Oberlin College Sues Insurers For Refusing To Cover $36 Million It Paid Gibson’s Bakery For Defamation And Other Torts (Update)

Four insurance companies have told the college to pound sand. Have you ever rooted for insurance companies ever? There’s a first for everything.

After a six year struggle, in December 2022 Gibson’s Bakery finally was paid by Oberlin College a total of $36 million, representing a judgment of approximately $32 million plus post judgment interest. We covered the payment on December 11, 2022, Finally, The Gibson’s Bakery Family Has Been Paid By Oberlin College.

It was a six year struggle for the Gibson family, which saw Grandpa Allyn Gibson and David Gibson pass away after the trial but before the appeals were concluded.

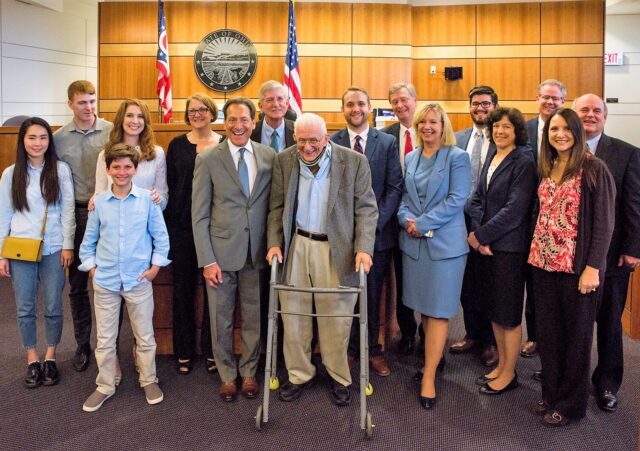

[David Gibson and Allyn W. Gibson at trial][Photo credit Bob Perkoski for Legal Insurrection Foundation]

(See full online event)

Along the way, for those of you paying careful attention, a controversy bubbled up as to whether the college’s insurers would cover the verdict. We covered the potential dispute on June 9, after the $11 million compensatory verdict, but before the $33 million (eventually reduced) punitive verdict, EXCLUSIVE: Oberlin College insurer likely to reject coverage for Gibson Bakery $11 million verdict:

A jury has awarded Gibson’s Bakery and its owners $11 million in compensatory damages against Oberlin College, for libel, intentional interference with business, and intentional infliction of emotional distress. The punitive damage hearing next week could add another $22 million, bringing the total to $33 million….

An obvious question, and one a lot of people have been asking, is whether the college has liability insurance to cover the verdict.

Based on court filings obtained by Legal Insurrection Foundation, it appears that the insurer, Lexington Insurance Company, is likely to disclaim coverage for the intentional torts which gave rise to the verdict.

The likelihood of refusal to cover the verdict was revealed in a May 1, 2019, Motion to Intervene (pdf.)(full embed at bottom of post) filed by Lexington Insurance Company.

The purpose of the motion, according to Lexington, was “for the limited purpose of submitting interrogatories to the jury in order to determine facts at issue in this action that would impact coverage under its policy.”

I then extensively quoted the Lexington Motion, which previewed how it would disclaim coverage and how the nature of the claims and verdict would be important:

Here is an excerpt from Lexington’s motion setting forth the nature of the insurance coverage (emphasis added):

Lexington issued a Commercial Umbrella Liability policy that potentially provides coverage to defendants Oberlin College aka Oberlin College and Conservatory (“Oberlin”) and Meredith Raimondo for certain damages in this action. Lexington seeks intervention in this action for the limited purpose of submitting interrogatories to the jury in order to determine facts at issue in this action that would impact coverage under its policy.

The Lexington policy does not provide coverage for “bodily injury” or “property damage” intentionally caused by defendants. While the Lexington policy potentially provides coverage in relation to “personal and advertising injury,” defined to include defamation and/or disparagement in certain circumstances, the Lexington policy excludes any such coverage if “personal and advertising injury” is caused “with the knowledge that the act would violate the rights of another … ,” or if the insured published material it knew to be false. Further, the Lexington policy provides coverage for punitive damages insurable by law, but only where the corresponding award of compensatory damages is also covered by the Lexington policy. In this action, plaintiffs Gibson Bros., Inc., Allyn Gibson, and David Gibson allege that defendants Oberlin and Ms. Raimondo published material that falsely characterized the bakery owned by plaintiffs (“Gibson’s”) as being a racist establishment. While such allegations potentially implicate “personal and advertising injury,” plaintiffs also alleged that the statements were published with malice, were intended to injure plaintiffs’ business reputation, and were part of a purported campaign to harm plaintiffs. If it is established that the defendants knew the alleged statements were false, or if the defendants knew their alleged acts would violate plaintiffs’ rights, the Lexington policy would exclude coverage for any resultant damage. Thus, Lexington seeks to intervene in order to submit jury interrogatories to determine the extent of the defendants’ knowledge in relation to the alleged publications.

Further, the Lexington policy provides coverage for punitive damages only when the punitive damages are assessed relative to covered compensatory damages. Here, plaintiffs seek punitive damages for the claims of libel, tortious interference with contract, tortious interference with business, intentional infliction of emotional distress, and trespass. Only the libel claim is potentially embraced by the Lexington policy. Thus, Lexington seeks to intervene in order to submit jury interrogatories and instructions to determine what punitive damages, if any, correspond to each cause of action.

The motion then sets forth Lexington’s inability to gain cooperation as to jury interrogatories from the college:

In particular, Lexington affirmatively requested on several occasions that the defendants submit jury interrogatories and instructions as proposed through this motion. Lexington also inquired as to when proposed jury interrogatories and instructions were due, and was informed on April 27, 2019 by defense counsel for Oberlin and Ms. Raimondo that there was currently no deadline set by the Court and that the deadline would probably be several weeks away. Lexington advised the defendants that Lexington understood the defendants would adopt Lexington’s request to submit jury interrogatories and instructions as outlined by Lexington. On April 27, 2019, the defendants responded that they would inform Lexington of their position on April 29, 2019. Defendants did not inform Lexington on April 29, 2019 as represented and, as such, Lexington is acting out of an abundance of caution in the form of this motion, as Lexington remains uncertain of defendants’ position, despite repeated communications and requests by Lexington.

The motion then sets forth the history of Lexington fighting with Oberlin College as to insurance coverage:

After tender of the lawsuit, Lexington informed the defendants that the Lexington policy did not respond to certain claims in the lawsuit. In particular, based on the claims that remain in the lawsuit, Lexington advised that the Lexington policy only potentially responds to the libel claim, . but that the Lexington policy is excess to other insurance provided through a commercial general liability policy issued by College Risk Retention Group, Inc. (“CRRG”) and an Educator’s Liability policy issued by United Educators (“UE”) in relation to the libel claim. Lexington further advised that the Lexington policy only embraces punitive damages when assessed relative to covered compensatory damages that implicate the Lexington layer of coverage. (Affidavit of Patrick Fredette (“Fredette Aff. ‘), ,r 3). In this regard, Lexington’s coverage, if any, is also excess to the UE policy not simply for any covered liability arising out of the libel claim, if any, but also any covered punitive damage award, subject to the $1 million cap in the UE policy for such damages. (Id.).

After quoting from the Lexington motion, I concluded;

Accordingly, based on Lexington’s court filing, it is likely that Oberlin College, should its post-trial motions and appeals fail, will have to pay out of pocket and then sue Lexington.

And so it has come to pass. I was alerted by a Legal Insurrection reader to a story in the local Chronicle-Telegram, Oberlin College sues 4 insurance companies over Gibsons Bakery settlement:

Oberlin College has sued four of its insurance providers in Lorain County Common Pleas Court to force them to cover the multimillion-dollar judgment that Gibson’s Bakery won against the college in 2019.

The college filed suit in April against Lexington Insurance Company of New York; United Educators Insurance of Bethesda, Maryland; Mount Hawley Insurance Company of Peoria, Illinois; and StarStone Specialty Insurance Company of Cincinnati.

