Rep. Chip Roy Reviving DeSantis Bill That Would Make Schools Pay for Bad Student Loans

“Enough. It’s time for schools to have skin in the game for how much debt they encourage young Americans to rack up.”

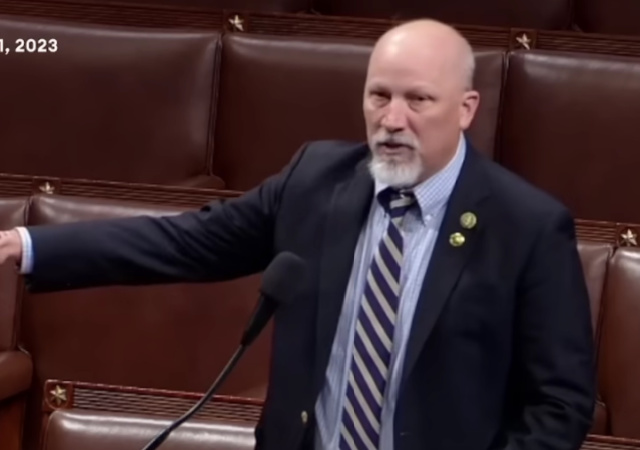

Rep. Chip Roy of Texas is breathing new life into a bill that was originally introduced by Florida Governor Ron DeSantis when he was serving in Congress.

The bill would force colleges and universities to get financially involved in the student loan debt crisis, which makes perfect sense given their role in the creation of the problem.

From Semafor, via Yahoo News:

Chip Roy is reviving a Ron DeSantis bill to make schools pay for bad student loans

Rep. Chip Roy, R-Texas, will introduce a bill hold universities accountable for unpaid student debt, reviving a component from a bill that Ron DeSantis introduced in 2017 when he served as a member of Congress.

The education bill would require colleges to pay an annual fine based on the overall amount of outstanding federal loans among their students in default — they would be liable for 15% minus the average national unemployment rate for that year. It also features other reforms, including requiring more transparency about repayment rates.

“Look, these universities have to have some skin in the game,” Roy said before sharing the legislation with Semafor.

DeSantis has also referenced his work on the policy since launching his campaign, saying it would push schools to emphasize job skills. “If they were responsible for guaranteeing the debts of the students, then they would change their curriculum,” he said at an event in South Carolina this month. “They would not be able to offer post-Marxist gender studies, because that’s not leading to anything.”

The bill, Roy said, would provide a Republican counter to President Biden’s student debt program, which was intended to provide borrowers up to $20,000 in one-time relief before being struck down by the Supreme Court.

Roy is doing this with support from Senator Mike Lee of Utah. They have released a joint statement:

Representative Roy said, “Higher ‘education’ in America has largely become a crony government-supported credentialing racket more interested in political indoctrination than pursuing truth or preparing Americans for the workforce.

The more involved the federal bureaucracy has become with educaion, the worse and more expensive things have gotten.

Enough. It’s time for schools to have skin in the game for how much debt they encourage young Americans to rack up. It’s time to start getting the feds out of the college business, and put states and students back in charge. That is why I’m proud to work with my good friend Mike Lee in introducing this critical first step toward that goal.”

Senator Lee said, “Too often, our bright young minds needlessly face the unfair choice of either drowning in debt or sacrificing their dreams of higher education. The HERO Act aims to alleviate the ever-increasing financial burden required of students pursuing their educational goals by capping loans that exacerbate costs. It would transform our educational landscape and allow students to tailor their unique learning journey and gain the skills needed to excel in today’s dynamic economy.”

The HERO Act will free up states to establish their own accreditation systems and cap the amount of money the federal government can loan. These reforms would lower the cost of higher education and lead to greater innovation as colleges and universities return to focusing on serving students.

As we recently pointed out, the cost of college tuition has risen at an astounding rate in recent decades.

Schools should be an active player in the aftermath, not just at the beginning when they get all the benefits.

Donations tax deductible

to the full extent allowed by law.

