IRS Tag

IRS: Obama’s Potent Weapon in War Against Dissent

Posted by Leslie Eastman

on September 26, 2016

16 Comments

I recently noted that President Obama's climate change edict for our national security strategists shows that he does not take warfare against American opponents seriously.

However, the President takes citizen opposition very seriously. For example, he is unleashing one of his most potent tools against Americans opting out of purchasing Obamacare.

Over 20 million Americans opted to pay a penalty rather that purchase health insurance. So, the Internal Revenue Service (IRS) has just sent them a formal letter suggesting they make a different choice.

...Getting a letter from the IRS can be a threatening and nerve-racking experience; it seldom is seen as a suggestion and more of a threat. But at President Obama’s direction, the IRS is “reaching out” to people who paid the tax penalty for not buying mandatory health insurance or who claimed an exemption in hopes of “attracting” more people to sign up for ObamaCare insurance. The government is particularly interested in compliance from healthy young people.

IRS Commissioner Admits Mistakes in Previous Testimony

Posted by Mary Chastain

on September 21, 2016

0 Comments

He wouldn't elaborate on those mistakes....

House Republicans Dump Impeachment Vote on IRS Commissioner

Posted by Mary Chastain

on September 15, 2016

14 Comments

The House Freedom Caucus and Judiciary Committee Chairman Bob Goodlatte (R-VA) struck a deal to hold a hearing for IRS Commissioner John Koskinen, thus delaying a Thursday House vote to impeach him.

The caucus had submitted a resolution to impeach Koskinen for impeding "Congress' effort to investigate the IRS for tough assessments of Tea Party groups that sought tax exemptions several years ago." Caucus members Members claim Koskinen failed to provide proper email documents and lied about deleting some emails. They also claim he has shown, “little effort to recover the lost documents.”

House Freedom Caucus Submits Resolution to Impeach IRS Commissioner

Posted by Mary Chastain

on September 13, 2016

13 Comments

The House Freedom Caucus submitted a resolution to force a vote to impeach IRS Commissioner John Koskinen. They have accused him of hampering, "Congress' effort to investigate the IRS for tough assessments of Tea Party groups that sought tax exemptions several years ago."

Caucus members Members claim Koskinen failed to provide proper email documents and lied about deleting some emails. They also claim he has shown, "little effort to recover the lost documents."

To speed up the vote, Rep. John Fleming (R-LA) introduced the bill, "under a privileged motion," allowing the bill to bypass committee. The House could vote on the bill as early as Thursday.

Top IRS Officials Knew Agency Targeted Conservative Groups

Posted by Mary Chastain

on July 28, 2016

14 Comments

What a shock. Judicial Watch discovered that top IRS officials, including Lois Lerner and Holly Paz, knew that the agency targeted conservative groups before they told Congress. Judicial Watch reported:

The FBI documents also reveal that IRS officials stated that the agency was targeting conservative groups because of their ideology and political affiliation in the summer of 2011. According to one senior tax law specialist, “The case seemed to be pulled because of the applicant’s political affiliation and screening is not supposed to occur that way … [Redacted] said he thought the cases were being pulled based upon political affiliations.” And IRS senior official Nancy Marks, appointed by [then-acting Commissioner Steven] Miller to conduct an internal investigation stated, “Cincinnati was categorizing cases based on name and ideology, not just activity.”

Hillary: As President, Trump Could Use IRS to Target His Enemies

Posted by Mike LaChance

on July 14, 2016

37 Comments

Have you noticed that many of Trump's critics accuse him of things he hasn't done yet but which other people have actually done already? The latest example comes from the presumptive Democratic nominee who warns President Trump could use the IRS to target his enemies.

Imagine that.

Allahpundit of Hot Air notes the irony:

Hillary: Can you imagine electing a vindictive man who might … send the IRS after his critics? You know what? I can imagine it. Pretty vividly, actually. Right down to the names of the “hypothetical” IRS officers involved.

