Democrat 2020 Hopefuls Already Competing for Who Wants the Highest Tax Rates

“There was a time in this country where the top marginal tax rate was over 90 percent”

As more Democrats declare their intention to run for president in 2020, they will be under increased pressure to distinguish themselves from the rest of the crowd.

One of the ways this is already unfolding is a competition to be the person who wants to raise taxes the highest on high earners.

Gabriella Muñoz reports at the Washington Times:

‘Over 90 percent?’ Liberals eyeing White House vie for title of highest tax raiser

Democrats eyeing bids for the White House also are competing to see who is willing to go the highest in raising taxes.

Rep. Alexandria Ocasio-Cortez, a New York liberal who is too young constitutionally to become president, nevertheless set a benchmark when she suggested in a “60 Minutes” interview Sunday that rates for the wealthy could top out at up to 70 percent.

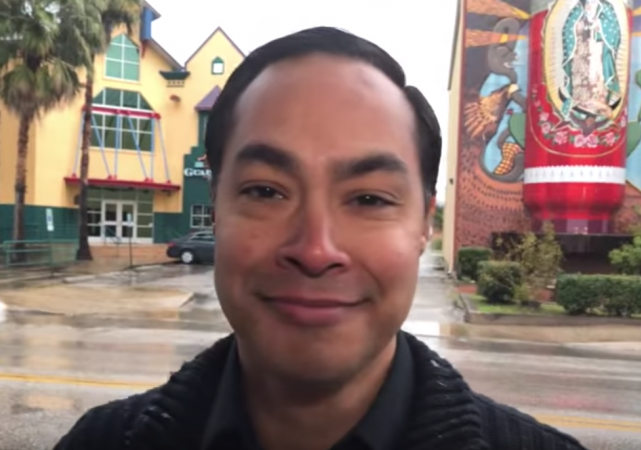

Julian Castro, an Obama administration Cabinet official who has announced a testing-the-waters presidential committee, quickly jumped on the bandwagon by telling ABC News that it’s time the wealthy be tapped for their “fair share.”

“There was a time in this country where the top marginal tax rate was over 90 percent,” Mr. Castro said in praising Ms. Ocasio-Cortez’s vision. “Even during Reagan’s era in the 1980s, it was around 50 percent.”

Sen. Elizabeth Warren, a Massachusetts Democrat, who also has formed a presidential exploratory committee, hasn’t committed to a high-water mark, but she too spoke approvingly of major rate hikes.

“Look, there was a time in a very prosperous America — an America that was growing a middle class, an America in which working families were doing better generation after generation after generation — where the top marginal rate was well above 50 percent,” Ms. Warren said on CNBC in July. “Ninety percent sounds pretty shockingly high. But what I’m trying to get at is this is not about negotiating over specific numbers.”

Get ready to hear a lot about paying your fair share. When it comes to fiscal policy, nearly all of the Democrats are going to sound like Bernie Sanders. They’re also eyeing Trump’s tax cuts and salivating.

“Repealing the trillion-dollar-plus Trump giveaway to the superrich and giant corporations is becoming the new floor for what Democrats will be pushing for on taxes,” said Adam Green, a co-founder of the Progressive Change Campaign Committee…

Mr. Castro embraced Ms. Ocasio-Cortez’s idea, but other potential Democratic presidential candidates said only that taxes need to be increased.

“I’m eager to have a discussion about it,” Sen. Kamala D. Harris of California told The Washington Times.

As my colleague Kemberlee Kaye noted in an earlier post, Julian Castro is expected to make a big announcement today. What could it be?

Gromer Jeffers Jr. writes at the Dallas Morning News:

Julian Castro launches presidential bid, as Texas Democrat looks to regain spotlight he once enjoyed

Julian Castro’s keynote speech at the 2012 Democratic National Convention was a potential star-making appearance designed in part to catapult the emerging politician to greatness.

The former San Antonio mayor was widely mentioned as a can’t-miss prospect who would lead Texas Democrats to a historic statewide victory as a 2018 candidate for governor. Others saw him as a presidential contender, particularly after he was considered as a running mate for Hillary Clinton in 2016.

Yet, in the years since his keynote speech in Charlotte, N.C., Castro has been content to remain on the sidelines as other Democrats moved ahead of him in attention and popularity.

Castro’s dreams, he hopes, won’t be deferred much longer.

In his hometown San Antonio on Saturday, Castro is launching his campaign for president, hoping to outrun a potential large and diverse field of Democratic Party contenders. If successful, he would be the first Hispanic and one of the youngest Americans to win the White House.

It won’t be easy.

No, it won’t. Especially when people learn his role as San Antonio mayor was largely ceremonial.

He was a ceremonial mayor of San Antonio. The kind that waves in parade and cut ribbons for store openings.

Obama made him HUD Sec with no experience whatsoever and he pissed off a bunch of Democratic city mayors.

Now he’s running for president on a thin, super thin resume.

— Pepper (@PepperGii) January 3, 2019

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

In a way there is some real “justice” to this. With billionaires and multi-millionaires supporting Democrats it only seems fair that they should bear a larger share of the cost of their liberal virtue signaling.

The trouble is that the commie plutocrats who run Silicon Valley won’t feel the pinch. They hold the Democrats’ leashes.

In fact, the ultra-rich who fund the Democrat Party will end up getting richer while everyone else gets poorer. That is what tax increases are designed to do.