Comments

In my opinion up until they start their 2nd year of college (and maybe even up to their 3rd year), students should have the option to walk away from the loan, and the school is on the hook for the full amount.

That way colleges will both be forced to actually screen students who are capable of graduating, and will be forced to actually convince students that they are providing them enough education value to justify the loan.

Right now colleges are incentivized to admit literally ANYBODY for the most ridiculous classes and majors imaginable.

Let us not forget that BarkyCare surreptitiously took over the student loan racket (when the federal government used to juts give loan guarantees, BarkyCare made the federal government the actual originator of the loans! … all just to steal some money from that racket and call BarkyCare “revenue-neutral” (LOL, lies all around, there)).

I like CHip Roy’s/DeSantis’ ideas but I would rather go further and have the federal government completely removed from the student loan racket, in full. Certainly, schools that have endowments greater than a billion dollars should not see any of their students get one red cent in loans from the federal government …

Students are a raw resource and that raw resource should be fully exploited. University recruiters are social geologists taking samples and identify lode sites.

Just like trees in a forest, or coal in a mine, but greener and sustainable.

#soylentgreenispeople

The Primordial One has rang the bell. The Federal Government should not be in the college loan business at all.

Maybe retain fed loans but focused on solid Students likely to succeed but limited to needed skills; healthcare, engineering, the various trades and so on. Even then limit it to replacement rate as the cap.

DeSantis: “They [universities] would not be able to offer post-Marxist gender studies, because that’s not leading to anything.”

Correction: Universities could still offer those useless, Woke curricula and degrees. They would just be discouraged from accepting student loan funds for them.

This shouldn’t adversely affect the schools in any way. Most of the students in those programs come from upper- or upper-middle-class families, who could almost certainly pay for their own education if they really want that degree.

Alternatively, they could work for a good STEM degree, for which the university can accept student loan funds, and which will equip the students for careers capable of repaying the loans.

Or, don’t bother with college and just go back to work as a barista since that’s where the Woke-friendly degree will leave them anyway, but this way they’re making money instead of spending it for nothing.

It’s a win-win-win. 🙂

The woke friendly degrees are a straight line to work for big business as human resources and a wide variety of commissar roles, and it is very lucrative.

I have several concerns about this legislation, but this highlights the main one: do colleges that accept federal student loans actually have discretion as to which students/programs are allowed to accept them? I don’t know, but I’m not actually seeing any evidence for this, and a lot of evidence to the contrary. For instance, following the link to the text of the legislation, and scrolling to the bottom, I see several paragraphs labeled “flexibility in counseling and advice”. If we have to change the law to give colleges the flexibility in *advising* students, then I’m willing to bet that we would have to change the law to allow colleges the flexibility in actually saying “hard pass” to underwriting particular combinations of academic profiles and programs. And that’s even before we get to swallowing the policy’s “disparate impact” (because literally all meaningful decisions have disparate impact).

Personally, I think that Congress should all but eliminate student loan programs. If you want a college education but can’t pay for it, Spend 4 or 5 years in the Military and get the GI Bill. You want to be a Lawyer? Okay, sign a contract that you will work for X number of years for this Agency, state or county and they will pay for lawschool. Same for Teachers, Social Workers, Paramedics, Nurses, Doctors, Engineers, etc. Fail to live up to your end of the deal, fine. You get hit with a $25K penalty and have to repay the State, plus interest at the going rate.

That would force colleges and universities to back off on some of the crazy useless degrees they offer, and end a lot of degree requirements that have creeped up over the years with the abundance of easy access to college loans.

Not only yes, but HELL YES. In addition, stop doing taxpayer-backed student loans and let the schools take on that risk. I’ll guarantee they’d be a lot more careful with admissions if they couldn’t just soak the taxpayer for the costs.

Except many universities have open admissions policies. Some of these universities provide perfectly decent educations and strong professional careers to those who complete the programs. E.g. I’ve worked professionally with graduates from Wright State University (Dayton, OH) and have been impressed. Of course, high dropout/flunk-out rates are baked in.

