How sad. Our president has been reduced to chasing demons.

Obama’s recent phony jobs bill which raised $400 billion in taxes on everyone making over $200,000 (couples over $250,000) apparently did not whip the masses into a pitchfork and torch frenzy, because it targeted our doctors, local business owners, and others who are just too damned hard to hate.

So Obama has narrowed his aim and now will target those making $1 million or more, who are so few in number and so easy to hate that it might just light the fire Obama needs for reelection.

As reported by The NY Times:

President Obama on Monday will call for a new minimum tax rate for individuals making more than $1 million a year to ensure that they pay at least the same percentage of their earnings as middle-income taxpayers, according to administration officials….

Mr. Obama, in a bit of political salesmanship, will call his proposal the “Buffett Rule,” in a reference to Warren E. Buffett, the billionaire investor who has complained repeatedly that the richest Americans generally pay a smaller share of their income in federal taxes than do middle-income workers, because investment gains are taxed at a lower rate than wages.

Mr. Obama will not specify a rate or other details, and it is unclear how much revenue his plan would raise. But his idea of a millionaires’ minimum tax will be prominent in the broad plan for long-term deficit reduction that he will outline at the White House on Monday.

Adds Jake Tapper:

Faced with a Congress that opposes many of the suggestions he has made for job growth and deficit reduction, the president is increasingly making proposals that seem designed to garner popular, even populist, support — Republicans call it “class warfare” — so as to draw contrasts with Republicans for election 2012.

The campaign and the perpetual Obama need to find enemies has completely overtaken fiscal policy. Obama has ceased even pretending.

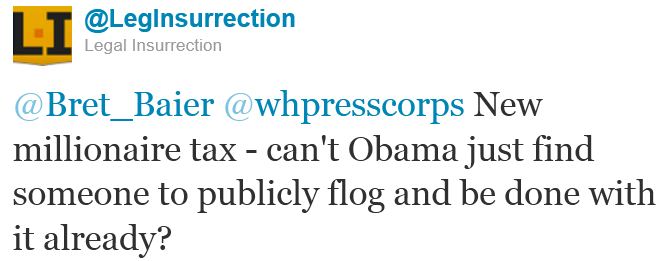

Here was my take when I saw a tweet from Brett Baier about the new tax:

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

Let’s call it the “Buffet” rule – this bill will make a good amount of pork available on a “all-you-can-eat” basis for those who are politically connected. Remember to drop the second “t”, who knows maybe this can be as embarrassing for Obama as that AttackWatch thing on Twitter.

Spot on tweet, Professor.

How many hard-working Americans do not aspire to earn $1 million a year?

I know I do.

More power to those who do … they are likely bringing more creative energy to our economy than anyone else.

LukeHandCool (whose dander is up a little … but when his wife is giving him cold beer and atarime (sun-dried squid dipped in soy sauce mixed with mayonaise … the absolute best thing with beer imaginable) before dinner … how can he possibly get really angry at this latest outrage?)

Some reactions, in no particular order:

1. Warren Buffett heads the list of people for whom I’ve lost respect lately.

2. Obama does not do a full-blown race- and class-baiting Jeremiah Wright only because he thinks he wouldn’t get away with it. If he gets desperate enough, who knows?

3. IMO the crony-capitalist kickbacks to rich Democrats will more than compensate for the proposed tax increases. Against rich Republicans, the tax increases will be reinforced by costly regulations.

4. I agree that the concentration of US wealth may become a serious problem if it is not one already. It does not follow that the solution is to let the government confiscate the money. Anti-protectionist obligations notwithstanding, I suspect there are ways to structure the tax code to the advantage of entities that create American jobs.

5. Hopefully the (swing) voting public will recognize that Obama is not remotely serious about addressing the above #4 in a manner that would benefit the overall economy. Neither, afaik, is either major party, but Obama and his cohorts are especially egregious.

Is anyone really surprised? The Obama MO is apparently to keep doing the exact same thing over and over. And over. That his entire staff seems to be completely oblivious to “the facts on the ground” is truly stunning.

