Banking Crisis Continues as Wall Street and Bond Yields Drop Amid New Bank Fears

Swiss central bank staved off a potentially disastrous day on Wall Street by throwing a financial lifeline to Credit Suisse after it shares plummeted by 30%.

The banking crisis continued for another day as stocks fell and bond yields plunged.

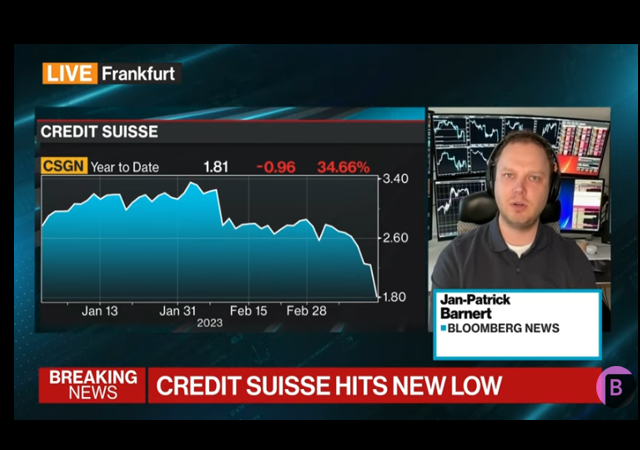

The S&P 500 sank as much as 2.1% before ending the day with a loss of 0.7%, while markets in Europe fell more sharply as shares of Switzerland’s Credit Suisse dropped to a record low. The Dow Jones Industrial Average lost 280 points, or 0.9%, after dropping as much as 725 points. The Nasdaq composite rose 0.1% after erasing a steep decline.

….Wall Street’s harsh spotlight has intensified across the banking industry recently on worries about what may crack next following the second- and third-largest bank failures in U.S. history over the last week. Stocks of U.S. banks tumbled again Wednesday after enjoying a brief, one-day respite on Tuesday.

The heaviest losses were focused on smaller and midsize banks, which are seen as more at risk of having customers try to pull their money out en masse. Larger banks also fell, but not by quite as much.

The 2-year Treasury bond yields posted the biggest 3-day decline since the aftermath of the 1987 stock crash.

The yield has fallen around 100 basis points, or a full percentage point, since Wednesday, marking the largest three-day decline since Oct. 22, 1987, when the yield fell 117 basis points. That move followed the Oct. 19, 1987 stock market crash — known as “Black Monday” in which the S&P 500 plunged 20% for its worst one-day drop. The move was bigger than the 2-year yield slide of 63 basis points that took place in three days following the 9/11 attacks.

The yield on the 10-year Treasury was down by more than 15 basis points at 3.543%.

Bond traders are now betting that the US Federal Reserve will implement rate cuts later this year, with expectations of a drop of around 100 basis points in the central bank’s policy rate from its anticipated peak in May.

According to Bloomberg and CME, swaps are pricing in a full point of Fed cuts between the expected May peak and year-end. The expected peak for the Federal Reserve policy rate is around 4.76%, with the March contract pricing in around a one-in-two chance of a single quarter-point hike for next week’s policy meeting. The expected year-end rate is around 3.67%, which is over a percentage point lower than the expected peak.

Priya Misra, Global Head of Rates Strategy at TD Securities, told Bloomberg, “The market is pricing in a Fed that might be forced to hike into a recession and thus will have to quickly turn around and cut. Anticipating a reversal in June is too soon, but the market is pricing in the risk of widespread tightening in financial conditions.”

The situation on Wall Street could have been much worse, except that Swiss regulators pledged a liquidity lifeline to Credit Suisse after the flagship Swiss lender’s shares plunged as much as 30%.

The indexes regained some ground in afternoon trading following an announcement from a Swiss regulator that the country’s central bank would give Credit Suisse liquidity if necessary. Investors were concerned after the Saudi National Bank, Credit Suisse’s largest investor, said it could not provide any more funding.

The news came after the Swiss lender said earlier this week it had found “certain material weaknesses in our internal control over financial reporting” for the years 2021 and 2022. U.S.-listed shares of Credit Suisse

closed nearly 14% lower.

This leads me to my question: How much longer can “big government” hold off the fiscal reckoning for pandemic police and focus on woke causes….like Black Lives Matter:

Silicon Valley Bank, which collapsed on Friday after a classic bank run, donated more than $73 million to groups related to the Black Lives Matter movement, online records show.

A database from the conservative Claremont Institute shows the bank donated around $73,450,000 to the BLM movement and other social justice-related causes.

As first reported by the Federalist, the now-defunct bank pledged in the summer of 2020 — when the nation was gripped by racial unrest after the police custody death of George Floyd — to increase its commitment to “diversity, equipment, and inclusion (DEI)” in the workplace.

A report from August 2020 highlighted the fact that around two-thirds of the bank’s workforce met the “diversity” criteria.

To quote author Brent Weeks: “They made a deal and they liked the deal, until they had to pay the price.”

I suspect the price tag is going to be a hefty one for the deals that have been made, that the crisis will not be resolved anytime soon, and that all of us will eventually be impacted.

Donations tax deductible

to the full extent allowed by law.

Comments

Can we call it the Biden Recession/Depression yet?

What part of the WH phrase “transitory” don’t you understand? Were you sick the day Janet Yellen taught the Economics of a Recession class?

After today, I bet KJP and Yellen both would like to call in sick.

“Were you sick the day Janet Yellen taught the Economics of a Recession class?”

No, just unable to hear in canine frequency ranges.

