94-year-old Grandmother Fights Home Equity Theft at the U.S. Supreme Court

Justices appear likely to side with elderly homeowner in tax foreclosure dispute

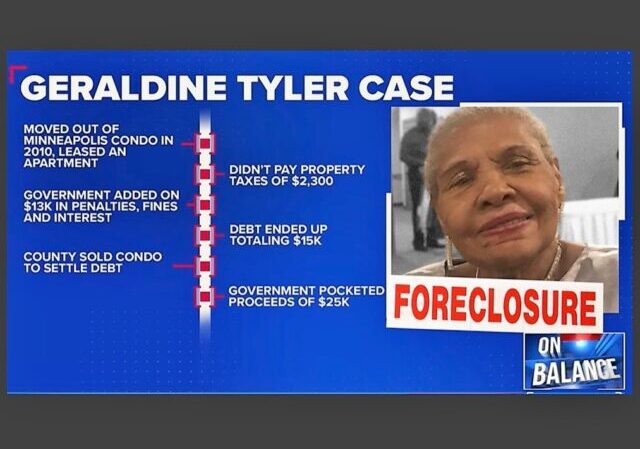

The State of Minnesota sold 94-year-old grandmother Geraldine Tyler’s Minneapolis condo for $40,000 to pay off a $15,000 tax debt, and then kept Tyler’s remaining equity of $25,000. On Wednesday, the United States Supreme Court heard oral argument on whether that was constitutional or not.

Facts of the Case

The Pacific Legal Foundation, who represented Tyler at the Supreme Court, has the back story:

As an elderly woman living alone, Geraldine Tyler was doing just fine in the one-bedroom condo she owned in Minneapolis. That is, until 2010, when a rise in neighborhood crime and frightening incidents near her home alarmed Geraldine and her family and prompted her hasty move to a safer area, where she rented an apartment in a senior community.

Finally Geraldine felt safe and comfortable again, surrounded by other seniors. But the property taxes on her condo started piling up. Soon Geraldine accrued a $2,300 tax debt; and the government started tacking on thousands of dollars in interest, fees, and other penalties until the total bill reached $15,000 in 2015. At that point, Hennepin County, Minnesota, seized Geraldine’s condo and sold it one year later for $40,000. Instead of keeping the $15,000 it was owed and refunding Geraldine the sale surplus, the county kept all of the $40,000.

The Legal Issue

It turns out, as both parties agreed in court, that Minnesota state law provides for just such a result. Pacific Legal reports: “State law allows Minnesota counties to keep such windfalls at the expense of property owners like Geraldine. From 2014 to 2020, 1,200 Minnesotans lost their homes and all of the equity they had invested for debts that averaged 8% of the home’s value.”

But, not so fast, said Geraldine Tyler. The Fifth Amendment to the United States Constitution, which trumps state law, says in the “Takings Clause” that “private property [shall not] be taken for public use, without just compensation.” And, Article I, Section 13 of the Minnesota State Constitution, which also trumps Minnesota state law, similarly provides that ‘[p]rivate property shall not be taken, destroyed or damaged for public use without just compensation therefor, first paid or secured.”

And not only that, the Eighth Amendment to the United States Constitution and Article I, Section 5 of the Minnesota Constitution both provide: “Excessive bail shall not be required, nor excessive fines imposed, nor cruel and unusual punishments inflicted.”

Geraldine Tyler thought Hennepin County keeping her $25,000 in equity was an unconstitutional “taking,” and an unconstitutional “excessive fine,” so she sued Hennepin County on both claims in federal court.

Federal District Court Proceedings

But Hennepin County fought back, moving to dismiss her case. Federal District Court Judge Patrick J. Schiltz agreed with the County and dismissed Geraldine’s case:

“[T]he United States Supreme Court has unambiguously declined to recognize a former property owner’s ‘fundamental interest in the surplus’ by virtue of her prior ownership of the forfeited property. To the contrary,…[a] former owner has a property interest in the surplus only if a provision of a constitution, statute, or municipal code creates such an interest…[but] Minnesota’s statutory scheme gives the property owner no right to the surplus.”