Oberlin College claimed the insurance companies wrongfully refused “to honor promises they made in their respective policies to protect the interests of Oberlin College” and its former vice president and dean of students, Meredith Raimondo.

The case is assigned to Judge Chris Cook, who was not the trial judge (that was John Miraldi). The Chronicle-Telegram quotes and paraphrase various aspects of the pleadings:

At the time of the events that led to the Gibsons lawsuit, Oberlin College said it had insurance policies providing “at least $75 million in total insurance coverage, which is more than enough to pay the underlying judgment and substantial unpaid defense costs” it incurred in the nearly six-year legal battle.

The college got $1 million from one of its insurance companies, but “also incurred millions of dollars in defense costs pursuing its appeals,” according to the lawsuit. The lawsuit did not give an exact dollar amount the college spent on legal fees.

Oberlin College’s insurance policies included $25 million in commercial umbrella liability coverage from Lexington; $10 million from Mount Hawley; $5 million from StarStone; and $25 million in overlapping educators legal liability coverage from United Educators, according to the lawsuit.

“These policies were intended to provide seamless coverage for lawsuits like the Gibson litigation,” according to the lawsuit. “Unfortunately, the defendant insurers have failed to pay a penny toward the $36,590,572.48 sum that Oberlin paid the Gibson plaintiffs. They also have failed to pay for the full cost of Oberlin’s appeals, which were pursued at the behest of the insurers in order to reduce their collective exposure.”

The insurers allegedly told the college that “some, if not all, of the damages” would be covered, according to the lawsuit.

Insted, Lexington and United Educators allegedly “engaged in a systematic, multi-year effort to avoid their coverage obligations by attempting to shift responsibility from the Gibson lawsuit to each other,” other insurance companies or the college, according to the lawsuit.

Lexington and United Educators also allegedly “both had numerous pretrial opportunities to resolve the underlying litigation for a small fraction of the eventual verdict” and could have settled the case for for less than $10 million on the eve of trial, according to the lawsuit. The college had even demanded the insurance companies do so, according to the lawsuit.

None of them did, according to the lawsuit, with Lexington failing to pay “a single cent” and Oberlin College facing “complete abandonment” by United Educators.

Mediation between the college and United Educators failed in early 2021, and the insurance company refuse to renew Oberlin College’s policy after a 34-year policyholder relationship, according to the lawsuit.

I am in the process of obtaining the case pleadings and motions and likely will have more details. Our six year journey continues, as we will now follow this insurance lawsuit.

Have you ever rooted for insurance companies ever? There’s a first for everything.

UPDATE 8-7-2023

I have obtained the original Complaint filed April 17, 2023. I am still trying to get the Amended Complaint filed at the end of July 2023.

It is clear from the Complaint that this is going to be a real airing of grievances, and we will get a look into the behind-the-scenes action we normally don’t get to see. I haven’t read the Complaint thoroughly yet, but this jumped out at me (emphasis added):

6. To make matters worse, Lexington and United Educators observed mock jury exercises before the Gibson trial and were therefore fully aware of the possibility for a substantial plaintiffs’ verdict. The record also shows that Lexington and United Educators both had numerous pre-trial opportunities to resolve the underlying litigation for a small fraction of the eventual verdict. For instance, on the eve of trial, it became clear that the case likely could be settled for under $10 million. Accordingly, Oberlin demanded that Lexington and United Educators fund a settlement that would have been well within the combined $50 million limits of their policies to avoid the risk of a substantial jury verdict.

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

When does insurance cover torts committed by the insured?

Will have better idea when get the pleadings, but generally insurance will not cover intentional torts or punitive damages.

that was supposed to be a rhetorical question

I’m rooting for all four insurance companies.

Right! But the question is: Can they ever be FORCED to cover such actions when their insured is found to have been at fault!

Virtually all insurance insurance policies cover torts, like negligence or other unintentional conduct.

Yeah but Oberlin wasn’t accused if negligence

Policies often do not cover intentional torts, or willful misconduct.

All the time.

What insurers do not cover is intentional torts.

Pass the popcorn! 🍿🤗

I’m routing for the insurance companies, but you’d think they’d have to cover intentional torts simply because a large institution has many players being insured. A large institution, like a college or hospital have morons employed. It’s part of the territory. You’d think they’d have insurance to cover moronic actions.

The insurers presumably paid for the defence, while reserving their rights. Punatives are almost never covered. We will see. I hope the insurers win.

If the Dean’s actions were the only tort, I’d think the insurance should cover the college’s share of the damages. What’s the point of paying for insurance if it can be voided by one out-of-control employee?

But from the coverage of the trial in Legal Insurrection, I think the fault was much wider than any one employee of the college. It seems to have been college policy to indoctrinate students in socialism, downplaying property rights. It seems to have been college policy to support students caught shoplifting against the local merchants. The entire college administration was behind this dean when she used college resources to help the picketers and spread lies about the bakery. It looks like an intentional tort, not just by the dean on one day, but by college policy all year.

Then they were stupid enough to let those policies go on trial before a jury of townies, who were probably already fed up with shoplifting and other misbehavior by the students…

Torts of negligence are routinely covered, but intentional torts, not so much.

I have encountered some exceptions to the no-coverage for intentional torts in relation to judgments for sexual harassment. Understandable, because although they are intentional torts, sexual harassment laws are so vague and hard to interpret that it’s not easy to tell when the law is intentionally being broken,

Having said that, I don’t feel that this is what happened in the Oberlin case. They clearly acted with bad intentions, and unless you think the folks at Oberlin are complete idiots or utterly deluded, they absolutely knew that. It pleases me, as I suspect it pleases Prof. Jacobson, to see these weasels at Oberlin reap the consequences of their despicable actions and get their butts kicked.

Amber Heard is facing the same issue. She’s trying to get her insurance to pay part of the judgement against her, and the insurance company says the trial proved she willfully and maliciously maligned Johnny Depp, so they don’t have to pay. They were still in court as of mid-July.

Licensed Insurance Producer here:

I was always cheering for the punitive portion for obvious reasons.

Producers don’t usually get to see the back side of stuff and also since I’m small potatoes I wouldn’t know the in’s and out’s of this one.

What strikes me big in my knowledge is the intentional act part, I was wondering if this would come back to haunt them in conjunction with the willful belligerence with which they clung to throughout the process.

“personal and advertising injury” is caused “with the knowledge that the act would violate the rights of another … ,” or if the insured published material it knew to be false. ,

Note that they had soooo many opportunities here to take the high road and have these damages be so much smaller. I’m really amazed attorneys for the insurance companies did not have a come to Jesus meeting with them about coverage as I think it was the belief that the insurers would bail them out that they felt empowered to not take the high road and the quotes you include reflect that this was their belief.

Karma comes knocking baby.

Andy’s comment – “I’m really amazed attorneys for the insurance companies did not have a come to Jesus meeting with them about coverage …”

Andy – I concur with your comment.

I dont know the ins and outs of the case , though I suspect that oberlin bypassed the insurance companies attorneys out of arrogance. Something about being woke blinded Oberlin from reality and thus making a rational business decision. Even if Oberlin (big if – Not!) thought that Gibson bakery was racist, it still would have been prudent to address case in a rational business like manner. I would have thought that a $500k settlement at the start would have made the case go away.

However, Oberlin probably ignored legal advise being excessively woke ( living in a woke bubble is a disease) and thus thought they were correct.

A few things likely “ticked off the jury such as the valuation expert for Oberlin stating the business was worth less than a $50k. The jury likely took that as an insult to the jury’s intelligence. Fwiw, as a cpa involved frequently in valuation issues (with the caveat that I did not have access to the books and records) a likely range for the valuation would have been 300k to 600k.

I find that the intelligentsia very much UNDER value physical labor. So in their world view, they would never be paid for working with their hands, much less PAY even a paltry 50k for a business.

