructions as outlined by Lexington. On April 27, 2019, the defendants responded that they would inform Lexington of their position on April 29, 2019. Defendants did not inform Lexington on April 29, 2019 as represented and, as such, Lexington is acting out of an abundance of caution in the form of this motion, as Lexington remains uncertain of defendants’ position, despite repeated communications and requests by Lexington.

The motion then sets forth the history of Lexington fighting with Oberlin College as to insurance coverage:

After tender of the lawsuit, Lexington informed the defendants that the Lexington policy did not respond to certain claims in the lawsuit. In particular, based on the claims that remain in the lawsuit, Lexington advised that the Lexington policy only potentially responds to the libel claim, . but that the Lexington policy is excess to other insurance provided through a commercial general liability policy issued by College Risk Retention Group, Inc. (“CRRG”) and an Educator’s Liability policy issued by United Educators (“UE”) in relation to the libel claim. Lexington further advised that the Lexington policy only embraces punitive damages when assessed relative to covered compensatory damages that implicate the Lexington layer of coverage. (Affidavit of Patrick Fredette (“Fredette Aff. ‘), ,r 3). In this regard, Lexington’s coverage, if any, is also excess to the UE policy not simply for any covered liability arising out of the libel claim, if any, but also any covered punitive damage award, subject to the $1 million cap in the UE policy for such damages. (Id.).

After quoting from the Lexington motion, I concluded;

Accordingly, based on Lexington’s court filing, it is likely that Oberlin College, should its post-trial motions and appeals fail, will have to pay out of pocket and then sue Lexington.

And so it has come to pass. I was alerted by a Legal Insurrection reader to a story in the local Chronicle-Telegram, Oberlin College sues 4 insurance companies over Gibsons Bakery settlement:

Oberlin College has sued four of its insurance providers in Lorain County Common Pleas Court to force them to cover the multimillion-dollar judgment that Gibson’s Bakery won against the college in 2019.The college filed suit in April against Lexington Insurance Company of New York; United Educators Insurance of Bethesda, Maryland; Mount Hawley Insurance Company of Peoria, Illinois; and StarStone Specialty Insurance Company of Cincinnati.Oberlin College claimed the insurance companies wrongfully refused “to honor promises they made in their respective policies to protect the interests of Oberlin College” and its former vice president and dean of students, Meredith Raimondo.

The case is assigned to Judge Chris Cook, who was not the trial judge (that was John Miraldi). The Chronicle-Telegram quotes and paraphrase various aspects of the pleadings:

At the time of the events that led to the Gibsons lawsuit, Oberlin College said it had insurance policies providing “at least $75 million in total insurance coverage, which is more than enough to pay the underlying judgment and substantial unpaid defense costs” it incurred in the nearly six-year legal battle.The college got $1 million from one of its insurance companies, but “also incurred millions of dollars in defense costs pursuing its appeals,” according to the lawsuit. The lawsuit did not give an exact dollar amount the college spent on legal fees.Oberlin College’s insurance policies included $25 million in commercial umbrella liability coverage from Lexington; $10 million from Mount Hawley; $5 million from StarStone; and $25 million in overlapping educators legal liability coverage from United Educators, according to the lawsuit.”These policies were intended to provide seamless coverage for lawsuits like the Gibson litigation,” according to the lawsuit. “Unfortunately, the defendant insurers have failed to pay a penny toward the $36,590,572.48 sum that Oberlin paid the Gibson plaintiffs. They also have failed to pay for the full cost of Oberlin’s appeals, which were pursued at the behest of the insurers in order to reduce their collective exposure.”The insurers allegedly told the college that “some, if not all, of the damages” would be covered, according to the lawsuit.Insted, Lexington and United Educators allegedly “engaged in a systematic, multi-year effort to avoid their coverage obligations by attempting to shift responsibility from the Gibson lawsuit to each other,” other insurance companies or the college, according to the lawsuit.Lexington and United Educators also allegedly “both had numerous pretrial opportunities to resolve the underlying litigation for a small fraction of the eventual verdict” and could have settled the case for for less than $10 million on the eve of trial, according to the lawsuit. The college had even demanded the insurance companies do so, according to the lawsuit.None of them did, according to the lawsuit, with Lexington failing to pay “a single cent” and Oberlin College facing “complete abandonment” by United Educators.Mediation between the college and United Educators failed in early 2021, and the insurance company refuse to renew Oberlin College’s policy after a 34-year policyholder relationship, according to the lawsuit.

I am in the process of obtaining the case pleadings and motions and likely will have more details. Our six year journey continues, as we will now follow this insurance lawsuit.

Have you ever rooted for insurance companies ever? There’s a first for everything.

UPDATE 8-7-2023

I have obtained the original Complaint filed April 17, 2023. I am still trying to get the Amended Complaint filed at the end of July 2023.

It is clear from the Complaint that this is going to be a real airing of grievances, and we will get a look into the behind-the-scenes action we normally don’t get to see. I haven’t read the Complaint thoroughly yet, but this jumped out at me (emphasis added):

6. To make matters worse, Lexington and United Educators observed mock jury exercises before the Gibson trial and were therefore fully aware of the possibility for a substantial plaintiffs’ verdict. The record also shows that Lexington and United Educators both had numerous pre-trial opportunities to resolve the underlying litigation for a small fraction of the eventual verdict. For instance, on the eve of trial, it became clear that the case likely could be settled for under $10 million. Accordingly, Oberlin demanded that Lexington and United Educators fund a settlement that would have been well within the combined $50 million limits of their policies to avoid the risk of a substantial jury verdict.

CLICK HERE FOR FULL VERSION OF THIS STORY