Widespread Cancel Culture Gives Everyone a Reason to Take Bitcoin Seriously

As cancel culture grows, it is crucial to have a form of money and an ability to transact that cannot be readily confiscated or manipulated.

As the readers of this site are already aware, cancel culture in America and elsewhere is growing. No longer limited to prominent figures or college campuses, it seems to be spreading to all aspects of modern life.

An outgrowth of mobile technology advancements and the network effects of social media, cancel culture thrives on the continuing breakdown of once widely expected threshold levels of privacy. The former assumption of privacy has given way to a more quantified and collated existence, which can be weaponized to target and economically punish politically or culturally disfavored individuals.

The speed with which the mob can descend upon targets is frightening. And the tactics used are often effective. To be sure, powerful and well-financed targets can and have weathered the storm. But that is a difficult task and one that is rarely available to ordinary people.

Perhaps more importantly, targeted individuals’ isolated successes only address the symptoms of this growing cultural affliction, but they do not attack the underlying escalation problem in cancel culture.

At first, the vendettas were relatively modest in their goals and aimed mainly at celebrities or public figures (literally, these were simple efforts to “cancel” their shows). Then it moved on to speakers on college campuses – canceling their presentations. It began targeting university officials and teachers who did not toe the increasingly complex and continuously fluctuating social expectations popular on campus. In this wave – the attempted purging of “problematic” academics – that we can say solidified the reality that “regular people” were officially at risk.

This most recent iteration has not remained isolated to campus. It is now regularly experienced by non-public individuals who get caught up in the viral social media campaign. Far from showing any sign of slowing down, cancel culture is propagating outward into all life walks. And worse, proponents of it are indicating their goals include total economic warfare against targets.

This is evidenced by calls on banks and payments providers to deplatform and/or cease to do business with disfavored individuals. Even Donald Trump, the former President of the United States, was targeted for economic exclusion by major banks. While Trump has the means to weather this kind of storm ably, many do not. Can they survive in the face of job loss, the freezing or limiting access of bank accounts, coupled with a collective de-platforming by payment processors like PayPal or Venmo?

If you think this sort of coordination sounds unlikely or overblown, look at Parler. In under a week, Parler went from the most popular app to being entirely delisted from all major app stores and having their server access revoked by Amazon. In a genuine sense, they were “disappeared.” No crime had been committed. And on top of that, many app supporters were systematically censored by most major tech platforms.

What happens when that same coordinated effort comes for you and your bank accounts, your stocks, and your very economic existence?

Believe it or not, Bitcoin offers a viable solution to this problem. If you are familiar with Bitcoin, you are doubtless familiar with its volatility. In this respect, I caution against looking at it as a “get rich quick scheme” and more as a means to upload your economic output somewhere de-linked from the increasingly erratic decision-makers in our society.

Suppose you’ve written off Bitcoin as a speculative bubble. In that case, I’d suggest taking a second look and considering whether a small interest in a parallel financial system might be worth pursuing, even if it comes with a degree of financial risk. At a minimum, taking the time to understand the network is prudent. When appropriately used, Bitcoin can be viewed as an essential arrow in the quiver to fight against the state’s expanding control and, increasingly, the social mob over our lives.

To be clear, Bitcoin is not “conservative” money or “liberal” money. It is, at the bottom, apolitical money. And that’s the point. Neither vindictive politics nor the ebb and flow of prevailing cultural norms should make one subject to the arbitrary confiscation or diminution of the fruits of their labor.

As cancel culture grows, it is crucial to have a form of money and an ability to transact that cannot be readily confiscated or manipulated. And despite the claims of countless “cryptos,” Bitcoin appears to be the only one with a network and infrastructure sufficiently robust to achieve that end, even in the face of coordinated resistance.

Donations tax deductible

to the full extent allowed by law.

Comments

Cryptocurrency—-only a step away from one global currency.

No thanks.

How long has it been since BitCoin was manipulated, with a rapid runup in price followed by a crash?

A bunch of people were skinned in that.

Umm, no.

Bitcoin has the same base as the US Dollar.

This article is a joke. If you think bitcoin is any safer from computer piracy than your bank account, you’re a fool. There is nothing even remotely safe or secure about digital currency.

Not necessarily true. Having a small amount of bitcoin just might save your butt.

A single bitcoin was recently worth the equivalent of one kilo of gold. I would be tempted to trade for the gold.