Morning- fwiw – a common error in business valuation is including the value of the owners personal service as part of the value of the business. The value of the business & and the value of the owner personal service are two separate and distinct items . The commonly get combined . Any valuation that combines the two usually gets shredded in cross exam or in the rebuttal report

I bet the ovens alone needed in a bakery like this are valued at 50k. The real estate is probably 3x that – at least!

Morning – The value of the business is the present value of the cash flows or the value of the hard assets, but not both. Valuing both along with counting the value of the owners services, is a common valuation error.

Both valuations for the plaintiff and for the defense were way outside the realm of reality. The Gibson’s got away with a grossly inflated valuation because the jury was already pissed off at Oberlin and the insult from the Oberlin valuation which was close to zero.

FWIW – I am a CPA involved frequently in valuation issues.

In this Oberlin case, wouldn’t the harmfulness of the accusation of “racism” be directed at the owners and other personnel involved in the business, rather than the machinery & equipment & furniture & fixtures & leasehold improvements, etc?

Or, are ovens and spatulas racist now?

Retired real estate appraiser(10+ years) here, experience is mostly single-family residential sales & refi’s and very little commercial appraisal experience which was segregated cost studies for tax purposes concerning the 1987 tax rule change apportioning what uses 39 yr depreciation & what uses accelerated dep.

Generally, appraisers use 3 approaches to indicate an arms-length transaction value: comparable sales (SFR), income (commercial), & cost (new construction). A rule of thumb in commercial is to assume a 10% rate of return for a general enterprise.

If I was valuing the bakery I would be most concerned about valuing where the salaries of family members fit into it. If every dollar is consumed by expenses (mtg, taxes, supplies, wages) with zero left on the balance sheet and assuming wages to family members equal $500K, what should the valuation be? $5 million due to the family wages or zero based on the balance sheet. Its an interesting valuation problem. However, lawsuits and insurance applications/claims often do not resemble arms-length valuations.

Well, Oberlin claims it’s all the insurance companies’ fault:

Lexington and United Educators also allegedly “both had numerous pretrial opportunities to resolve the underlying litigation for a small fraction of the eventual verdict” and could have settled the case for for less than $10 million on the eve of trial, according to the lawsuit. The college had even demanded the insurance companies do so, according to the lawsuit.

Are they lying? Probably. But that’s what they’re claiming

I suspect that reason the case was not settled for a small amount was because both the insurance company and Oberlin refused to write the settlement check.

The insurance company appears to be defending the case, but at the same time saying the loss was not covered.

Also, I agree with the comment that Oberlin’s valuation expert of the bakery market value added to the judgement amount.

Sure, Oberlin would like it if their insurance companies would pay, pre-trial, to make it all go away. But the insurance companies probably didn’t think even then that these intentional torts would be covered by their policies. So why should the innocent insurance companies fund a settlement? They have nothing to do with it, probably.

Presuming the ins cos were defending under a reservation of rights to deny covg and recoup defense costs, It is normal for the insd’s defense atty to demand the ins companies pay. You can be sure there are numerous “we demand you settle the case within the policy limit” letters. You gotta do that to set up an insurance bad faith case.

A $0K settlement at the start would have made the case go away. At the start of the case all the Gibsons wanted was an apology. If Oberlin had simply given them one they would have been out only their legal costs.

Welcome back.

Milhouse – that probably would have worked or should have worked. Though Oberlin was so infested with woke, that they thought they were the good guys

Imagine being the insurance agent in a call with Oberlin’s board: “Well, looks like all you need to do is apologize, we’ll write a small check to cover expenses, and you’re in the clear. How do you spell Gibson’s name… what do you mean, you won’t apologize? You’ll lose in court. That’s obvious. You’re going to wind up writing them a check worth millions. What do you mean *we* will be writing them a check? Have you read your policy?”

My dad always said insurance was just a way to spread expenses out over time. Oberlin’s rates are going *way* up after this, if anybody will cover them.

“if anybody will cover them”

Sure, we’ll sell you $75 million in coverage – for $100 million, in advance.

a classic example of how “pride goeth before a fall”.

Slight correction….pride did not go before a fall. A haughty spirit did. Fittingly here, pride went before destruction.

Indeed. Rest assured Oberlin’s insurance companies were telling them to settle at a much lower amount and to issue a formal apology. Instead, Oberlin acted high and mighty and decided to let this go to court. Now, their hubris is being rewarded.

I’ve been doing commercial lines insurance for twelve years now and except for two of those years I have been on the insurer side. It appears Oberlin didn’t read their contracts fully because intentional acts are specifically excluded. Sucks to be them, not really.

Fwiw – the Gibson’s expert valuation was grossly overstated & should have been shredded on cross examination though most likely the jury was ticked off at oberlin behavior and thus ignored the crappy over valuation if for no other reason that they thought the oberlin valuation was an insult

Here’s a question from a non-attorney (and non-attorney spokesman): if indeed the insurance companies took the approach you say, then they will, of course, have their own lawyers to help them craft letters spelling all this out, of which now they have a bulging file of copies? So, this may be a pretty cut-and-dried legal case? Wouldn’t a sensible judge, and jury, point to the letters and say, “they told you; you didn’t listen. So sad”?

Well, according to the update it appears the insurers pressed their luck and declined to listen to their client (Oberlin) and not settle at a lower amount, even after mock trials showed they would lose. If this is the case then I don’t see how a court doesn’t make the insurers pay. Assuming the facts are correct, that is gross negligence on the part of the insurers and not on the part of Oberlin.

ins co’s don’t have to pay for claims that re not covered by their policies. We can presume that all insurers involved issued reservation of rights letters to the insd from the get go reserving the right to deny covg and defense. It doesn’t matter if mock trials showed a huge verdict, if it’s not covered under the policy, the ins co doesn’t have to pay.

Oberlin wanted the insurers to pay for a settlement, according to the update. But if the act appeared to be an intentional tort, why would the insurance company pay a settlement? What a great scheme that would be: demand insurance companies pay settlements for things you didn’t pay them to insure against!

I read the complaint – A few things stand out

1) oberlin is claiming the insurance companies refused to settle.

2) the defendant or the plaintiff are the ones who have final say in settling a case, not the attorneys and certainly not the insurance company’s attorneys.

3) Oberlin is

Chris – the pleadings by oberlin claim the insurers refused to settle even though oberlin wanted to settle.

I have no information that would dispute oberlin’s claimed statement of facts. That being said, Oberlins claimed statement that they wanted to settle seems very dubious to me.

Oberlin was staffed with arrogant SJW jackasses that were absolutely assured that they were ‘right’, and that they would never actually have to suffer consequences.

Even AFTER the verdict they were still claiming they did nothing wrong!

Insurance defense paralegal here…I’m surprised they were not required to mitigate damages and settle the lawsuit

I read the whole thing. Oberlin wanted to settle for $10M. Insurance cos said fight.

Insurance people are masters of not paying. From my reading, they paid $1M. If the settlement was accepted, they would have been expected to pay $10M several years ago.

If they had already determined their max liability was $1M and they wouldn’t need to pay for years, then yep.

Probably also why they kept suggesting appeals. It would delay their paying the $1M.

At worst, several years from now, the companies will pay more. At best, another trial and Oberlin is the villain again and nothing more.

In Oberlin’s case, they will need to pay even more for attorneys.

It’s like watching a scorpion and spider fight. It’s not a question of who wins, I just want it painful for both.

Oberlin wanted the ins co’s to settle the case for 10 mill. on the eve of trial. There are multiple layers of insurance covg and a self insd retention. The ins co’s are not running the show here. Typically the ins co’s DO run the show when defending an insd, they hire def counsel, they decide whether or not to settle.. In this case, ins’ co’s were defending under a res of rights to deny covg, they don’t get to run the show. The insd and ins co’s are at odds with each other…+

I detest Oberlin, but I am not rooting for the insurance companies. The business of knowledge of rights and falseness is poppycock. No insurer would ever pay for libel under personal injury if they could get away with that nonsense. If Oberlin is telling the truth and they could have settled the case, it is the fault of the insurers and their lawyers. The only reason to have allowed this to balloon is that it was felt a bent judiciary was in their pockets. To me unfair insurance claim denial is a greater threat than disparagement by a wacky homo college. Oberlin should mostly prevail on this one.

