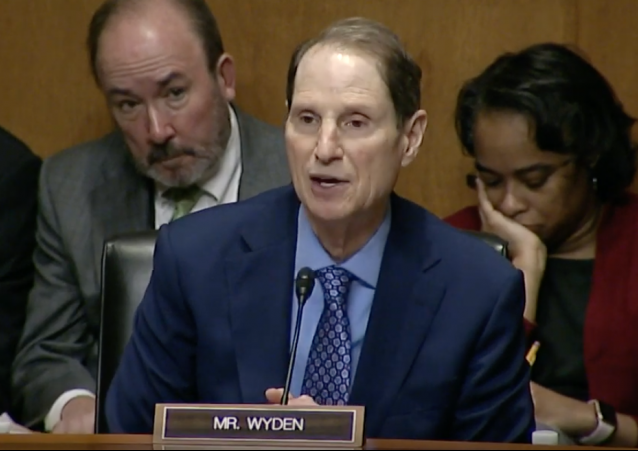

Dem Senator Wyden’s “breathtakingly terrible” plan to tax unrealized capital gains

Let’s hope this idea’s time never comes

If you were thinking it would be hard for Democrats to get any worse, along comes an idea like that of Senator Ron Wyden of Oregon, who thinks unrealized gains should be taxed. Wyden is no wide-eyed youngster, either. Not only is he 69 years old, but he’s the top-ranking member of the Senate’s tax committee. Here’s a description of his proposal:

Under current policy, capital gains, such as increases in value for held stocks, are only taxable when they are “realized.” In other words, if you own stock that increases in value from $1,000 to $1,500, you’re only liable to pay taxes on the $500 increase in value if you sell the stock at $1,500 and “realize” the $500 gain.

Wyden’s idea, on the other hand, would replace this simpler system with one in which capital gains would be taxed annually whether or not they were realized. In other words, if a stock you held increased in value from $1,000 to $1,500, you would still be liable for that $500 gain even if you didn’t sell and the value only changed on paper.

Wyden would counter that this is an oversimplification, and to an extent he would be right. Long-term capital gains, or capital gains on assets held for more than a year, enjoy a substantial zero percent bracket. Yet short-term capital gains, or capital gains on assets held for less than one year, are taxed as ordinary income. Without changes to this structure, Wyden would be imposing a tax on every new asset a taxpayer acquires that gains any value at all during that year.

In addition to all its other flaws, this would be difficult to carry out because the value of many assets would be hard to pinpoint until those assets are sold. And of course, values that rise can fall, and indeed they often do. So this amounts to a tax on the imaginary or at least potential value of assets. Hey, why not? It’s all in the service of making the rich poorer.

And Wyden is quick to assure us that this will only affect the rich, the really really really rich, not you and me, so what the hey?:

Sen. Ron Wyden, D-Oregon, announced on Tuesday that he is working on a mark-to-market system that would tax unrealized capital gains on assets owned by “millionaires and billionaires.”…

This levy, assessed annually, would kick in at the same rate as all other income, Wyden said. Currently, the top marginal rate on ordinary income is 37 percent.

In comparison, long-term capital gains are taxed at a top rate of 20 percent.

And capital gains are now taxed only when assets are sold and the gains are realized and not just on paper.

More:

“Everyone needs to pay their fair share and the best approach to achieving that goal is a mark-to-market system that would require the wealthy to pay taxes on their gains every year at the same rates all other income is taxed,” Wyden said in a statement.

Yeah, the wealthy aren’t paying their fair share, according to Wyden and the Democrats — even though the top 1% are actually paying 37.3% of all income taxes in the US. And by the way, unrealized gains are not income.

This particular idea may not be quite as dreadful as the Green New Deal, but it’s way up there (or down there). It’s another attempt to spread the wealth around, but this one is especially stupid/pernicious. Here’s the rationale behind it, ostensibly:

Wyden’s proposal would tax assets as soon as the price goes up, rather than when the asset is sold. The logic behind this is simple — paper gains represent real wealth, since you could sell the asset and get cash any time you want. Waiting until the asset is sold in order to tax it allows the wealth to compound untaxed, which causes wealth inequality to accumulate.

But paper gains represent potential wealth, wealth that is only made actual if and when the asset is sold. The thing itself has no stable value—the wealth it generates depends on what it actually does generate for the seller at the exact time it is sold. What’s more, an unrealized capital gains tax goes against what I understand to be the basis of our income tax laws, which is that they are a tax on income both earned (wages, etc.) and unearned (interest, dividends, etc.).