Bitcoin is a very different animal from the broad category of “digital assets,” so conflating the two suggests you’re not necessarily well versed on the topic. That’s fine and all, I’m just pointing it out for others who view the comment. And “computer piracy” is vague term so I’m not exactly certain how to address it but the fact is the bitcoin blockchain has been up and running for 12 years and never been hacked, despite being completely open to anyone on the planet. That’s quite an achievement. Banks, Equifax, Credit Cards, etc. by contrast, are hacked all the time. Something to consider.

If a novice wanted to convert some money into Bitcoin, what is the best way to do it? One reason I have not is that the complex options to navigate when you begin.

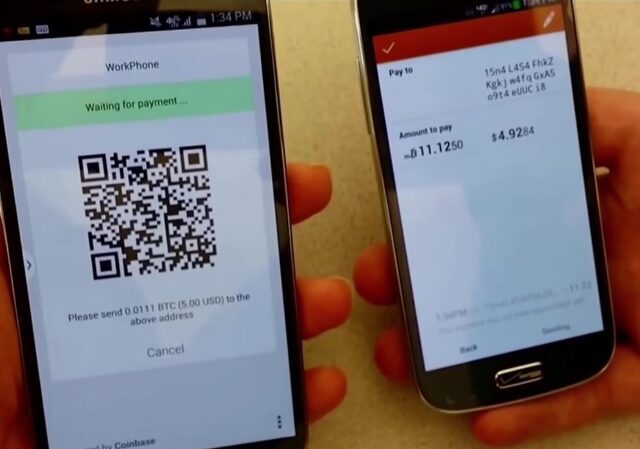

If you know very little or nothing about bitcoin and other cryptocurrencies, the easiest way to get some BTC is probably through a reputable exchange in your country (in the US, coinbase.com is a good example)–note that cryptocurrency stored on an exchange is not technically controlled by you (you are potentially vulnerable to hackers who attack the exchange).

A safer way would be to get a software or hardware (or paper) wallet to store your crypto–these don’t actually store your coin, they just store the keys necessary to find your coins on the decentralized ledger for the currency. There are a couple of fairly well-thought-of android or PC-based wallets–you _really_ want something that keeps the crucial keys private to you–for that reason, I use a hardware wallet from ledgerwallet.com. To get crypto on your wallet, you can either buy from coinbase or another exchange and transfer the coins to your wallet’s addresses, _or_ you can use a bitcoin ATM (seemingly now available in most cities of any reasonable size, more than 9,000 bitcoin ATMs in the US) to transfer funds directly to your wallet.

Except for the cryptocurrencies explicitly designed for stability (and there are several of those), cryptocurrencies are extremely volatile–so please don’t jump in with more than you can afford to lose.

As to security, as long as you can trust your wallet provider, and you control your own crypto keys, all of the cryptocurrencies appear to be extremely safe from theft–the thefts you may have read about were all attacks against exchanges or online services where _they_ control the crypto keys for their customers. I presently have a significant stake in cryptocurrency, but mostly because my investment is up almost 400% since I more heavily invested about 7 months ago–PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS!!!!

Depends on what you’re looking for. There are many ways to buy bitcoin or proxies of bitcoin. I don’t want to give you any financial advice but there are a number of services worth looking into to determine what best suits you, if any:

Grayscale Bitcoin Trust (A Bitcoin proxy that can be bought in a similar manner as a stock)

Buying through an exchange (i.e., CashApp, Coinbase, Swan Bitcoin, etc). There are quite a few of these.

Bitcoin ATMs (probably my least favorite method. Just feels odd).

Direct Peer to Peer exchange (just like the good old days)

There are other ways, too. But the point is to look into it yourself and try to avoid the temptation to just “trust” someone. You may find that level of effort just isn’t worth it, and that’s fine. Everyone has their own risk profile and their own goals. Have to do what’s best for you.

As a friend of mine says, “Personal responsibility is the new counterculture!”

Still can’t find any info about how to put bitcoin in my pocket. Do you have to be a computer scientist to figure this out? Great explanation of how it works on CrossPolitic last Sunday (https://www.youtube.com/watch?v=1grNZvd2hO8), they just don’t tell you how to buy it. It’s really no different than a bank credit card. You can buy anything around the world.

If it were possible to put up a picture, my sister sent me a photo of a Sunoco station in her area with a sign reading “Bitcoin sold here”.

Which isn’t confidence inspiring but as was mentioned, you might want to put some money into it.