All of ruling class Washington, especially the WH, Treasury and the DNC and MSM are all hands on deck for this cover up and narrative management. Even the wretched PBS docu-propaganda program “Frontline” was quick out the gate two nights ago with an official narrative about how this all started and who did what. SVB hadn’t been reopend 24 hours and yet PBS is running a smoke screen. There will be plenty of official versions of this as the contagion spreads.

To quote author Brent Weeks: “They made a deal and they liked the deal, until they had to pay the price.”

They made a deal with the Devil and they liked the deal, until the U.S. taxpayer had to pay the price. And make no mistake, it is the U.S. taxpayer paying the price for the whole rotten banking system as it collapses in shambles. And the best part? No SVB bank official will be held accountable. No Signature bank executive will be held accountable. Huzzah! Once again the common people get screwed by the federal government.

The real comic tragic element to the recent collapse is that not a whole lot changed between year end and last week in terms of the underlying problem. The exact same pressures and circumstances existed then. The difference is the realization of those pressures, the panicked reaction to them and failing about for someone else to blame.

The Fed Reserve kept rates artificially low for nearly 15 years to the benefit of the equities market and to the detriment of mom/pop savers and investors who didn’t trust overly inflated equities. This environment helped the financial services industry rake in profits b/c there wasn’t a good alternative to the equities market within fixed income investment to stay ahead of inflation.

The stock market is not the economy. The financial services players though present the facade that it is and they pour money into lobbying and provide lucrative board seats and no show/no work sinecures to the politicians, regulators and their families to ensure this myth becomes the political and policy reality.

Today the ECB picked 50 bp into the teeth of a liquidity crises based in large part on the declining value of bank portfolios holding long duration low yield instruments. That’s not gonna help short term though long-term if they have have the fortitude to continue it will.

In the US we are likely staring at a moderate to bad recession as companies shed jobs. The employees laid off or fired are going to have trouble paying mortgages; the specter of the Community Reinvestment Act loosening loan standards looms large. Get ready for something of another crisis on that front as well.

What we see is the popping of the ‘everything bubble’ created by too much loose, cheap money from Fed Reserve policy. Today we face even bigger challenges. In ’08 the National debt was less than $9 Trillion, today it is $32 Trillion. The Fed Reserve likewise holds far more debt today, also consisting of the same portfolio of govt and MBS instruments the commercial banks hold.

The bottom line is this was all self evident and eminently foreseeable. Other than the panic over the first couple of dominos toppling there really isn’t any material change in the circumstances from last week. The lemmings in their panic are engaging in the expected behavior of a prisoners dilemma scenario; transferring deposits from smaller banks to the biggest banks which are viewed as ‘too big to fail’.

It’s a prudent decision individually but collectively creates far more systemic weaknesses which sets up another round of panic later. The Fed is likely done with rate hikes, at most another 75 BP by year end which means inflation will not be tamed. That leaves aside questions of reducing the Fed balance sheet created by QE.

IMO, this will pass and be papered over with promises, programs and questionable policies. The politicians, the large financial players have too much to loose by not doing so. This will only delay the bigger bill that will eventually come due. Kicking the can down the road works …until we run out of road.

Good breakdown.

The impossible counter-force is the sidelined economy; if they’d only let up on what they’ve ground down and forced out, the pent up dynamism would take care of all this and more.

It won’t happen because more than they can’t let the little people be part of the solution, doing this would let them back into living their own lives.

These clowns would rather starve than let the livestock loose, even to save themselves.

The same tactic that agave us the 08 crisis. If we really had Capitalism in the US these “too big to fail” bank would be allowed to fail.

Our local “small bank” (still FDIC) sent an email to all its account holders three days ago which (when read between the lines) said, “Please don’t take all your money out of our bank.” Trust the plan, blah blah blah.

They haven’t paid me a penny of interest in ten years, and their risk rating just climbed above the mattress ceiling, so sorry, but elections have consequences, and this one is yours.

An interesting take on the SVB failure—the wokesters didn’t do this, the Keynesians did:

Welcome to Joe Biden’s america. Did anyone really think that putting that dementia riddled retarded pedophile in the White House was going to yield good results?

The Federal government should not be saving businesses that failed because of the bad decisions of their managers

If Democrats couldn’t shovel your tax money out to their friends and families, why would they run for office at all?

To summarize:

https://libertarianchristians.com/wp-content/uploads/2009/04/pearls-banker-bonuses1.gif

Attributed by Penn Jillette to a private communicatoin from Teller around the last crisis, or the one before that, or the one… I lost count.

“Do you remember the good old days, when failed speculators jumped out of their office windows?”

How, or why, does a bank’s drop in stock price drive it to insolvency?

The hot takes sure read like “Stock price crashes, makes the bank fail.” Unless the bank is holding piles of its own stock, that has nothing to do with that bank’s liquidity. They’re supposed to be holding piles of other stuff as assets against their deposits. If the banks are all holding each others’ stocks, that’s a different problem.

Can we stop calling these things “banks?” And especially talking about them like old-school savings and loans, deposit banks for small account holders, and the like?

At closest to “banks” these are commercial banks, extending financing to their client entities — loans that would be called “junk bonds” if they were bonds.

Or they’re investment funds, private equity and VCs by another name. Or they’re Ponzi schemes across financial instruments, industry segments, or both. Or they’re just plain frauds with monthly statements.

I don’t even feel bad for the “displaced workers” should SVB clients fail. If you’re gonn run your career chasing the next bubble, that’s speculation, not work.

Here’s my question: Why are regional banks somehow more at risk from low capital, narrow holdings, and accounting that amounts to speculative investment into their speculative clients? People just keeping accounts for going concernt and working folk should be immune to these shenanigans, no?