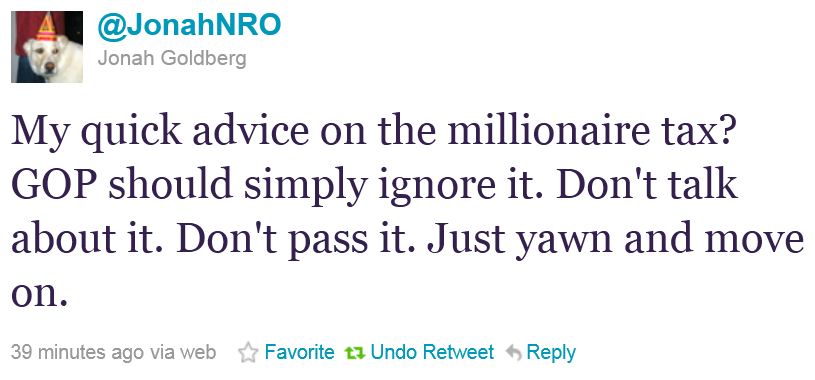

This seems like pretty good advice to the GOP, although the pathetic political ploy needs to be called for what it is (as I did last night):

Update: Time for an invervention, Obama’s on a tax hike bender

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

More class warfare – we must remove this scourge from ‘our house’. ABO Nov.2012

Barry’s trying to open the door, and we really ought to pretend not to hear the doorbell.

Let the details of his plan come out to the public (we can help with that if needed), and everyone will see Obama’s definition of ‘millionaire’ will include people making $125,000 or $250,000 and include families in New York, San Francisco and Chicago where $250,000 is barely enough to live a lower middle-class existance.

But, we know that won’t happen because there probably IS NO PLAN! The alphabet networks are rallying around the ‘millionaire tax’ the Buffett rule, etc. because they don’t have to produce a single sheet of paper. Phase out the AMT- sure, in about 36 years; that is probably something like what this scam of a bill really says.

Show us the facts, just the facts- if they come out the public will turn up their nose at their redistributionist President and start checking out the challengers.

Here is a tweet I will make: Bless me #AttackWatch for I have sinned. It has been 10 min since my last tweet. I love Legal Insurrection’s Bumper Sticker and Tweet posts.

[…] also enjoyed Legal Insurrection tweet and bumper sticker pics and Constitution […]

Obama is his own diversionary tactic. His minions are doing damage like termites in numerous unseen places.

When Bill Clinton passed a “millionaires tax” back in 1993, there was an exception for Hollywood celebrities and sports figures.

When Barbra Streisand sang at the MGM Grand in 1993, the head of MGM was paid less for the year than she got for a week. Guess who had to pay the millionaires tax ?

Of course, the unintended consequence of that “millionaires tax” was that corporate executives capped their salaries at $1 million, and made up the rest with stock options. This lead to the largest transfer of equity in the history of the world, as these executives acquired roughly 10% of the Fortune 500 through stock options over the next 10 years.

It wasn’t exactly a “millionaire’s tax” as the executive paid no additional taxes. Under Clinton’s law, the portion of an executive’s salary that exceeded a million dollars annually was no longer a deductible expense for the company paying it (unless certain “performance” criteria had been met).

It did, indeed, result in increased transfers of stock representing in-lieu-of payments. But mostly, executive salaries continued to soar because the law contained so many loopholes and companies were able to reward “performance” based on even the vaguest and most ephemeral of goals.

Special taxes on the “wealthy” never work as intended. They do, however, keep tax accountants and attorneys well employed.

Speaking of exceptions, does anyone else find it a bit ironic that this scheme is called the “Warren Buffett Rule” when it will affect about 235,000 taxpayers, but not Warren Buffet? He famously pays himself only $100,000 a year, and his “investment income” is Berkshire Hathaway’s, not his personally.

I agree. It is phoney measure to whip up support in a demoralized base. Obama is taking similar advice about Obamacare – Don’t talk about it.

[…] IT:” Probably good advice on pretty much any Obama initiative at this […]

It is hard to force your way when you are in the process of becoming irrelevant. His only chances to regain relevancy are to get another war started or to give the Europeans a few hundred billion dollars, both of which will make him even less popular.