The way the gov money printers are running crypto might have some value. Just don’t bet the entire farm on it. Or in other words, don’t invest more than you can comfortably lose.

https://twitter.com/michaeljburry/status/1363627735583629312?ref_src=twsrc%5Etfw

The twitter is the guy who warned about the real estate crash.

Forgot to add to joedoodl, Coinbase is what you should look at. One of the more well known sites to buy. Plus if you sign up they start you with $5 in bit coin.

They will come for Bitcoin too.

And you will be presumed to be a money laundering terrorist for instance if they catch you using it …

At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency? . . . . . . . . . . . . . . . . . . . . ▶ YesNo

From this year’s income tax return form …

I replied to another similar comment but worth repeating here: That seems unlikely given the positive or at least agnostic treatment of Bitcoin in recent regulations and comments by the IRS, SEC, FinCEN, DOJ, and Treasury Dept, and Office of Comptroller of the Currency.

if you’re truly concerned about ” security ” you need to get away from ” currency ” altogether

I’ve been thinking that there’s some value in that idea, if only as an SHTF option. The price of Bitcoin is so volatile, though, it’s hard to trust it as a store of value. But I think a modest crypto portfolio might have it’s place.

It has about the most unstable value of anything you can buy.

We are rebuilding an online store and are going to implement the ability to pay with bitcoin. There are many extensions/mods that offer the option to do so. Of course we will have to study up on it so any recommends on how to get started is appreciated.

People need to remember.

A person with nothing left to lose is a very dangerous person to confront.

At some point in time cancel culture is going to cancel the wrong person, and the cancelers are going to be permanently canceled.

Right on!

People also need to know that bitcoin is a pyramind scheme. But, if you’re in at the ‘bottom’, you’re doing well.

But like all ponzi schemes, they can bust at any second.

Better to invest in guns and bullets and survival supplies.

Yup. And the person who takes the brunt of the backlash could be a local Karen or SJW who gets someone fired from his work, or it could be an important figure in Silicon Valley who ruins someone’s business into which the owner had poured his life.

Just sayin’.

Read the story of Carl Drega if you haven’t.

I looked up Mr Drega’s Wikipedia page. Admittedly the article proved insufficient and most negative towards Mr Drega. I’m certain more to the story.

Outrageous the way this citizen was treated. Mr Drega seemed to be hounded and threatened by government agencies for making property repairs and home improvements on his cabin! Unbelievable!

Cautionary tale not to mess with a man who has nothing to lose.

For now, I’ll stay with the 3 precious metals: gold, silver and lead.

Crypto and bitcoin are worthless if you can’t buy anything with it. That’s where the attacks will be. They don’t have to steal your crypto. They just have to make it so you can’t use it.

Very dangerous IMHO. The ultimate canceling will come when the approved bear a mark or a chip or something and the unapproved are reduced to secret barter transactions for food and shelter.

I’ll add to that.

Bitcoin is the ultimate fiat currency. It has zero value without governments, and governments won’t abdicate their power to it. In the last runup, the government went after coinbase to force them to disclose their holders and force them to pay taxes on their earnings. This stuff is far from immune from government reach.

Why do you think coinbase made these pages?

https://help.coinbase.com/en/coinbase/taxes-reports-and-financial-services/taxes/coinbase-tax-resource-center

https://www.coinbase.com/learn/tips-and-tutorials/crypto-and-bitcoin-taxes-US

The US government I know is big enough to find your bitcoin and take it too.

Seems unlikely given the positive or at least agnostic treatment of Bitcoin in recent regulations and comments by the IRS, SEC, FinCEN, DOJ, and Treasury Dept, and Office of Comptroller of the Currency.

The blockchain and bitcoin are genius creations, no doubt, but bitcoin is not money. There will be some sort of cryptocurrency in the future that will be money (or just some accepted digital currency that doesn’t depend on crypto, since the crypto part costs far too much) but bitcoin is not it, in my estimation. It is not nearly as anonymous or trustworthy as you think. The bitcoin ledger is totally transparent – which is one of the foundations of it. Further, blockchains are still not quite the independent, free things you imagine. The miners determine what the blockchains are and they can determine all sorts of screwy stuff.

Look at Ethereum and how they just forked off when THEY made a huge error with the publishing of the DAO and some clever guy started sucking ether out of it (legitimately!). THey just undid all the transactions before their mistake. THEIR MISTAKE! That incident told you all you needed to know about the real state of cryptocurrency and how “independent” it is.