The insurance companies should and probably will settle for some cents on the dollar, then promptly drop coverage. This alone will shutter the college, a just outcome.

Would you send your children to a college knowing that it has no insurance coverage (in the event your child might become injured there somehow?)

Nothing you wrote is related to the post or what I wrote. It is emotional, off point and ignorant.

This EHH deserves a degree in

❄ ology from oberlin

Because I hate both pinko colleges and rapacious, dishonest insurance companies? I bet you’re the type the howls if your entire car is repainted after a minor fender bender.

I cannot figure out why Oberlin hasn’t already folded , just due to lack of applicants.

After all that’s transpired with ahi sons etc., what kinds of families even take Oberlin anything other than a bad punchline to a bad joke.

Enrollment has been surprisingly strong in the last couple of years.

They drastically reduced their admission standards.

Does anyone have enrollment numbers for Oberlin College from before 2016 until now. It would be interesting to see if there’s any trend(s) that can be correlated with the event, the slander, the lawsuit and the judgement, individually or collectively.

It is a social elite celebrity college. What do you expect?

the legions of the woke are unaffected by facts and information

It’s hard to get into any “name” college these days, even one as rickety as Oberlin. Many of those Oberlin wokesters would more properly be learning a trade, but that isn’t the world we have, and the endless pressure every year from new kids expecting to “go to college” creates a wonderful business opportunity for all sorts of shysters.

And you get the Feds to finance $70k for 6 years and then the students expect Joe-six pack to pay his taxes and eat it when the graduate refuses to pay it back.

The college would not have shuttered as there would be other companies willing to provide coverage. But they definitely would pay higher premiums because this claim will loom large over their school.

But other than that, the post is good.

It is a given that Oberlin’s counsel advised Oberlin to apologize and settle; as experienced attornies all, we are reasonable and recognize risk. Accept that this advice was given and rejected, you EHH nevertheless blame the insurers or their counsel? And, under what provision of an insurance policy is the insurer permitted to require its insured to issue an apology, forced speech does not fall under duty to cooperate – recall no one at Oberlin was “:responsible” until the jury said otherwise.

If I may ask: are you saying that somewhere along the way, the insurers would have warned the college that this outcome was getting more and more likely? And surely that’s in writing. I’m not trying to score points, I’m trying to understand this case, thanks for your answer in advance.

I’m saying Oberlin had it’s own counsel as well as president – lawyer who gave advice early on almost certainly to settle. Oberlin ignored advice, insisted on absence of wrongdoing, lost. Can Oberlin now succeed in imposing liability on insurers for “failure to settle” years after Oberlin rejected settlement including apology? There is authority for discoverability of Oberlin counsel’s advice and its rejection. .

Not so sure about their “president-lawyer”. Wasn’t she a main player in their social agenda? Some lawyers are bloodthirsty aggressive types who want to kill (at least figuratively, maybe more). Not all are conservative risk-minimizers.

g. ruqt- you obviously do not know Oberlin or this case. They thought they were in the right from the very beginning. They were never going to “settle” when they knew they did nothing wrong. Their arrogance is astounding, and they have still admitted no wrong doing as this suit shows.

Insurance is for accidents, not for deliberate acts. If you torch your car to get out of the note, your insurance company obligated to pay it off.

…. IS NOT obligated…

I think Gibson Bakery offered do drop their lawsuit if Oberlin admitted they we wrong and apologized. How can an insurance company be forced to pay if the insurer refuses to settle the case without payment? The insurance company shouldn’t have to pay a dime.

This

You have no idea what you’re talking about.

The director who made these scurrilous claims against the bakery had plenty of time to reflect and withdraw her comments and claims against them but didn’t. She persisted as do many of the woke generation when they get on their high horse. Once the claims had been proven false or at least in doubt, it should have ended with an apology by Oberlin. Cases such as this one may hasten the end of woke nonsense in the workplace and universities.

“If Oberlin is telling the truth and they could have settled the case, it is the fault of the insurers and their lawyers.” This is a key point; if the insurers controlled the litigation.

INs companies not req to pay for claims not covered by their policy.

Not the fault if ins co is def under ROR, INs co takes a risk by not settling, if they lose on their covg dec relief action. IN a situation with a ROR involving non covered dmgs and alleged intentional acts, the ins co would A) allow insd to select their own def counsel or 2) advise insd to hire atty at their own expense as counsel/monitor. Did OJ Simpson’s ins co pay any money on the wrongful death claim against him they were defending under a ROR?

The insurers could not have settled it, because the main thing the Gibsons were demanding was an apology, which the insurers could not provide. Only Oberlin could have provided that, and it refused; had it agreed, the settlement amount would have been a whole $0,000,000.00

Welcome back, bo! Wher u bin??

Long story. I lost internet access for a long time. But I’m back, at least for now.

That’ll teach you to stop for babies on the side of the road.

See? I can agree with something you post.

There are contract provisions protecting the insurer regarding the refusal of monetary settlements; not other forms. A demanded apology, a magic act or a dance routine are not relevant. People are allowing their justified hatred of Oberlin to cloud their judgment concerning the almost equally odious insurers. The insurers certainly benefit from this, and they know it.

The insurer would have been even happier if Oberlin hadn’t done these bad things and gotten themselves in trouble.

TYPO ALERT !

“I am in the process of obtaining the case pleadings and motions and likely will have more details. Our six year journey continues, as we will not follow this insurance lawsuit.”

not –> now

“The ensuing accusations by the college that the bakery had a long history of racial profiling let to a lawsuit, trial, appeals, and ultimately payment.”

Gibson’s is a bakery. Jack Phillips’ Masterpiece Cakeshop is a bakery. Why do leftists hate bakers? Phillips’ tormentors are individual, mentally deranged perverts who want to punish his Christian convictions about morality and God’s order for this natural world.

But what tortured logic drove Oberlin to interject itself into petty crime at a private business near campus that simply didn’t want to be plundered? Karen-ism? Black privilege? Or can this $36 million fustercluck be explained by ‘leftism is a mental disorder?’

Suffer, Oberlin.

Don’t have any idea on the potential outcome but if any plaintiff ever deserved to have to pay big bucks Oberlin is near the top of the list.

Can Oberlin College get insurance at any price now? I hope not.

It would be great to setup an operation to gain control of Oberlin and remake them in Hillsdale’s image. That would be justice.

They will be able to. There is insurance for every type of risk, even idiot Leftist colleges who are smug and condescending.

But at a cost that will be off the charts…. Hahaha

I dunno. Insurers are fleeing California due to risk. The question for an insurer would be is Oberlin a risk for another big payout? If they deem not, then they will be insured at a higher premium no doubt.

Two different scenarios. It’s easier to price the risk of one insured than it is to price the risks within an entire state, especially in a state that is very politically hostile to insurers. There will be a carrier willing to take on Oberlin, but the premium will be astronomical.

Until recently I suspect some insurance company boards and managements would pay out on these sorts of claims to support their personal agendas and dump some more on the right. Things are improving and shareholders of insurance companies won’t have to put up with too much more of that.

It should have no problem continuing to get liability insurance for bodily injury and property damage. (Do you people think that this issue has not already been dealt with and that the coverage denial date impacts this question?) The problem is personal injury coverage, which was the issue here. The insurers would most likely wish to provide a total exclusion for this standard coverage, but this is fraught with danger. Judges who wear bondage devices under their robes are fond of finding such exclusions or omissions of coverage ineffective. The solution is to provide personal injury protection, but with a token sublimit of $100,000 or some such amount.

All GL policies provide bodily injury, property damage, and personal and advertising injury. There won’t be any kind of exclusion to that coverage there and, in fact one of the policies did provide coverage up to the policy limit. The problem for Oberlin is that the damages exceeded their primary policy limits and they were hoping their excess policies would pick up the remainder. Since most excess and umbrella policies are follow form (meaning they follow the terms and conditions of the primary, underlying policies), the terms and conditions of the underlying policies dictate the obligations of the excess or umbrella policies. Oberlin will have a tough time trying to overcome this.