House Appropriations Bill Cuts IRS Budget

Posted by Kemberlee Kaye

on July 08, 2016

14 Comments

IRS Employee Explains Why Conservative Groups Were Targeted

Posted by Mike LaChance

on May 24, 2016

34 Comments

Cleta Mitchell is a conservative activist who has been very vocal about the IRS scandal which involved the targeting of conservative Tea Party groups in the run-up to the 2012 election.

She recently appeared on C-Span and an alleged IRS employee called into the show and explained to her that he would target these groups because they want to abolish the IRS.

Ali Meyer reported at the Washington Free Beacon:

IRS Employee Admits He Would Go After, Target, and Try to End Conservative Groups A self-identified IRS employee admitted he would go after, target and try to end conservative groups who wanted to abolish the IRS, to Cleta Mitchell, an attorney representing those groups, on a Washington Journal segment on C-SPAN.

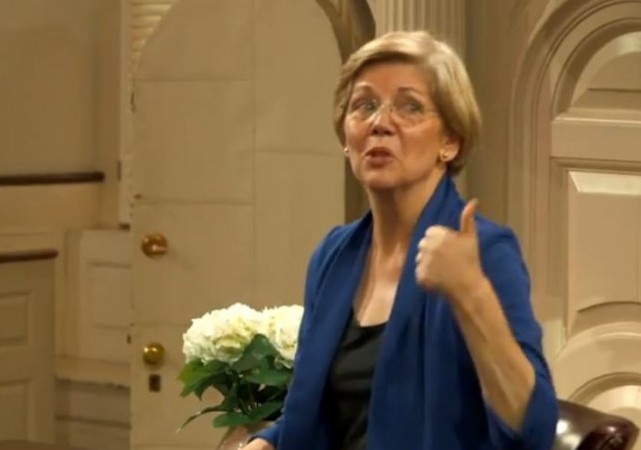

Elizabeth Warren Wants the IRS to Do Your Taxes

Posted by Mike LaChance

on April 17, 2016

26 Comments

Do you trust the federal government to prepare your taxes for you? Elizabeth Warren thinks so.

Should the Tea Party activists and others who have been harassed by the IRS for political reasons in recent years be expected to trust the agency with preparing their returns? Isn't it bad enough that the IRS can use its power of audit?

Boston.com reported:

Elizabeth Warren thinks the IRS should fill out your tax returns With Monday’s tax filing deadline looming over many Americans’ weekends, Sen. Elizabeth Warren’s new bill may seem like a godsend. The Massachusetts Democrat introduced legislation Wednesday that would allow U.S. taxpayers to have the government do their taxes for them—for free.

6th Circuit Dings IRS in Tea Party Targeting Case

Posted by Jonathan Levin

on March 22, 2016

18 Comments

The Sixth Circuit Court of Appeals issued a blistering rebuke of the IRS today in Tea Party groups' suit against IRS targeting.

The opinion by Chief Judge Raymond Kethledge on behalf of a three-judge panel opens:

Among the most serious allegations a federal court can address are that an Executive agency has targeted citizens for mistreatment based on their political views. No citizen—Republican or Democrat, socialist or libertarian—should be targeted or even have to fear being targeted on those grounds. Yet those are the grounds on which the plaintiffs allege they were mistreated by the IRS here. The allegations are substantial: most are drawn from findings made by the Treasury Department’s own Inspector General for Tax Administration. Those findings include that the IRS used political criteria to round up applications for tax-exempt status filed by so-called tea-party groups; that the IRS often took four times as long to process tea-party applications as other applications; and that the IRS served tea-party applicants with crushing demands for what the Inspector General called “unnecessary information.”

The IRS Hack Keeps Getting Worse

Posted by Taryn O'Neill

on March 02, 2016

6 Comments

In early 2014, the Internal Revenue Service launched a new feature on its website referred to as 'Get Transcript.' This feature allowed taxpayers to view and download their transcript, or a document that lists most line items on a tax return and includes accompanying forms and schedules.