As far as I know, most taxes (both local and federal) except for property taxes (which are not federal) involve paying when there is some kind of actual transaction in the real world. That transaction can be a purchase or the profit from a sale, it can be a tariff on the import of goods, it can be the receipt of wages or interest or dividends, but the tax is paid either at the time of the transaction or at the end of the tax year in which the transaction occurred. To change that rule for income tax from realized gains to unrealized ones is a big big deal and an enormous and transformative change rather than a small one.

Oh, and about those millionaires and billionaires, the only ones it will supposedly affect? That’s the sort of thing that was said in order to get the 16th Amendment passed to have a federal income tax in the first place—that it would only apply to the very very rich. We all know how that turned out.

David L. Bahnsen calls Wyden’s proposal “extreme, silly, impractical, dangerous, and inane…inherently destabilizing, logistically farcical, and ethically unforgivable.” in National Review, and says that “we do not tax theoretical income.” Bahnsen adds this about Wyden’s proposal:

…[T]he compliance costs would be the biggest boondoggle our nation’s financial system has ever seen. How in the world is illiquid real estate that has not sold supposed to be “valued” each and every year, let alone illiquid businesses, private debt, venture capital, and the wide array of capital assets that make up our nation’s economy but do not fit in the cozy box of “mutual funds”? What kind of drain to the economy would such an annual exercise in “mark-to-fantasy” represent, as professionals driven by an objective of tax efficiency are tasked with valuing an asset out of thin air?

But let’s ignore that deal-breaker of a problem for a moment. Let’s just assume we are talking about Microsoft stock, which has an easily definable market value and infinite trading liquidity: What should we do each year when the stock price has gone down?…The cluster-you-know-what that would be created in allowing people to take losses year-by-year on investments that have not been sold probably has the most sophisticated and tax-savvy investors salivating at the opportunity to game this mess of an idea to their own favor.

Much more at the link. Much much more.

Ron Insana calls Wyden’s idea “beyond ‘breathtakingly terrible'”:

This is yet another full-employment act for accountants, tax attorneys and others who would then create a wide variety of tax avoidance schemes forged from whatever loopholes may arise from new legislation.

Further, unless one is a trader and not an investor (short term versus long term), this idea will add unnecessary volatility to the financial markets and cause pockets of weakness in them when it comes time to pay the piper each and every year…

The proceeds to pay taxes have to come from somewhere, and no investor will take out loans to pay taxes. They will sell stocks and bonds, thereby creating a season of tax harvesting that will depress prices as the bills come due.

Much more at that link, too.

Whether Wyden is serious about this or not, it is a very ominous development that he is talking about it at all, another sign of how far the Democrats have gone off the rails with proposals that would almost certainly be destructive to our entire economy.

[Neo is a writer with degrees in law and family therapy, who blogs at the new neo.]

Donations tax deductible

to the full extent allowed by law.

Comments

This proposal, if passed into law, would probably result in a massive market crash, as people would be forced to sell their assets to raise funds to pay for the “capital gains taxes” on “income” that they don’t really have. There would be a wave of forced selling every April 15 to raise money to pay taxes which would be unrelated to the actual income of the taxpayer.

the willingness of people to invest at all would drop, and not just in the stock market.

the entire economy would crash & burn, which might just be the real goal here.

These democrats are a clear and present danger now. Ban them.

It’s turned into the modern version of the Nationalist Socialist Party, no?

Thanks for mentioning that property taxes are already a tax on unrealized gains rather than actual transactions.

A “sin tax” is a tax on something considered immoral and that is therefore in the public interest to discourage. Thus, prohibitive taxes on cigarettes, alcohol, etc. Now, when you consider that the Left also considers any form of wealth immoral — well, you can see where this is going.

Oops, reply fail. That was supposed to be a comment on the original article, not a reply to Johnny Dollar.

That’s not correct. Property taxes are levied on the full value of the property (subject to any chicanery involved in the assessment process) each year, not just on the unrealized gain.

As idiotic as Wyden’s proposal is, there’s yet another wrinkle not addressed here or, from what I can tell, by either advocates or opponents: Let’s say Asset X is acquired in year 0 for $1000. For tax year 1 it is valued at $1100, so the taxable unrealized gain is $100. In tax year 2 it is valued at $1200, but is the tax based on the gain of $100 in the most recent tax year, or on the full gain of $200 from time of acquisition? If the latter, then I can’t imagine anyone holding on to any asset for any lengthy period of time.

