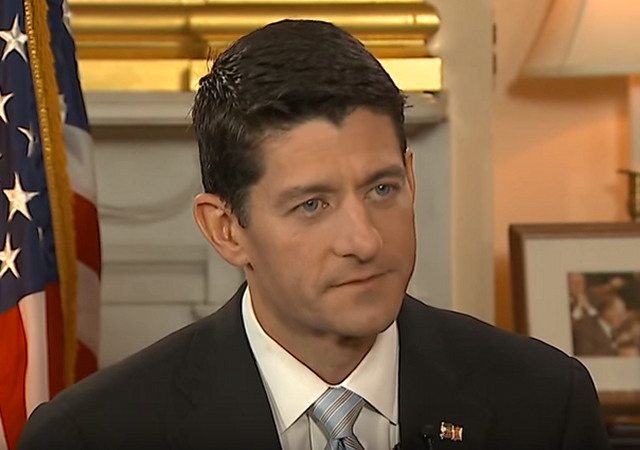

Paul Ryan Won’t Let Go of the Border Adjustment Tax

Let it go! No one wants your stupid tariff.

Speaker Paul Ryan (R-WI) will not let go of a border adjustment tax (BAT) when it comes to tax reform, which will set up a major showdown with the White House and possibly the Senate.

Ryan admitted today that the House could pass a tax bill without the BAT, but he’s still trying to sell the idea to his fellow lawmakers and the White House.

Paul Ryan and Kevin Brady

Ryan’s biggest supporter is House Ways and Means Chairman Kevin Brady (R-TX). Politico reported that Brady has started to pass out talking points to members of his convince in an effort to persuade them to support the BAT:

The document, obtained by POLITICO, tries to tap into populist sentiments that carried Donald Trump to the White House, arguing that the provision would end a “Made in America tax” that hurts U.S. manufacturers. It even claims that 80 percent of Trump supporters back the Ryan idea, which the president himself has never fully embraced and even criticized at times.

“I obviously think border adjustment is the smart way to go,” Ryan said at a press conference last Thursday. “I think it makes the tax code the most internationally competitive of any other version we’re looking at. And I think it removes all tax incentives for a firm to move… their production overseas.”

From The Hill:

“A border adjustment basically taxes the trade deficit, gets you revenue to lower your tax rates,” he said. “If you’re not going to tax our trade deficit, like every other country does, then you’ll have to get your base broadening from within the country. And that’s the kind of conversation we’re going to have all summer long.”

Ryan met with Treasury Secretary Steven Mnuchin and Freedom Caucus Chairman Mark Meadows (R-NC) on Tuesday night, where Mnuchin stressed that the White House does not approve of the BAT as it stands:

“We know that there are import-sensitive industries, retailers, that could be severely disrupted if this is done the wrong way,” Ryan said.

Ryan continued to speak positively about the border-adjustment proposal, however, saying it’s designed to treat imports and domestic-made goods equally.

“That’s the point we’re trying to make here,” he said. “Let’s equalize the tax treatment of American-made goods and services so they’re not put at a competitive disadvantage.”

The White House & the Senate

I have covered the tax reform debate extensively and have to side with the White House and the Senate on this one.

As Politico points out, the House “has the authority to write tax legislation.” But the White House remembers the disaster they faced when it came to repealing Obamacare and how Ryan could not rally enough votes to even bring anything to the floor. This is why the White House wants the administration heavily involved.

Plus the Senate has all but said that a tax reform bill with BAT in it will immediately die. Politico continued:

During an early April meeting with a group of New York-based CEOs, Senate Majority Leader Mitch McConnell told business leaders that the border adjustment tax was dead on arrival, according to two people with knowledge of the meeting. A spokesman could not immediately respond to the account of the meeting but noted McConnell has publicly noted how challenging the bill would be to get through the Senate.

“There is a piece of BAT that is appealing in theory but we don’t really feel like it is something in its current form that works in tax reform or is worth the gamble with the economy right now,” said one senior administration official. “Mnuchin has been very clear, in its current form [it] does not work — end of story.”

Mnuchin even lashed out at the idea of the BAT when he spoke “with centrist Republicans in the Tuesday Group.”

Back in February, Sen. Tom Cotton lashed out at the idea on the Senate floor:

The next day, Sen. Tom Cotton took to the Senate floor to slam Ryan’s so-called border adjustment tax, saying “some ideas are so stupid only an intellectual could believe them.”

“Many other senators share these concerns and we most certainly will not ‘keep our powder dry,’” Cotton went on, without naming the speaker in his speech.

Others had the same doubts:

Senate Finance Chairman Orrin Hatch (R-Utah), sources said, has warned Trump and Ryan that border adjustment won’t likely have the support needed to clear the Senate.

Hatch, in an interview after Ryan’s presentation, said the speaker “didn’t cover [the border adjustment proposal] as specifically as I would have liked.” And Sen. Roy Blunt of Missouri, the fifth-ranking GOP senator, said the Finance Committee will likely go a “different way.”

Others were more unequivocal.

“It’s beyond a complication. It’s a bad economic proposition,” said Sen. David Perdue (R-Ga.).