In May of last year, the IRS announced its Get Transcript feature had been hacked by criminals using taxpayer information that was obtained by different means. At this time, the IRS had determined that a little over 114,000 taxpayers' returns were accessed and the Get Transcript feature was taken offline. By August, the IRS revised the original number to 334,000 breached or targeted tax returns.

As of last Friday, however, the IRS added another 390,000 taxpayers to the list, upping the number of accounts effected to over 700,000. Not included in this number are 500,000 accounts the hackers targeted but were unable to obtain.

Tea Party Class Action Against IRS Abuse May Proceed

Posted by Jonathan Levin

on January 19, 2016

11 Comments

Tea Party groups won a major victory last week, when Judge Susan J. Dlott of the United States District Court for the Southern District of Ohio certified a class of Tea Party organizations that allege the IRS intentionally delayed their applications for preferential tax treatment based on their political viewpoints.

Winning class certification in NorCal Tea Party Patriots v. Internal Revenue Service is a big deal, because it means the Court has already made several determinations, all of which favor the class. The Court has determined that the number of Tea Party groups effected by the IRS's alleged behavior is so numerous that they can proceed together as a class. The Court has also determined that all of the Tea Party groups have valid legal claims against the IRS which share common legal issues; in other words, that the IRS has treated them all the same way.

Having survived the hazardous class certification step, the Plaintiffs will now get substantive discovery from the IRS and from third parties. As the Washington Times summarized:

DOJ – Lois Lerner to face no criminal charges

Posted by William A. Jacobson

on October 23, 2015

40 Comments

CNN Reports:

The Justice Department notified members of Congress on Friday that it is closing its two-year investigation into whether the IRS improperly targeted tea party and other conservative groups. There will be no charges against former IRS official Lois Lerner or anyone else at the agency, the Justice Department said in a letter. The probe found "substantial evidence of mismanagement, poor judgment and institutional inertia leading to the belief by many tax-exempt applicants that the IRS targeted them based on their political viewpoints. But poor management is not a crime."Despite incriminating evidence and findings by IRS inspectors that Tea Party and conservative groups were treated worse than other groups, DOJ found no support for the view that Lerner and others were politically motivated, as CNN further reported:

IRS: Lois Lerner had second secret personal email account (in addition to “Toby Miles”)

Posted by William A. Jacobson

on September 01, 2015

27 Comments

Last week, in an August 24, 2015 Status Report, the Internal Revenue Service disclosed that Lois Lerner used a secret personal email account denominated as "Toby Miles." The filing was in a FOIA case filed by Judicial Watch.

In a filing last night of an August 31, 2015 Status Report, the IRS revealed that Lerner also used "a second personal email account" that, unlike the Toby Miles account, "does not appear to be associated with a denomination; only the email address itself appears." The IRS refuses to disclose the email address for either the Toby Miles or the newly discovered account.

(added) Tom Fitton, President of Judicial Watch, commented on this latest disclosure:

“It is disturbing that the Obama administration’s explanations to a federal judge about Lois Lerner’s emails become inoperative after only one week. Last week, the court was told that that Lois Lerner had a second alias email account under the name “Toby Miles”. This week the court is told that the “Toby Miles” account isn’t a separate account but that that there still is a second Lerner account, address unrevealed, with IRS-related emails. This game of cat and mouse shows that both the Obama IRS and Justice Department continue with their contempt for Judge Sullivan’s orders that Ms. Lerner’s emails about this scandal be disclosed as the law requires.”The August 31 status report reads, in part (full embed at bottom of post):

Who is “Toby Miles” and why did Lois Lerner use that name for secret email account? (Court Document)

Posted by William A. Jacobson

on August 25, 2015

50 Comments

Late last night the IRS filed a Status Report (full embed at bottom of post) disclosing that Lois Lerner used a secret email account for some official business, under the name "Toby Miles."