It would also create a positive feedback to volatility.

During good economic periods, taxes would be high.

But during bad economic periods, the unrealized losses would drag the economy even lower.

i see someone else already noted the issue with investments that lose value…

all the money in the world wouldn’t be enough for the US Congress…. or the Legislature of #Failfornia, or…

It used to be a maxim that if it moved, if it existed, Democrats would find a way to tax it. Now they want to tax something on an imaginary value.

The theory of Schrödinger’s cat could almost be applied to this.

And when the same asset loses value in a following year?

Well, that’s tax free of course! See the socialists are looking out for you!

I hear they don’t plan on taxing your losses much at all.

So you buy at price point 1, have the price to up in the first year, pay taxes on that differential, then suffer a loss in the second year, what happens if it goes up in the third year? Taxes versys the previous high point? Or year two?

How much more proof do we nedd to declare these “beings” INSANE TYRANTS !

These non-productive jerks never stop wanting everyone’s money.

Should be a law AGAINST taxing capital gains.

Yes, indeed. Cap gains and interest/dividend income should be taxed at zero and labor income excluding all income saved/invested at punitive rates.

I just read a story about WalMart intending to add 1,500 robots to their store staff to replace shelf stockers and even floor cleaners–all the result of $15 minimum wage in many “progressive” locations. In the economy of the future in which labor demand will collapse as jobs are automated, we need to adopt policies to reduce the size of the labor force concomitantly and encourage individuals to earn their living more from returns on capital instead.

if labor income is taxed at punitive rates, how am i supposed to acquire the capital to invest to begin with, , armed robbery?

Anything you save would not be taxed at all. Strong incentive there. Over time you would get more of your income from returns on capital and less from labor as you would reduce your effort accordingly.

We have to remember that in a gig economy, the choice is not “employment” or “unemployment”–60+ hours a week or enforced idleness. We can ramp up or down our efforts, working only part-time or part-year.

I don’t know if Mortuaries have models but if they do this guy would be a real Show Stopper!

LOL

Doesn’t take much imagination to consider the turmoil in the stock markets as the periodic valuation date approaches, and then the days following that.

Only a Democrat would think this one up.

How about demanding the death tax before anyone dies and at a rate of what the anticipated value would be? Sorry for giving some Dem an idea.

Or .. simply… everything is owned by the government and everybody is employed by the government? Oh, that’s right .. that killed off 100 million people in the 20th century… but who’s counting?

only because it wasn’t implemented properly.

*this* time, it will be different…

This almost sounds like a 4Chan joke.

4Chan is a location on the Internet frequented by adults with fair to very good programming skills. From time to time, they run cons just for the “lulz.”

One such joke was to turn the “ok” symbol into a racist dog whistle.

Another was to lure Hillary Clinton into a fight with a green, cartoon frog.

Another was to write fan fiction that ultimately showed up in the Steele Dossier.

This story is just lurid enough to be the end result of a 4Chan joke.

G#d bless the weaponized autists, and again for them being on our side.

Can we pay imaginary taxes on imaginary profit with imaginary money?

The expressions of the two people behind this moron in the accompanying photo pretty much sum up this “idea”.

BREAKING NEWS:

Wyden just proposed a “thought tax” on capital gains.

I *thought* about buying Amazon stock in December 2008 when it was $50/s.

It is now $1,843 /s, and because I am a white cis man, I need to be aware of my white privilege that would have allowed me to buy the stock.

So I must pay.

[If only I wasn’t dissuaded by PJ O’Rourke (I think it was his book “Eat the Rich”) where he mocked how much money Amazon was losing on every book . . . ]

This idea may seem foolish and impractical but there is one asset that is treated in exactly this fashion and that is residential property. In most states, ones home value is assessed regularly and taxed based on the assessed value. When housing prices are on the rise, they are taxed accordingly. On the other hand, when housing values decline the assessments remain. Local governments depend on these taxes and when property values fall, they still have to meet a payroll and so property taxes keep rising.

Taxing income is probably the fairest and most efficient way to tax people but the great problem in democracies is that the public is unwilling to pay for the benefits it expects from the government. As a result, the public is taxed in a multitude of license fees, sales taxes, property taxes, parking tickets, fines, etc. none of which is particularly fair or transparent.