Look at ATTAAAAACK WAAAAAAATCH. It was clearly designed to do two things (I’ve been rereading Alinsky since I just found out that it is still what he’s teaching his “community organizers in training”–just finished up summer training, moving on to fall fellows): one, clearly to intimidate while jazzing up the hypocrites in his base who love the idea of snitching of our neighbors (as long as it’s for a dem), and two, as a pseudo-“birther” bone. The idea was to evoke, purposefully, the exact thing it evokes (communist totalitarianism with a side of fascism) and then to skewer, lambaste, isolate, ridicule, and destroy (that Alinsky is a fun guy) the entire TEA Party with Godwin’s law, those TEA Party hicks are clearly off the rails, unhinged, paranoid RAAAACISTs, etc. They probably had that one picture of a random TEA Party person’s sign depicting Obama as Hitler all lined up to be shown on MSNBC and HuffPo, etc.

Any one of us could have told him it was a huge mistake. Many dems could have told him it was a huge mistake. But Obama and his entire circle are completely out of touch, and undoubtedly deeply shocked that their little plan was blown out of the water. Within 24 hours.

Do you think they are sitting around wondering what else they could be wrong about? Nope. We’ll see more of the same, and it will have the same result it has: his numbers will continue to plummet. Countdown to “but polls show that voters like individual pieces of the loser jobs bill” and “it’s the messaging that’s off” in 10, 9, 8 . . . .

“(I’ve been rereading Alinsky since I just found out that it is still what he’s teaching his “community organizers in training”–just finished up summer training, moving on to fall fellows)”

Question: what do you mean “he’s teaching his ‘community organizers in training'”? Obama is still holding training sessions, while on the stump? Or is the Obama for America who is doing this? Or – which is what I suspect – is he taking his staffers and using them to train newbies in Alinsky tactics to spread them out among the various admin. areas to do his bidding?

The Obama administration: Alinsky on steroids.

[quote]Question: what do you mean “he’s teaching his ‘community organizers in training’”? Obama is still holding training sessions, while on the stump? Or is the Obama for America who is doing this? Or – which is what I suspect – is he taking his staffers and using them to train newbies in Alinsky tactics to spread them out among the various admin. areas to do his bidding?

The Obama administration: Alinsky on steroids.[/quote]

Same thing, but yes, Obama personally meets some of the prize Obama Youth at a luncheon. Here’s what his own teacher said about BO (sound familiar?):

[quote]Obama’s first mentor was an organizer named Mike Kruglik, who says Obama was “the best student he ever had.”

He was a natural, the undisputed master of agitation, who could engage a room full of recruiting targets in a rapid-fire Socratic dialogue, nudging them to admit that they were not living up to their own standards….he could be aggressive and confrontational. With probing, sometimes personal questions, he would pinpoint the source of pain in their lives, tearing down their egos just enough before dangling a carrot of hope that they could make things better.[/quote] http://riverdaughter.wordpress.com/2008/04/21/obama-the-community-organizer/

I say we pay for it with a 90% tax on the royalties of works of present and former federal employees, elected and unelected, for material about their time while employees.

If I had to put the resentment they are trying to foment into one sentence, it would be,

“These millionaires wouldn’t give you the time of day, so why shouldn’t we make them pay more?”

I wonder what the treasury would look like if everyone paid 10% of their gross (10% of their net for businesses) with no deductions at all period. No allowing off-shore hiding of funds. No deductions. No loopholes. Why should we care how many children people decide to have? That 10% deducted before reaching the recipient. No filing of income taxes. Greatly reduced IRS. No deadbeats not paying their taxes. Government could be reduced in one fell swoop with one law. It’s amazing that this has never occurred to those geniuses in congress. Or maybe it has and they did’t see how they could steal taxpayer money with this in place. Or give waivers to their cronies.

10% of their gross “what”? Before you get to this, you have to define (as the Internal Revenue Code and related case law does) what does or does not constitute “income” and then “taxable income”. Will you include gifts, loan forgiveness, alimony, child support, distributions from existing pension plans, social security benefits, etc? Will you tell individuals who otherwise have wages or salaries that they can or cannot deduct the expenses they must unavoidably incur in order to earn their incomes, or will you privilege businesses over individuals? Will you count benefits and perks and expenses paid on behalf of employees and others (in lieu of cash) as income to these employees and others? For your definition of a “business”, will you include sole proprietors, or anyone not pulling a pay check, or just formal partnerships and corporations? How about trusts and other kinds of entities? How about distributions from trusts of principal? With regard to those deductions, which ones will they be that result in that so-called “net income”? Will those taxpayers who rent facilities or equipment necessary to produce income get expense deductions, but those investing capital in building facilities or equipment that subsequently depreciate get none? Would you tax corporate income at 10% and then tax another 10% coming as dividends to the shareholders, or only once? How would you deal with shareholders, both corporate and individual, who control their businesses and can manipulate what are business expenses, or forego receipt of dividends or salary, thereby manipulating what constitutes their “income”?

