Taxes Tag

EU Forces Ireland to Collect $14.6 Billion From Apple in Unpaid Taxes

Posted by Mary Chastain

on August 30, 2016

26 Comments

The EU alleges that Ireland gave Apple, an American company, sweet deals in order to bring jobs to the island.

On Tuesday morning, the EU antitrust enforcer ordered Apple to pay 13 billion euros ($14.6 billion) in unpaid taxes in the biggest tax ruling in EU history.

The Clintons Donated Lots of Money to… Themselves

Posted by Mike LaChance

on August 14, 2016

17 Comments

It turns out the Clintons have been very charitable in their giving. The ironic part is that their own foundation was the greatest beneficiary of their philanthropy.

CNBC reports:

Clintons made $10.6 million in 2015, paid federal rate of 34% Hillary and Bill Clinton released their 2015 tax returns on Friday, showing they paid $3.6 million in taxes on adjusted gross income of $10.6 million.

Philadelphia Nanny Staters Pass Soda Tax

Posted by Mike LaChance

on June 17, 2016

26 Comments

The left is celebrating the passage of a new tax on soda and sugary drinks in Philadelphia. It's the second tax of its kind, the first was in Berkeley, California. This victory will only embolden proponents.

CNN reports:

Philadelphia passes a soda tax In a final vote of 13-4, the Philadelphia City Council on Thursday passed a 1.5-cents-per-ounce tax on sugar-added and artificially sweetened soft drinks. That would add 18 cents to the cost of a can of soda, $1.08 for a six-pack or $1.02 for a two-liter bottle.

House Votes to Condemn Carbon Tax

Posted by Fuzzy Slippers

on June 11, 2016

13 Comments

The House has voted to condemn a carbon tax as "detrimental to American families and businesses."

The Hill reports:

The House voted Friday to condemn a potential carbon tax, closing the door on a climate change policy popular in some conservative circles. Lawmakers passed, by a 237-163 vote, a GOP-backed resolution listing pitfalls from a tax on carbon dioxide emissions and concluding that such a policy “would be detrimental to American families and businesses, and is not in the best interest of the United States.” Six Democrats voted with the GOP for the resolution. No Republicans dissented. The non-binding resolution is first and foremost a defensive measure, to get lawmakers on the record against a carbon tax, in case it’s part of a future proposal, perhaps part of a comprehensive tax reform package or in return for repealing certain regulations. President Obama has not proposed a carbon tax, and while many Democrats support the idea, it has not taken hold as a serious legislative proposal in years.Obama has, in fact, proposed carbon taxes, the most recent being the $10 per barrel tax on oil; a fact noted in this Hill article: "The House also voted 253-144 to condemn Obama’s proposal from earlier this year to impose a $10.25 tax on each barrel of oil, an idea that never got much support in Congress."

Elizabeth Warren Wants the IRS to Do Your Taxes

Posted by Mike LaChance

on April 17, 2016

26 Comments

Do you trust the federal government to prepare your taxes for you? Elizabeth Warren thinks so.

Should the Tea Party activists and others who have been harassed by the IRS for political reasons in recent years be expected to trust the agency with preparing their returns? Isn't it bad enough that the IRS can use its power of audit?

Boston.com reported:

Elizabeth Warren thinks the IRS should fill out your tax returns With Monday’s tax filing deadline looming over many Americans’ weekends, Sen. Elizabeth Warren’s new bill may seem like a godsend. The Massachusetts Democrat introduced legislation Wednesday that would allow U.S. taxpayers to have the government do their taxes for them—for free.

The Tax Man Cometh… and is Carrying a Big Gulp

Posted by Leslie Eastman

on April 08, 2016

5 Comments

Tax Day this year is April 18th; ironically, it has been postponed this year because of a conflict with Emancipation Day.

After collecting a record amount from taxpayers last year, the Internal Revenue Service is going to make it even easier for Americans to pay. A new IRS program that allows citizens to pay income taxes at 7-Eleven convenience stores.

The DEA’s $86 Million Plane That Doesn’t Fly

Posted by Kemberlee Kaye

on March 31, 2016

12 Comments

Tipped off by an anonymous whistleblower in 2014, the Office of the Inspector General dug into the Drug Enforcement Administration's aviation operations with the Department of Defense in Afghanistan.