There is one exception to the taxing of realized capital gains. When a person dies, the basis for the inherited is figured from the time of the person’s death. Its value is subject to inheritance tax but unless one has an estate large enough to require some inheritance tax, the capital gain completely escapes taxation.

I’m not pointing these things out to support Whyden’s proposal which would essentially be impossible but rather to point out how complicated questions of taxation are.

Real property taxes are collected to pay for government services which benefit property owners. To be fair, they are applied based upon an established fair market value for the property. Property taxes come from a time when only property owners voted. Since then, governments have instituted other taxes, which are really service fees, not collected strictly from property owners. These are such things as gasoline taxes and bed taxes, which are supposedly earmarked for use to maintain or expand a particular service. Sales taxes are a way to spread the tax burden to people who do not own real property.

Then we get to the question of income tax. The problem with our current income tax laws is that it does not strictly tax income. It taxes income less deductible income values, some not even expenditures. Most non-business taxpayers fall into the 22-24% tax bracket. However, once they take advantage of the available deductions, they end up paying around 10-12% of their income. Those below the poverty level are taxed at 10-12% of their reported income. But, after their deductions, they pay 0% in taxes. In the corporate tax arena, we have many corporations which pay 0-10% of their income, after deductions, even though their tax rate is 37%. So, the question then becomes, how much simpler for all concerned if a flat tax on all income, of 10%, was initiated with 0 deductions. This would benefit the middle class and business owners filing their business income as personal income. Those below the poverty level would lose anywhere from $0 to $1000. But, all of the people in this range would be eligible for government assistance, which should make up the difference. So, nothing would really change for them. Corporations, especially those making $10,000,000+ would pay more taxes. But, they would still pay only 10%. This would actually make income taxation more equitable and the federal government would still garner as much or more money than they do now.

Oh! I didn’t realize Wyden was running for president, too. But is even this far enough left to win the nomination?

Next, expect him to propose the death penalty for people who refer to someone by the wrong pronoun.

Great idea, dummy.

A desperate old cadeaver trying to jump on the wacko train, thinking he’s going to become the new hip oldster.

Still waiting for someone to propose an income inclusion clause to tax all of the fringe benefits that elected officials gain when they assume a position in Washington and get rich.

I’m sure I’ll be waiting a long time for that one.

The so called millionaires and billionaires became rich by being quite smart and would have the resources to pay other very smart tax accountants and lawyers to avoid paying this stupid and punitive tax. This “Punish the Rich” tax will likely fall heaviest on the middle and upper middle class that do not have the resources to handle this punitive tax. Just image what would have happened if this “Punish the Rich” tax was in place during the housing boom when housing values were exploding, I’m sure there will be exceptions that the democrap overlords will grant us lowly and unworthy peons.

Wow. Forget stocks and investments — imagine what would happen to home ownership the next time real estate prices go up.

The proposal has the modest virtue of making Cortez look like a genius, by comparison.

It’s far past time that we took an ax to government spending. Across the board spending cuts. Everyone find 20% to cut. If the weasels choose to punish the taxpayers by cutting the services rather than administrative costs, abolish the entire program. We can all think of several major federal government programs that should be abolished to the immediate benefit of the country. Welfare for bureaucrats by creating elaborate barriers that serve no purpose other than to hinder economic activity and collect tolls. One big shakedown.

If the stock goes down is it written off as a loss? It would also destabilize the market where there is an advantage not to constantly trade. I can’t believe that this stupidity is not just a stunt to fool people who have no knowledge of investing and make them think that the Democrats care.

alaskabob raised an interesting point about a death tax before one dies. I sarcastically thought “hmmm, why not just take all our money and just give us an allowance?” Then I thought … whoah, Universal Basic Income.

This may be what the ruling class wants. Take all our money and give us a monthly stipend. “We’ve determined that this is enough for all your needs.” Big Brother Nanny State Overlords.

We need to revisit the Declaration of Independence. For instance, what does this mean? …

That whenever any Form of Government becomes destructive of these ends, it is the Right of the People to alter or to abolish it, and to institute new Government, laying its foundation on such principles and organizing its powers in such form, as to them shall seem most likely to effect their Safety and Happiness. Prudence, indeed, will dictate that Governments long established should not be changed for light and transient causes; and accordingly all experience hath shewn, that mankind are more disposed to suffer, while evils are sufferable, than to right themselves by abolishing the forms to which they are accustomed. But when a long train of abuses and usurpations, pursuing invariably the same Object evinces a design to reduce them under absolute Despotism, it is their right, it is their duty, to throw off such Government, and to provide new Guards for their future security.