Also, intentional acts that intend to cause injury are already excluded, something Oberlin’s insurers would have told them, urging them to settle.

Thanks for the lesson, but as a past recipient of the Distinguished Graduate Award in the CPCU program I find your analysis unimpressive. Oberlin has a very strong case against the insurer.

As a fellow CPCU recipient myself I find your attempt to pull the appeal to authority card to be equally unimpressive. Oberlin may be able to prevail in this, but it won’t be because the structure of insurance policy. Instead, they will only win if Oberlin did indeed instruct the insurance companies too settle at a lower amount and that the insurance companies failed to do so.

I don’t know how long ago you got your CPCU, but there is no need to be engaging in insults or attempting to demean others.

Hilarious, ,in your initial reply you wrote I didn’t know what I was talking about! I took those exams before they were all dumbed down and consisted of 10 essay exams. I also acted as licensed insurance advisor. I have since moved on to more intellectual and profitable pursuits. There are too many idiots in the insurance field who half-ass know everything.

That was before you decided to mouth off that you had Can’t Produce Can’t Underwrite certification. That being said, I still stand by what I said about you above. For someone who said he went on to more intellectual and profitable pursuits you gave an absolute turgid and emotional response. Yes, when I took the CPCU it was multiple choice. That being said, I didn’t just jump to taking the CPCU exam, I got several other designations plus I got about six years of experience under my belt before it, so I think I would have done just fine with essays.

As opposed to mouthing off and calling people names and getting all emotional (did somebody in insurance hurt you in the past?) why you don’t state your reasoning why you believe Oberlin will succeed in having the companies cover the claim?

But, as an outsider who never took nor passed a single one of those exams, hard or easy version, why would an insurance co. have to pay a settlement on non-covered behavior? If I don’t have homeowner’s insurance and my house burns down, can I demand that my car insurance pay for it? It’s not covered by my auto policy, but it is insurance after all.

Interesting point on “follow form.” I have some questions for you, They are not rhetorical, but genuine.

1. It appears that Lexington didn’t write the policy that paid the $1 million. That was done by one or two separate insurers, College Risk Retention Group and United Educators. Would Lexington be bound by the terms of those policies and/or the actions of those insurers?

2. I think I recall that there were internal emails within Oberlin that declared their intention to ruin Gibson’s. I don’t recall the exact wording, but I’m pretty sure that was the gist of it. As as non-lawer and non-insurer, would that not show something more than “advertising injury?”

3. Much seems to be made of a claim that Lexington was obligated to force or compel a settlement. Could you elaborate on that point? From a layman’s perspective, it seems to put the proverbial cart before the proverbial horse. Yes, the insurer might recommend settling, or not, but was it Lexington’s legal responsibility? They seem to have limited their participation in the case to determining their potential liability, but wasn’t the final decision up to Oberlin?

4. This might be outside your scope, so if you want to speculate, please label it as such if you answer me: What sort of further discovery can be expected here?

Again: I ask these questions in good faith. I am asking you because, unlike most of commenters, you think Oberlin has a strong case. As a layman, I don’t think so, but it’s my retrograde habit of a reasonably active and open mind to seek out the views that I might not agree with.

I hope you find this post among all the back and forth and will reply. Thanks much in advance.

It just be raining lawsuits in Oberlin.

Did y’all know that Kevin Bacon’s very first role was playing the part of Oberlin College in Animal House?

It conferred 6 honorary degrees on him for that.

Remain calm! All is well!

https://www.youtube.com/watch?v=wWBiLeVy45k

Who would want to insure Oberlin now? Karma is a bitch.

Some lefty “mission-driven” insurance company. The boards of insurance companies may be a lot like the boards of Disney and other woke corporations, and the only thing that would chill such behavior even a little would be shareholder lawsuits naming those directors personally for acting ultra-vires and with flagrant disregard etc. for providing such insurance based on their political preferences.

“since the inception of the protests outside the bakery in November 2022,”

Should be 2016.

Call me cynical if you must but it’s a shame all of them can’t lose.

Oberlin’s conduct has been so egregious that it really shouldn’t exist at all.

In my (very bitter) experience, the very first thing that an insurer will do is to find a reason to deny a claim. People trying to escape a burning building do not act with the urgency and zeal of an insurer when a claim is made.

They can all catch an Uber to hell as far as I am concerned.

In this case the reason to deny the claim is so obvious that I can see it, and I know nothing in particular about insurance. The policy didn’t cover the behavior that the jury found Oberlin committed.

Do you mean Twillie has been outsmarted ….. again? Hey Twillie, go ahead and blow a few more mil on legal fees.

I’m sure she gets outsmarted a lot, but usually nobody’s allowed to profit it because of “the agenda” i.e. Twillie is one of those designated to win in the name of “progress”.

This is going to be fun.. I love watching “progressives” hit themselves in the head with a hammer over and over again. Go ahead, Oberlin, make our day!

The next fun part will be when the insurance companies prevail and don’t have to pay, at which time Oberlin will have to examine its trusts and bequests and all only to discover that those funds are not allowed to be applied toward legal case settlements. Oberlin might have to pay this thing out of their own funds.

Ah, the cosmic irony if Oberlin has to hold a… bake sale!

If they’re interested in branching out from the bakery business, I know of a nearby local firm that recently acquired some cash and might bail them out in return for acquiring the Gibson-Oberlin College and Conservatory.

I think Oberlin should obtain a new policy that expressly covers “intentional torts by insured in the course of advancing wokeness.” That would probably cover similar incidents in the future, but the premiums might be hefty.

I doubt even the wokest insurer would even touch that type of policy! It would be like voluntarily writing a fire insurance policy for someone building a house in the middle of an existing lava flow from one of the world’s active volcanoes.

I’m no lawyer but this case seemed far too clear-cut to have even been dragged through the courts for six years. That in itself was a gift to Oberlin, giving them ample opportunity to come to their senses and settle. With an apology, of course. The fact that the top administration couid not do so, but instead insisted on its own imaginery virtue, just boggles the mind. I have often wondered who the heck were their lawyers. Decisions this bad are the stuff of legends. Of course, the insurance company should not pay. It’s not their responsibility that Oberlin willfully shot itself in the foot, and insisted on making a bad situation worse. I do have to say it’s a shame to see a formerly good college bite the dust like this. It would be difficult now to trust any decision this college makes.

So I finallly looked up the President of Oberlin College, Carmen Twillie Ambar. Turns out she’s a lawyer herself. She has a JD from Columbia Law School, an MA in Public Affairs from Princeton, and a B A in Foreign Service from Georgetown University. Those are impressive credentials which did her absolutely no good when judgment was needed.

Alas, those impressive credentials seem to have just made her arrogant.

But recall the time. Leftists were winning EVERYTHING. It was a reasonable calculated gamble, or at least understandable from someone who had had their path greased in every possible way and was part of a MOVEMENT.

I was pleased but surprised that wokeness stopped in that trial courtroom. That’s why we are so happy with this case and still covering it. It’s what the left would call a “landmark” case.

The college has been going downhill long before November 2016. None of my peers even had it on the list of possible places for our kids. Early on I speculated that the whole villification of the Gibsons was a desperate attempt to get back some of the counter-culture protest edginess that had been waning since 1970. I guess that like Portland, Oberlin sort of overshot the mark and now there is possibly no coming back. They seem to be sliding about 1 spot each year in the USNWP college rankings and in a few years will not only no longer be a nationally ranked school, but the 3rd best in Ohio.

I knew in December 2016 that they would never apologize. They can’t. No liberal has ever admitted that they were wrong, and these are special liberals. This case has always been about being about to call anyone a racist at any time as a tactic and get away with it. If you take that off the table, they basically have nothing to win arguments with. That alone is why they spent something likely north of $8M, and possibly as much as $10M, to win a lawsuit that was filed for $200K in damages. You will simply never see an apology because that would be an admission that calling Gibsons racists was wrong.