They found an $86 million plane that doesn't fly. Worse still, the DEA's Afghanistan mission ended in July.

According to the DEA's website, the aviation unit employs approximately 125 Special Agent Pilots:

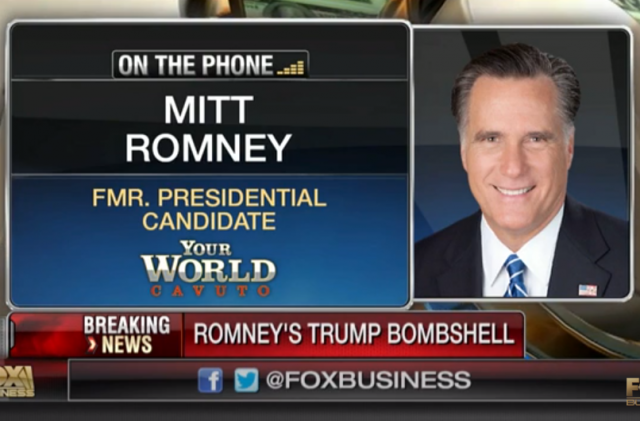

Is there any support for Mitt Romney’s Trump tax return suspicions?

Posted by New Neo

on February 27, 2016

61 Comments

On Wednesday Mitt Romney said some interesting things about Donald Trump and his tax returns, and they got picked up by a lot of news outlets and pundits, including Legal Insurrection. This is the way his remarks were generally reported:

He also called on the entire GOP field to release their tax returns. “I think there’s something there,” Romney said of Trump’s returns, “Either he’s not anywhere near as wealthy as he says he is, or he hasn’t been paying the kind of taxes we would expect him to pay,” Romney, a former Massachusetts governor, told Fox News’ Neil Cavuto on “Your World.”Trump supporters felt that this was a low blow, and unsubstantiated as well. Also, coming from Romney---the guy many judge as having been insufficiently hard on Obama in 2012---it seemed uncharacteristic. As usual, though, it's always instructive to look at the transcript, and then to do a little digging into the background. In the full transcript Romney went into more detail than that. He went on to say:

Obama Proposes New $10 Oil Tax

Posted by Fuzzy Slippers

on February 05, 2016

31 Comments

In his last year in office, Obama promised to be more bold (reckless?) in pushing his agenda, and one thing that has long irritated him about our great country is our consumption of oil.

To address this pet peeve of his, Obama has released a budget in which he proposes a $10 per barrel tax hike on oil; the money, he says, will go to boost the failed "green" energy economy for which he's long pined. Never mind his embarrassing and costly past plans to boost the green energy sector.

The Hill reports:

President Obama will propose a $10-per-barrel fee on oil production to fund a new green transportation plan, the White House announced Thursday.

Bernie’s “Free Stuff” Will Cost Taxpayers $19.6 Trillion in New Taxes

Posted by Fuzzy Slippers

on January 20, 2016

10 Comments

Last week, I noted that Bernie Sanders was reluctant to reveal how he intends to pay for everything for everyone; this week, the Washington Examiner has some answers.

The Washington Examiner estimates that the bill for Bernie's "free stuff for everyone!" promises will be approximately $19.6 trillion. Our national debt, which has nearly doubled under Obama, is under that at just over $18 trillion.

Where's the money going to come from? Taxes. Of course.

The Washington Examiner writes:

Sen. Bernie Sanders' populist message has put him in the position to potentially win Democratic nomination contests in both Iowa and New Hampshire, shaking the sense of inevitability that has surrounded Hillary Clinton. As the socialist senator from Vermont gains traction in polls, Clinton has more aggressively attacked his policy proposals, forcing Sanders to release details on how he would pay for his ambitious economic and social agenda.

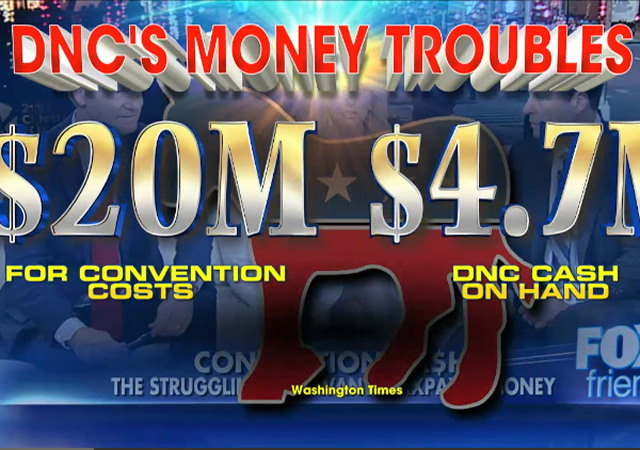

Cash Poor Democrats Want Taxpayers to Fund Their Convention

Posted by Mike LaChance

on December 15, 2015

27 Comments

Last month we reported that the DNC was going into debt while the RNC was raising millions. In a new but related development, the cash poor Democrats want taxpayers to help pay for their national convention.