Judge Schiltz also ruled that Hennepin County had not imposed an unconstitutional excessive fine:

“Minnesota’s tax-forfeiture scheme bears none of the hallmarks of punishment. It is a debt-collection system whose primary purpose is plainly remedial: assisting the government in collecting past-due property taxes and compensating the government for the losses caused by the non-payment of property taxes. The Court therefore finds that the statute does not impose a ‘fine’ within the meaning of the Excessive Fines Clause of either the United States or Minnesota Constitution. Tyler’s excessive-fines claims are dismissed.”

Federal Court of Appeals Proceedings

Geraldine was not happy with that result, so she appealed Judge Schiltz’s decision to the United States Court of Appeals for the Eighth Circuit, which covers federal district courts in Minnesota and six other midwestern states. But the Eighth Circuit agreed with Judge Schiltz:

Where state law recognizes no property interest in surplus proceeds from a tax-foreclosure sale conducted after adequate notice to the owner, there is no unconstitutional taking… once title passes to the State under a process in which the owner first receives adequate notice and opportunity to take action to recover the surplus, the governmental unit does not offend the Takings Clause by retaining surplus equity from a sale.

The Eighth Circuit also agreed with Judge Schiltz that Minnesota keeping Geraldine’s $25,000 in equity was not an excessive fine:

In addition to her takings claim, Tyler argues that the county’s retention of her surplus equity is an unconstitutional excessive fine…The district court carefully analyzed Tyler’s arguments and dismissed [this] count…We agree with the district court’s well-reasoned order and affirm the dismissal of th[is] count[] on the basis of that opinion.

Geraldine Tyler Asks the United States Supreme Court to Hear Her Case

Once again, Geraldine was not happy, so she took her case to the United States Supreme Court; a true long shot given that “the Court [only] accepts 100-150 of the more than 7,000 cases that it is asked to review each year.” After extensive briefing including eight amicus (friend of the court) briefs supporting Geraldine’s request to be heard, the Court took her case.

Supreme Court “Merits” Briefing

Even more extensive briefing “on the merits,” or the substance of the case, ensued, with 25 amicus briefs filed supporting Geraldine Tyler, including one by all four of Minnesota’s Republican congressmen, including Tom Emmer, the House Majority Whip. Notably, none of Minnesota’s four Democrat Congressmen, including Ilhan Omar, supported Geraldine.

The United States filed a brief that it claimed supported neither party, but in it the Government supported Geraldine Tyler’s claim that Minnesota keeping her equity was a “taking” and therefore unconstitutional without just compensation. The Government also argued, however, that Minnesota’s action was not an “excessive fine.”

Eight states, Utah, Arkansas, Kansas, Kentucky, Louisiana, North Dakota, Texas, and West Virginia, filed a joint amicus brief supporting Geraldine, arguing that the majority of states return equity to the homeowner after a tax sale, and that the “confiscation of surplus equity results in serious injustice in the minority of states that allow the practice,” specifically citing Massachusetts and New Jersey’s tax statutes.

Ten amicus briefs in support of Hennepin County were filed, including a joint brief filed by National Tax Lien Association, the Arizona County Treasurers Association, and the Tax Collectors & Treasurers Association of New Jersey. Also filing amicus briefs in support of Hennepin County were the Wisconsin Counties Association, the County Treasurers Association of Ohio, Oakland County, and the Minnesota and Michigan Association of Counties.

Supreme Court Oral Argument

On Wednesday, April 26, 2023, the assembled Justices of the Supreme Court heard oral argument. You can listen to the oral argument as it transpired here. You can also follow along with the transcript here, so you can tell which Justice is asking a question or commenting.

Christina M. Martin, Pacific Legal senior attorney representing Geraldine Tyler, started off with a bang:

When the government takes property to satisfy a debt and takes more than what is owed, it has a constitutional duty to return or pay for the excess…By taking absolute title to Ms. Tyler’s property, including the value that exceeded the debt, the county has taken private property without just compensation…The county could have collected the debt without violating the Constitution by following the traditional common law rule still followed in most states and still followed in Minnesota in nearly every other debt collection circumstance. Under that rule, the county should have taken the property, sold it, paid the debts from the proceeds, and refunded the remainder to Ms. Tyler. Instead, the county took everything.