What I suspect will doom the college will be the revelation that they never told the insurers about all of the damaging stuff that came out in discovery. If the insurers ever said that they shouldn’t settle, it may have happened with a very incomplete picture of how deeply Oberlin had invested itself in the attempt to destroy the Gibsons. The one consistency in all of this is how simply horribly Oberlin has been at all stages. For them to now act all “we tried to play nice but the insurers wouldn’t let us” is simply SO out of character that I cannot for a second ever believe it was true.

the ins co’s were following discovery closely. Oberlin didn’t -hide anything from them.

But the discovery revealed that Oberlin’s actions were not covered by the insurance. By “advising Oberlin to settle” what people really mean is “ponying up money to pay a settlement”. And the insurance company thought it was not liable, after doing their due-diligence by reading the discovery. (This is as I imagine it anyway.)

Beyond that, Oberlin wouldn’t be taking legal advice from an insurer, but from its lawyers.

Did the discovery reveal that? What if Oberlin sincerely believed that the bakery had a history of racism based on what students told them? That is why the ins co wanted to put roggs in front of the jury and that is why Oberlin didn’t let them. Keep the situation muddy. In CA, where I was an adj many years ago, in a res of rights situation like this, the insd would be able to select the def atty (normally, under the terms of the policy ,ins co selects def atty) due to the fact that the def atty could shape discovery to exclude covg (like putting roggs in front of the jury to nail down the covg issue) . IIt is not clear in this situation if oberlin was able to select their own def atty. It was clearly the right move of Oberlins def atty to keep those roggs away from the jury+

How huge a pile of $$ is Oberlin’s endowment again? Oh, look: in 2021 it exceeded $1 Billion.

https://oberlinreview.org/23201/news/college-endowment-surpasses-1-billion/

We don’t know what restrictions govern that endowment. I think of the rancher with 100 sections. It’s a matter of stereotype that farmers and ranchers can be “land rich but cash poor.” I wonder how much readily liquid cash Oberlin can use from that endowment for this purpose.

We really need a movie done in the sprit of “The Big Short” about this trial. It almost writes itself with a pathology from Oberlin that often defies belief. It reminds me of the classic Doonesbury with Duke tied to a stake in front of a firing squad screaming “and that’s my final offer.” From day 1 Oberlin has been a complete d!ck about everything and now we are supposed to see them as a poor misunderstood child.

Actually, I do see this type of behavior on a daily basis as I am somewhat addicted to police chase videos on Youtube. It like NASCAR except that you are almost always guaranteed a crash of some sort. After 15 minutes of mayhem, the perps are dragged from the wreck and suddenly it is “I am sorry this” and “I am sorry that.” Oberlin has failed to apologize because deep down they always figured that they would get away with something, and they actually have. All of the principals have been drawing paychecks for the last 6-1/2 yrs when as a white male my butt would have been fired immediately.

I thought that once the check was written and delivered that the digging was done, but it seems that Oberlin wants a bigger hole than the one they find themselves in. Even more legal fees on top of what must be something on the order of $8M at this point, which was spent to win a $200K lawsuit (4 claims at $50K each). As an alumni I can tell you that I have seen next to nothing in any of the mailings from the college. This is one well guarded secret lest the alumni start to ask difficult questions, beginning with “what were you thinking?”

BTW, shouldn’t the sequel in the form of the Title IX suits be starting soon?

Typo alert:

“Our six-year journey continues, as we will not follow this insurance lawsuit.”

I think Prof. Jacobson meant to write “we will NOW follow this insurance lawsuit.”

yes, thanks, thought I fixed it earlier.

Beautiful; I love it. Karma is a bitch.

Oberlin’s arrogant, obnoxious and callous administrators never gave a damn about the hurt and harm they had caused the Gibson family and their business, through their imprudent and outrageous slanders.

If reasonable and fair-minded administrators had been at the school, the entire matter could have been settled with a public apology and a handshake, and, no trial would have ever occurred, nor, a massive judgment awarded.

If the insurance companies prevail, can Oberlin go after Ms. Raimondo and force her to pay them a share of the judgement that was paid to the Gibson family?

That’s exactly what I was wondering (see below)?! Chances are she has some type of liability limitations in her employment agreement, but I wonder if those limitations include intentional acts, and how this legally comes together between the bonding company and the insurers and Oberlin. Either way, anything that brings a ton of trouble her way is quite overdue. She seems to have instigated all of this, and now let her feel the bit of Karma on her backside.

Thanks for your reply drsamherman.

Whatever calamitous financial hardships Ms. Raimondo is forced to endure is deserved.

I doubt it matters. Her pockets aren’t deep enough to bother with.

Tats Raimondo is now at a college in GA. I wonder if she left Oberlin voluntarily, or was asked to leave (maybe by the Board)?

She’s at Oglethorpe near Atlanta. It’s a small university with a rather insignificant endowment most likely heavily dependent on current revenue from tuition and fees. I googled Ms. Raimondo, and I discovered much to no surprise that she also has quite the reputation for supporting antisemitism as well as her other shenanigans, both at Oberlin and Oglethorpe based on interactions with Jewish students and alumni who turned to her with help with antisemitic conduct on their respective college campi. Quite the SJW is Ms. Raimondo, and her Karma account matches the financial damage she contributed to at Oberlin.

A vile Dumb-0-crat Jew-hater comfortably ensconced in academia. She’s in her element.

Oglethorpe, another one to avoid. They hired Raimondo and let her continue in her ways. Let not your way cross hers.

I thought she would have joined Emory and it’s Jimmy Carter hate-the-zionists center or excellence.

Whatever Oberlin CAN do, I would be shocked to my socks if they went after her personally. Among other things, I doubt her pockets are deep enough to matter.

Besides there’s a lot of sympathy for her in the upper admin. What she was doing was no secret to her enablers. That’s why they hired her!

>> The college had even demanded the insurance companies do so, according to the lawsuit. <<

Yeah, that sounds EXACTLY like the Oberlin I know and love. /s /s /s

The benefit of attending such a college is to learn how to engage in and profit from such abusive and antisocial / psychopathic behavior.

Did you fail to learn the unwritten curriculum? I get the sense that you have not profited much from it.

Laugh out loud funny.

Insurers (being, you know, insurance companies) trying to shift liability to other insurers and intervene to develop factual grounds to deny coverage based on exclusion of intentional torts?

Hilarious!

Now denying coverage to the woke Fascists at Oberlin?

Hilarious!

The only crack in that armor is the potential claim that insurers are estopped from denying coverage for expenses/damages arising from appellate proceedings they encouraged Oberlin to pursue (assuming that actually happened.

I suspect there will be a compromise down the road, both sides have too much exposure not to settle.

But still, hilarious!

If we hate insurance companies, we should hate the laws that require us to have insurance. They have a right to try to protect themselves from legal liability. Maybe their sin was to insure and enable Oberlin in the first place because they probably knew what Oberlin was and what its tendencies were. But that’s a smaller sin than what Oberlin did by committing the acts they were found responsible for in court.

Insurance companies stay in business by fighting to not pay claims or deny them outright. In this case , as in many the only group that will make out are the lawyers. In this case may Oberlin extend their losing streak.

Billable hours matter

ins co’s stay in business by sound underwriting, not denying or lowballing claims. 6

I disagree. Insurance companies are surely helped by denying and lowballing claims. If it didn’t keep them in business and prospering, they wouldn’t do it so much.

But that doesn’t mean Oberlin’s insurers owe in this case, because it seems Oberlin’s acts were not covered by the policies.

no, denying and lowballing claims results in multi million dollar bad faith judgments. No adjusters are trained to deny or low ball claims without good reason. Adjusters are rewarded /promoted for settling claims quickly, not for having low settlements. What evidence to you have that ins co’s deny or low ball legitimate claims?