If you have a bazillion $$ to begin with, you’re not going to miss an extra couple of millions by virtue signaling.

We definitely need a wealth tax on wealthy Democratic donors. They have earned the privilege the old fashioned way — by being incredibly stupid when it comes to politics.

So they have no intention to compete for MY vote?

You are right. They have no intention of any kind of inclusiveness. It is their way or the proverbial highway (which you did not build). Used to be there could be an agreed goal and then a difference on how to get to that goal. Now, if you support a different party than the one that holds office in your district or state, your interests are pretty much unrepresented.

The Dumb-o-crat heir-apparent apparatchiks are all the same — self-reverential narcissists and egomaniacs, tired guitar players, strumming the same old song from the Marxist-Leninist playbook of human misery — profligate spending on an endless array of government “solutions” to contrived and exaggerated problems, which, if real, have been exacerbated by the Dumbs’ own prior policies; onerous taxation to punish the “rich,” with the predictably deleterious effects on business investment, business expansion, job growth and general economic prosperity; continued tribal Balkanization of American society, dividing Americans into every conceivable racial, gender, religious and economic category, for the purpose of pitting them against each other; and, of course, all topped with a nice dose of embittered demagoguery and total spite for the blessings of liberty and an ingrate’s lack of gratitude for the uniqueness of the American Experiment.

“There was a time in this country where the top marginal tax rate was over 90 percent,” Mr. Castro said in praising Ms. Ocasio-Cortez’s vision. “Even during Reagan’s era in the 1980s, it was around 50 percent.”

This is true, but no one paid that percentage. These mendacious marxist malcontents conveniently leave out the 40,000 page IRS ‘loophole’ leviathan constructed by the ‘Lobbyists/Lawyer/Account’ industry to combat the government’s assault upon private wealth. The Democrats then cry ‘Loopholes!,’ as if human nature doesn’t dictate that when a thief attempts to pick your pocket, you defend against the robbery.

These sound bites are simply a DOG WHISTLE to reassure their marxist base that the fundamental transformation of the federal government into a machine powerful enough to take away all wealth is still on-track. After that, fundraising!

It’s always revealing (and, revolting) when these career Dumb-o-crat apparatchiks, who’ve spent their entire working lives in government, attempt to wax sagacious regarding economics and finance.

The Dumbs’ paucity of private sector work experience and entrepreneurial experience founding and/or managing a business informs their infantile hostility towards the free market and the “rich,” and, of course, their general fiscal illiteracy.

That’s right Reagan dropped rates to 28% max and did away withe all the shelters. Before that you could depreciate a house or airplane in a few years and then sell it.

They also ignore all of their fellow pols who were caught cheating on their taxes.

We really need a progressive tax with political donations; the more you donate to elected officials the more you pay in taxes. All donations in any year that total under $100 is free, all donations over $100 taxed at 100%. All donations over $200, taxed at 500%, etc.

Buying politicians needs to be more expensive than it is and the purchase price should accrue to the benefit of all.

Go on. I double dare you to run on increasing taxes! HAHAAHAHAHA

They will, it’s just that they’ll say we need “increased revenue for the government”. And the best way to do that is to give the government more of rich people’s money.

And then, they’ll redistribute it in a fair way to the unions, who will generously give most of it back to the Dimocrat Party.

Unfortunately, it works. They sell it by claiming that “the rich” need to pay more, so that everyone else can get more free sh*t. Too many people become captivated at the idea of more free sh*t and miss the fine print that defines “the rich” as “anyone who has a job.”

They are mad at the rich for their wealth so they want to raise taxes on the wage earners, who are not those same people. Do they really think Buffet, Styer, etc care about income… Their lives are on solid ground and they could easily do day-to-day living on 100K or less annually; not that they would necessarily choose to.

The first step of anything called “fair share” should address the 47% who pay no income tax at all. Zero percent tax when others are paying upwards of 15% (and higher) doesn’t look like fair from over here. And a 50%, or 70%, rate does not raise much money if “no one actually pays it”.

You can bet there will be loopholes to ensure the rich really won’t pay any more but the increased burden will be on working class Americans.

“There was a time in this country where the top marginal tax rate was over 90 percent”

For that matter, there was a time when there was no personal income tax at all.

The centennial of the permanent income tax was about five years ago. I don’t remember any big commemorative celebrations, though.

It’s probably just me, given my background and all that, but it gives me the creeps to just imagine somebody named “Castro” talking about taking 90% of people’s income.

“talking about taking 90% of people’s income”

To be fair, no matter the number discussed, their intent is to take 100%.

“Fair share” would be 100% of people paying taxes, not just 50%. Skin in the game. Right now,, those 50% have representation without taxation. What is “fair” about that, I ask you?

On the other hand, 100% not paying taxes has a certain appeal as well.

Jump the line and claim that you want 110% tax rate on the rich!

This party knows it’s customers: people who want to get those sweet, sweet government contracts. The more money the government has, the more money can flow to friends and family of corrupt politicians.

Nancy Pelosi, I am looking at you.

Why stop at 70% or 90%?

Why not 135%, just take it all!

Their warped views aside, can you imagine any of these half-wits becoming the CEO of the United States?

We need another demented putz like barack obama like we need another demented putz like moooochelle obama.

There was a time in England when the marginal tax rate was so high …. that doctors [who generally reached that point around October] took the rest of the year off. Who wants to work for pennies on the dollar?