The county apparently does not dispute that Ms. Tyler had a property interest in her former home or in its value. Instead, it asserts that the government may redefine private property by statute. The consequence of that would be an unlimited power to define away private property and to confiscate it to pay debts, no matter how valuable the property or how small the debt.

Martin also argued that “If not remedied with just compensation, then the confiscation acts as a fine punishing Ms. Tyler for the public offense of failing to timely pay her property taxes.”

Remarkably, the Justices let Attorney Martin complete her entire argument without questioning. That alone is an indication that they are at least sympathetic to Geraldine Tyler’s plight. And we aren’t the only ones who noticed.

Amy Howe at the excellent SCOTUSblog, which follows every U.S. Supreme Court case, noticed too: Justices appear likely to side with homeowner in foreclosure dispute:

Geraldine Tyler, a 94-year-old grandmother, lost her Minneapolis condo when she failed to pay the property taxes for several years. Tyler does not dispute that Hennepin County could foreclose on the $40,000 property and sell it to obtain the $15,000 in taxes and costs that she owed it. But she argued that the county violated the Constitution when it kept the $25,000 left over after the property was sold. After roughly 100 minutes of debate on Wednesday, a majority of the justices seemed inclined to agree with her.

Howe also commented on the United States’ argument, which was argued by Assistant to the Solicitor General Erica Ross, representing the Department of Justice:

Ross was equally straightforward, referring back to the government’s brief. The taking occurs, she said, when the county seizes the title to property and there is no mechanism for the property owner to recover the excess value of the property. The court, she urged, should vacate the decision by the U.S. Court of Appeals for the 8th Circuit.

Howe also noted that “[p]erhaps because the justices seemed likely to rule for Tyler on her takings clause claim, they spent relatively little time on her excessive fines claim. But Justices Neil Gorsuch and Ketanji Brown Jackson signaled that they believed that the county’s actions also violated the excessive fines clause.”

Perhaps the best indicator that the Court is likely to rule in Geraldine Tyer’s favor was Justice Kagan’s key question to Neal Katyal, attorney for Hennepin County. She asked him if there was “a $5,000 tax debt and a $5 million house. Could the government sell the house and keep the surplus?” Katyal replied in the affirmative, to which Chief Justice Roberts replied: “If that’s all true, what’s the point of the takings clause?”

Another dagger in Hennepin County’s case was “[w]hen Katyal agreed with Kagan that the government could not seize an entire bank account containing $100,000 to pay a $10,000 income tax debt,” but could, as they did here, seize all the proceeds from a real property tax sale. From SCOTUSblog’s piece:

“‘If the mind rebels,’ [Kagan] said, ‘at the idea that the government can seize a $100,000 bank account to pay a $10,000 tax debt, why should the government be allowed to rely on 13th- or 18th-century history to do essentially the same thing with real estate?'”

Justice Brett Kavanaugh agreed. ‘Why,’ he asked Katyal, ‘would we read the Constitution to disfavor real property? That seems counterintuitive.’

Roberts suggested that any difference between real property and other forms of property would lead to the ‘exact opposite’ conclusion from Katyal’s theory. The Supreme Court’s cases, Roberts said, characterize property as ‘essential to the preservation of liberty.’ To say that money is more deserving of constitutional protection than property, Roberts observed, ‘has it exactly backwards.'”

Hopefully the Justices will rule in Geraldine Tyler’s favor and return the $25,000 in real estate equity to her. We will update you when the Court’s opinion issues.

Donations tax deductible

to the full extent allowed by law.

Comments

The bastards that did this should be invited as honored guests to a necktie party.

Some places, what they did is apparently legal. It doesn’t make it right.

The fact that it’s legal in Massachusetts and New Jersey tells you all you need to know.

New York also.

Hennepin County should win this case.

The homeowner is allowed many opportunities to resolve her taxes before she loses her property.

For example, she could have sold the property, subject to the outstanding taxes or she could have entered into a ten-year payment plan.

Hennepin did win the original case when they confiscated the old ladies house to sell it to pay off her tax debt.

Where they fucked up is in keeping the excess that they absolutely should not be entitled to.

Hopefully SCOTUS will do the right thing and rule in this ladies favour.

So you think the government is just allowed to confiscate the property, REGARDLESS OF ITS VALUE OR THE VALUE OF THE DEBT?