Stephen Dinan reported at the Washington Times:

Struggling DNC craves tax dollars for convention Already struggling with finances, the Democratic Party has drafted a plan to have taxpayers help pay about $20 million for next summer’s nominating convention, reversing a change Congress approved just a year ago. Democratic National Committee Chairwoman Debbie Wasserman Schultz, who is also a congresswoman from Florida, has drafted a bill to restore money that both parties used to receive from the federal government to help defray the costs of running their quadrennial conventions.

Art Laffer: Rand Paul and Ted Cruz Have Best Tax Plans

Posted by Fuzzy Slippers

on November 27, 2015

6 Comments

Art Laffer, famed member of President Reagan's Economic Policy Advisory Board, has co-authored, with Stephen Moore, an article for Investor's Business Daily in which they assert that Rand Paul and Ted Cruz have the "best" tax proposals.

They begin with a bit of a warning to those serious about tax reform:

All the GOP tax plans look good to us — though some are admittedly better than others. The danger now is that too many conservatives have formed a circular firing squad and are shooting down nearly all proposals on purity grounds or attacking trivial differences. This is the surest way to derail tax reform altogether. If Ronald Reagan, Jack Kemp and Bill Bradley had held to such a "my way or the highway" approach, the epic 1986 tax reform that collapsed tax rates to 15% and 28% never would have happened.That said, Laffer and Moore continue by narrowing their focus to Rand and Cruz:

Which brings us to Rand Paul and Ted Cruz. The two of us helped craft their low-rate flat tax plans. The plans are similar: Paul's rates are 14.5% on business net sales and wages and salaries. Cruz has a 16% business net sales tax and a 10% wage and salary tax.

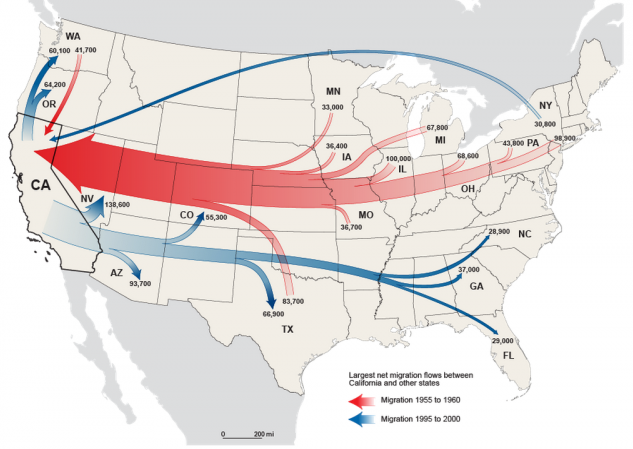

Fleeing blue state taxpayers should leave their blue politics behind

Posted by Mike LaChance

on September 06, 2015

37 Comments

A newly published study shows taxpayers are (still) abandoning blue states and heading to states where Republicans retain a greater level of influence.

Leah Jessen of the Daily Signal reported:

Study: Taxpayers Are Leaving Democrat-Run States for States Controlled by Republicans In an analysis of Internal Revenue Service income statistics and migration data, Americans for Tax Reform—an advocacy group for lower and simpler taxes—concluded that in 2013 more than 200,000 taxpayers fled states with a Democrat governor to states with Republicans in control. The analysis shows that in 2013 states run by Democrats lost 226,763 taxpayers while Republican-run states gained about 220,000 new taxpayers. The state with the most growth in new taxpayers? Texas. The state, governed by Republican Rick Perry during the 2012-2013 year, saw a positive net migration of 152,477 people. “Texas accounted for more than half of the net migration into the South,” the IRS reports.The IRS report can be seen here.