It’s not Biblical mumbo jumbo, or stuff of science fiction. It is real and worthy of consideration.

Perhaps, then we could exact a penalty for “unrealized stupidity”

Imagine a stick goes from $1000 to $1100 – you don’t sell but pay the tax on the gain. The next year it drops from $1100 to $1000 creating a loss. But you still don’t sell. Then the year after that is goes up $1000 to $1100.

You pay tax twice on the gain from $1000 to $1100. Which is why you normally only pay on realized gains (BTW, there is some idiocy in current law where you can get taxed under unrealized gains – and it’s painful)

Imagine another scenario where when it goes to $900 and you sell. You paid income tax on a $100 loss. Awesome!

Which creates the problem …

1) the proposed law may or may not allow that to offset losses on other capital gains

2) if it does, you may not have any other capital gains on that year to offset it

3) even if it lets you offset in the future against capital losses in future years there are usually restrictions in that

Eg the government will get the full benefit of gains but you will get screwed in how the losses are used.

Couple more points:

– stock market volatility coming into Dec 31st will be high as many people may be forced to sell their assets to pay tax, eg unrealized gains will forced to be realized

Which will turn us all from long term to short term investors, arguably not a good thing.

– valuing income by continuously marking assets to market (mark to market) will lead to many other abuses.

Read the story of Enron to understand how mark to market led to some of the greatest accounting abuse of all time.

Stupid stupid stupid.

When you exercise your stock options the difference between the exercise price and the market price is taxed as income even though it’s unrealized gain. Some poor souls have a huge tax liability, but the stock price crashes before they sell so they have pay taxes without realizing the income.

Such stupefying idiocy, inequity and fiscal illiteracy, evinced by Wyden and his neo-communist Dumb-o-crat apparatchiks.

Consider this — the Dumbs claim to want to support & encourage long-term, “buy-and-hold” purchasing behavior by investors (as opposed to more short-term, speculative investing behavior). This foolish proposal does the opposite, by punishing buy-and-hold investors. It also punishes long-term investors — many of them senior retirees — who rely on their long-held positions for dividend and interest income, a virtual “pension,” if you will.

Also, what happens when an investor pays a gigantic tax bill on unrealized gains, & the positions lose 15% of their value the next day, in a massive correction? There is a very good reason why capital gains taxes at present are only assessed on realized gains, meaning, the investor has affirmatively reaped the benefits of his/her investment.

This proposal is so manifestly infantile, ill-conceived & steeped in fiscal ignorance, it does not deserve to be rebutted. But, this is an example of the totalitarian lunacy that the Democrats want to foist upon Americans who use markets to increase their wealth & to secure their retirements.

Mister Wyden, instead of cheating us out of more money, why don’t you justify what you’ve done with the trillions you’ve already stolen from us?

How long until 401K’s are treated this way? 5 minutes? Why am I reminded of this song by some guys?

https://www.youtube.com/watch?v=l0zaebtU-CA

Ron Wyden has once again demonstrated the breath taking stupidity he first displayed in Civil Procedure class at the University of Oregon Law School way back in 1971, when he would lob off the wall comments from the back of the room at Professor Orlando John Hollis, bringing class to a halt as the rest of us would turn and look back at him with annoyance.

Bless his heart. He never could pass the Oregon bar, even after three ties. He finally passed the Iowa bar exam.

And, no, he never has held a real job. He started off his political career as an advocate for the Grey Panthers, a seniors advocacy group.

Oh the stories you must know…

I’m surprised that nobody recalled (from some years ago – Clinton administration?) when the IRS proposed to tax property owners who owned unrented rental properties as if they had actually received rental income from those properties.

Hair dresser used too much dye but the embalmer did a good job.

If brains were taxed the Democrat caucus would be on welfare….oh, wait. The leeches are.

I wish these idiotic proposals will bring the people to their senses and destroy the dim-o-crat party come 2020. Wish Trump would hurry up in investigating the DNC and cohorts now!

Freebies and higher taxes, that’s all the democrats have to offer. i don’t know how anyone who works for a living can support these morons.