Kathleen Breitman on the battle for Tezos – “I’m doing it as an act of love for my husband”

An UPDATE on the story of former Legal Insurrection writer Kathleen (McCaffrey) Breitman and her husband Arthur’s vision of “a good thing for the world”

A little over a year ago former Legal Insurrection author and Cornell undergrad Kathleen (McCaffrey) Breitman wrote about her experience co-founding, with her husband Arthur, the blockchain platform Tezos, Dear Legal Insurrection readers, remember me?

It’s been five years since I last posted in LI.

As some of you may remember, I was the first non-Prof contributor back in 2010. I mostly covered the coveted late afternoon slot while Prof was teaching and I usually linked to articles that covered my funky amalgam of technology and free-market fetishisms.

A few days ago, Prof Jacobson reached out to me to share a bit of an update on myself.

I’ve been in the press recently (here, here, here, here, and here) for Tezos, a project I started with my husband Arthur.

As I explained in my note to that post, “I have zero idea what she’s talking about with the new-fangled thing she’s created….”

Kathleen tried to explain:

Tezos is a blockchain-based smart contract platform in the same vein as Ethereum. (For a 101 explanation of blockchains and smart contracts, check out this introductory text I wrote in 2015.) The core observation that led to its development was the recognition of blockchain protocols as a commons. Typically, commons suffer from two issues in economic theory: 1. maintenance, or the question of who will fix issues in the code and 2. governance, or the question of who decides upon the direction of development. Tezos addresses this through a native governance mechanism which allows token holders to come to consensus on upgrades to the protocol while facilitating the creation of bounties on-chain to address existing issues with the code.

I STILL don’t have a clue what it does.

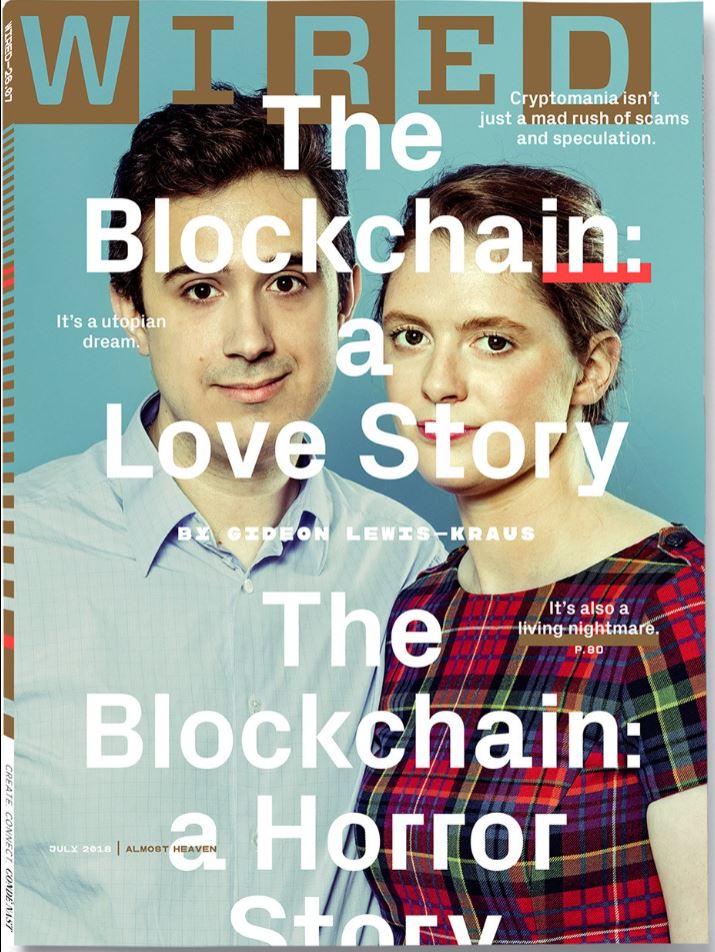

Since that post at Legal Insurrection, Kathleen and her husband have been on a rollercoaster ride, as detailed in a cover story at Wired:

The Wired article is titled Inside The Crypto World’s Biggest Scandal, but based on the article, I don’t think “Scandal” is the right word.

Rather, it’s a story about the relationship between Kathleen and Arthur, how they developed this platform, and how they almost lost it through a variety of obstacles including mischievous hires, lawsuits, and attempted hijackers.