GOLD is money. It satisfies pretty much every single requirement to be “perfect money” – it cannot be created or destroyed, it is hard to counterfeit and easy to verify, it can be easily split or combined, it can be totally anonymized by melting, and on and on, falling short only in transportability to some extent.

The fact is, though, that the government(s) have the last word in what must be considered money in any society by making taxes and all government fees be paid in that currency. That is a lot of power to force a currency on a people, no matter how crappy it is or how much it is manipulated and abused.

In the end, if you can’t trust the government’s money then you really can’t trust the government, which is a problem far beyond money. We are going to see this specific interaction in the not-too-distant future when the dollar implodes. People have no idea how dangerous our policies have been over the past few decades – most especially since we went full apeshit after the 2008 credit crisis.

One good thing is that with bitcoin, you can take it with you.

I’ve never seen so many downvotes and contrarian opinions. A new author, a “non-traditional” article, and the trolls come out of the woodwork like cockroaches when the lights go out. I don’t trust a platform that purports to be perfect when there are humans in the mix. Call me a Luddite.

Just because you call people trolls, doesn’t make them so.

I’ve been here since the Professor started the site,

Where does my comment say herm2416 is a troll? And considering I agree with your comment you may have me confused with someone else. In the meantime, let me say this about that …

Oh not to worry, I knew I was walking into at best skeptical territory here on this particular subject. Just was hoping to reach out to a new audience given its intersection with a hot political topic. And I actually began writing here in 2012 when I was in law school. Though, sadly, my law practice doesn’t let me contribute that often any more. Thanks for the comment, though. Good to be back!

Welcome. I don’t necessarily agree with your opinion, though I wish it were realistic.

Bitcoin seems like another investment vehicle to me with high volatility. The tech in bitcoin is actually older and weaker than most blockchains, so it is trading on name recognition and the lead in adoptions of use right now. I think it has the makings of a bubble if another crypto with superior tech can displace it from its pedestal. Crypto tech is here to stay, but I don’t think it is the haven from oppressive governments that it is sometimes touted to be. The FBI has already been able to track bitcoin and use it to catch criminals that thought they were beneath the radar. Just remember that the “criminal” mentioned in this article could be you someday if wrongthink becomes a crime.

https://www.sciencemag.org/news/2016/03/why-criminals-cant-hide-behind-bitcoin

There is money to be made in volatility, but there is also money to be lost. Tread carefully on bitcoin with only what you can afford to lose. Also, the IRS wants you to pay taxes on bitcoin, and they usually get what they want. Be careful in what you do, my fellow Americans and compatriots.

You debase a civil disagreement with insults (disagreeing respectfully with legitimate talking points rather than ‘gotcha’isms is not trolling). It seems to me that you are having trouble handling a discussion that doesn’t comport to your view. Are you sure you aren’t a liberal?

Bitcoin is an illusory attempt at freedom from the state. If the state is bigger than the free rebellion, then the state will win in the end, regardless of what form the money takes. You have organic and biological realities (needs for food, shelter, amenities and vulnerability to injury) that crypto cannot hide you from.

Just like with any investment, 1) don’t invest any more than you are comfortable losing, and 2) don’t put all your eggs in one basket.

And as far as financial matters go, 2) applies just as much if not more to sources of income. The corona nonsense of 2020 ought to have been a stark lesson in that, with so many of us having but one source of income (a job) only to find ourselves up shit creek when the job was destroyed because of the lockdowns.

Never depend solely on an employer for your livelihood.

Good advice.

Another I will add that I always have to remind the wife of:

“Live beneath your means”

This means saving, being smart, investing when situations present and you can stay below your means.

Yes, we have a crap ton of stupid people in this country and they seem to be rewarded for their stupidity with handouts a lot of the time. This can tempt you to join them and just not care. Fret not, though. Your life is still better than theirs because you are smarter and have self-discipline. As a group, they won’t last very long when things get rough.

You too can own shares in the blue sky.

If you are old or paid attention in b-school, you know what I’m talking about.

After years of lurking, I created an account just to comment on this article. I have extensive involvement with cryptocurrencies.