The key point of contention is not that she owes the government money, or that government can force a sale of the property to settle the debt.

The key point is that the government kept ALL proceeds of that sale, far beyond the actual amount of debt they were owed.

As Kavanaugh states, and AS THE DEFENSE ATTORNEY AGREES, if this were a bank account, they would not have been allowed to seize a $40,000 account over a $15,000 tax bill. They would have been allowed to only take the amount of the tax bill, not a penny more.

Wow!

You are one heartless SOB. Taking a $25,000 profit on the sale of a 94 yo woman’s home.

The future is the one you are looking for. An elderly person works their whole life to buy and pay off a house. Then they retire on a small fixed pension, and the evil Sheriff of Nottingham continues to raise taxes to the point that the fixed income can no longer keep up. Thus forcing the homeowner to move.

Then, the Sheriff creates an atmosphere of criminal activity through inaction, thus reducing the ability of the homeowner to sell the house at a reasonable price.

Take the house through unpaid taxes, get some crony to pay a bit more for the house, but less than market value, pocket the rest.

What a great deal for the Sheriff and the future landlord (likely Blackrock and their real estate rental arm Invitation Homes).

My take. Anyone who lives to be 75 yo should be exempt from paying property taxes for their personal primary dwelling.

Your take. Throw grandma out because she’s a deadbeat!

Some people just aren’t fit to be in society.

Yeah most of them work for the government.

While I agree in principle, such a thing in practice would be laughably easy to exploit.

Literally every single mansion would be legally in the name of a 75 year old relative to avoid paying taxes. A family of 10 would put the house in the name of the oldest person to avoid taxes. All sorts of shenanigans would ensue.

The mansion would still be seized and sold. The taxes paid. Heck, I could even see the county applying a reasonable process fee. 5%? 10%?

But the government still needs to provide “just compensation” after seizing the property.

Government should not be allowed to charge any kind of ‘process fee’. That is a function of government for which we pay taxes. As we have seen time and again, the people who run the gov have no problem using our tax dollars to prosecute and persecute individuals into bankruptcy, making the process the punishment. The government has more than enough funding to accomplish all of its appropriate functions. If it does not, it is for to the legislators to remedy. As is pointed out in the article, Minnesota governments have seized tons of money to which they were not entitled, just because they can. As with civil asset forfeiture and qualified immunity, governments have run amuck going far beyond what was originally intended.

While I agree that some would attempt to gain benefit, I envision that the elder owner would have had to work and pay for the mansion over decades of effort. Thus any primary dwelling that is transferred could not be transferred from a family member within say 5 to 10 years prior to tax age.

The original tax lien was $2,300. The County seized and then auctioned off the property for $40K. Even after deduction of fines and interest increasing the amount owed to $15K (nearly 7 times the original lien) the County wants to pocket the $25K difference. Bro that’s BS.

The County recovered the taxes, interest and fees in the $15K claim. It is beyond unfair to support the County then seeking to pocket an additional $25K. Their Counsel maintained to SCOTUS that they believe they would be justified in seizing a $5 Million property to settle a $5K tax lien and pocketing the value above $5K. That’s an insanely excessive view and hopefully SCOTUS is gonna clean their clock to put the brakes on this totalitarianism.

It gets worse Commo…the commies then agreed they couldn’t seize money from a bank account to satisfy their debt and then keep the difference afterwards.

A person’s age or family status should not affect the law. At the same time, when a property is worth more than the tax debt, a financial arrangement should be worked out!

I think you’ve hit the nail on the head

No, I disagree there. The persons age should mean some accommodation should be taken in to consideration.

In this instance a second charge could have been levied on her house due to her proximation to meeting her maker and when she did get to take her place in heaven THEN the commies could claim their pound of flesh. But no…they couldn’t wait and kaaaablam…here they are at SCOTUS about to fuck up their little State scam and I cannot wait for the avalanche of claims they are about to be tsunami’d by! 😂

“Justice Kagan’s key question to Neal Katyal, attorney for Hennepin County. She asked him if there was “a $5,000 tax debt and a $5 million house. Could the government sell the house and keep the surplus?” Katyal replied in the affirmative,”

Wow. Proof again that government has become our enemy.

Insane that anybody would even attempt to make that argument.

Just another form of asset forfeiture, isn’t it?