The sub-headline to the Wired article better reflects the story:

Arthur and Kathleen Breitman thought they held the secret to building a new decentralized utopia. On the way, they plunged into a new kind of hell. A crypto-tragedy in three acts.

Read the whole thing. It’s amazing, and impossible to summarize in a few paragraphs.

One section in the Wired article jumped out at me. It’s where Kathleen discussed how Swiss business culture worked against her and Arthur’s attempt to wrestle back their vision of Tezos:

Kathleen’s measured tone went out the window. “All these Swiss people calling me and telling me to shut the fuck up and do things the discreet way. If I got raped at a party, would you tell me it was my fault for wearing a skirt? Swiss business culture is a load of shit.” …

Kathleen now felt as though they had one option: brinkmanship. This was no longer about the utopia to come but ascendancy in the here and now. “I feel like I’m in a hole, so fuck it, the game’s afoot. I’m going to blow this fucking canton up. I’m going to play the hand I was dealt, and I’ve got a much better deck. I keep telling Arthur that the people on the other side are just going to play their game for a billion dollars. It’s not about the morality of crypto. It’s about shipping and winning the game. I’ve got 60,000 lines of code that will ship with or without those guys in Zug.

She paused to stare out at the hills near Santa Barbara, blackened and denuded by fire. “They fucked with the wrong nerds, is my take.”

I literally laugh out loud every time I read that passage.

Kathleen was always such a “nice” person. I never knew she could curse like that. But I’m glad she can curse like a sailor now, because being nice almost cost her the company.

Kathleen has had to be tough to persevere, and it appears to be paying off.

A February 2018 article in Fortune reported, Tezos Finally Plans to Launch ICO Coin After Ousting Swiss Foundation Head. Now they are fighting a bunch of rearguard actions, fending off and pursuing lawsuits.

Where and how it ends I don’t claim to know, but Kathleen appears ready to continue the fight. A “beta” version was recently released:

Tezos released a so-called genesis block, or first foundation stone, of its testing network, the Zug-based foundation which governs the technology said in a statement on Saturday. The move means that Tezos’ prolific community members, who were instrumental in a governance spat settled earlier this year, can connect and begin validating the network’s code.

Arthur and Kathleen Breitman – the Franco-American couple who developed the technology behind the so-called «Tezzie» – urged community members to be «careful with the sharp edges». The Breitmans as well as foundation head Ryan Jesperson thanked backers in a video released on Saturday:

Fast forward to Fortune Magazine’s recently published The Ledger 40 under 40 list.

For the first time ever, Fortune has assembled a supplementary honor roll of the most impressive, young superstars who are transforming business at the leading edge of finance and technology.

Guess who clocks in at No. 13?

At the time of the Tezos ICO last summer, the blockchain company set a new record for so-called “initial coin offerings,” raising $232 million. After a turbulent year in which lawsuit drama hamstrung development, Breitman is finally through the woods, and planning to launch one of the crypto industry’s most highly anticipated projects later this month.

The Wired article explains how Tezos was Arthur’s technical and philosophical vision and passion, one which he almost lost but for his wife’s actions in protecting him and the platform against a sea of turmoil.

If there is a big takeaway from from this story, it’s Kathleen’s explanation in the Wired article of how this battle she has been fighting is “an act of love for my husband”:

Exhausted, Kathleen looked out to the placid expanse of sea and wilted a little. “It’s the 13th inning, and we’re getting a little tired. Neither of us needs to be doing this. I’m doing it as an act of love for my husband, and he’s doing it because he thinks he can do a good thing for the world. We’re going to birth Tezos as an act of love and collaboration.”

My Note to Kathleen’s year-ago post, which I partially quoted above, read in full:

WAJ adds: I reached out to Kathleen when I saw an article about her business success. I have zero idea what she’s talking about with the new-fangled thing she’s created, but apparently a lot of people think she and her husband are onto something big. This makes me so proud. Not just Kathleen’s success, but her maturity in keeping life in perspective.

I think I called it right.

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

I am going to get the book, and then I am going to figure out how to invest in the business!

Best of luck to the Breitmans!

I’m in. I like her spirit. Sure she’s not a Marine?

But first I have to figure out what The Blockchain is.

https://youtu.be/Aq_1l316ow8

My thoughts exactly. Scott Adams, of Dilbert fame, has talked about Blockchain a lot as well and I haven’t been up to sitting through one of his talks on the topic.