Lexington and United Educators also allegedly “both had numerous pretrial opportunities to resolve the underlying litigation for a small fraction of the eventual verdict” and could have settled the case for for less than $10 million on the eve of trial, according to the lawsuit. The college had even demanded the insurance companies do so, according to the lawsuit.

So the college that at every step of the way went out of their way to piss off Gibson Bakery, is now claiming it’s all “those mean insurance companies’ fault”?

LMAO

I am an attorney that handles insurance coverage cases, albeit in a state far from Ohio.

Where the insurers might be in trouble here is the failure to settle claim. Most states, likely including Ohio, impose a duty on insurer’s to settle a claim where it is both possible and objectively reasonable to do so.

I would have to know more about the layering of Oberlin’s multiple policies to have a sense of which insurer(s) might be on the hook under this theory. This information is not included in the article.

Typo–insurers, not insurer’s

I agree. And while I do not handle claims, I handle policies. Failure to accept a settlement (with other peoples money, mind you), will limit the insurer.

So the insurance company would not have had to pay out for the settlement? Then I can hardly imagine them discouraging it.

I thought they would have been paying the settlement. In that case if they think they are not liable, it’s normal for them not to offer to pay for a settlement, isn’t it?

No, you have it backwards. At least in my state, insurer’s generally have a duty to settle unless they can show that their policy CLEARLY does NOT cover the claim. In a case like this, that should have been established by a declaratory judgment action prior to trial.

When puhiawa talks about “limiting the insurer,” I think he means limiting the insurer’s ability to deny or avoid paying on the claim.

many times it is not possible to have a DJA completed before trial and and trial discovery and witness testimony often provide ammo for the DJA.

Yes, it seems to be the most pertinent question. I note (as a non-lawyer and non-insurer) that the $1 million was paid not by Lexington but by one or two other insurers. As a layman, I wonder whether Lexington is governed by the terms of policies it did not write. I’d guess that it would hinge on the wording of the Lexington umbrella policy, but what do I know?

As for the timing issue, I guess (but don’t know) that Lexington refused Oberlin’s claim quite a while ago. “Settle” doesn’t have to mean “pay,” does it?

Umbrella policies can, but don’t necessarily, follow-the-form of the underlying insurance.

What would be interesting to know here is which insurers had to step up and provide the next (1 million already having been paid) 10 million in coverage. That insurer, or those insurer’s, are the ones potentially on the hook.

that seems to be the argument between lexington and united educators, which one is next in line. . …the first insurer (starts with a “C”) prob paid their limit to avoid more def costs. ONCE YOU PAY YOUR LIMIT, YOU DONT HAVE TO DEFEND ANYMORE.. They prob started appealing, paid their limit and then dropped out of funding the appeal.

req to pay 10 mil on noncovered claims?

At least in my state, if there were any reasonable argument, either in law or in fact, that the policy would (or might, depending on what the jury found) provide coverage, then the insurer has a duty to try to get the claim settled.

Is this duty imposed when the ins co has reserved their rights to deny covg?

What amazes me is that they were fighting with the insurance companies while the case was in progress, and apparently needlessly so. How would it have hurt them to include the interrogatory that the insurance company wanted?

So, Oberlin counted on their insurance companies to rescue them, but deliberately angered said companies. What the heck!

Cults don’t counsel rational behavior. As a sort of seminary of the Woke, Oberlin is ground zero for indoctrination into the Church of Wokery.

If they had settled, it would have signaled to the rest of the Woke high priests and cultists, that Oberlin was insufficiently dedicated to the foundational principles of Woke. From there, they concluded that settling with Gibsons would be more harmful to their “reputation” than losing millions.

What I can’t decide is whether Woke makes one mentally ill, or if the mentally ill are attracted to Woke, or if as the Blogfather always says, “Embrace the power of ‘AND'”.

It would hurt Oberlin to let the ins co do rogs because the ins co intended to use the rog answers to deny covg. Ins co attempting to use rogs to surgically and precisely deny covg. The ins co (lexington) attempted to intervene at trial with these roggs.

And in principle there’s nothing wrong with that if the judge would allow it. The insurance co. is acting normally by asking questions that “surgically and precisely” bear on its own liability, rather than other issues where it wouldn’t have standing.

Agreed. Lexington attempted to intervene and the judge ruled against them for being untimely. But if I am Oberlins def counsel, I do not want the ins co to get those roggs in.

One point made not so far — this is precisely what is needed so that insurers will exercise more oversight and diligence in the future. A college wants liability insurance? Well now, there’s some new rules to follow, and you’ll have to demonstrate that your administrators all know the rules.

People at a university should be in fear that the insurance companies will walk away from them. That’s how you mitigate this sort of egregious behavior.

One person of interest in this has always been Gina Raimondo, who is truly at the center of all of this as she was the senior administrator largely responsible for instigating all of it. If the insurers refused coverage based on her actions, and it seems to a large extent (at least, prima facie) they did, this renders her absolute poison. Her present employer, not to mention any future employer needs to take that into account. I can imagine her present employer is looking at this situation and consulting with their own risk management and general counsel. I am reasonably certain she has some sort of liability limitations in her employment contract, but even those limitations have limitations. I am not at all familiar with whackademic employment agreements, but if they are anything like medical employment agreements (and I am reasonably certain they are for most purposes), any intentional act on her part voids her being shielded from liability. Hmmm…..

Make that MEREDITH Raimondo.

Thanks. I was pretty sure Gina was governor of RI and then moved into Brandon’s cabinet. You had me wondering if she had this skeleton in her closet before becoming governor.

She is now GC and Chief of Staff at Oglethorpe U. in Georgia..she took that position about 2 years ago so they should have known all about this episode.

Oberlin can hide their ignominy and put this behind them by adopting a new name.

I suggest: Lena Dunham College. They can keep the Squirrel mascot.

It can offer a “plaintive” curriculum.

it seems to my no lawyer self that Oberlin’s claim against their insurers will hinge on the wording of their policies.

If they had a “refusal to settle” clause, then Oberlin’s position is strong.

However, if not, and they declined the advice of their insurers to settle, then they would seem to be up the proverbial creek.

Please explain a “refusal to settle” clause in as much detail as you can.

Well in med- mal policies, for example, the insurance may tell the doc to settle, as the losses might be a lot higher should they proceed to trial. But there is often a clause described as “ refusal to settle”, whereby the doc can say “no, I want to go to trial, and you, the insurance, has to cover me, even if you advised me differently.

Link?

Med mal policies and other professional malpractice policies are diff than GL policies. They require the insd’s permission to settle, as the insd’s professional reputation is at stake. GL policies do not req the insd’s permission to settle.

GL policies do not have “refusal to settle” clauses. Those are found in mal practice policies..

I’ll accept your word for that, as I’m no lawyer.

Still, I think the fine print in the policy here will determine the outcome.

https://www.kevinmd.com/2022/03/understanding-consent-to-settle-in-your-malpractice-insurance-policy.html#:~:text=To%20protect%20their%20interests%2C%20many%20insurers%20include%20language%E2%80%94referred,your%20refusal%20to%20settle%20will%20not%20be%20covered.

I’ve never seen an insurance policy cover intentional torts-if they did, there would be no incentive for people and companies to behave appropriately since they could behave as badly as they chose and then have some insurance company pick up the tab–that’s really what Oberlin is asking here

Welcome to the world of “intentional harm” by the insured. Welcome to the world of “last offer in compromise” notice of acceptance of settlement. Oblerlin wanted its high ground and is now on a slippery slope. No one will cover it again unless Buffet or Soros demand it and offer indemnity.

I can’t say about Soros, but Buffet has not been known for writing blank checks to the Oberlins of the world.

Gift that keeps on giving

Expect battles over discovery:

Attorney client privilege, Oberlin had lawyer -president, reams of communications about apology, Oberlin intra mural debates, should we settle?, how do we deal with insurance?, who’s in charge of this case?, should the Board be informed -make decisions?