This is the result of the steady erosion of ethics, morals and the mal- application of law.. The power of government has grown at every level to the detriment of the public who fund them.

When I was younger, “ government work” was seen as lesser than private and was lesser compensated, it was seen as steady, safe work for those who didn’t want to take chances or work beyond nine to five. Some aspects of that still remain BUT, some clever, even very smart people saw the flaws and soft spots in government that could be exploited and the race was on!

At this point they have won, top government salaries and perks outdo what private enterprise can offer.

You can bet that there are several county employees who benefited from stealing Mrs Tyler’s money and you can also bet that she is not alone in being robbed.

I think that’s the point that the Founding Fathers were trying to make to their brethren in Britain

I’m gonna do a Justice Millhouse here 😂 The reason you pay public servants well is to put them above the threshold of corruption.

While traditionally public service has been treated less than private work you absolutely shouldn’t be paying them fuck all otherwise you end up where we are now…which throws my whole theory out the window because Democrats have corrupted their soles so utterly 🤬🤬😡

I’m in favor of doubling the penalty for any government employee found guilty of committing a crime in the course of their duties.

While everyone here is going back and forth about the governement keeping the excess $25k, I don’t see anyone saying anything about the “excess fine”. Come on! she owed 2,300 in 2010 and it grew to 15K by 2015?

I sure wish I could find any ROI that was over 800% in 5 years.

Penalties should never exceed the value of the debt.

Not in a free country.

When was the last time we had one of those?

I mean… the numbers match up.

Property taxes come every year. If she didn’t pay in 2010, then she presumably didn’t pay in 2011, 2012, 2013, or 2014.

If it was $2300 per year, that’s 5 years and $11,500 in property taxes, so only ~$3500 in fines. Again, over 5 years, that doesn’t strike me as shockingly out of line.

That’s some heavy annual property tax on a home bought at auction for $40K. Thank goodness Bama has reasonable property tax rates. I pay less than $500 annually on nice home, small barn, 7+ acres of timber, 2.5 acres of ponds and 2.5 ish acre home site. In El Paso, TX the property tax was $500+ monthly.

I live in Texas and it does have higher property taxes. But then we don’t pay state income tax like you do in Alabama.

The lesson here is The Man ™ will always find a way to satisfy its sugar addiction.

We do have State income tax but it is very low compared to other States with an income tax. Our State/Local sales tax is high though; my little town is slightly above 11% combined.

I am paying way less overall tax burden in Bama than in TX. Mailman is correct though, the govt man is gonna get their cut from somewhere.

The total tax due was apparently $2300.00, not $2300.00 in annual tax each year, accumulating. As CommoChief points out, an annual tax bill of $2300.00 on a property likely accurately valued at about $40,000.00 is one hell of a tax rate (17.39% of value annually). It wouldn’t take too many years, at seventeen and a third of value, to wipe out the value of any home in paid realty taxes.

The legislature thought they were doing “good” by limiting the percentage increase the county could add each year. So the counties (at least those with school districts which suck up money like a fire sucks up O2) simply make sure the valuations skyrocket (e.g. daughter’s 2o year old doublewide bought new @ $35,000, ten years ago appraised @ $18,000, Only change is a new roof, now appraised >$100k (the MH only).

Well, my reply wound up in the wrong thread.

The total tax due was apparently $2300.00, not $2300.00 in annual tax each year, accumulating. As CommoChief points out, an annual tax bill of $2300.00 on a property likely accurately valued at about $40,000.00 is one hell of a tax rate (17.39% of value annually). It wouldn’t take too many years, at seventeen and a third of value, to wipe out the value of any home in paid realty taxes.

Oh, the game is once they have an in, they can just pile on. So, off course the fees and similar explode. Take a look at what the EPA does — they rack up fines for non-compliance every day you are contesting their finding. Let’s not get started on abuses of asset forfeiture or RICO.

Since govt at all levels has multiple, embedded debts and deficits, they’re gonna be coming for all they can get, any way they can, for the foreseeable future. Myself, I’m too asset-poor to come after.

They love mortgages on places people live.

Real property is held by title, so it’s yours if they say it is. Also hard to move, and where many people stash a lot of their limited equity. Of course they’re gonna use real property to anchor extractions, any which way they can.