The Washington Times reports:

Lois Lerner had yet another personal email account used to conduct some IRS business, the tax agency confirmed in a new court filing late Monday that further complicates the administration’s efforts to be transparent about Ms. Lerner’s actions during the tea party targeting scandal. The admission came in an open-records lawsuit filed by Judicial Watch, a conservative public interest law firm that has sued to get a look at emails Ms. Lerner sent during the targeting.The Status Report (embed below) discloses, in relevant part:

On August 24, 2015, the Internal Revenue Service (“Service”) released to Judicial Watch, Inc., a CD containing documents responsive to Judicial Watch’s Freedom of Information Act (“FOIA”) request for Lois Lerner communications regarding the review and approval process for 501(c)(4) applications.... In the process of preparing this status report and for the August 24, 2015, release of Lerner communications, the undersigned attorneys learned that, in addition to emails to or from an email account denominated “Lois G. Lerner” or “Lois Home,” some emails responsive to Judicial Watch’s request may have been sent to or received from a personal email account denominated “Toby Miles.” The undersigned attorneys contacted the Office of IRS Chief Counsel, and IRS Chief Counsel attorneys informed the undersigned attorneys that these denominations refer to a personal email account used by Lerner. (See Pl.’s Mot. for Status Conf., 15 n.8 (Docket No. 20-2) (noting that the Congressional database includes documents that Lerner’s attorneys provided from Lerner’s “personal home computer and email on her personal email” account(s)).)

Lois Lerner Emails: Republicans are Evil and Dishonest

Posted by Mike LaChance

on August 14, 2015

25 Comments

Lois Lerner is back in the news. According to a new report, emails Lerner sent to a friend reveal that the called Republicans evil and dishonest.

She also criticized the Citizens United ruling as one of the worst things to happen in the United States.

Andrew Kugle of the Washington Free Beacon:

Lois Lerner: GOP is ‘Evil and Dishonest’ Former IRS official Lois Lerner said that Republicans are “evil and dishonest,” in a email dated March 26, according to Fox News reporter James Rosen. In the email, Lois Lerner described the time when she was called back to testify about the IRS targeting of conservatives before Congress. “They called me back to testify, on IRS ‘scandal,” Lerner wrote. “I took the fifth again and they had been so evil and dishonest in my lawyer’s dealings with them.”Here's the video report with James Rosen of FOX News:

Jindal: If Elected President, Will Send the IRS Into Planned Parenthood

Posted by Fuzzy Slippers

on August 08, 2015

13 Comments

When Lois Lerner preemptively "broke" the story in 2013 about the IRS targeting conservative groups from (at least) 2010 to the time leading up to the 2012 presidential election, there was outrage and a bit of curiosity because it was she, then director of the Exempt Organizations Unit of the IRS, who admitted to these illegal actions. Four days later, the Inspector General's office issued a report confirming the targeting, and three years later, we are learning of additional targets such as Bristol Palin.

After his initial feigned outrage, Obama, of course, is adamant that there is not a "smidgen of corruption" at the IRS, but that remains to be seen as reports of ongoing IRS targeting of conservatives emerge.

Conservatives were—and are—justifiably outraged at such a blatant and illegal weaponization of the IRS against those whom Lerner and others in the IRS, perhaps on up to the White House, deemed threatening or otherwise "enemies."

DONATE

Donations tax deductible

to the full extent allowed by law.

CONTRIBUTORS

- William A. Jacobson

Founder

- Kemberlee Kaye

Sr. Contrib Editor

- Mary Chastain

Contrib Editor

- Fuzzy Slippers

Weekend Editor

- Mike LaChance

Higher Ed

- Leslie Eastman

Author

- Vijeta Uniyal

Author

- Stacey Matthews

Author

- Jane Coleman

Author

- James Nault

Author

- Mandy Nagy

Editor Emerita

- Learn more about the Contributors