Inflation: CPI Rose 0.1% in November, Prices Increased 7.1% Over Last 12 Months

Food at employee sites and schools rose 110.1% in the past 12 months. Food at elementary and secondary schools went up by 254.1% in the past 12 months!

Headlines across the country claim inflation “cooled” or “eased” in November’s Consumer Price Index (CPI) report.

Oooooo, inflation only increased by 0.1% from October to November compared to 0.4% from September to October number.

La. Dee. Dah.

I have to say this before I continue. Food at employee sites and schools rose 110.1% in the past 12 months. Food at elementary and secondary schools went up by 254.1% in the past 12 months!

This is why you must read the entire report and all of the tables.

The report mentions a decrease in energy indexes. However! The increase in shelter indexes offset any of those decreases.

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1 percent in November on a seasonally adjusted basis, after increasing 0.4 percent in October, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 7.1 percent before seasonal adjustment.

The index for shelter was by far the largest contributor to the monthly all items increase, more than offsetting decreases in energy indexes. The food index increased 0.5 percent over the month with the food at home index also rising 0.5 percent. The energy index decreased 1.6 percent over the month as the gasoline index, the natural gas index, and the electricity index all declined.

Not counting food and energy, which are considered volatile, the index for all the other items went up by 0.2% in November, down 0.1% from October.

Yippee.

Over the past 12 months:

The all items index increased 7.1 percent for the 12 months ending November; this was the smallest 12-month increase since the period ending December 2021. The all items less food and energy index rose 6.0 percent over the last 12 months. The energy index increased 13.1 percent for the 12 months ending November, and the food index increased 10.6 percent over the last year; all of these increases were smaller than for the period ending October.

Let’s break it down, shall we? This is my favorite part. No babble from so-called experts. No spin.

Just the facts, Jack.

Four of the six grocery food group indexes increased in November:

- Fruits and veggies: 1.4% (these guys fell 0.9% in October)

- Cereals and bakery goods: 1.1%

- Dairy and similar goods: 1.0%

- Nonalcoholic beverages: 0.7% (My Diet Coke is way too expensive. But that will be the last thing I cut.)

All food at home went up in the last 12 months, too. Cereals & bakery and dairy & similar items went up by 16.4%. The other major food indexes increased between 6.8% to 13.9%.

Food away from home increased in November by 0.5%. It rose 7.5% in the last year.

Here comes Christmas. How about the 12-month changes on items we all need for Christmas Eve and Christmas Day or even just treats we make for family and friends…or ourselves.

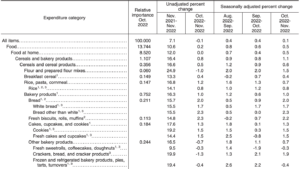

Largest increases in the past 12 months under cereals and bakery products? Everything so here’s a screenshot of Table 2.

- Eggs: 49.1%

- Milk: 14.7%

- Cheese: 12.4%

- Canned fruits: 20.9%

- Canned veggies: 16.2%

- Frozen veggies: 18.3%

- Butter: 27%

- Margarine: 27%

- Fats and oils: 21.8%

Energy decreased from October to November. Great. But the numbers over the past 12 months are not great.

- Fuel oil and other fuels: 41.7%

- Fuel oil: 65.7%

- Motor fuel: 10.8%

- Gasoline (all of them): 10.1%

- Unleaded regular: 9.8%

- Unleaded midgrade: 10.7%

- Unleaded premium: 12.4%

- Other motor fuels: 43.3%

- Evergy services: 14.2%

- Electricity: 13.7%

- Utility gas service (piped): 15.5%

Shelter and shelter indexes erased that energy decrease:

- Shelter: 7.1%

- Rent of shelter: 7.2%

- Rent of primary residence: 7.9%

- Lodging away from home: 3.2%

- Housing at school, excluding board: 2.8%

- Other lodging away from home including hotels and motels: 3.3%

- Owners’ equivalent rent of residences: 7.1%

- Owners’ equivalent rent of primary residence: 7.1%

- Tenants’ and household insurance: 0.8%

Used cars decreased by 3.3%. But the other indexes under transportation went up, especially if you need to work on that used car:

- New vehicles: 7.2%

- Motor vehicle parts and equipment: 11.6%

- Tires: 10.3%

- Vehicle accessories other than tires: 13.7%

- Vehicle parts and equipment other than tires: 11.8%

- Motor oil, coolant, and fluids: 19.6%

Other significant increases:

- Health insurance: 13.5%

- Transportation services: 14.2%

- Motor vehicle maintenance and repair: 11.7%

- Motor vehicle body work: 12.4%

- Motor vehicle repair: 15%

- Motor vehicle insurance: 13.4%

- Public transportation: 23.8%

- Airline fares: 36%

- Pet services including vets: 10.9%

- Veterinarian services: 11%

- Delivery services: 13.8%

- Apparel services other than laundry and dry cleaning: 14.1%

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

Yeah, Brandon’s economic miracle. Actually might be for a few, especially climate grifters. Not so much for the serf deplorables though.