Businesses Do Not Want BAT

Businesses have spoken out against the BAT, explaining to Congress that the tax will force them to push costs back to consumers:

Some retailers and other big importers doubt the dollar would rise that much. They warn of tax bills that would exceed profits, forcing them to pass costs to consumers. Some are in the early stages of working on an alternative plan they can present to lawmakers, says a person familiar with those plans.

Cody Lusk, president of the American International Automobile Dealers Association, says his members are shocked that a Republican Congress is proposing a 20% tax on imports.

“We view this as a very, very serious potential blow to the auto sector and the economy,” says Mr. Lusk, whose members sell Toyotas, Hondas and other cars from foreign-headquartered companies.

He likes aspects of the House plan, “but when we look at the whole, I don’t think the juice is worth the squeeze.”

Best Buy, Walmart, and Target share Lusk’s concerns. From Politico:

Brad Anderson, the former CEO of Best Buy, a company that opposes a BAT, released a statement clarifying his position on the tax after the committee packet quoted him saying that “I’m not sure that the full impact [of border adjustability] would get passed along to the consumer.”

Anderson said his once-supportive remarks were made after “having been given inaccurate information” about the tax. He reaffirmed his current opposition: “The BAT is a new tax on everyday items purchased by hardworking consumers which would lead to significant price increases on essential products and job losses for the retail industry, an industry that is responsible for 42 million jobs in the U.S.”

Critics, which also include big retailers like Walmart and Target, have echoed those very concerns. They argue that consumers will ultimately pay for the tax when retailers raise prices to cover their higher tax bill. That, they say, would mean goods from clothing to cars would become more expensive, hurting middle and lower-income Americans.

No Guarantees

In the past, Ryan has said that if a business needs to pass the costs to consumers, those costs “would be offset by an increase in the dollar’s value due to the policy, thus negating the need for the importers to hike prices for consumers.” Nope. Steve Forbes explained that politicians forget that the country belongs to “elaborate global supply chains.” No one knows the consequences if those chains come undone.

From The Wall Street Journal:

Tax experts are puzzling over how to describe who wins and loses from border adjustment. One thing is clear, economists say: If the dollar goes up 25%, U.S. holders of foreign assets—including pension funds and endowments—would suffer a one-time loss in wealth of more than $2 trillion.

There is also global uncertainty: Other countries may retaliate, either by border-adjusting their corporate taxes or by challenging the U.S. plan at the World Trade Organization as too tilted toward American producers.

From The Financial Times:

Prices tend to be sticky, particularly when 93 per cent of US imports and more than 40 per cent of global trade is invoiced in US dollars. These prices would have to be renegotiated over time. Furthermore, the Federal Reserve and the People’s Bank of China would do their best to lean against such a currency move.

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

This is the moron the rino’s ran for VP.

Ryan continued to speak positively about the border-adjustment proposal, however, saying it’s designed to treat imports and domestic-made goods equally.

“That’s the point we’re trying to make here,” he said. “Let’s equalize the tax treatment of American-made goods and services so they’re not put at a competitive disadvantage.”

The PROPER way to do this is to tax ALL new good equally with an IMPLICIT tax (meaning it’s ALREADY part of the final listed price on the shelf), and to put that tax on ALL new goods (foreign AND domestic).

Concurrently, you repeal the 16th Amendment and eliminate the Income Tax, Corporate Tax, FICA, Gift Tax and Estate Tax.

Boom. All goods are now taxed equally, regardless of where they’re made, the tax only gets paid ONCE, and the system corrects and manufactures flock here because there would be ZERO taxes on EXPORTS.

It’s called the FAIRTAX proposal.

Sorry but I’m not vehemently against tariffs. Our goods get the same treatment elsewhere…at the very least, this notion is negotiating power for reducing trade tariffs against US goods in other countries.

“A border adjustment basically taxes the trade deficit, gets you revenue to lower your tax rates”

So, “we had to destroy the tax base in order to save it.”

This guy isn’t particularly stupid … but he certainly thinks we are.

“Border adjustment tax”? A cute name for the same-old same-old is the first clue that someone’s peddling pure flim-flam.

If one subscribes—as I do—to the theory that American manufacturing is too expensive to be competitive entirely because of government actions (bizarre regulations and excessive taxation, primarily the personal income tax), then it’s certainly possible, in principle, for government to rectify the situation … but not by adding yet another tax. Taxes are the problem, not the solution.

And he worked out as expected – he couldn’t even hold his own against biden.

This is the pathetic john boehner’s guy – what does anyone expect except son of boehner?

That Art Laffer, what a guy … the first time I’ve ever heard “quadruciary” used in a sentence.

Perhaps I’ve led a sheltered life.

Ryan appears eager to lose the Republican majority in Congress for no other reason than to impede Trump.

— Or to be able to be all talk, and no action.

Nice gig if you can get it. The GOPe has been offering these positions to an exclusive club of hacks for years.

Primary-out every GOPe hack. Every one of them.

I am not opposed to the Tariffs.

I would rather spend the extra dollar, and keep the money circulating within the United States.

Far preferable to exporting a red cent in wealth we would never see again.

The economic illiteracy and plain stupid is always appalling to me.

Cripes…

It is politically unfeasible to restore capitalism. We are stuck with labor, environmental, and regulatory arbitrage. He should focus on emigration reform, ending catastrophic anthropogenic immigration reform, providing relief to Americans and businesses, and adjusting immigration rates before selective-child.