In summary, I would describe Bitcoin as complete garbage (the first implementation of a wonderful idea – an implementation that has become mostly obsolete due to subsequent technological advancement). I have compared Bitcoin to a Model T for the past few years, and having recently seen someone else independently use that analogy on the internet, have become even more convinced of its accuracy. Obviously, most would not use a Model T as an every day automobile. I will offer a further two metaphors for Bitcoin, however. First (those of age will remember this), I liken Bitcoin to AOL. This appears particularly apt to me, because in the early 1990s, people said “AOL” when they meant “the internet.” Today, people say “Bitcoin” when they really mean “digital assets” (or “cryptocurrencies”). More than 1000 cryptocurrencies exist now, although I expect most of them to go the way of Pets.com. AOL eventually became irrelevant (among other reasons) by failing to adapt to the advent of broadband. And for those who still believe that the first-mover status of Bitcoin guarantees perpetual dominance, I cite the example of AltaVista, the first (and for a time most popular) “search engine.” They eventually became part of Yahoo! (and disappeared into oblivion) as Google took over the vast majority of search traffic.

The choices made in the design of Bitcoin (and the relative inability to improve it) have allowed competitors to emerge that outperform Bitcoin in terms of speed, cost, privacy, security, and efficiency (while I don’t feel particularly concerned about “climate change,” Bitcoin represents an environmental disaster and complete waste of resources, which always bothers me, by any measure – the Bitcoin network now consumes more electricity than the entire country of Argentina). Bitcoin consists of nothing more than a list of account numbers (“addresses”) and balances (number of bitcoins) in those addresses. A person with the cryptographic key to a specific address can sign a transaction to transfer value to another address. New transactions get added to the end of the linked list. To prevent double spending, Bitcoin requires a consensus algorithm (so that nodes agree on the validity of transactions), and Bitcoin uses the notoriously inefficient Proof of Work. “Miners” compete for a reward (currently 6.25 BTC) by repeatedly using a hash function as a pseudo-random-number generator until the function produces a value (approximately) that begins with 23 zeroes. While some refer to this as “solving mathematical problems,” I describe it as “punching virtual lottery tickets.” Obviously, finding such a value has an extremely low probability (similar to winning the lottery three times in a row playing a single ticket each time), but the total number of hashes (per second) across the network comes to about 160,000,000,000,000,000,000 (160 quintillion), which produces such a value (and thus, a new block) every 10 minutes, on average. Some math (6.25 bitcoins per block times 6 blocks per hour times 24 hours times a current Bitcoin price of ~50,000) gives us a daily “network subsidy” of 45,000,000 USD, meaning the miners get paid $45 million per day to run a (fairly useless) network that can handle… seven transactions per second. That obviously makes no economic sense whatsoever.

I will run through some of the areas where Bitcoin has fallen behind. It costs roughly 10 USD now to make a transaction on the Bitcoin network, and it takes about an hour to confirm it (using the standard of waiting for six subsequent blocks). By contrast, one can transfer any amount on the Ripple network in less than a second, and it costs less than one-thousandth of a cent (the SEC has filed a lawsuit against Ripple complaining about the way that Ripple funded itself, so don’t rush to blindly buy a bunch of Ripple). An offshoot (“fork”) of Bitcoin called Bitcoin SV has handled up to 9000 transactions per second on its test network. Some new blockchains have zero transaction fees (people who do transactions validate other transactions). As others have pointed out here, every transaction ever made on the Bitcoin network remains viewable by anyone (with governments closely monitoring transactions, and linking them with the people behind them). Other coins (Monero, Zcash) have enhanced privacy features that can prevent connecting balances with addresses. I have already mentioned Proof of Work. Virtually no new cryptocurrency uses that now. Proof of Stake has become the new standard, and even some established cryptocurrencies (Ethereum, for example) have begun a transition from Proof of Work to Proof of Stake. With Proof of Stake, holders of the cryptocurrency validate transactions (they have no incentive to accept invalid transactions, which would harm the value of their holdings), and the payments for doing so effectively equate to holders “earning interest.”

So why doesn’t Bitcoin evolve? I would give as the answer “poor governance” (or rather no governance). To achieve “decentralization,” Bitcoin has ceded control of itself to the miners (most of which operate in China or eastern Asia), and the miners don’t want any changes that reduce their income or importance. Any group of miners with more than half of the hashing power can eventually determine which transactions to accept, and which to reject, meaning any changes require the support of at least half of the miners, and whatever the desires of the other stakeholders (developers, merchants, users), the miners can simply refuse any software upgrades which adversely affect them. The location of the miners also puts them under control of the Chinese government. I could imagine (for example) the Chinese government going to the miners, and telling them that they have to run software that allows the government to make transactions without having to provide signatures. Sure, this would cause a fork, but the original Bitcoin might end up with a minority of hashing power, and have to adopt a new name.