I haven’t a clue what anyone is talking about. But I like nerds and fighting nerds are great. Best of luck to Kathleen and Arthur.

There’s a perverse strain in human nature that reflexively fights innovation, or tries to co-opt it.

I hope the market-players world-wide lift this notion up!

Blockchain establishes a cryptographically secure chain of evidence.

Or rather a chain of custody and confidence.

“Block Chain” (Yeah, I should make this an article under my own byline, I think.)

What if common, reliable, public records were common, reliable and public? If you do it right, Block Chain can let you do that.

You know how when you want to do something to the lot you think you own, whether you do or not depends on what’s filed in the court house. And what they find there is up to whoever’s looking? This is going on with a friend’s family right now. Who’s juiced in? Who’s related to whom, say your neighbor’s people in the court house?

What if everyone, and anyone could see the titles, deeds and claims whenever they wanted, without going through your neighbor-who-hates-you’s brother’s sister’s cousin to see them?

Rule of law for property rights lets us leverage our combined effort to enforce who owns what … if we trust that we know who owns what. Rule of law for property rights has huge leverage — look at the relevant results from Hans Rosling, for example. What if we could all just look up the chart of who owns what, and trust it, vs. “You own what I say you own.” from the courthouse, or depending on the simple kindness of strangers to not take your stuff when you’re not looking?

Socially, and politically, whoever got the rake-off for access to the “official” record of who owns what doesn’t much like not having that control any more. People who get by on venue shopping don’t like it either. See “Pale Rider”‘s bad guy, who went venue shopping to get a deed … from someone he could buy off. Or “Silverado” where the rapacious bad guys burned the court house where inconvenient land claims were filed. Now, nobody knows who owns what for sure, so the people won’t collectively stand up to the thug-boss with more guns than any one of them.

How about we don’t do things that way? Rule of law: for property needs trusted records. You can extend that to contracts of all kinds: we enforce contracts together, so we get to make contracts and believe they’ll be enforced, which makes us way, way, way more productive than if we each had to carry around our own thug enforcers n fight it out every time.

Enforcing contraccts together only works if there’s a way to trust what the contract actually is. You sign a contract. Notarize others. File still others, and things like trademarks … all just ways to get more confident that we know what the contract actually is. None are particularly common, reliable, or public.

When you hear “BlockChain” think “Highly-verifiable: available, ubiquitous, and trusted.” Also hear “records” and “done for cheap.” “BlockChain” — “Highly-verifiable: available, ubiquitous, and trusted records. Better than a notary, for less than pennies, anywhere, any time you want.”

(Blockchain-based, “highly verifiable” records for public administrative records, political operations, and investigations — discuss.)

So, with the right wrappers in tech, practices, and community, you can make the basic BlockChain technology be that kind of record system. That’s a big deal.

Now, on to the tech in the next installment…

Block Chain, The Tech (Yeah, this should become an article, too.)

The problem with understanding BlockChain tech is that the tech for doing anything useful is like a sandwitch with The Block Chain in the middle. Also, nerds.

In the Middle:

What if you could make a ledger that was spread around, that anyone who joined in could see, that couldn’t be forged? But noone is to be trusted, so how do you decide what it says? Keep a bunch of (visible, unforgable) copies and vote on what matches.

Better if anybody can update — as in add to — the ledger, and that entry will just propagate, the same as the old ones.

So, is “Block Chain” the magic that makes an unforgable ledger, or the coordination that lets anyone add new entries, n wrangles consensus on old ones? Already with the layers. Making “Block Chain” go takes all three things, so when you hear “Block Chain” tech, think of those three things: an unforgable ledger w/ many copies, a way anyone can add n have their addition join the shared ledger, and a way to consensus vote on what’s in the already recorded ledger.

So, three things happening together to do one thing that they talk about like it’s one thing, because nerds.

It’s called “Block Chain” because that’s a bit of the tech magic that makes this stuff go: a “chain” metaphorically, of “blocks” metaphorically, holding ledger entries. Or literally a “chain” of “blocks” in computer/info-world where they often can’t tell a metaphor for the thing it resembles. Because nerds.

And depending on which conversation, you can get told that “block chain” is the chain of blocks, or the ledger, or the three combined things that make it interesting. Because nerds.