Record $2.6 Trillion tax revenue not enough to feed federal gov’t beast

Posted by Mike LaChance

on August 16, 2015

10 Comments

Since the beginning of fiscal year 2015, the federal government has taken in a staggering $2.6 trillion in tax revenue. Despite this record breaking haul, the United States is still operating in the red.

Terence P. Jeffrey of CNS News reports:

$2,672,414,000,000: Federal Taxes Set Record Through July; $17,955 Per Worker--Feds Still Run $465.5B Deficit The federal government raked in a record of approximately $2,672,414,000,000 in tax revenues through the first ten months of fiscal 2015 (Oct. 1, 2014 through the end of July), according to the Monthly Treasury Statement released today. That equaled approximately $17,955 for every person in the country who had either a full-time or part-time job in July. It is also up about $183,397,970,000 in constant 2015 dollars from the $2,489,016,030,000 in revenue (in inflation-adjusted 2015 dollars) that the Treasury raked in during the first ten months of fiscal 2014. Despite the record tax revenues of $2,672,414,000,000 in the first ten months of this fiscal year, the government spent $3,137,953,000,000 in those ten months, and, thus, ran up a deficit of $465,539,000,000 during the period.FOX News put the issue in perspective:

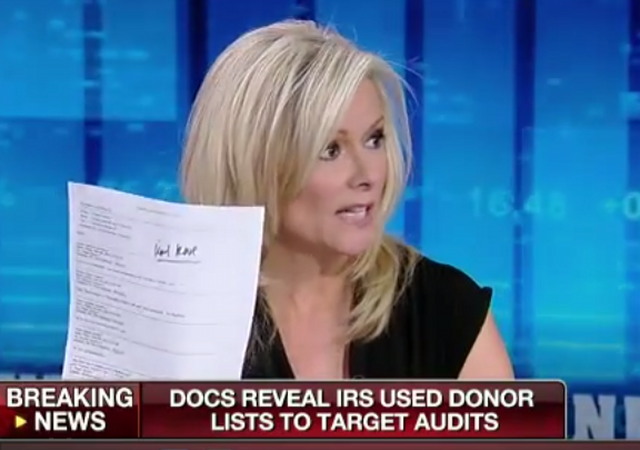

Report: IRS Used Donor Lists to Target Conservatives for Audits

Posted by Mike LaChance

on July 23, 2015

17 Comments

President Obama appeared on the Daily Show this week and claimed that the IRS never targeted the Tea Party.

Yet according to an explosive new report from Judicial Watch, the IRS used donor lists from certain organizations to target specific people for audits:

Judicial Watch: New Documents Show IRS Used Donor Lists to Target Audits (Washington, DC) – Judicial Watch announced today that it has obtained documents from the Internal Revenue Service (IRS) that confirm that the IRS used donor lists to tax-exempt organizations to target those donors for audits. The documents also show IRS officials specifically highlighted how the U.S. Chamber of Commerce may come under “high scrutiny” from the IRS. The IRS produced the records in a Freedom of Information lawsuit seeking documents about selection of individuals for audit-based application information on donor lists submitted by Tea Party and other 501(c)(4) tax-exempt organizations (Judicial Watch v. Internal Revenue Service (No. 1:15-cv-00220)). A letter dated September 28, 2010, then-Democrat Senate Finance Committee Chairman Max Baucus (D-MT) informs then-IRS Commissioner Douglas Shulman: “ I request that you and your agency survey major 501(c)(4), (c)(5) and (c)(6) organizations …” In reply, in a letter dated February 17, 2011, Shulman writes: “In the work plan of the Exempt Organizations Division, we announced that beginning in FY2011, we are increasing our focus on section 501(c)(4), (5) and (6) organizations.”