Redistributive change (i.e. ponzi scheme, so-called “trickle-down” economics) in contrast to capitalism (i.e. retained earnings or grass-roots economics). Some people… persons prefer the former for its perceived instant gratification.

Biden’s economic miracle: Figuring out how to make prices go up.

“It was not hard at all,” said Jean-Pierre.

“Can you make prices go down?”

“I don’t think so. We haven’t tried.”

“Why not?”

“That is disrespectful”, she said as she stomped off in a huff.

Any objection is clearly racist in nature.

Would also accept homophobic or misogynistic in addition to racist as reasons for leftists to seek to deflect blame and avoid responsibility.

Used food is down, though. Plenty available from the Biden administration experts.

the all items index increased 7.1 percent before seasonal adjustment

Say. I have this bridge I own. I’d like to unload it cheap to you, my friend. It’s a great investment….

Local News readers emphasize it is down from the peak. They don’t say it’s nearly 3 time the rate two years ago.

So we are drowning is a little less water than last month?

The rate went up by .01% MoM and is up 7.1% YoY.

So the amount of water increased. The other key point to keep in mind as we move forward is the rate of increase may drop but part of that decline is from the increased base of comparison. Prices started moving higher last fall. Think of like compound interest that steals from you over time b/c your current $ will buy less in the future.

Yes, soon the 12-month comparisons will be made to the previously jumped-up prices.

So: “Look how much gasoline prices have fallen, $4 vs. $5. Don’t you just LOVE what we’ve done to make your lives SO much better?”

And then all the grotesque general price increases since 2020 can be conveniently memory-holed.

The irony of progressive prices (“inflation”) is that they are the effect of compensating for polices and votes (e.g. Obamacares, Bidencares) to mitigate the effects of process policies (e.g. Medicare/Medicaid. Subsidized single/central/monopolistic solutions, Green deals (corporatism/environmentalism), immigration reform).

Oooooo, inflation only increased by 0.1%

This is sorta like the Ukraine war slowing down during the winter.

Never mind that there is no electricity in many places and hundreds, if not thousands, of homes have been destroyed.

CPI “seasonally adjusted rates” is software driven thus cooking the books on what is really true on the ground. All this amounts to is statistical gas-lighting to make people feel better about a worsening situation.

Anything climate related is sky high. All the numbers like ele ction results are lies.

And since it’s open enrollment time let me take a moment to salute Obama with a big middle finger for destroying the health insurance industry. I think he missed the point and what affordable means. Trump was no better promising we would have the best system in the world and then doing nothing. Now here comes DeSantis who is IMO the deep state’s alternative to trump.

The MIC (Medical Industrial Complex) has been nothing short of a disaster for decades now, Obama just added more furniture to burn and the MIC threw gasoline on it’s self with the fake plandemic and the vaccine BS we face now and will continue to deal with for years to come.

Why do we, as in America, spend the most on healthcare but are the unhealthiest? Sounds like tinfoil hat time here……….

All I can say is what I have myself experienced.

I frequent Winco. It is an employee-owned grocery chain with Walmart quality stores, good produce, doesn’t offer sales, does little to no advertising, makes you bag your own groceries, and offers rock-bottom everyday pricing. It caters to military (Lewis/McChord), who often shop in uniform. Also Hispanics.

I went there a day or two ago after having not been for six to eight weeks.

Prices had skyrocketed. The produce was MUCH more expensive. Many items more than double. You used to be able to by most Progresso soup for about $1.50 a can; its now about a dollar more. Soda used to be under $4 a 12 pack, its now about $7. Etc.

Anyone is claiming prices have only risen by 7% over the last year is is serving you a steaming pile of bullschitsky.

Joe Biden says he is sick of being blamed for inflation.

A smaller increase is still an increase.

Trying to claim that as some sort of victory is like a wife-beater saying, “Well, honey, I didn’t hit you as hard as I did last time.”

The CPI they’re admitting rose 0.1%.

Look at how they’re behaving vs. what they’re reporting to see what they really believe. (It’s like when some financier offers to let you in on a “hot market.” If you think that market is so hot, why are you selling your position in it?)

Nobody quoting these number is acting like they believe them.