As to failure to settle, Oberlin’s records not likely to support this given it would not apologize. More likely, Oberlin rejected advice of counsel. Will this be discoverable? And if not, will the judge understand what the advice was from the other documents?

Additional context

“The Gibsons presented several printed text and email messages between senior college administrators to demonstrate that, nearly a year after the bakery incident, they did not believe that the college should work with the Gibsons to resolve this situation…One text message sent by the interim assistant dean expressed that the criminal conviction of the three students was ‘an egregious process’ and that she hoped the college would ‘rain fire and brimstone’ on the bakery.”

Gibson’s counsel elicited testimony that Oberlin feared students throwing food in the cafeteria to protest?! And the article’s author correctly notes that Oberlin had no “adult” in its bureaucracy.

https://ohiocapitaljournal.com/2022/04/08/gibsons-bakery-v-oberlin-a-case-on-being-adults-not-fighting-discrimination/

The nice thing about this suit is that the insurance company(ies) in question have a very strong institution reason to fight this suit and appeal any adverse decisions for YEARS. A) Oberlin won’t win, B) even if they manage some small victory, it’ll be after YEARS of legal fees and appeals.

They’ll have highly experienced insurance defense counsel, and significant motivation to protect their policy language disclaiming intentional torts. And, they’ll have deep-enough pockets that cost won’t be an overriding concern.

Oberlin, on the other hand, has a losing record at trial, on appeal, and on further appeal. All of the evidence in the case demonstrates not only that Oberlin knew EXACTLY what it was doing – LYING WITH SPECIFIC INTENT TO HARM THE GIBSON BUSINESS – but when offered an opportunity to back off that lie, they doubled and tripled down.

When you think about how this started, it’s just amazing. A student goes in and tries to steal a bottle of wine. He gets caught and, rather than just give up the wine and apologizing, the kid claims discrimination and prejudice. There was a time when someone would have asked him if he tried to steal the wine and tell him how wrong that was, instead we have the college go woke. Why should any business permit theft? Cheering for the insurance companies.

At the time, Oberlin was having issues with attracting students as its reputation as a college with deep involvement in social issues was starting to fade. Sometime in the first 72 hrs someone had a brainstorm idea that this could be a way to reinstill that reputation. One thing which has always been in the background was how a board member early on paid for the shoplifter to go to Columbus to confer with a criminal attorney. Has this ever happened before? There were just too many coincidences and unexplained happenings for me to not think that this was an orchestrated event from very early on. I can easily see administrators weighing the upside/downside and deciding to go ahead and allow/support a full-on protest against the Gibsons as a way to demonstrate that the college, via their student army, wasn’t going to let “whitey” get away with this. They likely saw themselves as too big to fail, that they had the resources to crush the Gibsons. The big problem was that all of this took place inside a bubble, and all of the damage took place long before the insurance companies were ever brought into the fold.

Maybe we should start a poll now. Will Oberlin be able to obtain insurance down the road at an annual rate less than 5 times what it is currently paying? Given their ability to annoy, I will say no.

On top of all that 33 millions in damages, I am curious to know how much they have to pay to their Perry Masons for their impeccable performances.

I vaguely recall that what Gibson’s had spent for lawyers was quoted in court at something like $5 million, before the appeals were all done. So, something like $8-10M for Oberlin would not surprise me.

Now add in a million to go after the insurance companies. I’m guessing that they want to “look like they did everything they could” by going after the insurance companies, and hope to reach an out of court settlement that covers some portion of their losses. The insurance companies need to stick together and form a united front and not settle. Since this is being tried in Lorain County Courts and the entire community is totally aware of the Oberlin’s shenanigans, this suit won’t go well for Oberlin either. Just goes to show you the hard left mindset – nothing is your fault, ever.

The one, very few instances, that I agree with the insurance companies.

Cut your pound of flesh, Oberlin, and reflect on why this happened.

Just a few questions for any Oberlin grads on this topic:

1) Has Oberlin hit you up for donations to cover up this mess?

2) How have they approached their culpability?

3) Would you give a cent to help them out of this?

As an alumnus, my first question would be “what mess?” I can only recall a few emails sent to the alumni, and each of these was in the form of “this is where we stand and we are fighting it.” Even the last one where they announced that they were paying the Gibsons was heavily laced with suggestions that it would all be covered by insurance. Move along, nothing to see here.

At no time do I ever expect to receive an email which states “our little adventure into Social Justice Adventurism cost us about $50M, which will no longer be available to earn income ($3M/yr at 6%). As a result, we will likely need to either terminate 20 faculty positions, or not offer 40 full-ride scholarships each year from now till the end of time.” Were they to say this, heads would roll, and at this point the highest priority for all of them is simply staying employed.

I think that they are counting on the fact that most liberals are very comfortable with being lied to.

Liberals see it as a war wound but part of their commitment to the Cause.

I agree with Major Wood.

– They have not hit us up either directly or indirectly, like saying publicly how needy they are because of this.

– Not a peep about doing anything wrong. Having to protect their brand seems to be their posture. To be honest that has worked, as recent enrollment has been excellent (to my surprise).

– I would not give “a cent to help them out of this” or ever again. IMO this is no longer one of the top few liberal arts colleges in the country that it was when I graduated, nor “liberal” in the classical definition sense – willing to respect or accept behavior or opinions different from one’s own; open to new ideas.

I think we need a C&W or folk singer to write a song:

“A “U” named Sue”

Most if not all comprehensive general liability policies exclude coverage for intentional torts

Donica Thomas Varner was Oberlin’s Vice President and General Counsel during the trial.

She sent an amazing message about the jury’s failure to come to the correct decision, right before the punitive damages part of the trial.

Now, she has the same positions at Cornell University.

I am curious if Professor Jacobson has any personal insights about Varner.

Cornell, unfortunately, has become a repository for the dregs: IDKW

Present company excluded, of course.

Why would they hire her after that letter? Shows poor judgment.

Disappointed in this move by Cornell. I had the impression the admin. there has more common sense than is typical at Ivies these days.

She “checked all the boxes” . . .

Anyone have any idea how Gibson’s is fairing these days, businesswise? Have students returned to shopping there?

I just google mapped it and it said ‘Busier than usual.’ HTH

If Oberlin does win and force their insurers to pay up I doubt there will be any insurance company that will insure them unless the premiums are astronomical. I can almost guarantee that Lexington Insurance Company of New York; United Educators Insurance of Bethesda, Maryland; Mount Hawley Insurance Company of Peoria, Illinois; and StarStone Specialty Insurance Company of Cincinnati will cancel any coverage they provide Oberlin.

No insurance company will cover any damages that you deliberately cause. They usually have a clause in the policy stating so. They would be negligent in their duty to their shareholders if they did not.

If Oberlin thought along the way that this would be covered by insurance they would not have fought so hard. This is a last-ditch effort by them to collect some of their money back. Screw Oberlin.

My pet hypothesis all along has been that Oberlin was a proxy in a much larger fight. At stake here was “the practice of calling someone a racist as a way to win a fight.” That is why Oberlin fought so hard and tried to destroy the Gibsons to win. They could not under any circumstances lose their trump card. What they didn’t factor in was that people outside of the bubble might see this differently, and show their disgust as they did. IIRC, even after trial has wrapped up and the jury was deliberating, Oberlin offered something on the order of $4M to settle, which in reality would probably have not even covered the billable hours put in by Plakas et al at that point. It must have come as a huge shock when the jury came back with 10X that amount. Since June of 2019 Oberlin has done nothing but delay the arrival of a reality that they really really screwed up and that there was no way out. This lawsuit is basically an extension of them paying out $4300/day while appealing. There was never a possibility that they would win. It was just them desperately trying to not be held accountable. They were spending $4300 a day simply to say “this is ongoing litigation and we can’t talk about it. I am pretty certain that down the road a statement will be issued along the lines of “we really wanted to discuss this matter in an open and candid fashion with the alumni, but insisted that we refrain from doing so.”

I have my own pet theory along different lines. President Ambar came in shortly after this got started and had nothing to do with the incident or its immediate aftermath..