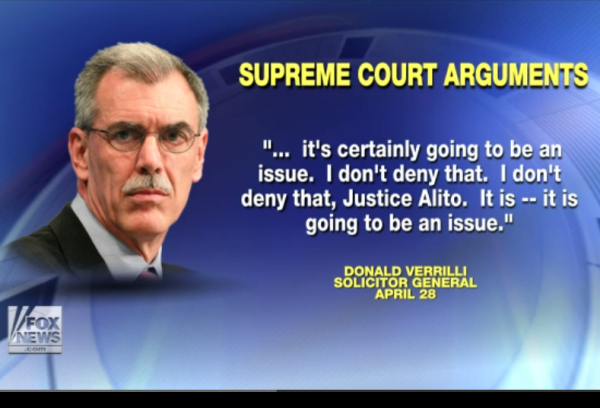

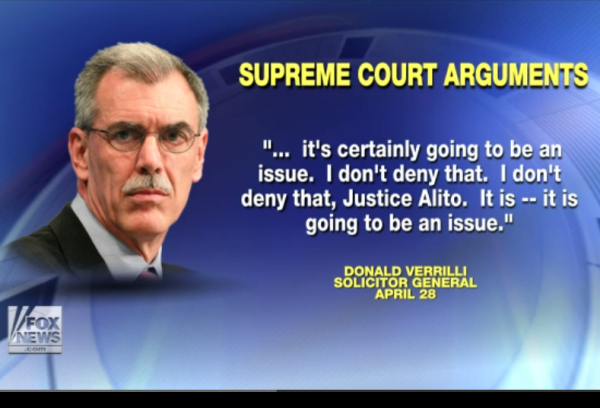

Post-SCOTUS Gay Marriage: Religious institution tax exemptions at risk

Posted by Kemberlee Kaye

on June 28, 2015

83 Comments

Forty-eight hours after the Supreme Court's monumental gay marriage decision, and progressives are already calling for an end to tax exemptions for churches.

Anticipating the Supreme Court's eventual ruling on Obergefell v. Hodges, Senator Mike Lee and Rep. Raul Labrador introduced the First Amendment Defense Act. The bill would protect religious institutions who, for religious beliefs, do not actively participate in gay wedding ceremonies.

In an op-ed published two weeks ago in the Deseret News, Sen. Lee explained:

After hearing the oral arguments in Obergefell v. Hodges, Sen. Lee was most disturbed by a question asked by Justice Alito.

After hearing the oral arguments in Obergefell v. Hodges, Sen. Lee was most disturbed by a question asked by Justice Alito.

This is a bill that would prohibit the federal government from penalizing individuals or institutions on the basis that they act in accordance with a religious belief that marriage is a union between one man and one woman. The First Amendment Defense Act, which Rep. Raúl Labrador, R-Idaho, will introduce in the House of Representatives, would prevent any agency from denying a federal tax exemption, grant, contract, accreditation, license or certification to an individual or institution for acting on their religious beliefs about marriage.

After hearing the oral arguments in Obergefell v. Hodges, Sen. Lee was most disturbed by a question asked by Justice Alito.

After hearing the oral arguments in Obergefell v. Hodges, Sen. Lee was most disturbed by a question asked by Justice Alito.

Clinton Foundation turns itself in before getting caught

Posted by Mike LaChance

on April 28, 2015

17 Comments

The Clinton Foundation has admitted that it may have made "mistakes" with regard to their taxes and will refile five years of returns.

The admission came after a Reuters report was published on Sunday:

Clinton Foundation admits making mistakes on taxes The Clinton Foundation's acting chief executive admitted on Sunday that the charity had made mistakes on how it listed government donors on its tax returns and said it was working to make sure it does not happen in the future. The non-profit foundation and its list of donors have been under intense scrutiny in recent weeks. Republican critics say the foundation makes Hillary Clinton, who is seeking the Democratic presidential nomination in 2016, vulnerable to undue influence. After a Reuters review found errors in how the foundation reported government donors on its taxes, the charity said last week it would refile at least five annual tax returns. "So yes, we made mistakes, as many organizations of our size do, but we are acting quickly to remedy them, and have taken steps to ensure they don't happen in the future," Clinton Foundation acting Chief Executive Officer Maura Pally said in a statement.Watch Dana Loesch of The Blaze discuss the issue with Dinesh D'Souza. The Clinton Foundation's finances are so questionable that non-profit experts are calling it a slush fund.

DONATE

Donations tax deductible

to the full extent allowed by law.

CONTRIBUTORS

- William A. Jacobson

Founder

- Kemberlee Kaye

Sr. Contrib Editor

- Mary Chastain

Contrib Editor

- Fuzzy Slippers

Weekend Editor

- Mike LaChance

Higher Ed

- Leslie Eastman

Author

- Vijeta Uniyal

Author

- Stacey Matthews

Author

- Jane Coleman

Author

- James Nault

Author

- Mandy Nagy

Editor Emerita

- Learn more about the Contributors