That’s the middle of the sandwitch: Block Chain.

The Bottom Bread:

How do we know the ledger is consistent? Unforgable? Shared accurately? Read right when we look at it? How does the “add to the end” record the right thing the right, end place? What about the consensus voting when you want to check something?

The bottom bread does the magic, so we can know chunks of the chain of blocks are the same, and haven’t been tampered with.

Underneath Block Chain is crypto-based identity, security, and privacy that we know work (we think.) Because math. It’s the same stuff that secures your ATM transation (but better), the same stuff that goes with the little lock icon for a “secure” site in your browser (but better), the same stuff that lets you VPN your connection, or encrypt your email, or run one of those sneaky-chat apps. (But don’t do that or the NSA will hoover up all your stuff to keep around untll they can crack it. Or so they’ve said. And denied. Because they can’t crack that yet. Or so they’ve said. And … not quite denied.)

All modern crypto rests on two big ideas: one-way hash functions, and factoring large numbers. You can get this token that depends on every part of the thing you looked at, but you can’t get from the token to the thing. The best you can do is trial and error: way harder than doing the hash. And factoring large numbers is way harder than multiplying them. “Way” Because math.

If you’re really clever, you can combine those two things to make stuff like signing and verifying who signed documents or emails. “Certificate” authorities saying who’s who. And other similar stuff.

Blocks in The Block Chain have tokens so the blocks can’t change without knowing it. And the blocks connect to the previous blocks, so those and that connection can’t chainge… This is how you get to the “trusted” part of the ledger. Everybody who joins in is like a notary, who’s stamp is harder to forge, and you can’t mess with the thing they signed after they signed it. Because math.

None of this math and coding does any good if somebody’s got a sniffer in before things get crypto-ized; of if the NSA has that quantum computer they deny they have. Will real quantum computing break all the crypto in the world? Experts and mathemeticians say “Yes”, “No”, “Maybe”, and “Make me a sammich.”

We’re pretty good at implementing the crypto / hash / signature / exchange math and protocols under BlockChain. Until quantum computing, maybe. Or the aliens come. Or both.

The Top Bread…

So, now that you’ve got this ledger, how do you let people get at it?

There’s a fair amount of scaffolding to let people join in to be ledger-wranglers, share lookups of what’s in the ledger, find more space to put things in the ledger, and so on. There’s a fair amount of social and legal wrangling for that human and run-time system. All the math and Block Chain design could just sit there. You’ve got to get it out there, so people can get at it. (But careful; this may bet you the attention of the US Feds, as Mr. Zimmerman learned from a decade or two’s prosecution — also “persecution” perhaps — for implementing code and strategies that had been published in text books for years before.)

The stuff that companies with “Block Chain-based” tech build themsleves is this top layer. Who can play. Who owns what rights to the commons (that the real property rights contracts live in).

It’s all implemented in code, so generally; “Grab it and run it.” and you’re part of that Karass. People who make their living granting permission for that sort of association, or recording who’s in what club for the yearbook don’t like that very much. Some are actively malicious. Most are just dumb; behaving with their habits that they never realy thought of. “Who’s in?” “Anybody, OK but where’s the list?” “This is what they call themselve’s but who are they in the world?” “What? We can’t have people being whoever they define themselves to be.”

On the internet nobody can tell you’re a dog. For purposes of this ledger here, you’re whoever you identified yourself to be. So, we can know way better which in-ledger persona has claim to what, says the ledger. Knowing who that is in the real world doesn’t get much better. When the records get solid enough the next link becomes the weak one. That’s the power, and the limitation of Block Chain public ledgers.

And no, I am not getting an implant to make that connection stronger. Because once it’s in, the they who like to be in charge won’t just use it as an ID. Because overlords, not nerds.

Weirdness…

Finding the next block for the ledger takes ever more work than the last. This makes blocks and “The Block Chain” interesting as a currency. There’s also one(-ish) Block Chain implementation in code, but you can make lots of Chains of Blocks, and invite people to play in your sand box. They talk about these as if they are the same thing, because nerds.

If you set up a Block Chain and call the ledger a currency, you get BitCoin, Etherium and others. It gets harder to make more of it. Hard enough that after people re-tasked banks of porn-streaming computers to finding more “Coins”, you started to get custom-built “find the next coin” farms, then brutal competition to get plane-loads of GPUs to plug into your coin-farming, farms, n get the next coin before the other guy. Because finding the one after that is way, way, way more expensive than finding this one. And it only gets worse.