I spoke with a faculty member at WSU some years ago who said that part of the job is advising students early: “engineering’s not for you. In the unlikely event you graduate, you’re not getting an engineering job with a 2.0 GPA. Try a program at which you can succeed.”

With the exception of the G.I. Bill, the government should not be in the business of guaranteeing any personal loan, regardless of the purpose of the loan. Only free markets that can honestly weigh risk vs. reward.

Mr. Roy speaks common sense. Very novel in Congress.

That’s why we elected him, and why I want him to primary Cornyn.

The federal government should be out of the school loan business, period. The ramp up over the last 40 years was designed to raise the salaries of college administrators and professors. Now the public is on the hook for these damn loans. I put my kids through college so they wouldn’t have any loans. And now I and they are stuck subsidizing these marxist as?holes. FJB

I support the spirit of this legislation, although it’s not my preferred solution: make bad student loans dischargeable in bankruptcy, just like other bad debts. Actually, make *all* bad debts dischargeable in bankruptcy, i.e. stop carving out categories like tax and child-support debt.

But I have other concerns. Note that the 15% is a fine. It’s not actually applied to a student’s loan balance, and the provisions of this legislation that prohibit Biden’s various “debt forgiveness” programs likely prevent such application.

We also need to make sure we understand what incentives we are creating. For instance, I know we’re all against various woke-studies programs, but there is nothing wrong with getting a degree in, e.g. English, so long as you’re paying cash for it, not borrowing in expectation of future returns on that degree. As I wrote earlier, I’m not at all sure colleges themselves are empowered under the law to exercise that kind of discretion on behalf of their students.

A large local teaching medical center is a huge portion of the total university campus footprint and is well known for cutting edge medical research. That’s great and a point of pride for the state. But you should see the newest student housing and amenities. Compared to student housing common on colleges only a few decades ago, “luxury” doesn’t begin to describe it. That’s part of the problem. The kids are spoiled.

“I want it all now” is their attitude. Okay, great. They can pay for it.

.

I want all Federal and State governments to stop loans for college and Trade Schools. I want all the loans to go back to banks. This will cause the schools to drop costs due to lack of people applying.

When I went to college back in the mid 70s the costs were much lower as there was less extra fees and added college personnel that you now pay for. Today we must spend more on STEM then other degrees, but that is not happening.

Sell useless degrees, suffer the liability. Seems consistent with other liability law, and might make colleges and universities act in a more fiduciary manner—keeping an eye on the best interests of students.

I’ve thought some more about this. We all have this model in our heads that the only reason people aren’t paying their student loans is because they obtained “useless degrees”. Are we sure? How many graduates that have paying jobs in good careers and *could* be paying their student debt but would rather spend that money in other, more gratifying ways? This behavior is certainly immoral and possibly short-sighted for those who ever aspire to home-ownership, but it’s not like the education itself can be repossessed. Add to that the endless dangling of “forgiveness” and I can see many debtors going into default to see what happens.

Imposing a “fine” of 15% of delinquent balances on colleges likely makes it less expensive for colleges in any given year to just *make the payment* on behalf of their former students. But what perverse incentives for those students! Take a loan, pay it back if you want to, and if not, it gets paid for you. Heck, *I* wouldn’t make student loan payments under those incentives!

I predict that colleges are smart enough to see this problem and will simply decline to accept the covered loans, except in those charity cases where they are already prepared to eat those loans.

What loans are covered? Again, reading the legislation itself and not just the press release, I see multiple references to “Federal Direct simplification loans under section 460A”. These are surely not all student loans; in fact, my understanding is that *most* delinquent student loans aren’t federal direct student loans at all, but rather private education loans. If I’m wrong about any of this, then I’m wrong, but it surely looks like the effect of this legislation is to drive more students to more toxic sources of debt.

I’m going to double-down on my insistence that putting colleges on the hook should be part of bankruptcy proceedings.