Bitcoin has completely abandoned its founding ethos (the first sentence in the abstract of the white paper contains the quote “version of electronic cash would allow online payments to be sent directly from one party to another”) by attempting to solve the scalability problem by creating the Lightning Network. Bitcoin, which came into existence to transfer value without using intermediaries, wants to increase transaction throughput by… forcing people to use intermediaries (each of which would rake off a transaction fee). People would still need to “finalize” their Lightning Network transactions on the main Bitcoin blockchain anyway. I will point out here that Lightning Labs (the company behind Lightning Network) has paid some of the Bitcoin developers. While I explicitly do not want to make any accusations (or even insinuations) here, two things become immediately obvious. First, any concerns regarding Bitcoin that affect the Lightning Network will receive full consideration. Second, such an arrangement can present the appearance of a conflict of interest (due to the origination of salaries).

Given the open source nature of Bitcoin, anyone can download the source code, change a few lines, and create their own (technologically identical) coin. Creating value for the coin only requires getting other people to use it, and convincing them that it has value. While I frequently encounter claims that fiat currencies have nothing to back them, Bitcoin has even less backing. It entirely depends on the belief of others in its value (as if the many terawatts of electricity burned up to maintain the Bitcoin network in the past makes it worth more). If Bitcoin disappeared tomorrow, only the people directly involved with it would even notice. In contrast, the Ethereum blockchain already hosts hundreds, if not thousands, of other projects. The Ethereum blockchain has already become far more important (at least two orders of magnitude, I estimate) to Decentralized Finance than Bitcoin. Many of the other networks simply have more value (in terms of utility of the network – not the price of the native asset).

The blockchain revolution has barely started, and future applications will continue to provide economic benefits through disintermediation of anything tangentially related to finance (imagine replacing sports books with other bettors competing to provide the best odds). Already, however, using Bitcoin feels like using the first iPhone (from 2008) – better than what came before, but no one with access to all of the current options would choose it over the present-day alternatives. While I don’t know what happens to Bitcoin relative to fiat currencies given the rapid expansion of the money supply of said fiat currencies, I feel relatively confident that superior cryptocurrencies will ultimately overtake Bitcoin in total value and mind share. I would guess that will take somewhere between a few months and two or three years (though sometimes, such displacements happen much more slowly than expected).

For full disclosure, I do own Bitcoin (and several other cryptocurrencies), and plan to continue to reduce my Bitcoin exposure over time while adding other cryptocurrencies. I did not post this to “talk my book.”

I appreciate your thoughtful and articulate effort, but you’re not looking at the big picture. There’s common saying in politics that, “perception is reality”… So too is this true of “value”… What practical purpose does artwork have? Sure, you can look at it but… What else can you “do” with it that is of any practical value? There are enough individuals and institutions that perceive value in Bitcoin and other crypto currencies, therefor, value exists. Mastercard and Visa will be coming out with crypto-backed credit cards very soon, along with BitPay, BlockFi, and others. The challenge of the user experience will be history very soon, and with the obvious, intentional destruction of The US dollar in its final stages, it’s no wonder people like Elon Musk, Michael Saylor, and Chamath Palihapitiya take crypto so seriously. Full disclosure, I personally own stocks, metals, and yes, cryptos. For me, crypto currencies have proven themselves the best performing investment instrument of any of them.

I believe your reply focuses too much on my minor points while not addressing my main proposition – that Bitcoin’s inefficiency, expense, slowness, and lack of flexibility will allow other technically superior cryptocurrencies to overtake it in importance, particularly since Bitcoin represents the ultimate “surveillance coin” (governments don’t even need to mandate that financial institutions maintain records – Bitcoin’s complete transaction history remains open for anyone, friend or foe, to analyze and exploit).

Conceptually, I agree with your criticism of BTC… That said, there’s TREMENDOUS value in being first, even if you’re not the best…

“…it is crucial to have a form of money and an ability to transact that cannot be readily confiscated or manipulated.”

I am not convinced that Bitcoin, etc. fulfill this requirement.

Not to mention susceptibility to EMPs, CMEs, massive infrastructure failures, etc. Even our fiat currency can be traded (ala black markets) if there were a collapse (with the only downside being most people don’t have cash on hand).