Effectively the supply of blocks in any one chain is limited, which makes it interesting as a currency; a bit of a limitation for tracking contracts and property records. There’s a couple ways around that limitation fighting it out, because nerds.

The work-arounds to make something like a property ledger with unlimited space, vs. a currency ledger with limited entires, go in the “company” and “system” that lives over The Block Chain. And these things are entangled in laws and conventions and whatever else.

I hope that helps, Prof and others…

/Meta

Surprising everyone, especially me, I have yet to be thrown off the interwebz.

Thank you for indulging me.

Bierce, I made it two-thirds of the way through your explanation and still have no idea what this is about.

And your reference to Hans Rosling does not help — who the $#$ is he and why did you refer to him? Wikipedia’s article on him does not help explain it.

Well, I tried. Not the first to fail at this.

Re: Hans Rosling,

Per Rosling’s data analysis, including some of his TED talks available online, more rapid economic development tends to go with property rights, free-er markets and rule of law (common law vs. administrative law.)

A readily available, un-forgeable ledger of who owns what, like, say, real propety, might help with property rights vs. a market where who owns what is whoever Boss Hog says. It’s easier to do business when getting a copy of the deed to your house doesn’t depend on bribing the clerk in the court house.

Block Chain is a technical way to make ledgers that are hard to hijack. So, maybe good for economic development.

The Blockbuster chain went out of business, if that’s any help.

These two really walk the walk.

Technology will save us!

This reminds me of the first time I heard an explanation of public and private key encryption – the basis for SSL, which is the basis for HTTPS. I left the room shaking. I thought, “What a wonderful way for a totalitarian government to put you out of business instantly!”

The more powerful the technology, the better it can be used for good and evil.

I saw no mention of Bob nor Alice. Perhaps it could be used to determine how Hillary’s emails with top secret info ended up on Weiner’s laptop?

I’m lost here, trying to understand how you went

from: ‘public key, private key, HTTPS’

to: ‘totalitarian government putting you out of business instantly’

The security of the website you use for your business is completely dependent on a “certifying authority”. If that certifying authority revokes your certificate, your website has no security. You can do HTTP, but not HTTPS.

No. That’s NOT correct.

First, Certificate Authorities are NOT government. I am not denying that government can influence their decisions, but they are NOT government. And if one CA revokes your certificate you can always obtain a new certificate from another CA; there’s plenty of them. And don’t tell anybody, but you can be your own CA, if you know how to do it.

Second, if the CA revokes your certificate, you can, and still do use HTTPS, your site is still secure as such security consists on the encryption of the communication between your server and the client computer. Your client receives a notification that the certificate is not trusted, but they are free to continue if they choose to do so, AND the communication still uses encryption.

Are you saying that a totalitarian government would not be able to take control of the CAs?

You can be your own CA, but unless your customers’ browsers are configured to recognize your CA, they will get the kind of scary message which will discourage them from doing business with you.

We are not currently under a totalitarian government, but if we were this would be a nice “off switch” for its enemies.

“You can do HTTP, but not HTTPS.”

Your words. Incorrect.

It depends on your definition of “works”. My definition includes “browser does not display scary error message”.

And I’m puzzled again, trying to understand how a totalitarian government is going to force a CA outside their jurisdiction to cancel somebody’s certificate.

You suffer from a lack of imagination.

Oh. Imagination.

I will stick to knowledge and understanding.

If that’s your definition of “works” in this context, then we should end this unproductive conversation.

Have a good day.

???????????????

My head hurts.

Well, best I could do off the top of my head, on something pretty complicated, and often misrepresented.

Sorry, I’m not better at communicating this.

Well, that didn’t help at all. Sorry folks.

Anybody in the thread ever read Hernando de Soto’s works on capitalism?

Apparently it is illegal to buy/sell the “Tezzy” (symbol XTZ) in the Unites States. All the crypto currency markets will not allow me to purchase any amount of them because I live in the U.S.. If I lived in Indonesia I could buy some right now. I really would like to purchase some. Does anybody know if Trump has replaced the head of the SEC yet? If not it is time to do so. So much for free market capitalism…

If you wish to purchase XTZ, you might want to drop an email to Interactive Brokers to determine whether or not they may be of some assistance.