There’s no such thing as a free immigration amnesty

Amnesty, and particularly citizenship, for people who broke the law to get here is bad policy because it rewards law breakers and advantages them over law abiders.

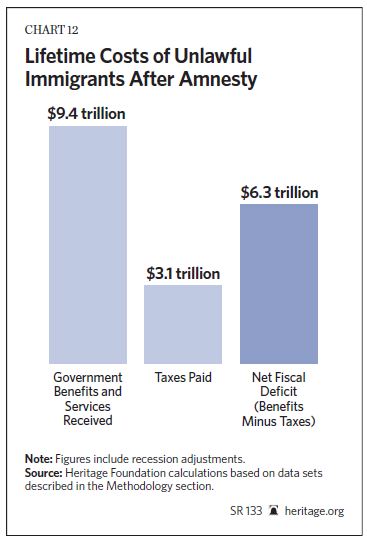

It’s also very costly, as a study released by the Heritage Foundation demonstrates, The Fiscal Cost of Unlawful Immigrants and Amnesty to the U.S. Taxpayer:

Executive Summary

Unlawful immigration and amnesty for current unlawful immigrants can pose large fiscal costs for U.S. taxpayers. Government provides four types of benefits and services that are relevant to this issue:

- Direct benefits. These include Social Security, Medicare, unemployment insurance, and workers’ compensation.

- Means-tested welfare benefits. There are over 80 of these programs which, at a cost of nearly $900 billion per year, provide cash, food, housing, medical, and other services to roughly 100 million low-income Americans. Major programs include Medicaid, food stamps, the refundable Earned Income Tax Credit, public housing, Supplemental Security Income, and Temporary Assistance for Needy Families.

- Public education. At a cost of $12,300 per pupil per year, these services are largely free or heavily subsidized for low-income parents.

- Population-based services. Police, fire, highways, parks, and similar services, as the National Academy of Sciences determined in its study of the fiscal costs of immigration, generally have to expand as new immigrants enter a community; someone has to bear the cost of that expansion.

The cost of these governmental services is far larger than many people imagine. For example, in 2010, the average U.S. household received $31,584 in government benefits and services in these four categories.

The full report is here.

Bottom line — $6.3 trillion.

CLICK HERE FOR FULL VERSION OF THIS STORY