They got a taste for feeding in the mortgaged homes garden from a couple generations’ financing shenanigans. Like the Fanny / Freddie magical “fee” buried in their proclamation a couple weeks back. Just a little administrative adjustment. Turns out to be wealth transfer from them who gots a bit more — decent credit ratings, to them who aspire and have a lot less — crappy credit ratings. Just a little adjustment to the “fee”, paid ongoing. You pay to cover their risk.

People who live where they mortgage, and can’t just pay it off have to stick, and get extracted. This is application of a clause enacted post-2008, to ensure “stability.” (How’s that banking system stability working out these days? Where’s Barney Frank when you need him to set things right?)

They’re good at constructing these things. More clients for their patronage, more fees for their cohorts, more control on who can afford their own place to live, more foreclosures n forced exits to cash in on. It’s all dressed up in class-n-exploiters righteousness. What’s not to like?

I don’t find myself surprised at all considering the government is nothing but a bunch of thieves.

The most amazing thing to me about this whole story is how the homeowner’s dogged pursuit of justice didn’t far outspend the $25K in question. Unless she’s demanding reimbursement of attorney fees, and even that would have to cover all her cases including the ones she previously lost.

I don’t know in this particular case (I can’t seem to find info on it), but a lot of times cases like these are done for free by lawyer groups.

If they were trying to get rid of this law, it seems likely they sought her out and asked to take her case.

Pro bono work b/c the set of facts is really good and a very sympathetic plaintiff. Sometimes advancing the ball in CT requires a near perfect combo of facts and plaintiff and here Pacific Legal Foundation has both. This is a case with potentially big implications if SCOTUS chooses to weigh in more broadly on takings clause and excessive fines. Very far reaching to hinder all sorts of govt shenanigans well beyond a County govt pocketing the difference beyond the tax, fine and interest of a home sold at auction.

The problem here is Society. This likely happens most often with the elderly or someone with a mental disability who ends up alone owning a house. Where is a social worker assisting them to get help. Instead they seize the home, sell it on the courthouse steps at a discount to market value, and keep the excess. When you have an “incompetent” owner this comment also applies to the states that do not keep the excess, because the home is not being sold for fair market value. Those of us thankfully not in this situation should keep our eyes open for anyone in our community who might be and could benefit from some guidance.

Social workers are assigned to “help” someone with difficulty navigating the system, to navigate the system. For the system’s benefit, not theirs.

Ask me about “social work” help offered me after my stroke by the containing medical system. All about “helping” me fill out papers(*) so “I” can claim funding for this or that “service’ they’ll provide. Recovery support, advice, or reentry guidance not so much.

The PC practice did point me at two embedded “support” programs; regular meetings, “information.” They had no answer to “Great. What are they gonna tell me that I don’t already know; have me do that I’m not already doing?” No better to: “What outcomes are we going for, with this?”

The “social work” function did promote its results — in dollars secured for the containing medical system, year over year. At least they were clear who they work for, and what their job was.

They don’t work for you. You are a token, they can cash in for funding, and importance — a perma-token if you never get off needing their “services.” Better for you is worse for them.

So what’s to stop the politicians from working out a behind the scenes deal with friends to sell the house for just the cost of the tax and outrageous fines, then getting their bribe at some later point?

Sure lady, you owe $18,000 and we value your home at $500,000, but the first person to offer $18,000 wins your home.

Historically, that kind of fraud was fairly common. The homeowner would remain unnotified of a tax bill/legal action, a fraudulent ‘auction’ would be conducted, the second-cousin to the judge would write a check all nice and legal like, and the first thing the homeowner would know about the scam was the sheriff showing up to evict them. Frequently, the judge, sheriff, and fraudster were all family members, and if any legal action was tried, good luck.

Land fraud has a long, rich history.

Note how none of Minnesota’s Dumb-o-crat Congressional reps supported the petitioner, here. You’d think this case would be a no-brainer for the Dumbs, supporting an elderly homeowner “of color” against a clearly avaricious and inequitable government taking. Yet, the Dumb-o-crat apparatchiks predictably side with the lawless and obnoxious exercise of unfettered state power.

BTW, thank you to Mr. Nault for the excellent summary of the case and factual background.

