Post-SCOTUS Gay Marriage: Religious institution tax exemptions at risk

Forty-eight hours after the Supreme Court’s monumental gay marriage decision, and progressives are already calling for an end to tax exemptions for churches.

Anticipating the Supreme Court’s eventual ruling on Obergefell v. Hodges, Senator Mike Lee and Rep. Raul Labrador introduced the First Amendment Defense Act. The bill would protect religious institutions who, for religious beliefs, do not actively participate in gay wedding ceremonies.

In an op-ed published two weeks ago in the Deseret News, Sen. Lee explained:

This is a bill that would prohibit the federal government from penalizing individuals or institutions on the basis that they act in accordance with a religious belief that marriage is a union between one man and one woman.The First Amendment Defense Act, which Rep. Raúl Labrador, R-Idaho, will introduce in the House of Representatives, would prevent any agency from denying a federal tax exemption, grant, contract, accreditation, license or certification to an individual or institution for acting on their religious beliefs about marriage.

After hearing the oral arguments in Obergefell v. Hodges, Sen. Lee was most disturbed by a question asked by Justice Alito.

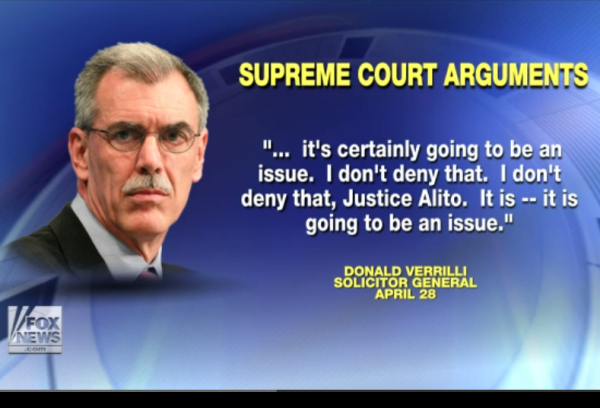

But back in April, when the Supreme Court heard oral arguments in the case, Solicitor General Donald Verrilli revealed that the implications of the court’s ruling in Obergefell v. Hodges extend far beyond the narrow issue of marriage licenses.In a brief back and forth about IRS regulations, Justice Samuel Alito asked Solicitor General Verrilli whether religious institutions — including schools — that maintain the traditional definition of marriage would lose their tax-exempt status should the court strike down state laws defining marriage as the union of a man and a woman.The solicitor general responded: “It’s certainly going to be an issue. I don’t deny that. I don’t deny that, Justice Alito. It is, it is going to be an issue.”This was a chilling moment, but not totally unexpected. For years we’ve seen warnings that, for some activists, the objective is not just legal recognition of same-sex unions, but government coercion of individuals and institutions to affirm — and even participate in — such unions, regardless of good-faith religious objections.

Video report via Fox News:

Sunday, TIME published an article by New York Times columnist Mark Oppenheimer called, Now’s the Time To End Tax Exemptions for Religious Institutions.

Liberals tend to think Sen. Lee’s fears are unwarranted, and they can even point to Justice Anthony Kennedy’s opinion in Friday’s case, which promises “that religious organizations and persons [will be] given proper protection.”But I don’t think Sen. Lee is crazy. In the 1983 Bob Jones University case, the court ruled that a school could lose tax-exempt status if its policies violated “fundamental national public policy.” So far, the Bob Jones reasoning hasn’t been extended to other kinds of discrimination, but someday it could be. I’m a gay-rights supporter who was elated by Friday’s Supreme Court decision — but I honor Sen. Lee’s fears.I don’t, however, like his solution. And he’s not going to like mine. Rather than try to rescue tax-exempt status for organizations that dissent from settled public policy on matters of race or sexuality, we need to take a more radical step. It’s time to abolish, or greatly diminish, their tax-exempt statuses.

Interestingly, Oppenheimer doesn’t argue for abolishment of tax exemptions as punishment for holding sacred the belief in traditional marriage. So why strip churches of their tax-exempt status? To redistribute the wealth, of course; use one social issue as a guise to push another, completely unrelated issue.

Defenders of tax exemptions and deductions argues that if we got rid of them charitable giving would drop. It surely would, although how much, we can’t say. But of course government revenue would go up, and that money could be used to, say, house the homeless and feed the hungry. We’d have fewer church soup kitchens — but countries that truly care about poverty don’t rely on churches to run soup kitchens….I can see keeping some exemptions; hospitals, in particular, are an indispensable, and noncontroversial, public good. And localities could always carve out sensible property-tax exceptions for nonprofits their communities need. But it’s time for most nonprofits, like those of us who faithfully cut checks to them, to pay their fair share.

If you were among the many who saw the writing on the wall before Obergefell v. Hodges was handed down, you weren’t paranoid. You were right.

Follow Kemberlee Kaye on Twitter

CLICK HERE FOR FULL VERSION OF THIS STORY