I hope it includes a provision for MAKING WARREN BUFFETT PAY UP ON HIS BACK TAXES. What say you, Warren? You tool. How much DOES Berkshire Hathaway owe anyway?

Ironic, isn’t it? When Warren Buffett penned that op-ed demanding he be taxed more, we assumed that meant he had actually paid his taxes.

◼ HOW MUCH IS WARREN BUFFETT’S BERKSHIRE HATHAWAY BACK-TAX BILL EXACTLY? ABOUT $1 BILLION – The Blaze

http://www.theblaze.com/stories/how-much-is-buffetts-berkshire-hathaway-back-tax-bill-exactly-about-1-billion/

DR. O : “One Million Dollars.”

LukeHandCool (Dr. Who, who says $1 million ain’t what it used to be … the budget for the entire movie was $1 million. It’s one of the film’s laugh lines now).

When will Republicans take on – and pound it out clearly – the meme that the the “rich fat cat millionaires and billionaires” are “eeeevvvviiiiillll” Republicans?

In actual fact, they are, by and large, liberal DEMOCRATS! And they donate to DEMOCRATS! And they get WAIVERS from elected DEMOCRATS! So, when DEMOCRATS make these statements, what they really mean is, “We are going to tax to death any millionaire or billionaire who didn’t donate to DEMOCRATS or aren’t loyal to the Party!” Because, you see, DEMOCRATS will be the ones getting waivers, special consideration, or will just plain be allowed to break the law and it will be excused (think Tax Cheat Timmy Geitner, Rahmbo, Buffet himself, Immelt…..you get the picture?)!

Republicans don’t have the smarts, it seems, to see the obvious glaring opening Obama and class-warfare warriors leave open; or, if they do, they don’t want to use it, because the image of Mr. Monopoly “rich fat cat”=Republican is a stereotype that is NO LONGER TRUE. Today, Mr. Monopoly “rich fat cat”=laid-back, denim wearing – though a sharp dresser when necessary, eco-friendly, easy-going-but tough DEMOCRAT — like Robert Redford, Bill Gates, Al Gore……..you get the picture. Usually with their own private jet – not a “corporate jet” per se, so that makes it all okie dokie…..hypocrites.

True, there are some exceptions to this. However, taking on the “big lie” is essential to smashing their argument.

The only “millionaires and billionaires” who will be made to pay such punishing tax rates are Republicans; and, as so many have already said, they will just take their businesses outside the US. Probably even their residences. Which is what the Democrats really want, don’t they?

Two quick thoughts on BHO’s latest proposals:

1) focus on class warfare tactics demonstrates that he never matured from a community organizer, focused on the plight of downtrodden Chicagoans, into a presidential-caliber thinker capable of representing the entire population; and

2) Rev. Wright must’ve never preached about the 10th Commandment in all of those 20 years of church… Most Dems could used a refresher course (after they finish the one in 10th Amendment…)

[…] Sad. Obama has been reduced to chasing demons, says Legal Insurrection […]

Naming it after Buffett is particularly cynical since Ol’ Warren doesn’t pay income tax. He lives off capital gains. And it appears he doesn’t even pay those.

[…] […]

In a time of economic crisis and likely an economic depression, Obama can only think of extending the pain to people rather than a plan the would truly help others. Not that I advocate the govenment helping, that is only a street to ruin. Instead, Obama should understand that the govenment is the force that has caused this economic problem and is preventing the recovery. It was true in 1930 and is evident now.

I agree with others that Buffet has really creeped out. Is this man seriously making economic decisions?

Janitor

Don’t get carried away. I meant what is being taxed now so don’t give them any ideas. 10% of what is taxable now. Get it?

Oh. Okay. I guess I misunderstood. Keep everything essentially the same. Just raise taxes on low-earning W-2 employees (part-timers, students, etc.) via withholding with no filing for refunds (would you also put a new withholding requirement on those making 1099 payments?) — and eliminate all personal and charitable deductions while otherwise lowering or eliminating taxes for everyone else.