Sorry, but the government seizing a house over unpaid taxes is not a “taking” in the Constitutional sense any more than locking someone up in jail for a crime is taking their power to earn or that towing a car illegally parked on a public street is a “taking” of the car for that period of time. The 5th amendment has no bearing on this case.

Finally Geraldine felt safe and comfortable again, surrounded by other seniors. But the property taxes on her condo started piling up. Soon Geraldine accrued a $2,300 tax debt;

Huh? So … she moved out and just stopped paying her property taxes?? What did she expect to happen? Did she expect that the state should act as realtor, sell her property for her and then return to her all monies in excess of the tax bill (that seemed to just “accrue” all by itself)? Hell, even an agent would take 6%.

This is not any sort of “home equity theft”.

This lady just moves out of her condo and stops paying taxes on it, but doesn’t want to sell it. It took 5 years for the state to seize the property. It was a condo; was she also not paying condo fees for those five years? I’m sure her condo association was thrilled with her.

The onus, in this case, is on the property holder, not the state. And the lady’s age has nothing to do with anything, except that she’s old enough to know better.

There’s a reason why mortgage companies force tax payments to be made through them … because everyone knows that, of all the bills not to pay on a property, the tax bill is the last one to ever consider skipping out on. This ain’t rocket surgery.

Not all condo’s are in a place requiring “condo fee’s” or having any type of association. I’m wondering, though about what you said. Why did she move out and then do nothing for 5yrs? If it was apparent that she wasn’t going back why not just sell the property? Doesn’t make what the State did right but it is curious. Her willingness to have it sold and only want the proceeds above the tax bill sounds like she was using the State as her real estate agent.

Tax foreclosure and seizure of all proceeds from the sale of private property and civil asset forfeiture are both evils that should be abolished.

As a former inmate of the Soviet Socialist State of Minnesota, there are a couple of small points of which some may not be aware.

1) Hennepin County is not some small, rural county, it is the vast gaping black hole of Minneapolis into which the majority of the state budget disappears. Between Hennepin (Mpls) and Ramsey (St. Paul) counties they effectively run the state. Since they are collectivist/statist/authoritarian-run (think somewhere to the left of J. Stalin) they have utterly and completely destroyed what was once a beautiful pair of cities.

2) Neal Katyal is the flaming POS that assisted in the railroading of Derek Chauvin for the fentanyl-induced death of St. George Floyd. He assisted the prosecution on a “pro bono” basis, meaning he got his jollies by convicting the guy without even being paid. Nobody ever questioned how he could spend that much time and effort without compensation.

3) No one is really questioning the ability of the State to confiscate a property based on the non-payment of taxes over the course of several years. What is being challenged is the outright theft of the money IN EXCESS of the tax liability. When Kagan (!?!) asked Katyal the hypothetical about a $5 million house and a $5,000 tax debt, and he answered in the affirmative, the reductio ad absurdum is what I hope put the nail in the coffin of this State behavior.

Finally I’d like to thank the staff at LI for covering this, since in my opinion it has not gotten the coverage I believe it deserves.

Diversity, perhaps, Equity, and Inclusion (DEI) with a growth IRS/Treasury industrial complex.

Nah, corrupt government employees have been doing this stuff forever. It’s even in the Bible.

I would love to see a decision paraphrased as follows: Grandma was wrong to not pay her taxes. The state was right to insist she did, somewhat right in imposing fees on her for not paying them (although they look excessive), and sadly right in eventually auctioning off the property to pay the bill. At which point the State became VERY wrong to keep the money above and beyond the bill, and VERY VERY wrong for pursuing this through the court system. The State is ordered to reimburse Grandma’s legal bills in full and any other expenses she incurred while fighting this decision. In addition, the State is ordered to pay back 100% of the withheld funds, plus the full amount of the debt as a reminder not to do this again. This decision is made to establish precedent from this point on, so stop it, you greedy twits or you’re going to get your assets handed to you in court over and over as you well deserve.

Hoping for a slightly different wording, something like:

A govt entity may pursue just claims at law but must never attempt to seize or retain even one cent more than that entity can prove it is owed and not before fully adjudicated.

That’s the sort of broad reaching language we want and need to stop the confiscation of property. Make that the opening para to yours and actually accomplish that.